PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850152

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850152

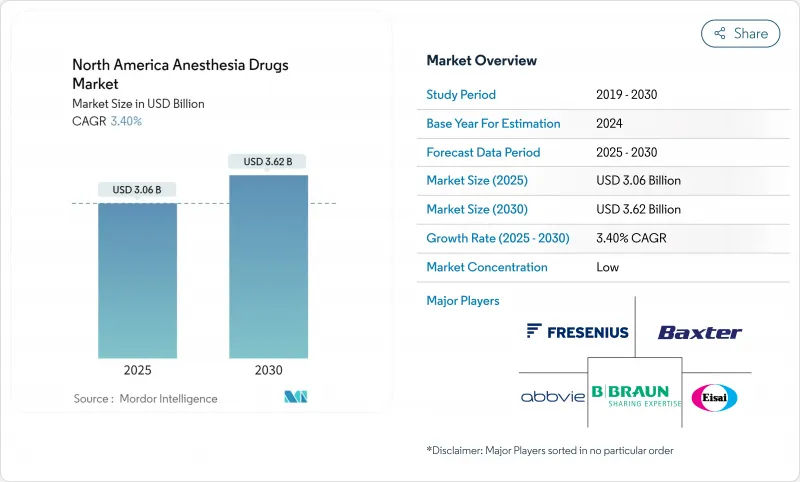

North America Anesthesia Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America anesthesia drugs market is valued at USD 3.06 billion in 2025 and is projected to climb to USD 3.62 billion by 2030, reflecting a 3.40% CAGR over the forecast period.

This moderate pace signals a maturing environment in which technological advances, rather than procedure volume growth, contribute most of the incremental value. Artificial intelligence (AI) now guides closed-loop delivery systems that fine-tune propofol and sevoflurane dosing, cutting drug waste while improving hemodynamic stability. Machine-learning models also outperform manual methods in predicting intraoperative complications, leading to shorter recovery times and lower readmission rates. Ambulatory surgery centers (ASCs) are pivotal: procedures shifting from inpatient suites to outpatient theaters expand demand for ultra-short-acting agents that enable same-day discharge. Meanwhile, next-generation molecules such as ciprofol and remimazolam are positioned to erode propofol's lead by offering milder cardiovascular effects.

North America Anesthesia Drugs Market Trends and Insights

Increasing Number of Surgeries

Surgical episodes across the region keep rising, with Medicare reporting 5.7% annual gains in procedures per beneficiary during 2024. ASCs anticipate a 22% lift in procedure counts by 2033, reinforcing demand for fast-acting anesthesia formulations. The 65-plus cohort undergoes more complex operations, which lengthen anesthetic exposure and elevate drug consumption. Cosmetic interventions now generate USD 13 billion yearly, expanding use of tailored agents that limit postoperative nausea in aesthetic clinics .

Growing R&D Investment by Pharmaceutical Companies

Pharma sponsors channel record sums into anesthesia pipelines, with AbbVie overseeing roughly 90 active compounds and USD 56.3 billion in 2024 revenue that funds clinical programs. Pfizer lists 64 novel entities among 112 pipeline projects, underscoring broad discovery momentum. The FDA cleared Journavx (suzetrigine) in January 2025, a non-opioid that could reshape perioperative pain protocols and curb opioid co-administration .

Adverse Effects & Safety Concerns of General Anesthetics

FDA pharmacovigilance tallied 1,126 sevoflurane adverse events between 2004 and 2022, ranging from atrial fibrillation to malignant hyperthermia. Pediatric surveillance uncovered novel signals such as encephalopathy, prompting clinician caution. Environmental moves like the NHS plan to phase out desflurane pressure hospitals to substitute agents despite familiarity advantages. These factors favor newer molecules that claim narrower cardio-respiratory profiles but may require costly education programs.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Outpatient/Ambulatory Surgeries Driving Demand for Ultra-Short-Acting Anesthetics

- Rapid Adoption of AI-Enabled Anesthesia Monitoring Improving Drug Utilization Efficiency

- Stringent FDA & DEA Regulations on Controlled Substances

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

General anesthetics accounted for 70.34% of the North America anesthesia drugs market share in 2024. Propofol's rapid onset underpins this lead, yet ciprofol is gaining clinician interest because it mitigates injection pain and cardiovascular swings. Sevoflurane remains the dominant inhaled choice for pediatric cases even as desflurane usage fades under green-house gas scrutiny. Dexmedetomidine enjoys expanding roles in awake procedures and intensive care where respiratory stability is vital. Remifentanil provides ultra-short opioid support for brief ambulatory cases, whereas midazolam remains a versatile anxiolytic adjunct.

Local anesthetics advance at a 3.87% CAGR, the fastest among all segments, and they benefit from regional blocks that reduce opioid reliance. Bupivacaine leads for its prolonged analgesia in orthopedic and obstetric settings. Ropivacaine's lower cardiotoxic risk makes it the spinal agent of choice for high-risk populations. Lidocaine, still indispensable for infiltration, now sees extended uses in intravenous regional anesthesia. Ultrasound-guided techniques broaden indications for locals, raising total consumption. The North America anesthesia drugs market size for local agents is projected to swell at a volume pace that outstrips the overall sector during 2025-2030.

Inhalation drugs held 63.56% of the North America anesthesia drugs market in 2024 due to operating room infrastructure geared toward volatile agents. Sevoflurane's predictable kinetics underpin its primacy. Supplier concentration is rising after Baxter invested in Puerto Rico fill-finish lines that secure regional stocks. Environmental policies, however, accelerate substitution into total intravenous anesthesia.

Injectables are recording a 4.25% CAGR as ASCs and ERAS pathways reward precise titration. Propofol remains the anchor but fresh FDA clearance for ciprofol and remimazolam will diversify options. The North America anesthesia drugs market size for injectable agents is expected to reach USD 1.84 billion by 2030, reflecting clinician preference for rapid turnover. Ready-to-use vials reduce medication errors and contamination, sustaining demand. Although topical and transdermal routes stay niche, innovation in liposomal lidocaine foams and dermal patches could open incremental revenue.

The North America Anesthesia Drugs Market Report Segments the Industry Into by Drug Type (General Anesthesia Drugs, Local Anesthesia Drugs), by Route of Administration (Inhalation, Injection, and More), by Application (General Surgeries, Cosmetic Surgeries, and More), End User (Hospitals and More), and Geography (United States, Canada, Mexico). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Abbvie

- Baxter

- Fresenius

- Pfizer

- Aspen Pharmacare Holdings Ltd.

- B. Braun

- Eisai

- Avet Pharmaceuticals

- Roche

- Novartis

- Hikma Pharmaceuticals

- Viatris

- Piramal Group

- Teva Pharmaceutical Industries

- CSL Vifor

- Sun Pharmaceuticals Industries

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing number of surgeries

- 4.2.2 Growing R&D investment by pharmaceutical companies

- 4.2.3 Shift toward outpatient/ambulatory surgeries driving demand for ultra-short-acting anesthetics

- 4.2.4 Rapid adoption of AI-enabled anesthesia monitoring improving drug utilization efficiency

- 4.2.5 AI-enabled anesthesia monitoring

- 4.2.6 Commercialization of next-gen agents (e.g., ciprofol/HSK3486) offering improved safety profiles

- 4.3 Market Restraints

- 4.3.1 Adverse effects & safety concerns of general anesthetics

- 4.3.2 Stringent FDA & DEA regulations on controlled substances

- 4.3.3 Limited domestic production of sevoflurane/propofol APIs risks periodic shortages

- 4.3.4 Supply-chain vulnerability for critical APIs (e.g., propofol, sevoflurane)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value - USD million)

- 5.1 By Drug Type

- 5.1.1 General Anesthesia Drugs

- 5.1.1.1 Propofol

- 5.1.1.2 Sevoflurane

- 5.1.1.3 Desflurane

- 5.1.1.4 Dexmedetomidine

- 5.1.1.5 Remifentanil

- 5.1.1.6 Midazolam

- 5.1.1.7 Other General Anesthesia Drugs

- 5.1.2 Local Anesthesia Drugs

- 5.1.2.1 Bupivacaine

- 5.1.2.2 Ropivacaine

- 5.1.2.3 Lidocaine

- 5.1.2.4 Chloroprocaine

- 5.1.2.5 Prilocaine

- 5.1.2.6 Benzocaine

- 5.1.2.7 Other Local Anesthesia Drugs

- 5.1.1 General Anesthesia Drugs

- 5.2 By Route of Administration

- 5.2.1 Inhalation

- 5.2.2 Injection (IV/IM)

- 5.2.3 Other Routes (Topical, Transdermal, etc.)

- 5.3 By Application

- 5.3.1 General Surgeries

- 5.3.2 Cosmetic Surgeries

- 5.3.3 Dental Surgeries

- 5.3.4 Other Applications

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centers

- 5.4.3 Other End Users

- 5.5 By Geography

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 AbbVie Inc.

- 6.3.2 Baxter International Inc.

- 6.3.3 Fresenius SE & Co. KGaA (Fresenius Kabi)

- 6.3.4 Pfizer Inc.

- 6.3.5 Aspen Pharmacare Holdings Ltd.

- 6.3.6 B. Braun SE

- 6.3.7 Eisai Co. Ltd.

- 6.3.8 Avet Pharmaceuticals Inc.

- 6.3.9 F. Hoffmann-La Roche Ltd.

- 6.3.10 Novartis AG (Sandoz)

- 6.3.11 Hikma Pharmaceuticals PLC

- 6.3.12 Viatris Inc. (Mylan)

- 6.3.13 Piramal Pharma Solutions

- 6.3.14 Teva Pharmaceutical Industries Ltd.

- 6.3.15 CSL Vifor

- 6.3.16 Sun Pharmaceutical Industries Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment