PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906934

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906934

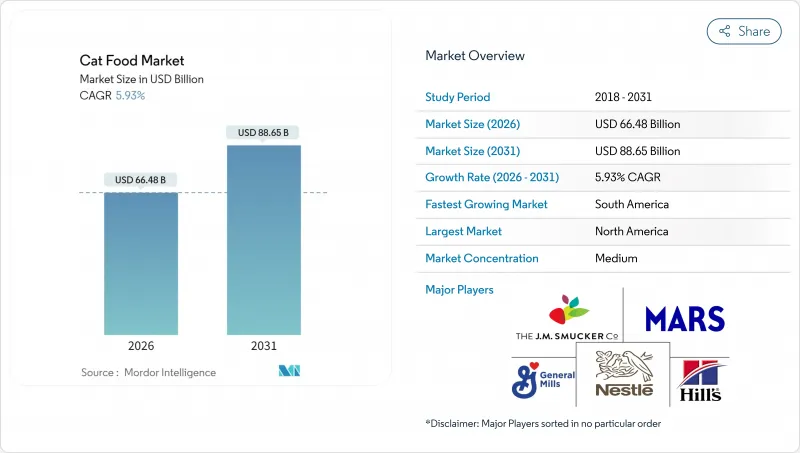

Cat Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Cat food market size in 2026 is estimated at USD 66.48 billion, growing from 2025 value of USD 62.76 billion with 2031 projections showing USD 88.65 billion, growing at 5.93% CAGR over 2026-2031.

The sustained upswing reflects how owners increasingly view feline nutrition as part of household health spending. Premium formats, subscription-based delivery, and nutraceutical add-ons are outpacing staples as urban, single-person, and senior households channel discretionary income toward cats' perceived wellness needs. Competitive pressure is rising as direct-to-consumer entrants use data analytics to tailor recipes while incumbents defend shelf presence through brand extensions and acquisitions. Ingredient cost swings, especially for meat and fish, and tightening label rules temper profit visibility but also accelerate protein innovation cycles.

Global Cat Food Market Trends and Insights

Dry-Food Affordability and Shelf-Life Advantages

Inflationary budgets accentuate dry formulations' cost-per-serving edge, often lower than wet equivalents. Long shelf life reduces waste and supports bulk buying, a priority for multi-cat homes. Emerging-market retailers use vacuum-seal packaging and nitrogen flushing to keep kibble fresh, narrowing the sensory gap versus premium wet fare. Flavor-coated kibbles now feature poultry-fat drizzle technology that lifts palatability scores in in-house trials, reinforcing value and taste in a single proposition.

Rising Cat Ownership in Single-Person and Senior Households

Demographic shifts toward smaller household sizes and aging populations are creating distinct consumption patterns that favor premium cat food categories. Senior citizens exhibit similar premium purchasing behaviors while showing a preference for wet food formats that align with their cats' changing nutritional needs. This demographic convergence is reshaping product development priorities toward smaller package sizes, enhanced digestibility, and age-specific formulations. The trend is particularly evident in urban markets where apartment living and delayed family formation extend the period of intensive pet investment.

Volatile Meat and Ocean-Fish Input Costs

Chicken meal prices swung in 2024 as avian flu disrupted supply chains, while tuna and salmon faced quota limits tied to climate-driven stock declines. Smaller brands without hedging tools suffered margin compressions, fueling consolidation talk. Ingredient substitution with poultry by-products steadied costs but raised palatability concerns that required intensified flavor system investment. The volatility is most acute for smaller manufacturers lacking procurement scale and hedging capabilities, potentially accelerating industry consolidation as cost pressures mount.

Other drivers and restraints analyzed in the detailed report include:

- Premiumization of Wet and Soft-Natural Formats

- Surge in E-Commerce and DTC Subscription Models

- Premium Price Sensitivity During Inflationary Periods

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Food products generated 69.15% of 2025 revenue, giving them the largest slice of the cat food market. Nutraceuticals and supplements are projected to expand at an 7.85% CAGR to 2031. Within this base, dry kibble provided scale, but wet formats captured higher per-unit spend as owners embraced hydration narratives. Pet nutraceuticals, although smaller in scale, are increasing their contribution to the cat food market size and influencing cross-merchandising with main meals. Digestive supplements combining probiotics and omega-3 gels demonstrate the convergence of therapeutic benefits and consumer treats, challenging traditional categorizations. Treats are increasingly used as training aids, with freeze-dried poultry dice priced significantly higher per ounce compared to average kibble. Despite the premium pricing, these products maintain a strong sales performance in specialty aisles that emphasize natural offerings.

Veterinary diets, a niche of the broader cat food market, deliver premium margins under digestive and urinary care lines that veterinarians prescribe, making them resilient to general trade-down pressures. Dry recipes utilize twin-screw extrusion efficiency, resulting in lower energy consumption per pound compared to retort wet lines, which supports ESG reporting goals. Conversely, wet lines innovate around recyclable aluminum trays and reclosable plastic cups, aligning with consumer demands for waste reduction. Brands that integrate functional botanicals cranberry for urinary tract support or turmeric for joint health, add a second layer of value capture without cannibalizing base feeding occasions.

The Cat Food Market Report is Segmented by Pet Food Product (Food, Pet Nutraceuticals/Supplements, Pet Treats, and Pet Veterinary Diets), by Distribution Channel (Convenience Stores, Online Channel, Specialty Stores, Supermarkets/Hypermarkets, and Other Channels), and by Geography (Africa, Asia-Pacific, Europe, North America, and South America). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

North America captured 39.85% of the 2025 value. United States households display high spending per cat and early adoption of subscription services, boosting the cat food market size ahead of other regions. Canada mirrors the trend with rapid natural and organic uptake, while Mexico's rising middle class and cross-border e-commerce inflows pull premium cans into supermarkets.

South America posts the fastest growth rate of 7.9%. Brazil anchors growth by pairing its domestic protein supply with improved logistics networks that transport chilled products to interior cities. Argentine consumers tend to lean toward European-style pates and grain-free recipes, reflecting cultural palate preferences. Currency volatility prompts manufacturers to localize inputs whenever possible, thereby stabilizing pricing and safeguarding volumes.

Asia-Pacific occupies a dynamic middle ground. China's urban households transition from table scraps to complete diets, making it the largest incremental contributor to the cat food market. Local factories co-pack for global players, lowering tariff exposure. Japan and Australia focus on innovations in single-source protein claims, while India explores early-stage growth with entry-level kibble products positioned for value but gradually targeting premium segments as incomes rise.

- ADM

- Agroindustrias Baires

- Clearlake Capital Group, L.P. (Wellness Pet Company Inc.)

- Colgate-Palmolive Company (Hill's Pet Nutrition Inc.)

- Simmons Foods Inc.

- General Mills Inc.

- Mars, Incorporated

- Nestle S.A.(Purina)

- The J. M. Smucker Company

- Central Garden and Pet Company

- Sunshine Mills, Inc.

- heristo aktiengesellschaft

- PLB International

- Diamond Pet Foods (Schell and Kampeter, Inc.)

- Unicharm Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY & KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Pet Population

- 4.2 Pet Expenditure

- 4.3 Consumer Trends

5 SUPPLY & PRODUCTION DYNAMICS

- 5.1 Trade Analysis

- 5.2 Ingredient Trends

- 5.3 Value Chain & Distribution Channel Analysis

- 5.4 Regulatory Framework

- 5.5 Market Drivers

- 5.5.1 Dry-food affordability and shelf-life advantages

- 5.5.2 Rising cat ownership in single-person and senior households

- 5.5.3 Premiumization of wet and soft-natural formats

- 5.5.4 Surge in e-commerce and DTC subscription models

- 5.5.5 Novel-protein adoption (insect and single-cell)

- 5.5.6 AI-driven personalization of feline nutrition plans

- 5.6 Market Restraints

- 5.6.1 Volatile meat and ocean-fish input costs

- 5.6.2 Stringent global labeling and FSMA-style regulations

- 5.6.3 Premium price sensitivity during inflationary periods

- 5.6.4 High carbon-footprint scrutiny on beef-based recipes

6 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 6.1 By Pet Food Product

- 6.1.1 Food

- 6.1.1.1 By Sub Product

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.1.1.1 Kibbles

- 6.1.1.1.1.1.2 Other Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.2 Wet Pet Food

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1 By Sub Product

- 6.1.2 Pet Nutraceuticals/Supplements

- 6.1.2.1 By Sub Product

- 6.1.2.1.1 Milk Bioactives

- 6.1.2.1.2 Omega-3 Fatty Acids

- 6.1.2.1.3 Probiotics

- 6.1.2.1.4 Proteins and Peptides

- 6.1.2.1.5 Vitamins and Minerals

- 6.1.2.1.6 Other Nutraceuticals

- 6.1.2.1 By Sub Product

- 6.1.3 Pet Treats

- 6.1.3.1 By Sub Product

- 6.1.3.1.1 Crunchy Treats

- 6.1.3.1.2 Dental Treats

- 6.1.3.1.3 Freeze-dried and Jerky Treats

- 6.1.3.1.4 Soft & Chewy Treats

- 6.1.3.1.5 Other Treats

- 6.1.3.1 By Sub Product

- 6.1.4 Pet Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.4.1.1 Derma Diets

- 6.1.4.1.2 Diabetes

- 6.1.4.1.3 Digestive Sensitivity

- 6.1.4.1.4 Obesity Diets

- 6.1.4.1.5 Oral Care Diets

- 6.1.4.1.6 Renal

- 6.1.4.1.7 Urinary tract disease

- 6.1.4.1.8 Other Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.1 Food

- 6.2 By Distribution Channel

- 6.2.1 Convenience Stores

- 6.2.2 Online Channel

- 6.2.3 Specialty Stores

- 6.2.4 Supermarkets/Hypermarkets

- 6.2.5 Other Channels

- 6.3 By Geography

- 6.3.1 Africa

- 6.3.1.1 By Country

- 6.3.1.1.1 South Africa

- 6.3.1.1.2 Rest of Africa

- 6.3.1.1 By Country

- 6.3.2 Asia-Pacific

- 6.3.2.1 By Country

- 6.3.2.1.1 Australia

- 6.3.2.1.2 China

- 6.3.2.1.3 India

- 6.3.2.1.4 Indonesia

- 6.3.2.1.5 Japan

- 6.3.2.1.6 Malaysia

- 6.3.2.1.7 Philippines

- 6.3.2.1.8 Taiwan

- 6.3.2.1.9 Thailand

- 6.3.2.1.10 Vietnam

- 6.3.2.1.11 Rest of Asia-Pacific

- 6.3.2.1 By Country

- 6.3.3 Europe

- 6.3.3.1 By Country

- 6.3.3.1.1 France

- 6.3.3.1.2 Germany

- 6.3.3.1.3 Italy

- 6.3.3.1.4 Netherlands

- 6.3.3.1.5 Poland

- 6.3.3.1.6 Russia

- 6.3.3.1.7 Spain

- 6.3.3.1.8 United Kingdom

- 6.3.3.1.9 Rest of Europe

- 6.3.3.1 By Country

- 6.3.4 North America

- 6.3.4.1 By Country

- 6.3.4.1.1 Canada

- 6.3.4.1.2 Mexico

- 6.3.4.1.3 United States

- 6.3.4.1.4 Rest of North America

- 6.3.4.1 By Country

- 6.3.5 South America

- 6.3.5.1 By Country

- 6.3.5.1.1 Argentina

- 6.3.5.1.2 Brazil

- 6.3.5.1.3 Rest of South America

- 6.3.5.1 By Country

- 6.3.1 Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Key Strategic Moves

- 7.2 Market Share Analysis

- 7.3 Brand Positioning Matrix

- 7.4 Market Claim Analysis

- 7.5 Company Landscape

- 7.6 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.6.1 ADM

- 7.6.2 Agroindustrias Baires

- 7.6.3 Clearlake Capital Group, L.P. (Wellness Pet Company Inc.)

- 7.6.4 Colgate-Palmolive Company (Hill's Pet Nutrition Inc.)

- 7.6.5 Simmons Foods Inc.

- 7.6.6 General Mills Inc.

- 7.6.7 Mars, Incorporated

- 7.6.8 Nestle S.A.(Purina)

- 7.6.9 The J. M. Smucker Company

- 7.6.10 Central Garden and Pet Company

- 7.6.11 Sunshine Mills, Inc.

- 7.6.12 heristo aktiengesellschaft

- 7.6.13 PLB International

- 7.6.14 Diamond Pet Foods (Schell and Kampeter, Inc.)

- 7.6.15 Unicharm Corporation

8 KEY STRATEGIC QUESTIONS FOR PET FOOD CEOS