PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1403102

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1403102

In Vitro Fertilization - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

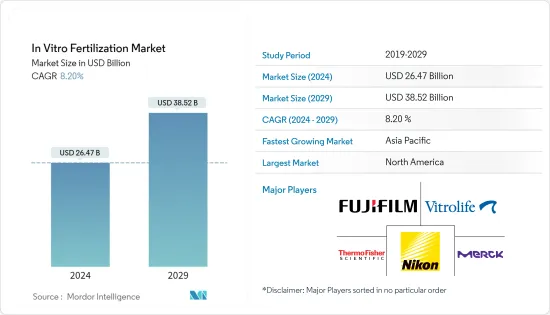

The In Vitro Fertilization Market size is estimated at USD 26.47 billion in 2024, and is expected to reach USD 38.52 billion by 2029, growing at a CAGR of 8.20% during the forecast period (2024-2029).

The COVID-19 pandemic has impacted the growth of the studied market owing to the suspension of in vitro fertilization treatments, and this had a profound impact on women undergoing IVF procedures. For instance, according to an published in Reproductive Biomedicine and Society Online, the pandemic has resulted in the large-scale cessation of assisted reproductive technology treatment in Europe owing to the closure of clinics, which resulted in delayed fertility treatment of thousands of patients in the region, especially the United Kingdom. Thus, the disrupted treatment has impacted the growth of the market during the pandemic period. However, with released restrictions and proper sanitization and measurements taken during the treatment procedures, the demand for in-vitro fertilization has increased. Thus, the studied market has witnessed significant growth and is expected to grow over the forecast period.

Factors such as the rising success rate of IVF technology, increasing awareness about IVF procedures, and delayed onset of pregnancy are expected to boost market growth over the forecast period.

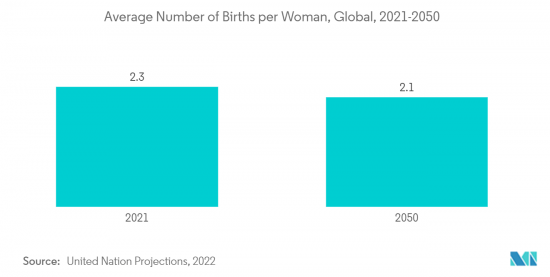

Infertility continues to represent an increasing global challenge due to multiple factors such as environment, genetics, age, and comorbidities associated with impaired reproductive function. The rising number of infertile cases has increased the demand for fertility procedures that help couples with difficulties or an inability to conceive children. For instance, according to an article published in Cell in May 2022, it has been observed that male infertility is an increasing and serious medical concern that affects approximately half of infertile couples worldwide. Also, an article published in the International Bar Association in March 2022 showed that fertility rates have consistently declined to below replacement levels across developed countries globally. This is anticipated to fuel the demand for in-vitro fertilization to treat infertility issues, propelling the market growth.

Additionally, there is a growing effort by the government and other organizations to launch several campaigns to educate the public about fertility care, treatment options, and the factors contributing to infertility issues. For instance, in August 2022, Pinnacle Fertility launched the Save IVF campaign to educate on potential new legislation that threatens family-building treatment. Also, in July 2022, Oasis Fertility launched the Infertility Knows No Gender campaign to commemorate World IVF Day. IVF offers a ray of hope to millions of couples struggling with infertility.

Furthermore, the increasing launches of IVF facilities and new technologies across the globe for providing better ART services are also contributing to segment growth. For instance, in August 2022, the Rejuvenating Fertility Center (RFC) launched Injection-Free IVF or Needle-Free IVF procedures. This non-conventional holistic treatment uses oral and nasal fertility drugs to stimulate the patient's ovaries during in vitro fertilization (IVF). This gently stimulates the ovaries to produce multiple higher-quality eggs. Such developments are expected to increase the demand for needleless IVF treatment.

Therefore, owing to the factors above, such as the high burden of infertility, increasing IVF awareness campaigns, and the growing number of IVF facilities and products, the studied market is anticipated to grow over the forecast period. However, the complications associated with in-vitro fertilization, social stigma, and ethical and legal issues associated with in-vitro fertilization are likely to hinder the market's growth over the forecast period.

In Vitro Fertilization Market Trends

The Sperm Separation Systems Segment is Expected to Witness Significant Growth Over the Forecast Period

In most assisted reproductive technologies (ART), such as in vitro fertilization (IVF) and artificial insemination, sperm separation systems are used. These systems are critical for assisted reproductive technologies (ARTs) because they provide purified samples that can be used in subsequent procedures. These systems are crucial for ARTs as they provide purified samples for further procedures. Furthermore, the rising focus of companies on developing novel devices for use in assisted reproductive technology (ART) procedures conducted by fertility clinics and obstetrician-gynecologist (OB/GYN) practices is driving the market growth.

The increasing use of advanced technology, such as sperm syringes, in selecting high-quality sperm is expected to fuel the segment growth. For instance, an article published in Advanced Materials Technologies in March 2022 reported that a sperm syringe provides the maximum contact area between 1.5 ml of the semen sample and selection events, thereby enabling a highly parallelized and rapid sorting mechanism. This retrieval efficiency provides a sufficient volume and number of high-quality sperm for droplet-based IVF and intrauterine insemination (IUI) to avoid the more invasive intracytoplasmic sperm injections (ICSI) procedure.

Also, sperm syringe offers a promising option for clinics to deploy less invasive assisted reproductive technologies (ARTs), hence minimizing the related clinical strain and improving the long-term health outcomes for ART-conceived children as compared to intracytoplasmic sperm injection.

Furthermore, the growing technological advancements in the sperm separation segment are also contributing to the segment's growth. For instance, in March 2022, Malta, in collaboration with Pera Labs's commercialization advisors at the University City Science Center, started the research and development of an AI-powered sperm and egg selection technology for fertility treatments. Pera Labs's Malta operations are accelerated by the EUR 800,000 (USD 8,83,040) of financial support from Malta Enterprise, coupled with Pera Labs's financing.

Therefore, due to the rapid advancements in technology and the accuracy of sperm selection procedures, the sperm separation systems segment is expected to witness significant growth over the forecast period.

North America is Expected to Have the Significant Market Share Over the Forecast Period

North America is anticipated to hold a significant share of the market over the forecast period owing to factors such as the rising prevalence of associated conditions such as polycystic ovary syndrome (PCOS), standardization of procedures, government funding for sperm and egg storage, and a constant rise in the incidence of infertility in both sexes. In addition, the presence of various leading players in this region, the growing number of single women and same-sex couples, and favorable regulatory reforms are also expected to boost the market growth in the region.

The rising number of single women and same-sex couples in the country are increasing the demand for IVF treatment to help them become parent, which is expected to fuel the market growth. For instance, according to the 2022 data published by the United States Census, about 1.2 million same-sex couples were living in the United States in 2021, of which 710,000 (60%) were married and 500,000 were unmarried. Additionally, the rising number of in-vitro fertilization procedures in the region contributes to the market growth. For instance, about 368,502 ART cycles were performed in the United States in 2021, an increase of 19% compared to the previous year.

Additionally, the incidence of infertility is increasing due to rising levels of smoking, alcohol consumption, use of some illicit drugs, and underlying problems, including obesity. For instance, as per the 2021 data published by the WHO, 12% of the people in Canada smoke regularly, and people aged 20 years or above have the highest rate of smoking (11%) as compared to people aged 15 years to 19 years (4%). The rising prevalence of smoking is associated with a high level of ferroptosis in seminal plasma, which affects the quality of semen and lowers the probability of getting pregnant, which is expected to propel the growth of the studied market over the forecast period.

The increasing adoption of various business strategies such as acquisitions, partnerships, and others by the companies increases the introduction of advanced fertility treatment centers and options, which is anticipated to propel market growth. For instance, In December 2022, Kindbody launched a state-of-the-art clinic and in vitro fertilization (IVF) lab in Dallas to meet the increasing demand for world-class fertility care and comprehensive family-building benefits by patients and employers in the area.

Similarly, in December 2021, Cooper Companies acquired Generate Life Sciences, a provider of donor eggs and sperm for fertility treatments, fertility cryopreservation services, and newborn stem cell storage (cord blood and cord tissue) for approximately USD 1.6 billion. With this acquisition, CooperSurgical can offer fertility clinics, Obstetrics, and Gynaecology even stronger services and products.

Therefore, owing to the factors above, the studied market is anticipated to grow over the forecast period.

In Vitro Fertilization Industry Overview

The in-vitro fertilization market is consolidated in nature due to the presence of several companies operating globally as well as regionally. The key players are adopting key strategic activities such as acquisitions, collaborations, partnerships, and new product launches to withhold their position in the in-vitro fertilization market. Some of the key companies in the market are Thermo Fisher Scientific Inc., Vitrolife AB, Fujifilm Holdings Corporation, Merck KGaA, Nikon Corporation, Cooper Surgical Inc., and Boston IVF, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Success Rate of IVF Technology

- 4.2.2 Increasing Awareness about IVF Technology

- 4.2.3 Delayed Onset of Pregnancies

- 4.3 Market Restraints

- 4.3.1 Complications Associated with In Vitro Fertilization

- 4.3.2 Social Stigma, Ethical, and Legal Issues Associated with In Vitro Fertilization

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Product

- 5.1.1 Reagent

- 5.1.2 Instrument

- 5.1.2.1 Imaging Systems

- 5.1.2.2 Incubators

- 5.1.2.3 Cryosystems

- 5.1.2.4 IVF Cabinet

- 5.1.2.5 Ovum Aspiration Pump

- 5.1.2.6 Sperm Separation Systems

- 5.1.2.7 Micromanipulator Systems

- 5.1.2.8 Other Instruments

- 5.2 By End User

- 5.2.1 Fertility Clinics

- 5.2.2 Hospitals

- 5.2.3 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cook Group Incorporated

- 6.1.2 CooperSurgical Inc.

- 6.1.3 Fujifilm Holdings Corporation

- 6.1.4 Genea Biomedx Pty Ltd

- 6.1.5 Hamilton Thorne Ltd

- 6.1.6 Merck KGaA (EMD Serono Inc.)

- 6.1.7 Nikon Corporation

- 6.1.8 Thermo Fisher Scientific Inc.

- 6.1.9 Vitrolife AB

- 6.1.10 Oxford Gene Technology (Sysmex Corporation)

- 6.1.11 Rocket Medical PLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS