PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444030

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444030

Fish & Shrimp, Fish Feed & Shrimp Feed and Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

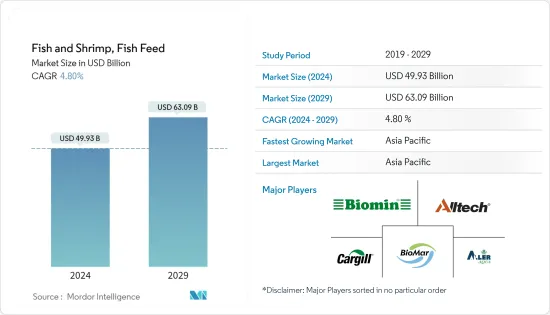

The Fish & Shrimp, Fish Feed & Shrimp Feed and Additives Market size is estimated at USD 49.93 billion in 2024, and is expected to reach USD 63.09 billion by 2029, growing at a CAGR of 4.80% during the forecast period (2024-2029).

Key Highlights

- The growing demand for livestock products has been driving significant changes on the supply side to improve livestock product yields. New capital-intensive technologies have made poultry and pig meat production in industrial-style production facilities possible across regions, such as North America, Europe, and Asia-Pacific, especially in countries where arable land is limited.

- According to FAO, the global cattle population has grown upward over the past four years. In 2020, the cattle population was 1,523 million heads, which increased to 1,529 million heads in 2021, demonstrating that cattle production has been rising to meet the accelerating demand for meat. Thus, the inflating demand for meat is expected to boost the need for feed additives during the study period.

- Asia-Pacific and European regions produce more than 70% of the world's fish and shrimp. Fish is the largest aquaculture sector, accounting for 66% of the market. The most popular varieties of fish produced globally are salmon, trout, and sea bass. The demand for seafood and the annual fall in the quantity of captured wild fish are expected to drive exponential growth in fish and shrimp production. The adoption and advancement of technology and automation are expected to impact the market positively.

- The market for fish and shrimp feed and feed additives is proliferating, owing to the increase in production and consumption of fish and shrimp. The rise in demand for high-quality fish and shrimp and the development of processed and innovative value-added products are anticipated to drive the feed and feed additive market.

- The key players are involved in several inorganic and organic growth tactics, such as new product introduction and acquisitions, to increase their market share in the global aquaculture industry. For instance, Orffa expanded its aquaculture portfolio by introducing three product lines: ingredients, specialties, and veterinarian pharma products in 2021. This product consists of a unique blend of branded additives. Small-scale aquaculture farming is adopted by developing regions to increase the productivity of several commercial species and to create substantial growth opportunities in the global aquaculture market.

Aquatic Feed & Additives Market Trends

Increase in Fish Consumption

Fisheries and aquaculture are increasingly becoming primary sources of protein, foreign exchange, livelihoods, and well-being for the global population. Additionally, population growth, rising incomes in developing nations, and urbanization have led to a surge in the consumption of animal protein. This may be positively related to increasing fish and other seafood consumption at the expense of staple foods. Of the overall production of aquatic animals, nearly 89% were used for human consumption. The remaining were destined for non-food uses, producing mainly fishmeal and fish oil. This indicates a high demand for fish, which raises concerns about product quality. The use of high-quality feed and additives supports the market. Therefore, the growing balance of consumption demand for fish and other aquaculture species is evident in international markets. This is anticipated to boost the demand for the aquatic feed and additives market during the forecast period.

Asia-Pacific Dominates the Market

Asia-Pacific produced 26.6 million metric tons of fish feed and 1.6 million metric tons of shrimp feed in 2021. With rising incomes and health consciousness, the food patterns of consumers in the region are shifting from a heavy carbohydrate-based diet to one rich in protein, accelerating market growth.

China and India are the leading markets in this region, contributing a significant part to the growing demand. The increased aquaculture and fisheries production, coupled with the growth in the per capita consumption of aquaculture products and the development of processed and innovative value-added shrimp and fish products, are expected to drive the market in these countries.

Furthermore, various government projects to increase the production of certified sustainable seafood are hastening the demand for aqua feed and feed additives. According to the national plan for 2022, Vietnam's total export revenue from shrimp products is expected to reach USD 10 billion by 2025.

Aquatic Feed & Additives Industry Overview

The aquatic feed and additives market is moderately consolidated, consisting of small to medium feed and feed additive manufacturers and a few notable players, like Biomar, Cargill, and Aller Aqua. Biomar, being a leading supplier involved in larval, fry diets, grower diets, and functional feeds, has strong sales in China, the world's largest aquaculture market. Strategies such as expansions and partnerships have helped the companies hold a major market share. Further, companies are innovating products to broaden their product lines and cater to the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in Fish Consumption

- 4.2.2 Rise in Export-oriented Aquaculture

- 4.3 Market Restraints

- 4.3.1 Fluctuating Global Prices of Raw Materials

- 4.3.2 Increasing Disease Epidemics in Major Markets

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers/Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Feed Market by Animal Type

- 5.1.1 Fish

- 5.1.2 Shrimp

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.2 Asia-Pacific

- 5.2.2.1 India

- 5.2.2.2 Japan

- 5.2.2.3 China

- 5.2.2.4 Rest of Asia-Pacific

- 5.2.3 South America

- 5.2.3.1 Brazil

- 5.2.3.2 Ecuador

- 5.2.3.3 Rest of South America

- 5.2.4 Middle East & Africa

- 5.2.4.1 South Africa

- 5.2.4.2 Rest of Middle East & Africa

- 5.2.5 Europe

- 5.2.5.1 Germany

- 5.2.5.2 United Kingdom

- 5.2.5.3 France

- 5.2.5.4 Spain

- 5.2.5.5 Norway

- 5.2.5.6 Rest of Europe

- 5.2.1 North America

- 5.3 Fish Feed Additives Market by Additive Type

- 5.3.1 Binders

- 5.3.2 Vitamins

- 5.3.3 Amino Acids

- 5.3.4 Antioxidants

- 5.3.5 Enzymes

- 5.3.6 Antibiotics

- 5.3.7 Minerals

- 5.3.8 Acidifiers

- 5.4 Shrimp Feed Additives Market by Additive Type

- 5.4.1 Binders

- 5.4.2 Vitamins

- 5.4.3 Amino Acids

- 5.4.4 Antioxidants

- 5.4.5 Enzymes

- 5.4.6 Antibiotics

- 5.4.7 Minerals

- 5.4.8 Acidifiers

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Most Adopted Strategies

- 6.3 Company Profiles

- 6.3.1 Alltech Inc.

- 6.3.2 Aller Aqua AS

- 6.3.3 Biomar AS

- 6.3.4 Biomin GmbH

- 6.3.5 Cargill Incorporated

- 6.3.6 Nutreco NV

- 6.3.7 Ridley Corporation

- 6.3.8 Archer Daniels Midland Co.

- 6.3.9 BASF SE

- 6.3.10 Nutriad International

7 MARKET OPPORTUNITIES AND FUTURE TRENDS