PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686599

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686599

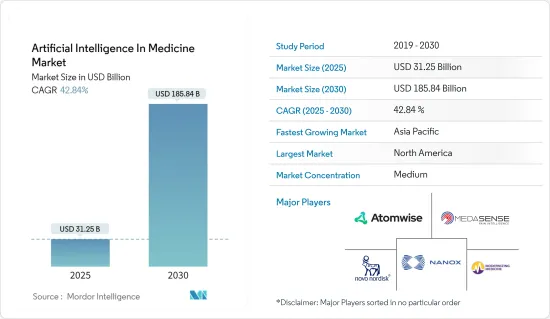

Artificial Intelligence In Medicine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Artificial Intelligence In Medicine Market size is estimated at USD 31.25 billion in 2025, and is expected to reach USD 185.84 billion by 2030, at a CAGR of 42.84% during the forecast period (2025-2030).

Artificial Intelligence (AI) in the medical field is driven by several factors, including the need to manage data more effectively and optimize healthcare costs, the growth of public-private partnerships, and the increased regional spending on healthcare. Additionally, the market for artificial intelligence in the medical sector is anticipated to grow as opportunities in geriatric population care with the aid of AI technology and imaging and diagnostics to generate data for research development arise.

Key Highlights

- Chronic illnesses such as diabetes, heart disease, and cancer pose significant healthcare challenges globally. These conditions often necessitate long-term care, regular monitoring, and advanced diagnostic tools. Artificial Intelligence (AI) enhances early detection and personalizes treatments to meet these requirements. For instance, AI-driven technologies like HeartFlow provide a non-invasive alternative to angiograms by analyzing coronary CT scans to identify blockages.

- The American Diabetes Association reported that over 37 million Americans were diagnosed with diabetes in 2023, underscoring the critical role of AI in effectively managing such health issues. 'The integration of AI in healthcare not only improves patient outcomes, optimizes resource allocation, and reduces overall healthcare costs but also enhances overall healthcare efficiency. As the prevalence of chronic diseases continues to rise, the adoption of AI technologies is expected to grow, driving innovation and efficiency in the healthcare sector.

- The digital revolution has profoundly transformed the healthcare sector. Notably, innovations and integrations have reshaped care delivery and system performance. As digital convergence paves the way for the seamless integration of technologies like AI, IoT, and machine learning (ML), the healthcare sector is poised for a new wave of transformation, steering towards a customer-centric business model.

- Artificial Intelligence (AI) in healthcare leverages technologies such as machine learning, natural language processing, and deep learning to improve experiences for both healthcare professionals and patients. With its data-processing and predictive capabilities, AI empowers healthcare professionals to optimize resource management and adopt a proactive stance in diverse healthcare facets, contributing to the emergence of smart healthcare systems.

- AI-enabled solutions hold significant promise, yet their implementation in clinical settings faces constraints. Clinicians need high-quality datasets to validate AI models both clinically and technically. Yet, the fragmentation of medical data across multiple electronic health records (EHRs) and software platforms complicates the collection of patient information, making it challenging to test AI algorithms.

- The ongoing conflict between Israel and Hamas, amid geopolitical complexities, threatens to disrupt the global semiconductor industry. Israel plays a significant role in Integrated Circuit (IC) production and innovation, which can impact the price and availability of devices worldwide used for AI in medicine solutions.

- Additionally, in June 2024, Intel Corp stopped building a new chip manufacturing plant worth USD 25 billion in Israel. This could indirectly lower the availability and production volume of semiconductor solutions and impact the global artificial intelligence in medicine market during the forecast period.

Artificial Intelligence in Medicine Market Trends

Patient Management Application Segment Holds Significant Market Share

- Artificial intelligence is rapidly advancing in patient management and witnessing growth in applications to optimize staff scheduling, reduce patient wait times, and streamline or automate routine tasks. AI drives innovation in the healthcare sector by predicting patient needs, streamlining workflows, and providing personalized care.

- Moreover, AI-driven solutions provide crucial insights for healthcare professionals, especially in the early identification of conditions like cancer, diabetes, and coronary artery disease. By scrutinizing data from diverse sources, including X-rays and medical imagery, AI can pinpoint patterns linked to the onset of these diseases. Additionally, merging AI with smart devices, like wearable bands, facilitates monitoring patients' heart rates constantly. This promotes proactive health management and acts as an alert system, notifying physicians, caregivers, or patients about potential heart attacks or strokes, thereby enhancing the chances of saving lives.

- Market vendors are launching AI-enabled solutions and services to help healthcare organizations improve patient management and monitoring. For instance, in November 2024, Oracle Health announced its plans to unveil a state-of-the-art electronic health record (EHR) platform in 2025. With a vision to reshape the healthcare landscape, the platform will seamlessly integrate artificial intelligence (AI) and sophisticated data analytics. This groundbreaking platform will merge Oracle's clinical AI agent and voice-activated functionalities with its Health Data Intelligence (HDI) system, streamlining workflows for healthcare professionals. Anticipated to transcend conventional record-keeping methods, the new EHR platform is designed to be proactive and offer enhanced patient outcomes.

- Further, in June 2024, Aidoc unveiled its latest AI-driven patient management technology to boost clinic volumes and elevate patient care. This innovative technology focuses on refining the identification and monitoring of patients requiring follow-ups for incidental or chronic conditions.

- Moreover, appointment management and care coordination are becoming pivotal applications of AI in patient management. AI enhances appointment scheduling by factoring in patient preferences, urgency, and provider availability. Furthermore, AI facilitates smooth coordination among healthcare teams by keeping up-to-date patient records and care plans.

North America is Expected to Hold Significant Market Share

- AI technologies are rapidly being adopted in the healthcare and pharmaceutical sectors, driven by significant investments from both government and private entities. These investments focus on bolstering research and development activities. The US, with its advanced infrastructure capable of supporting cutting-edge medical solutions, is poised to lead the regional market. Furthermore, the surge in investments directed towards AI-focused startups is set to further propel market growth.

- The use of AI technology has been encouraged by many healthcare industry players since it can potentially enhance the service provided manifold. Access to data, collection of symptoms related to patients, and the communication of corresponding treatments are the primary functions that need the highest integration of AI in the industry.

- For instance, in October 2024, Alimetry has secured an oversubscribed USD 18 million in its A2 financing round. The funds will be directed towards the commercialization of its innovative wearable device, designed for monitoring gut health. This move comes as a response to the rising adoption of the device by an expanding number of hospitals across the US Key drivers behind this adoption include Alimetry's achievement of its fourth FDA clearance, the introduction of a CPT III reimbursement code, and the successful conclusion of more than 30 clinical studies.

- Many players in the healthcare sector are championing the integration of AI technology, recognizing its potential to significantly elevate service quality. Key areas for AI integration include data access, symptom collection, and communication of relevant treatments.

- For instance, in September 2024, Palantir Technologies Inc. has secured a multi-year, multi-million-dollar contract with Nebraska Medicine, a prominent academic health system in Omaha valued at USD 2.5 billion and recognized nationally for its healthcare innovations. The contract centers on Palantir's Artificial Intelligence Platform (AIP), aimed at enhancing healthcare through groundbreaking technologies.

- As technology evolves, reshaping every facet of healthcare, software powered by artificial intelligence (AI)-particularly its subset, machine learning (ML)-is becoming integral to a growing array of medical devices. A standout advantage of ML lies in its capacity to extract vital insights from the immense data generated daily in healthcare delivery.

- With the increasing investment and funding to improve the healthcare system, the market value has increased. Health Canada, the Canadian government's department overseeing national health policy, acknowledges AI's transformative potential in the healthcare sector, spanning areas like diagnosis, disease onset prediction, and prognosis. According to the Federal Innovation Ministry, Canada is channeling around USD 15 million into advancing artificial intelligence in the healthcare sector. However, Health Canada grapples with numerous challenges in crafting a fitting framework for AI/ML medical devices, and other regulatory challenges.

- In September 2024, Calabrio Canada, a workforce performance company, spearheaded The CareAI project. They collaborated with ORX, a developer of AI-driven solutions, and WELL Health Technologies, a tech-enabled healthcare provider. The initiative garnered a USD 14 million investment from DIGITAL, Canada's global innovation cluster for digital technologies. This amount is set to be bolstered by an additional USD 30 million from industry partners.

Artificial Intelligence in Medicine Industry Overview

The intensity of competitive rivalry in the market studied will likely be moderately high over the forecast period. The growing presence of big players in Artificial Intelligence in the Medicine industry is expected to intensify competitive rivalry during the forecast period. Market incumbents, such as Atomwise Inc., IBM Watson Health, etc., considerably influence the overall market.

These firms have been continuously expanding their scale of operations by focusing on market expansions and acquisitions. Acquisition activities effectively have significantly contributed to overall market growth in the Artificial Intelligence in Medicine market.

Large companies have also been expending significant resources on R&D operations to protect their market position and drive innovation in the artificial intelligence in medicine market in the near future.

High barriers to exit, growing levels of firm concentration, and market penetration are some of the significant characteristics influencing the competition in the market. Overall, the intensity of competitive rivalry remains moderately high, mainly driven by the strong presence of the prominent players involved in the market studied.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Stakeholder Analysis

- 4.4 Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Instances of Convergence Between IT and Healthcare Players Driving Innovations

- 5.1.2 Expanding Application Base and Growing Emphasis on the Adoption of Digital Transformation Practices to Realize Cost Savings

- 5.1.3 Increased Emphasis on Ensuring Patient Well-being and Relative Shortage of Physicians in Major Countries to Drive Adoption

- 5.2 Market Challenges

- 5.2.1 Initial Implementation and Perception Concerns

- 5.3 Market Opportunities

- 5.4 Major Partnerships and Collaborations

- 5.5 Key Technical and Stakeholder-related Considerations for the Implementation of AI in Medicine

6 TECHNOLOGY SNAPSHOT

- 6.1 Evolution of AI in the Field of Medicine

- 6.2 Key Innovations and Advancements

- 6.2.1 Discovery of Drug Interventions and Candidates

- 6.2.2 Clinical Trail Facilitation

- 6.2.3 Identification of Bio-markers

- 6.2.4 Advancements in Gene Editing

- 6.3 Major Areas of Research

- 6.3.1 Cardiology

- 6.3.2 Pulmonary Medicine

- 6.3.3 Nephrology

- 6.3.4 Neurology

7 MARKET SEGMENTATION

- 7.1 By Application Type

- 7.1.1 Medical Administration and Support

- 7.1.2 Patient Management

- 7.1.3 Research and Development

- 7.1.4 Other Applications

- 7.2 By Type

- 7.2.1 Hardware

- 7.2.2 Software

- 7.2.3 Services

- 7.3 By Geography

- 7.3.1 North America

- 7.3.1.1 United States

- 7.3.1.2 Canada

- 7.3.2 Europe

- 7.3.2.1 United Kingdom

- 7.3.2.2 Germany

- 7.3.2.3 France

- 7.3.2.4 The Nordics

- 7.3.3 Asia

- 7.3.3.1 China

- 7.3.3.2 India

- 7.3.3.3 South Korea

- 7.3.3.4 Singapore

- 7.3.4 Australia and New Zealand

- 7.3.5 Latin America

- 7.3.6 Middle East and Africa

- 7.3.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Atomwise Inc.

- 8.1.2 Novo Nordisk A/S

- 8.1.3 Modernizing Medicine Inc.

- 8.1.4 Nano-X Imaging Ltd

- 8.1.5 Medasense Biometrics Limited

- 8.1.6 BPGbio, Inc.

- 8.1.7 Sense.ly Corporation.

- 8.1.8 AiCure LLC

- 8.1.9 Cyrcadia Health

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET