PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1402981

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1402981

Whole Slide Imaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

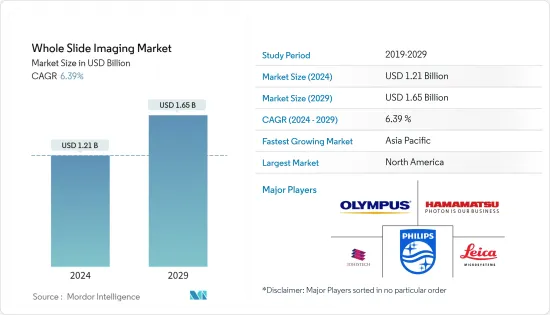

The Whole Slide Imaging Market size is estimated at USD 1.21 billion in 2024, and is expected to reach USD 1.65 billion by 2029, growing at a CAGR of 6.39% during the forecast period (2024-2029).

COVID-19 significantly impacted the global whole slide imaging market due to the increased research studies conducted to identify COVID-19 strains using whole slide imaging (WSI). For instance, in an article published in March 2023 in PubMed, the Centers for Medicare & Medicaid Services waived the requirement for pathologists to perform diagnostic tests in Clinical Laboratory Improvement Amendments (CLIA)-licensed facilities during the pandemic, which led to the rapid implementation of WSI across all surgical pathology subspecialties in the United States. Thus, the increased demand and implementation of WSI in laboratories significantly impacted the market's growth during the pandemic. In the coming years, the market is expected to witness healthy growth owing to the advancements in whole slide imaging and the rise in research and development utilizing whole slide imaging techniques.

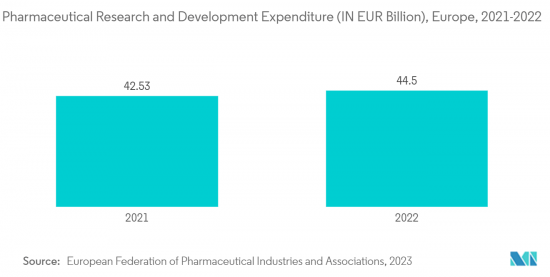

The key factors propelling the whole slide imaging (WSI) market are an increase in research and development in drug discovery processes, technological advancements in whole slide imaging, and the rising popularity of virtual slides compared to physical slides.

Also, the increasing incidence of cancer is expected to drive the growth of the overall market since advanced image analysis can lead to automated examination of histopathology images, which is essential for fast cancer diagnosis. For instance, according to the American Cancer Society 2023 Cancer Statistics, the estimated new number of cancer cases is 1.9 million in the United States in 2023. This estimation includes 1.01 million males and 948,000 cases of females. A significant burden of cancer cases can increase the demand for WSI since WSI scans assist doctors in analyzing larger areas to detect malignant cells or other mutations in a specific tissue, which is further expected to fuel the market growth over the study period.

Furthermore, an increase in research activities and the presence of key players and their strategic activities are expected to bolster the market growth over the study period. For instance, in March 2023, OptraSCAN, an end-to-end digital pathology solution provider, launched the OnDemand Digital Pathology solution that offers complete digital transformation of pathology laboratories in North America. Similarly, using whole slide imaging in various chronic diseases is expected to raise the demand for WSI and bolster market growth. For instance, according to an article published in June 2022 in PubMed, whole slide imaging-based systems were helpful in digitally frozen sections at cancer centers.

Thus, owing to the high number of chronic diseases, an increase in the adoption of WSI in malignant tissue detection and strategic product launches by the key players are expected to bolster the market growth over the study period. However, stringent regulatory approvals and the high cost of whole slide imaging systems are expected to hinder market growth.

Whole Slide Imaging Market Trends

Telepathology Segment is Expected to Grow Significantly Over the Forecast Period

Telepathology is the practice of remote pathology using telecommunication links to permit the electronic transmission of digital pathology images. Telepathology can be utilized for providing primary diagnoses, second opinion consultations, quality assurance, education, and research purposes.

The telepathology segment is expected to witness significant growth owing to the increase in the adoption of telepathology in various departments, the increase in product launches, and other strategic activities. For instance, in August 2022, Tribun Health, one of the European leaders in software development for digital pathology, entered a strategic partnership with Mindpeak, a global leader in pathology AI software, to help pathologists analyze whole-slide-images (WSI) of immunohistochemically (IHC) stained human breast cancer tissue to detect, classify, count cancer cells, and to provide the respective quantitative score. Similarly, in August 2022, Diagnexia, Deciphex's telepathology care provider, and Saudi Ajal Medical Laboratories, a company offering medical laboratory products in Saudi Arabia, entered a strategic collaboration to provide expert consultation telepathology services in Saudi Arabia.

Furthermore, telepathology provides immediate expert anatomic pathology consultation to sites without an in-house or subspecialized pathologist, which leads to the adoption of the same. For instance, according to the article published in March 2023 in PubMed, the concentration of contradictory diagnoses among a few pathologists showed that they were all familiar with diagnoses using frozen sections or telepathology. Thus, due to the increase in the adoption of telepathology services by the researchers, the demand for the same is expected to rise, fuelling the market growth over the study period.

North America is Expected to Witness a Significant Growth Over the Forecast Period

North America is expected to witness significant market growth in the studied market owing to the increasing investment in drug discovery and development processes and the rise in strategic product launches by the key players.

Also, the increasing funding from the United States government for supporting healthcare and publishing new guidelines for WSI in toxicological studies is expected to bolster the market growth over the study period.

For instance, in May 2023, the FDA issued final guidance on the use of whole slide imaging in nonclinical toxicology studies. The guidance is in a question-and-answer format and addresses issues such as validating the whole slide imaging system and protecting the images' integrity. Nonclinical laboratory investigations that can assist sponsors and regulators in understanding the toxicity of medicine often involve the histopathological evaluation of tissue samples utilizing whole-slide imaging. Thus, the release of such guidelines is expected to increase the quality of WSI procedures conducted by the researchers, which is further expected to create demand for the studied market in North America over the forecast period.

Similarly, an increase in procurement of WSI equipment by the major universities is expected to increase the market growth in the region. For instance, in May 2021, the University of Chicago purchased a brand-new Olympus VS200 Slideview Research Slide Scanner from Olympus Corporation. The scanner is utilized as a part of the drop-off service, and it is a whole slide, widefield scanning system capable of imaging full-color histology and fluorescent slides at a wide range of magnifications. Similarly, in March 2022, Leica Microsystems launched Mica, one of the first Microhub. A Microhub is a new type of wholly integrated imaging solution that leverages machine learning software, automation tools, and unique fluorescence unmixing techniques to automate the imaging workflow for researchers, regardless of their microscopy experience levels.

Thus, owing to the government's recommendations and product launches by the key players, North America is expected to witness significant growth over the study period.

Whole Slide Imaging Industry Overview

The global whole slide imaging market is moderately competitive and consists of a few major players. The market players are taking strategic initiatives such as collaboration for the development of advanced products. Some of the companies that are currently dominating the market are Hamamatsu Photonics K.K., 3DHISTECH Ltd, Leica Microsystems GmbH, Olympus Corporation, and Koninklijke Philips NV, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Popularity of Virtual Slides as Compared to Physical Slides

- 4.2.2 Technological Advancements in Whole Slide Imaging

- 4.2.3 Increasing Research in Drug Discovery

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory Approvals

- 4.3.2 High Cost of Whole Slide Imaging Systems

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Technology

- 5.1.1 Scanners

- 5.1.2 IT Infrastructure

- 5.1.3 Viewer

- 5.1.4 Image Management System

- 5.2 By Application

- 5.2.1 Telepathology

- 5.2.2 Cytopathology

- 5.2.3 Immunohistochemistry

- 5.2.4 Hematopathology

- 5.3 By End User

- 5.3.1 Academic Institute

- 5.3.2 Research

- 5.3.3 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Olympus Corporation

- 6.1.2 Koninklijke Philips N.V

- 6.1.3 Leica Microsystems GmbH

- 6.1.4 Nikon Corporation

- 6.1.5 Visiopharm

- 6.1.6 3Dhistech

- 6.1.7 Hamamatsu Photonics KK

- 6.1.8 Indica Labs

- 6.1.9 Mikroscan Technologies Inc.

- 6.1.10 Akoya Biosciences

- 6.1.11 Molecular Machines & Industries

- 6.1.12 MBF Bioscience

7 MARKET OPPORTUNITIES AND FUTURE TRENDS