PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685713

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685713

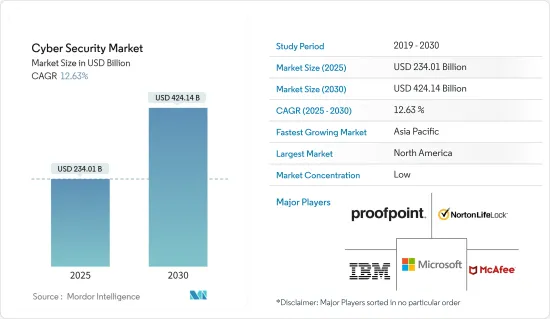

Cyber Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Cybersecurity Market size is estimated at USD 234.01 billion in 2025, and is expected to reach USD 424.14 billion by 2030, growing at a CAGR of 12.63% during the forecast period (2025-2030).

The rising number of cyber-attacks with the emergence of e-commerce platforms, the proliferation of smart devices, and the deployment of cloud solutions are some factors driving the market's growth. Cyber threats are expected to evolve with the increased use of devices with intelligent and IoT technologies. As such, firms are expected to adopt and deploy progressive cyber security solutions to detect, minimize, and mitigate the risk of cyber-attacks, thereby driving market growth.

Key Highlights

- The upsurging of transformative trends in the cybersecurity industry is expected to drive the market studied. For instance, increased cloud computing has provided organizations with much greater infrastructure scalability than was previously possible. Organizations can also scale their infrastructure up or down with cloud environments. While some organizations have transitioned their data centers entirely to the cloud, others have embraced cloud computing to augment on-premise data centers.

- Moreover, with AI being introduced in all market segments, this technology, integrated with machine learning, has brought considerable changes in cybersecurity. Artificial Intelligence has been critical in building automated security systems, face detection, natural language processing, and automatic threat detection. However, it is also used to create smart malware and attacks to overlook the latest security protocols for handling data. Artificial Intelligence-enabled threat detection systems can predict new attacks and instantly notify admins of any data breach. Trends like the implementation of new technologies in cybersecurity are expected to drive.

- However, a shortage of cybersecurity professionals persists, affecting businesses across the board, irrespective of size or industry. This scarcity highlights the evolving nature of cybersecurity roles, which now demand a blend of technical and non-technical proficiencies, reflecting the diverse needs of different specializations, organizations, and industries.

- After the COVID-19 pandemic, global enterprises have been faced with an increasing number of attacks on their networks, owing to which investments in safeguarding the network are expected to increase worldwide. Organizations are targeted with botnets with Mirai, Gh0st. Rat and Pushdoare are the most common botnets. A prominent share of the investment into IT hardware in terms of network is expected to be focused on enhancing security. Throughout the forecast period, network security equipment is expected to be a significant part of enterprise IT spending worldwide.

Cybersecurity Market Trends

BFSI Industry to be the Largest End User

- The BFSI end-user industry in the cybersecurity market encompasses institutions involved in banking, financial transactions, insurance, and related financial services. These organizations prioritize robust cybersecurity measures to protect sensitive financial data, ensure regulatory compliance, and safeguard against cyber threats. The sector includes commercial banks, insurance companies, non-banking financial companies (NBFCs), investment firms, and credit unions.

- As financial institutions increasingly digitize their operations and services, robust cybersecurity measures are necessary. The BFSI sector is one of the key targets for cybercriminals due to the high-value transactions, sensitive customer data, and critical financial infrastructure it manages.

- Moreover, as per SentinelOne, there has been a substantial surge in the frequency and sophistication of attacks on the BFSI industry in recent years. Financial institutions were the sector with the second highest impact as per the number of reported data breaches last year. Ransomware attacks on financial services have increased to 64% in 2023 from 55% in 2022, almost double the 34% reported in 2021.

- The industry is witnessing a significant shift in security measures, driven by factors such as the digital transformation of financial services, cloud adoption, and integration of advancing technologies, such as blockchain and AI. The increasing prevalence of fintech innovations adds complexity, necessitating agile cybersecurity strategies to secure transactions and customer information in an interconnected and dynamic environment.

- According to Sophos, ransomware attacks on global financial organizations primarily stem from many key factors; 40% are due to exploited vulnerabilities, while 23% result from compromised credentials.

- The augment in the adoption of digital technologies and the rise of online financial services have stretched the attack surface for cyber threats in the BFSI sector. The expansion of mobile banking, digital payment platforms, and online transactions created new challenges for cybersecurity, necessitating advanced solutions to protect against fraud, data breaches, and other cyber risks.

North America Holds Largest Market Share

- The United States faces a continuously evolving and sophisticated cyber threat landscape, and it is at the epicenter of cybercrime globally due to the high penetration of digital technologies and cloud computing in end-user industries compared to other countries. It is the most highly targeted nation, and American businesses face a higher volume of attacks and more costly consequences when an attack is successful.

- Cybersecurity has become an increasingly important area of focus in the United States in recent years, owing to the augmenting number of cyber threats and attacks that organizations and individuals face. As per the Identity Theft Resource Center, in 2023, the United States witnessed 3,205 data compromises, impacting 353 million individuals. These compromises encompassed breaches, leaks, and exposures, culminating in one shared outcome: unauthorized access to sensitive data.

- The increasing frequency and sophistication of cyber-attacks drive the adoption of cybersecurity solutions in the United States. The growing regulatory requirement leads many organizations to adopt and invest in cybersecurity solutions, as many industries in the United States are subject to regulations such as HIPPA, GDPR, and PCI DSS, which require the organization to implement. Due to this, companies are increasing their investments in cybersecurity.

- For instance, in September 2023, the Open Commerce solution from Google Cloud and ONDC was accepted by over 20 e-commerce enterprises. This allows buyers, sellers, and logistical service providers to join the ONDC network seamlessly. With this, there will be an increase in the number of consumers and sellers who can use the generative AI tools offered by Google Cloud to transact on the network, particularly people who reside in smaller cities.

- The cybersecurity market in Canada is evolving with the increasing digitalization trends in different private and public sector sectors. For instance, the Canadian energy sector is entering a period of transformation, which is driven by the digital capabilities of technologies like cloud, AI, IoT, and quantum computing. As the industry evolves, the country's cybersecurity demand is growing.

- Cybercrime is rapidly gaining traction in Canada, and its impact is increasing alarmingly. According to a report published by the Communications Security Establishment (CSE) in August 2023, there were 70,878 reports of cyber fraud in Canada, with over USD 390 million stolen. The rising frequency and sophistication of cyber threats, including ransomware attacks and data breaches, have driven organizations in Canada to invest in cybersecurity solutions to protect against evolving threats.

Cybersecurity Industry Overview

The Cybersecurity market is highly fragmented, owing to global players and small and medium-sized enterprises. Some of the major players are IBM Corporation, Nortonlifelock Inc. (Gen Digital Inc.), Microsoft Corporation, Proofpoint Inc. (Thoma Bravo LP), and Mcafee LLC. In order to enhance their services and solution offerings and gain sustainable competitive advantage, players in the market adopt strategies such as acquisitions and partnerships.

- July 2024 - IBM and Microsoft bolstered their cybersecurity collaboration, aiming to assist clients in streamlining and updating their security operations, especially in the realm of hybrid cloud identity management. The collaboration combined IBM Consulting's cybersecurity services and Microsoft's robust security technology suite, equipped clients with the necessary tools and know-how to streamline their security operations, leverage cloud capabilities, safeguard their data, and fuel business expansion.

- June 2024 - Microsoft Corp. unveiled a cybersecurity initiative to bolster the defenses of hospitals catering to over 60 million residents in rural America. Complementing this, Microsoft collaborates with community colleges to roll out the Cybersecurity Skills Initiative. Furthermore, through its TechSpark program, Microsoft is actively fostering technology and cybersecurity employment opportunities in tandem with local partners.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Competitive Rivalry within the Industry

- 4.2.5 Threat of Substitute Products and Services

- 4.3 An Assessment of the Impact of and Recovery From COVID-19 on the Industry

- 4.4 An Assessment of the Impact of Macroeconomic Trends

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Digital Transformation Technologies and Rise of Security Intelligence

- 5.1.2 High Potential Damages From Attacks On Critical Infrastructure and Increasing Sophistication of Attacks

- 5.1.3 Increase in Adoption of Data-intensive Approaches and Decisions

- 5.2 Market Challenges

- 5.2.1 Integration Complexities With Legacy Infrastructure

- 5.3 Key Use Cases

- 5.4 Regulations and Cybersecurity Standards

- 5.5 Cybersecurity Training Trends

- 5.6 Analysis of Pricing and Pricing Model

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Solutions

- 6.1.1.1 Application Security

- 6.1.1.2 Cloud Security

- 6.1.1.3 Data Security

- 6.1.1.4 Identity and Access Management

- 6.1.1.5 Infrastructure Protection

- 6.1.1.6 Integrated Risk Management

- 6.1.1.7 Network Security Equipment

- 6.1.1.8 Other Solutions

- 6.1.2 Services

- 6.1.2.1 Professional Services

- 6.1.2.2 Managed Services

- 6.1.1 Solutions

- 6.2 By Deployment

- 6.2.1 On-Premise

- 6.2.2 Cloud

- 6.3 By End-User Industry

- 6.3.1 IT and Telecom

- 6.3.1.1 Use Cases

- 6.3.2 BFSI

- 6.3.2.1 Use Cases

- 6.3.3 Retail and E-Commerce

- 6.3.3.1 Use Cases

- 6.3.4 Oil Gas and Energy

- 6.3.4.1 Use Cases

- 6.3.5 Manufacturing

- 6.3.5.1 Use Cases

- 6.3.6 Government and Defense

- 6.3.6.1 Use Cases

- 6.3.7 Other End-user Industries

- 6.3.7.1 Use Cases

- 6.3.1 IT and Telecom

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.2.6 Greece

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Australia

- 6.4.3.5 Indonesia

- 6.4.3.6 Philippines

- 6.4.3.7 Malaysia

- 6.4.3.8 Singapore

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Mexico

- 6.4.5 Middle East and Africa

- 6.4.5.1 Saudi Arabia

- 6.4.5.2 United Arab Emirates

- 6.4.5.3 South Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Nortonlifelock Inc. (Gen Digital Inc.)

- 7.1.3 Microsoft Corporation

- 7.1.4 Proofpoint Inc. (Thoma Bravo LP)

- 7.1.5 Mcafee LLC

- 7.1.6 Fortinet Inc.

- 7.1.7 Check Point Software Technologies Ltd

- 7.1.8 Trend Micro Inc.

- 7.1.9 Cisco Systems Inc.

- 7.1.10 Sophos Ltd

8 VENDOR SHARE ANALYSIS

9 RANKING OF VENDORS AT A REGIONAL LEVEL

10 INVESTMENT ANALYSIS

11 FUTURE OF THE MARKET