PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444218

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444218

Global Peripheral Vascular Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

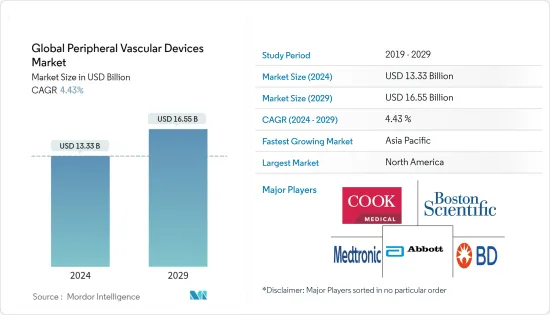

The Global Peripheral Vascular Devices Market size is estimated at USD 13.33 billion in 2024, and is expected to reach USD 16.55 billion by 2029, growing at a CAGR of 4.43% during the forecast period (2024-2029).

The COVID-19 pandemic negatively affected the treatment and diagnostics procedures other than COVID-19 which had a significant impact on the studied market as it not only affected diagnostic and treatment procedures but also research and development activities in the area. Further, many studies suggested that people with cardiac diseases were at major risk from COVID-19, which further led to the reduction in footfall in hospitals and diagnostic centers. For instance, according to the research study titled 'Impact of COVID-19 on cardiac procedure activity in England and associated 30-day mortality' published by the National Center for Biotechnology Information in May 2021, during the COVID-19 pandemic, cardiac procedural activity in England decreased dramatically, with a deficit of about 45,000 procedures, with no increase in the risk of mortality for most cardiac procedures conducted during the pandemic. This study shows the negative impact of COVID-19 on cardiology services. Further, the study was conducted in England.

However the market started to gain traction as the COVID-19 cases declined and the lockdowns were taken off. For instance, according to the Australian Institute of Health and Welfare May 2022, out of 11.8 million admissions, 7.0% of hospitalizations involved a stay in the intensive care unit, and 3.8% of hospitalizations involved Cardio vascular diseases. Such increasing admission in emergency and critical care created the need for the availability of arterial blockage treatment and this is expected to drive the growth of the peripheral vascular devices market studied over the analysis period.

In addition to it, rising demand for minimally-invasive procedures and an increase in the incidence of peripheral arterial disease (PAD) are actively affecting the growth of the studied market.

According to the American Heart Association 2021 report, Peripheral artery disease (PAD) affects more than 200 million people worldwide and is associated with high mortality and morbidity. With the aging global population, it is likely that PAD may be increasingly common in the future. Hence, the statistics show that the number of PAD is increasing at a faster pace, which is ultimately driving the market for peripheral vascular devices.

A Scientific study titled 'Lower Extremity Peripheral Artery Disease: Contemporary Epidemiology, Management Gaps, and Future Directions' published by the American Heart Association in August 2021 stated that lower extremity peripheral artery disease (PAD) affects more than 230 million persons worldwide and is linked to an elevated risk of a number of unfavorable clinical outcomes (including cardiovascular diseases like coronary heart disease and stroke and limb outcomes like amputee status). The increased incidence of PAD is ultimately boost the peripheral vascular devices market over the forecast period.

Therefore, owing to the aforementioned factors the studied market is anticipated to witness growth over the analysis period. However, the high cost of installation and maintenance is likely to impede the market growth.

Peripheral Vascular Devices Market Trends

Peripheral Vascular Stents are expected to witness growth over the forecast period

Due to the increase in the number of cardiac disorders there is an increased demand for peripheral vascular stents globally. The American Heart Association (AHA), Heart Disease and Stroke Statistics - 2022 Update data shows that cardiovascular disease (CVD) is listed as the primary underlying cause of death accounting for 19.05 million deaths all over the world in the year 2020. As per the same source, around 7.08 million deaths worldwide were attributed to cerebrovascular diseases in the year 2020. Such a high prevalence of cardiac disease among the population in the country reaped the demand for peripheral vascular stents.

The advancements in technology and increasing product approvals, along with partnerships and collaborations by key players are helping in the market growth. For instance, in March 2022, Cordis, a global cardiovascular technology company, announced the United States Food and Drug Administration (FDA) approval for the S.M.A.R.T. RADIANZ Vascular Stent System, a self-expanding stent specifically designed for radial peripheral procedures The RADIANZ Radial Peripheral System is completed by the recently approved vascular stent system, BRITE TIP RADIANZ Guiding Sheath, and SABERX RADIANZ PTA Catheter. This system was created specially to optimize radial access, produce remarkable results, and increase patient satisfaction.

Furthermore, in October 2021, Boston Scientific Corporation presented favorable clinical trial results for the Eluvia Drug-Eluting Vascular Stent System during a clinical trial presentation at the Vascular InterVentional Advances (VIVA) meeting in Las Vegas. The Eluvia stent outperformed self-expanding bare metal stents (BMS) for the treatment of patients with peripheral arterial disease (PAD) and superficial femoral artery (SFA) lesions up to 210 mm in length, according to data from the EMINENT trial that were presented. The study included 775 patients, making it the biggest drug-eluting stent randomized trial for PAD treatment to date. Such developments are anticipated to fuel the usage of peripheral vascular stents.

Therefore, there is a growth in the Peripheral vascular stents segment of the studied market.

North America Dominates the Peripheral Vascular Devices Market

North America is expected to dominate the market owing to factors such as the rising incidence of cardiovascular diseases, growing geriatric population, the strong presence of industry players in the region, better healthcare infrastructure, awareness among people and healthcare industry stakeholders about available technologies, and the high concentration of market players in the United States.

According to the Centers for Disease Control and Prevention (CDC)'s article titled 'Heart Disease Facts' published in September 2020, heart disease is the leading cause of death in the United States. The same source also reports that every year about 805,000 Americans have a heart attack. As the number of deaths due to heart diseases is increasing there is a continuous need for the proper treatment of cardiac diseases since peripheral vascular devices provides helps in the treatment of artery blockages and narrowing and hence are expected to show growth over the forecast period.

The increasing product launches, partnerships, and acquisitions particularly in the United States are leading to an increase in market growth. For instance, in March 2022, Siemens Healthineers launched next-generation ACUSON AcuNav Volume 4D ICE Catheter in the United States. As per the company, AcuNav Volume ICE catheter transforms care delivery by enabling the treatment of patients who were previously not able to undergo Structural Heart procedures.

Additionally, in September 2021, Abbott announced the acquisition of Walk Vascular, LLC, a medical device company with a minimally invasive mechanical aspiration thrombectomy system designed to remove peripheral blood clots. Walk Vascular's peripheral thrombectomy systems will be incorporated into Abbott's existing endovascular product portfolio. The collaboration enabled Abbott to increase the range of its peripheral vascular services.

Therefore, owing to the above-mentioned factors, the growth of the studied market is anticipated in the North America Region.

Peripheral Vascular Devices Industry Overview

The peripheral vascular devices market is slightly consolidated in nature due to the presence of a few companies operating globally as well as regionally. The competitive landscape includes an analysis of a few international as well as local companies which hold the market shares and are well known. Abbott Laboratories, Boston Scientific Corporation, Becton, Dickinson and Company, Cook, Medtronic, Cordis Corporation, Edward Lifesciences, and Volcano Corporation among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Minimally-invasive Procedures

- 4.2.2 Increase in Incidence of Peripheral Arterial Disease (PAD)

- 4.3 Market Restraints

- 4.3.1 Stringent Regulation Related to Peripheral Vascular Devices

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Device Type

- 5.1.1 Peripheral Vascular Stents

- 5.1.2 Peripheral Transluminal Angioplasty (PTA) Balloon Catheters

- 5.1.3 Peripheral Transluminal Angioplasty (PTA) Guidewires

- 5.1.4 Atherectomy Devices

- 5.1.5 Embolic Protection Devices

- 5.1.6 Inferior Vena Cava Filters

- 5.1.7 Other Device Types

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Australia

- 5.2.3.5 South Korea

- 5.2.3.6 Rest of Asia-Pacific

- 5.2.4 Middle-East and Africa

- 5.2.4.1 GCC

- 5.2.4.2 South Africa

- 5.2.4.3 Rest of Middle-East and Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Argentina

- 5.2.5.3 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Abbott Laboratories

- 6.1.2 Boston Scientific Corporation

- 6.1.3 Becton, Dickinson and Company

- 6.1.4 Cook

- 6.1.5 Cordis Corporation

- 6.1.6 Edward Lifesciences

- 6.1.7 Medtronic

- 6.1.8 Volcano Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS