Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686304

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686304

Automotive Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

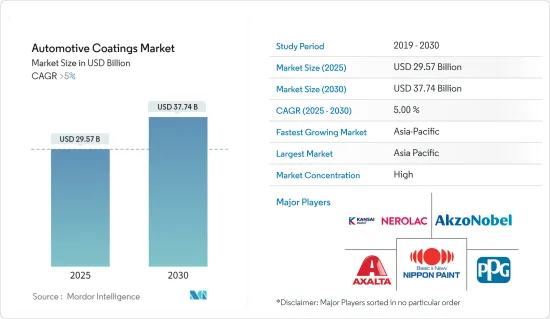

The Automotive Coatings Market size is estimated at USD 29.57 billion in 2025, and is expected to reach USD 37.74 billion by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

Key Highlights

- The growing automotive production, increasing investments, and favorable government policies for automotive OEMs are expected to drive the market for automotive coatings.

- However, stringent VOC regulations are expected to hinder the market's growth.

- Growth in the electric vehicle market is expected to create opportunities for the market during the forecast period.

- The Asia-Pacific region is expected to dominate the market, registering the highest CAGR during the forecast period. This is due to the rising demand for automotive coatings from automotive OEM and refinish industries in the region.

Automotive Coatings Market Trends

OEM Segment is Likely to Show Significant Growth

- Automotive vehicles such as passenger cars and light commercial vehicles are subjected to various harsh environments, such as changing temperatures, acid rains, dust, and water, which deteriorate the aesthetics and performance of the vehicle. Coatings help in increasing the vehicle's overall efficiency by making it lighter or enhancing the tires' rolling resistance.

- Polyurethane-based coatings deliver an improved appearance and high gloss for a longer period to automotive surfaces. While a polyurethane resin system will initially cost more compared to an epoxy resin system, it is more cost-effective in the long term as its lifespan is roughly one and a half to double that of the epoxy resin system.

- Acrylic-based coatings and polyester-based coatings are other types of resin coatings found in automotive OEM applications. Epoxy resin is a tougher plastic than acrylic resin. Hence, it provides minor details more effectively and also offers good polishing properties for automotive OEM applications.

- In automotive OEM coatings, solvents play a significant role. Consumer preferences are shifting toward lesser VOC in paints and coatings, and hence, water-borne coatings are expected to be more preferred during the forecast period. However, solvents offer greater properties when compared to water-borne coatings.

- Rising automotive production globally is likely to increase the demand for the automotive OEM coating market. For instance, according to the European Automotive Manufacturers Association (ACEA), global vehicle production reached 85.4 million in 2022, which increased by 5.7% compared to 2021.

- Owing to these factors, the OEM application segment of the market studied is likely to witness growth during the forecast period.

Asia-Pacific is Expected to Witness the Highest Growth Rate

- Asia-Pacific is the largest market for automotive coatings, followed by North America and Europe. Automotive production in India and ASEAN countries is expected to boost the demand for automotive coatings in the region.

- According to the China Association of Automobile Manufacturers (CAAM), vehicle production in China reached 30.16 million units in 2023, witnessing a growth of 11.6% compared to the previous year. According to the International Organization of Motor Vehicle Manufacturers (OICA), vehicle production in China reached a total of 27.02 million units in 2022, which is an increase of 3% over 2021 for the same period.

- Domestic production in China is expected to reach 35 million units by 2025, according to the International Trade Administration. The growing production of automobiles in the country is likely to create a hike in the consumption of automotive coatings.

- The automotive industry in India is an essential indicator of the Indian economy, as this sector plays a vital role in both technological advancements and macroeconomic expansion. As per industry trends, the automotive industry in India has been growing on a huge scale in recent times.

- The rising vehicle production is projected to increase the demand for automobile coatings in the coming years. Several domestic and international manufacturers are investing in the country to increase vehicle production and meet the country's demand. For instance, in May 2023, Maruti Suzuki India, the largest vehicle producer in India, revealed its plans to invest over USD 5.5 billion to double capacity by 2030.

- Japan's automotive industry is the world's third-largest automotive manufacturing industry, with 78 factories spread across the country employing more than 5.5 million workers. Automotive manufacturing accounts for 89% of the largest manufacturing sector (transportation machinery industry) in the country, while auto parts suppliers have become a significant part of the Japanese economy.

- In September 2023, Japan's new vehicle market grew by nearly 11% to reach 437.493 units from 395.163 units in the previous month, according to new vehicle registration data published by the Japan Automotive Manufacturers Association (JAMA). The strong September growth followed a positive market development in August. After slowing for three consecutive months, the Japanese market picked up speed in August. The August sales rate reached an impressive 5,36 million units per year, a 28% increase from the weak July.

- Due to all these factors, the market for automotive coatings in the region is expected to show steady growth during the forecast period.

Automotive Coatings Industry Overview

The automotive coatings market is fragmented in nature. Some of the major players in the market include (not in any particular order) Akzo Nobel NV, Axalta Coating Systems Ltd, Kansai Nerolac Paints Limited, Nippon Paint Holdings Co. Ltd, and PPG Industries Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 51942

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Automotive Production

- 4.1.2 Increasing Investments and Government Policies for Automotive OEM

- 4.1.3 Other Drivers

- 4.2 Market Restraints

- 4.2.1 Stringent VOC Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Type

- 5.1.1 Polyurethane

- 5.1.2 Epoxy

- 5.1.3 Acrylic

- 5.1.4 Other Resin Types

- 5.2 By Technology

- 5.2.1 Solvent-Borne

- 5.2.2 Water-Borne

- 5.2.3 Powder

- 5.3 By Layers

- 5.3.1 E-Coat

- 5.3.2 Primer

- 5.3.3 Base Coat

- 5.3.4 Clear Coat

- 5.4 By Application

- 5.4.1 OEM

- 5.4.2 Refinish

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Australia and New Zealand

- 5.5.1.6 Indonesia

- 5.5.1.7 Malaysia

- 5.5.1.8 Thailand

- 5.5.1.9 Rest of ASEAN

- 5.5.1.10 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Egypt

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel NV

- 6.4.2 Axalta Coating Systems Ltd

- 6.4.3 BASF SE

- 6.4.4 Beckers Group

- 6.4.5 Cabot Corporation

- 6.4.6 Eastman Chemical Company

- 6.4.7 HMG Paints Limited

- 6.4.8 Jotun

- 6.4.9 Kansai Nerolac Paints Limited

- 6.4.10 KCC Corporation

- 6.4.11 Nippon Paint Holdings Co. Ltd

- 6.4.12 Parker Hannifin Corp.

- 6.4.13 PPG Industries Inc.

- 6.4.14 RPM International Inc.

- 6.4.15 Shanghai Kinlita Chemical Co. Ltd

- 6.4.16 The Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Opportunity in the Electric Vehicle Market

- 7.2 Other Opportunities

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.