PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851981

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851981

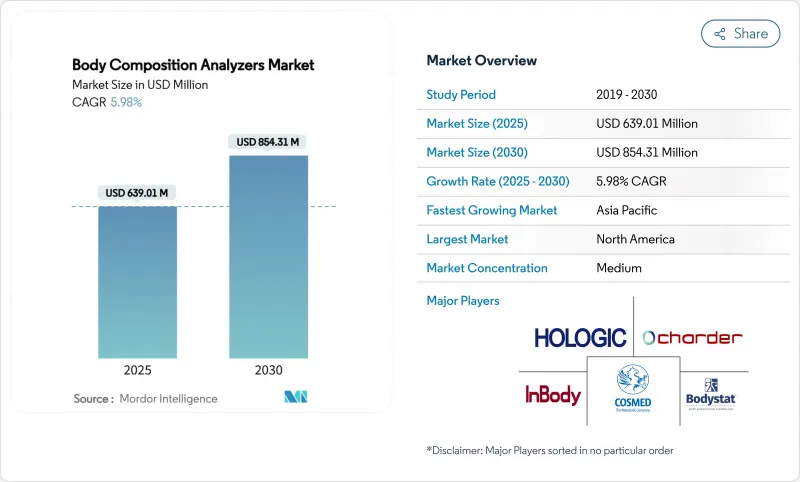

Body Composition Analyzers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Body Composition Analyzers Market size is estimated at USD 639.01 million in 2025, and is expected to reach USD 854.31 million by 2030, at a CAGR of 5.98% during the forecast period (2025-2030).

Growth reflects a clear migration of body composition measurement from a niche diagnostic to a widely adopted health-monitoring tool across clinical, fitness, and household settings. Uptake is propelled by the convergence of rising global metabolic-disease prevalence, continual product miniaturization, and multi-frequency bioelectrical impedance innovations that now approach dual-energy X-ray absorptiometry (DEXA) accuracy while preserving portability and cost benefits. Regulatory support such as clearer U.S. Food and Drug Administration (FDA) device classifications and the gradual inclusion of metabolic screening in reimbursement schedules reinforces provider confidence, while home users embrace connected scales that translate raw impedance signals into actionable wellness guidance. Competitive activity shows established manufacturers refining algorithms for ethnic- and age-specific accuracy even as smartphone-based 3-D optical scanning gains traction, setting the stage for hybrid ecosystems that blend hardware precision with cloud analytics.

Global Body Composition Analyzers Market Trends and Insights

Large Pool of Obese & Metabolic-Disorder Patients

Obesity is rising at an unprecedented pace, with adults living with obesity projected to more than double to 1.13 billion by 2030. Clinical guidelines increasingly prefer body composition metrics over BMI because impedance-based analysis can uncover sarcopenic obesity hidden high-fat low-muscle profiles that BMI alone misses. Global estimates show 506 million people already living with metabolic disorders in 2024. Health systems are therefore upgrading diagnostic protocols to include impedance testing for visceral adiposity, transforming analyzers from optional equipment into core preventative-care devices. The shift aligns with payer incentives that reward early risk stratification; insurers see reduced long-term outlays when metabolic deterioration is caught early. Hospitals consequently incorporate analyzers into annual wellness checks and bariatric-surgery pathways, cementing demand over the long term.

Technological Advancements in Multi-Frequency BIA

Multi-frequency BIA measures intracellular and extracellular water separately, pushing correlation with DEXA beyond 0.973 in current clinical studies. Advancements in eight-electrode placement and phase-angle analytics provide a window on cellular membrane integrity-useful for oncology, nephrology, and critical-care nutrition. Manufacturers embed artificial-intelligence routines that auto-select ethnic-specific equations, removing a key accuracy barrier in diverse populations. Wearable impedance patches now relay hydration and muscle-glycogen estimates to mobile dashboards, enabling continuous monitoring. Together these upgrades reduce inter-operator variability and extend use cases beyond weight management to comprehensive metabolic profiling.

High Equipment & Maintenance Costs

Entry-level multi-frequency units start around USD 6,755 and climb to USD 50,000 for research-grade systems. Annual calibration, electrode replacement, and software-license renewals inflate lifetime cost, deterring small clinics and independently owned gyms. Emerging-market providers face higher financing costs and spotty service coverage, raising downtime risk. Leasing programs soften the blow but still require volume guarantees difficult to meet in sparsely populated regions. Until economies of scale drive pricing down, upfront expense will cap the body composition analyzers market penetration rate in cost-sensitive geographies.

Other drivers and restraints analyzed in the detailed report include:

- Rising Consumer Awareness for Health & Fitness

- Expansion of Preventive-Care Reimbursements

- Measurement Inconsistency Across Device Types

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bio-impedance Analyzers held a 44.32% body composition analyzers market share in 2024 due to extensive clinical validation and relatively modest capital requirements. 3-D Optical Body Scanners, however, post the fastest 7.48% CAGR to 2030 as computer-vision algorithms mature and hardware costs fall. Dual-energy X-ray Absorptiometry retains relevance for research and osteoporosis screening but remains limited by high purchase price and radiation protocols. Skinfold Calipers continue in educational settings where budget and technical simplicity outweigh precision. Air-Displacement Plethysmography and Hydrostatic Weighing serve research institutions seeking gold-standard accuracy, whereas smart connected scales attract cost-conscious home users. Continuous R&D in electrode materials, impedance signal filtration, and phase-angle analytics ensure that bio-impedance devices stay competitive amid optical advances.

The product landscape diversifies further as hybrid systems fuse impedance cores with optical cameras, delivering both internal composition metrics and external body-shape visuals. Such convergence positions manufacturers to tap fitness-app partnerships and leverage social-media-sharing trends. Intellectual-property filings reveal interest in dynamic electrode selection and miniaturized current-injection circuits, pointing to future wearables that deliver DEXA-like insight without clinic visits. Hence, while incumbents anchor volume today, innovators leveraging artificial intelligence and alternative sensing modalities will shape longer-term demand.

The Body Composition Analyzers Market Report is Segmented by Product (Bio-Impedance Analyzers, Skinfold Calipers, Hydrostatic Weighing Equipment, and More), Measurement Technology (Single-Frequency BIA, Multi-Frequency BIA, and More), End User (Hospitals & Clinics, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 33.93% of global revenue in 2024, anchored by well-funded healthcare systems, explicit CPT reimbursement codes, and mature telehealth infrastructure. Market expansion there now leans on replacement demand, software-subscription add-ons, and broader household uptake rather than first-time clinical purchases. Canada mirrors U.S. trends but adds provincial tele-nutrition pilots that outfit rural clinics with portable analyzers to offset specialist shortages.

Asia Pacific records a robust 9.68% CAGR through 2030, underpinned by aging populations, obesity escalation, and government-backed preventive-health campaigns. Japan's sarcopenia-screening guidelines spur hospital procurement, while China's fitness-club boom embraces connected scales for member engagement. Local manufacturing clusters in South Korea and China cut device cost, aiding price-sensitive segments. Telemedicine expansions across India and Southeast Asia unlock rural deployments, though device financing and physician-training gaps temper near-term volumes.

Europe remains steady, benefiting from stringent EU MDR compliance that assures device quality and GDPR-aligned data governance attractive to risk-averse providers. Public-health agencies promote malnutrition and sarcopenia screening, expanding clinical use. Nordic countries showcase near-universal electronic-health-record integration, setting benchmarks for seamless data flow. Southern and Eastern European nations advance gradually, balancing tight budgets with EU funding earmarked for digital health modernization.

- Inbody

- OMRON

- Hologic

- Tanita

- Seca GmbH & Co. KG

- COSMED Srl

- Bodystat

- Charder Electronic

- Withings SA

- Google (Fitbit Inc.)

- Koninklijke Philips

- EatSmart

- Evolt 360

- Styku Inc.

- Renpho Health

- BVI Medical Ltd (Body Volume Indicator)

- Maltron International

- Biospace Co. Ltd (InBody's brand)

- AKERN Srl

- Xiaomi (Mi Body Composition)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Large Pool of Obese & Metabolic-Disorder Patients

- 4.2.2 Technological Advancements in Multi-Frequency Bia

- 4.2.3 Rising Consumer Awareness for Health & Fitness

- 4.2.4 Expansion of Preventive-Care Reimbursements

- 4.2.5 Integration with Tele-Nutrition & Telehealth Platforms

- 4.2.6 Adoption in Professional Sports Performance Analytics

- 4.3 Market Restraints

- 4.3.1 High Equipment & Maintenance Costs

- 4.3.2 Measurement Inconsistency Across Device Types

- 4.3.3 Data-Privacy & Cybersecurity Compliance Hurdles

- 4.3.4 Emerging Optical/AI Body-Scan Substitutes

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Bio-impedance Analyzers

- 5.1.2 Skinfold Calipers

- 5.1.3 Hydrostatic Weighing Equipment

- 5.1.4 Air-Displacement Plethysmography

- 5.1.5 Dual-energy X-ray Absorptiometry (DEXA)

- 5.1.6 3-D Optical Body Scanners

- 5.1.7 Smart Connected Scales

- 5.1.8 Other Products

- 5.2 By Measurement Technology

- 5.2.1 Single-frequency BIA

- 5.2.2 Multi-frequency BIA

- 5.2.3 Segmental BIA

- 5.2.4 Portable/Hand-held Systems

- 5.2.5 Benchtop/Standalone Systems

- 5.3 By End User

- 5.3.1 Hospitals & Clinics

- 5.3.2 Sports Medicine Centers

- 5.3.3 Home Care Settings

- 5.3.4 Academic & Research Institutes

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 InBody Co. Ltd

- 6.3.2 Omron Healthcare Inc.

- 6.3.3 Hologic Inc.

- 6.3.4 Tanita Corporation

- 6.3.5 Seca GmbH & Co. KG

- 6.3.6 COSMED Srl

- 6.3.7 Bodystat Ltd

- 6.3.8 Charder Electronic Co. Ltd

- 6.3.9 Withings SA

- 6.3.10 Google (Fitbit Inc.)

- 6.3.11 Koninklijke Philips N.V.

- 6.3.12 EatSmart Inc.

- 6.3.13 Evolt 360

- 6.3.14 Styku Inc.

- 6.3.15 Renpho Health

- 6.3.16 BVI Medical Ltd (Body Volume Indicator)

- 6.3.17 Maltron International Ltd

- 6.3.18 Biospace Co. Ltd (InBody's brand)

- 6.3.19 AKERN Srl

- 6.3.20 Xiaomi (Mi Body Composition)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment