PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849930

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849930

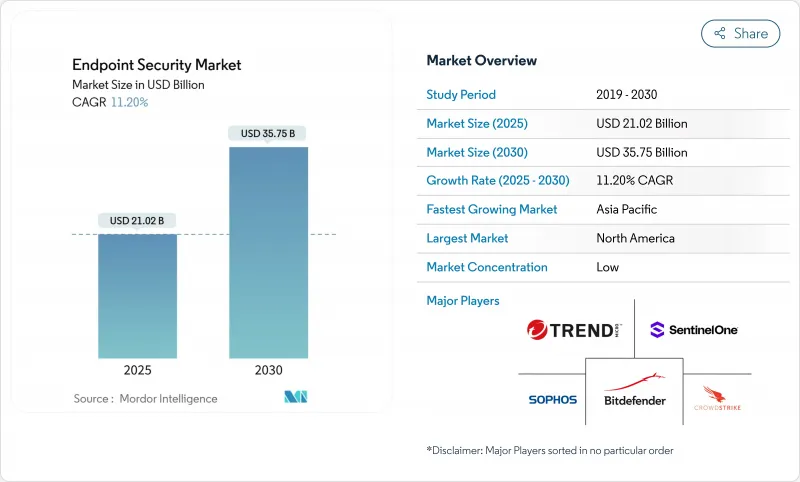

Endpoint Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Endpoint Security Market size is estimated at USD 21.02 billion in 2025, and is expected to reach USD 35.75 billion by 2030, at a CAGR of 11.20% during the forecast period (2025-2030).

Strong demand stems from the steady shift toward remote and hybrid work, the expansion of bring-your-own-device (BYOD) policies, and the growing sophistication of ransomware-as-a-service toolkits. Enterprises also face an expanding Internet-of-Things (IoT) footprint that blurs the line between information-technology and operational-technology networks, exposing critical industrial assets to the same threats historically aimed at office devices. Cloud-delivered controls, zero-trust access policies, and AI-driven behavioural analytics are therefore becoming default components of modern endpoint protection strategies. Platform providers are responding by embedding chip-level security features and bundling endpoint protection platform (EPP) and endpoint detection and response (EDR) capabilities into secure-access-service-edge (SASE) offerings to simplify policy enforcement across distributed users.

Global Endpoint Security Market Trends and Insights

Surge in BYOD and Mobile Workforce

BYOD policies have exposed roughly 4.7 billion mobile endpoints that sit outside traditional firewalls, prompting rapid deployment of mobile-device-management tools that partition corporate data from personal apps. Identity compromise now appears in 70% of attacks, so firms lean on zero-trust frameworks that verify device posture before allowing network access. Executives increasingly view cybersecurity as a board-level priority, with 91% describing it as a strategic asset rather than a compliance exercise. AI features embedded in modern endpoint suites perform real-time behavioural analysis to flag risky actions across a diverse device ecosystem.

Escalating Sophistication of Ransomware-as-a-Service

Service-based ransomware lowered the barrier to entry, triggering a 50% spike in infections during early 2024. Healthcare breaches now cost USD 10.1 million on average, forcing hospitals to adopt extended-detection-and-response platforms that correlate endpoint and network telemetry. Double- and triple-extortion tactics also target backups, compelling enterprises to redesign data-recovery plans. Analysts expect ransomware damage to surpass USD 265 billion annually by 2031, funnelling more spend into proactive endpoint defences.

Skill Shortage in SOC and Incident-Response Teams

The global deficit of 3 million cyber professionals leaves roughly half of chief information security officers anxious about coverage gaps. Managed-detection-and-response (MDR) uptake is therefore accelerating, with half of organizations expected to outsource 24/7 monitoring by 2025. Automation and AI tools that triage alerts and script containment actions are seen as practical stopgaps until the workforce pipeline improves.

Other drivers and restraints analyzed in the detailed report include:

- Proliferation of IoT Endpoints Across OT Networks

- Wider Adoption of SASE Bundling EPP/EDR at Edge

- Budget Constraints Among SMBs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Endpoint detection and response products are expanding at 15.8% CAGR, easily eclipsing legacy antivirus tools. Organizations favour behaviour analytics that spotlight zero-day exploits, while firewall/UTM appliances retain 20.02% revenue share thanks to deep integration with existing network gear. Managed-detection-and-response subscriptions are also gaining ground as firms lease expertise rather than build internal security operations centres.

Regulatory scrutiny is breathing life into encryption and data-loss-prevention modules as rules such as GDPR and NIS2 demand demonstrable data-protection controls. Patch-management utilities attract spend because security updates still average a 97-day rollout window, leaving attack surfaces exposed. Application-control tools that block unauthorized software help limit shadow-IT risks for personal devices on corporate networks.

Cloud platforms already command 58.04% of the endpoint security market size in 2024 and will compound 15.2% annually to 2030. Centralized policy engines accelerate rollout across globally distributed devices and feed AI models with large data volumes in real time. Hybrid architectures remain popular for firms facing data-sovereignty rules or specialist operational-technology constraints.

On-premises deployments persist in defence and critical-infrastructure verticals where local processing is mandated. Even there, many teams adopt SASE overlays that couple software-defined networking with cloud-delivered security to simplify administration. Integrated EDR analytics in the cloud reduce dwell time and enhance mean-time-to-respond statistics.

Endpoint Security Market is Segmented by Solution Type (Antivirus/Anti-malware, Firewall/UTM, and More), Deployment Mode (On-Premises, Cloud, and Hybrid), Organization Size (Large Enterprises and Small and Medium-Sized Enterprises), End-User Industry (BFSI, Government and Defense, Healthcare and Life Sciences, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintained 33.5% revenue share in 2024. Deep security budgets, an advanced threat landscape, and early AI adoption fuel ongoing upgrades. Government cloud-security programs and a dense network of vendors create a virtuous innovation cycle.

Europe's momentum is tied to the full enforcement of the NIS2 directive in October 2024, which compels more than 160,000 organizations to deploy certified endpoint controls or face fines up to EUR 10 million. The regulation keeps demand high across critical infrastructure, manufacturing, and digital services providers.

Asia-Pacific is the fastest-growing territory at 12.4% CAGR. Nations across the region pour investment into cyber-resilience frameworks, and high-profile attacks on telecoms and financial institutions have sharpened executive focus. Chinese security teams rank API exposure as their top concern, with 27% putting it ahead of malware. Government funding and local vendor ecosystems accelerate adoption across Japan, South Korea, Australia, and the ASEAN bloc.

The Middle East and Africa notice rising cyber-insurance premiums and tougher privacy laws, nudging banks and energy operators to upgrade endpoint controls. Latin America expands cloud deployments that leapfrog legacy on-premises estates, particularly in retail and digital-banking firms.

- Trend Micro Inc.

- CrowdStrike Holdings Inc.

- SentinelOne Inc.

- Sophos Ltd.

- Bitdefender LLC

- ESET Spol. s r.o.

- Kaspersky Lab JSC

- Trellix (Musarubra US LLC)

- OpenText (Cybersecurity & Carbonite Unit)

- WatchGuard Technologies Inc.

- Fortinet Inc.

- Cisco Systems Inc.

- Palo Alto Networks Inc.

- Broadcom Inc. (Symantec Endpoint)

- Microsoft Corporation (Defender for Endpoint)

- Deep Instinct Ltd

- Cybereason Inc.

- BlackBerry Ltd (Cylance)

- Malwarebytes Inc.

- AhnLab Inc.

- F-Secure Corp.

- Elastic NV (Security)

- ReaQta BV (IBM)

- Comodo Security Solutions Inc.

- Seqrite (Quick Heal Technologies)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in BYOD and mobile workforce

- 4.2.2 Escalating sophistication of ransomware-as-a-service

- 4.2.3 Proliferation of IoT endpoints across OT networks

- 4.2.4 Wider adoption of SASE bundling EPP/EDR at edge

- 4.2.5 Chip-level security IP integrated by OEMs

- 4.2.6 Cyber-insurance premium discounts for certified EDR

- 4.3 Market Restraints

- 4.3.1 Skill shortage in SOC & incident-response teams

- 4.3.2 Budget constraints among SMBs

- 4.3.3 Rising privacy backlash against continuous endpoint telemetry

- 4.3.4 Supply-chain risk of third-party security agents

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Solution Type

- 5.1.1 Antivirus / Anti-malware

- 5.1.2 Firewall / UTM

- 5.1.3 Endpoint Detection and Response (EDR)

- 5.1.4 Managed Detection and Response (MDR)

- 5.1.5 Encryption and Data Loss Prevention

- 5.1.6 Patch and Configuration Management

- 5.1.7 Application and Device Control

- 5.1.8 Others

- 5.2 By Deployment Mode

- 5.2.1 On-premises

- 5.2.2 Cloud

- 5.2.3 Hybrid

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium-sized Enterprises (SME)

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 Government and Defense

- 5.4.3 Healthcare and Life Sciences

- 5.4.4 Manufacturing

- 5.4.5 Energy and Utilities

- 5.4.6 Retail and e-Commerce

- 5.4.7 IT and Telecom

- 5.4.8 Education

- 5.4.9 Other End-User Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Singapore

- 5.5.4.7 Malaysia

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Trend Micro Inc.

- 6.4.2 CrowdStrike Holdings Inc.

- 6.4.3 SentinelOne Inc.

- 6.4.4 Sophos Ltd.

- 6.4.5 Bitdefender LLC

- 6.4.6 ESET Spol. s r.o.

- 6.4.7 Kaspersky Lab JSC

- 6.4.8 Trellix (Musarubra US LLC)

- 6.4.9 OpenText (Cybersecurity & Carbonite Unit)

- 6.4.10 WatchGuard Technologies Inc.

- 6.4.11 Fortinet Inc.

- 6.4.12 Cisco Systems Inc.

- 6.4.13 Palo Alto Networks Inc.

- 6.4.14 Broadcom Inc. (Symantec Endpoint)

- 6.4.15 Microsoft Corporation (Defender for Endpoint)

- 6.4.16 Deep Instinct Ltd

- 6.4.17 Cybereason Inc.

- 6.4.18 BlackBerry Ltd (Cylance)

- 6.4.19 Malwarebytes Inc.

- 6.4.20 AhnLab Inc.

- 6.4.21 F-Secure Corp.

- 6.4.22 Elastic NV (Security)

- 6.4.23 ReaQta BV (IBM)

- 6.4.24 Comodo Security Solutions Inc.

- 6.4.25 Seqrite (Quick Heal Technologies)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment