PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1403827

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1403827

UAE In-Vitro Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

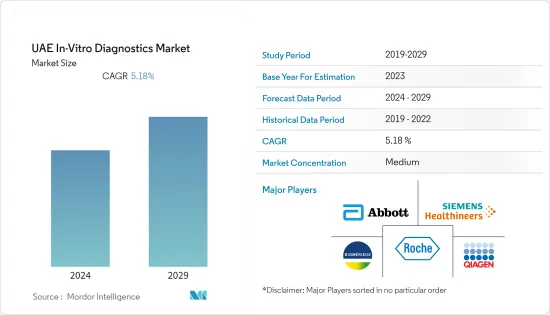

The UAE in-vitro diagnostics market size is expected to grow from USD 334.87 million in 2024 to USD 431.07 million by 2029, at a CAGR of 5.18% during the forecast period.

Initially, COVID-19 significantly impacted the in-vitro diagnostics (IVD) market owing to the high demand for these tests for COVID-19 detection. Various market players have launched innovative IVD tests for rapid viral detection. For instance, in February 2021, YAS Pharmaceuticals and Pure Health launched one of the world's first artificial intelligence (AI)-powered rapid COVID-19 antigen tests in the UAE. Through this device, results were delivered within five to eight minutes, with 98.3% specificity in detecting the SARS-CoV-2 virus. Such innovations elevated the demand for IVD in the country during the pandemic. However, the market in the current state has seized since the COVID-19 cases have declined worldwide. The market is expected to show a stable growth rate during the forecast period due to its widespread application in other diseases as well.

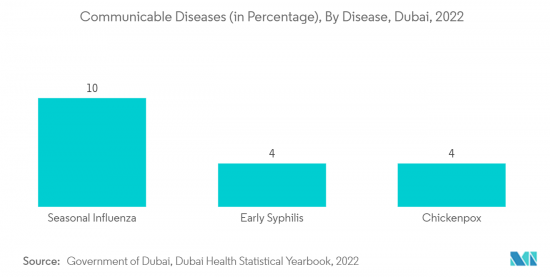

The growth of the UAE in vitro diagnostics market is attributed to the high prevalence of chronic and infectious diseases and government initiatives for the management and control of such diseases, which boost the demand for IVD in the country. For instance, according to the UAE government portal 2022 update, 11.8% of the UAE's population were affected by diabetes in 2021. Also, as per the Dubai Health Statistical Yearbook 2021 report, cardiovascular diseases were the most abundant, with a prevalence of 31.1% in Dubai in 2021. Therefore, the high burden of diabetes and cardiovascular diseases in the country is expected to propel the demand for IVD for the diagnosis of diabetes for the better management of such diseases, thereby accelerating market growth.

Furthermore, government initiatives for increasing the screening of diseases utilizing IVD also contribute to the growth of the market. For instance, in January 2023, a new document named 'Sharjah Declaration 3.0' outlining the path for the elimination of cervical cancer was launched during the Cervical Cancer Forum (CCF). The declaration highlighted the importance of collaboration and partnerships between governments, healthcare providers, and civil society organizations, as well as the necessity of increased funding for cervical cancer prevention, screening, and treatment programs. The country's adoption of cancer control initiatives is expected to boost the demand for IVD, such as PCR tests used in laboratories and hospitals to assess cervical cancer in the country, thereby propelling the market growth.

Additionally, the strategic initiatives adopted by market players, such as product launches, approvals, or awards, are also contributing to the market growth. For instance, in December 2022, Roche Diagnostics was one of the first in-vitro diagnostics companies in the Middle East to achieve ISO:27001 Information Security certification, demonstrating its commitment to protecting patient data information and building trust across the region. The expansion of major market players in the country and such achievement is expected to propel the demand for its IVD products, which is ultimately projected to propel the market growth in the forecast period.

Therefore, owing to the aforementioned factors, such as rising government disease control initiatives promoting the usage of IVD and the high concentration of key market players in the country, the studied market is anticipated to witness growth over the analysis period. However, stringent manufacturing and marketing regulations are expected to restrain market growth.

UAE In-Vitro Diagnostics Market Trends

Oncology Segment is Expected to Hold a Significant Growth Over The Forecast Period

The oncology segment is expected to grow during the forecast period owing to factors such as rising awareness regarding early cancer diagnosis and launches of technologically advanced products.

The growing government initiatives in spreading cancer awareness among the population are expected to drive the segment's growth. For instance, in October 2022, the Ministry of Health and Prevention (MoHAP) launched a national breast cancer awareness campaign, 'Screen and Reassure Us,' to highlight the importance of early detection of breast cancer and prevention methods in the United Arab Emirates. Such awareness initiatives accelerate the utility of in-vitro diagnostics for breast cancer detection.

Additionally, in March 2022, Sheikh Shakhbout Medical City (SSMC), based in UAE, entered into a joint-venture partnership with Abu Dhabi Health Services Company (SEHA) and Mayo Clinic to launch an awareness campaign emphasizing the importance of screening and prevention during colorectal cancer awareness month. Such awareness campaigns drive the need for IVD for cancer diagnosis, thereby propelling the segment's growth during the forecast period.

Furthermore, the rising company's focus on adopting various business strategies such as collaboration, partnerships, and launches is also expected to fuel the segment's growth. For instance, in May 2022, ColoAlert tests were launched in the UAE; they are easy-to-use at-home colon cancer tests that can be self-administered and can detect colorectal cancer with a sensitivity and specificity nearly as high as the invasive procedure usually performed in hospital settings.

Therefore, owing to factors such as rising cancer screening awareness and technological advancements in cancer IVDs, the segment is expected to witness healthy growth during the forecast period.

Molecular Diagnostics Segment is Expected to Hold a Significant Market Share Over The Forecast Period

Molecular diagnostic tests detect specific sequences in DNA or RNA to detect diseases. Factors such as the high burden of COVID-19, the high burden of infectious diseases such as HIV and malaria, and the engagement of market players in an exhibition of molecular diagnostics in the international event are expected to boost the growth of the market segment over the forecast year.

The high burden of COVID-19 cases in the country boosted the utility of PCR during the pandemic. For instance, as per the United Arab Emirates Ministry of Cabinet Affairs statistics, as of December 24, 2021, 334,275.9 COVID-19 PCR tests were conducted in the United Arab Emirates every day. Such a high demand for PCR testing during the pandemic boosted the growth of the market segment.

Also, the high burden of infectious diseases such as malaria, HIV, and hepatitis is expected to create an opportunity for market players to develop innovative molecular diagnostic tests, which is expected to propel market growth. For instance, an article published in the Journal of STD & AIDS in March 2021 stated that the United Arab Emirates (UAE) has the second highest incidence rates of HIV/AIDS in the Middle East and North Africa (MENA) region. The high burden of HIV in the country is expected to boost the demand for molecular diagnostic tests, which is expected to accelerate the segment growth.

The initiatives by market players, such as participation in exhibition events, launches, and technological advancements in their products and launches, significantly contribute to the segment growth. For instance, in February 2023, Co-Diagnostics, Inc., a molecular diagnostics company, hosted a booth at the Medlab Middle East 2023 trade show at the Dubai World Trade Centre. The company exhibited its molecular diagnostic tests that are designed using the detection of nucleic acid molecules (DNA or RNA).

Therefore, owing to factors such as the high burden of infectious diseases that create the demand for molecular diagnostics and strategic initiatives by market players to expand molecular diagnostic tests, the segment is expected to witness growth during the forecast period.

UAE In-Vitro Diagnostics Industry Overview

The UAE in-vitro diagnostics market is moderately competitive due to the presence of some global players in the country along with some local market players. The major market players in the UAE in-vitro diagnostics market are biomerieux, QIAGEN, Abbott Laboratories, Hoffmann-La Roche Ltd, and Siemens Healthineers AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Prevalence of Chronic and Infectious Diseases

- 4.2.2 Government Initiatives Leading to a High Usage of IVD and Point-of-care (POC) Diagnostics

- 4.2.3 Technological Advancements in IVD Devices

- 4.3 Market Restraints

- 4.3.1 Stringent Manufacturing and Marketing Regulations

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Test Type

- 5.1.1 Clinical Chemistry

- 5.1.2 Immunodiagnostics

- 5.1.3 Molecular Diagnostics

- 5.1.4 Hematology

- 5.1.5 Other Test Types

- 5.2 By Product

- 5.2.1 Instrument

- 5.2.2 Reagent

- 5.2.3 Other Products

- 5.3 By Usablity

- 5.3.1 Disposable IVD Devices

- 5.3.2 Reusable IVD Devices

- 5.4 By Application

- 5.4.1 Infectious Disease

- 5.4.2 Diabetes

- 5.4.3 Oncology

- 5.4.4 Cardiology

- 5.4.5 Other Applications

- 5.5 By End User

- 5.5.1 Diagnostic Laboratories

- 5.5.2 Hospitals and Clinics

- 5.5.3 Other End Users

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Abbott Laboratories

- 6.1.2 Becton, Dickinson and Company

- 6.1.3 bioMerieux

- 6.1.4 Bio-Rad Laboratories Inc.

- 6.1.5 Danaher Corporation

- 6.1.6 QIAGEN

- 6.1.7 F Hoffmann-La Roche Ltd

- 6.1.8 Siemens Healthineers AG

- 6.1.9 Sysmex Corporation

- 6.1.10 Thermo Fisher Scientific

7 MARKET OPPORTUNITIES AND FUTURE TRENDS