PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907272

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907272

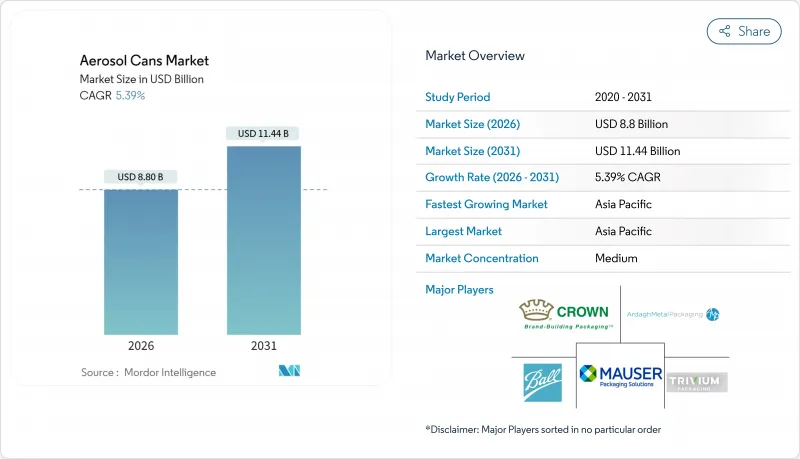

Aerosol Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Aerosol cans market size in 2026 is estimated at USD 8.8 billion, growing from 2025 value of USD 8.35 billion with 2031 projections showing USD 11.44 billion, growing at 5.39% CAGR over 2026-2031.

Sustained growth is shaped by the packaging sector's pivot toward recyclable materials, regulatory alignment with circular-economy targets, and the proven ability of aluminum containers to meet stricter volatile-organic-compound (VOC) limits. E-commerce expansion adds momentum as brands seek leak-proof, shelf-ready pack formats that withstand complex fulfillment networks. Innovation in low-GWP propellants and mono-material can designs is strengthening the competitive differentiation of market leaders. At the same time, raw-material cost volatility and fast-rising refillable concepts temper near-term margins.

Global Aerosol Cans Market Trends and Insights

Recyclability and circular-economy alignment

Aluminum's infinite recyclability has turned it into a decisive material for brand owners that must document end-of-life performance under extended producer responsibility schemes. Ball Corporation's ReAl alloy cuts the can body's carbon footprint by 50% while maintaining strength, reinforcing the closed-loop advantages of an existing global recycling infrastructure where 75% of aluminum ever produced remains in active circulation. Such credentials underpin long-term supply contracts with consumer-goods majors that face climate-reporting requirements and plastic-reduction targets.

Surging demand from personal-care and cosmetics

Premium personal-care lines increasingly specify brushed-metal aesthetics and specialized valves that elevate user experience and enable higher pricing. Ball and Meadow's 2025 launch of refillable MEADOW KAPSUL cartridges illustrates how luxury skin- and hair-care brands turn to elegant aluminum aerosols to differentiate on sustainability and design. E-commerce accelerates this trend because metallic containers resist dents and leakage during last-mile delivery while offering 360-degree imaging for digital merchandising.

Stringent VOC and disposal regulations

EPA amendments effective July 2025 enforce product-weighted reactivity ceilings that oblige formulators to swap high-reactivity solvents or face penalties. Parallel F-gas restrictions in Europe intensify compliance complexity, pushing smaller firms to outsource R&D or exit affected lines.Disposal rules now require spent cans to be vented and baled under documented protocols that elevate processing costs, yet also spur specialized recycling solutions such as Republic Services' dedicated facilities.

Other drivers and restraints analyzed in the detailed report include:

- Transition to low-VOC/green propellants

- E-commerce "shelf-ready" differentiation

- Volatility in aluminum and steel prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Aluminum captured 84.72% of the 2025 volume, underscoring its entrenched infrastructure and acceptance under most recycling codes. This leadership supports cost-efficient closed-loop supply and aligns with extended-producer-responsibility statutes already active in the EU. The aerosol cans market benefits from ReAl alloy advances that trim gauge weight by 15% without compromising dent resistance, keeping unit economics competitive while lowering carbon metrics.

Plastic aerosols, growing 8.18% annually, address brand requirements for full transparency, shatter resistance, and compatibility with acidic formulas. Plastipak's metal-free SprayPET Revolution validates that polymers can meet pressure thresholds and remain compatible with mainstream PET recycling infrastructures as resin suppliers roll out advanced barrier layers, plastics secure footholds in personal-care and food spray applications where metal taste or cold shock are concerns. Even with this momentum, mono-material legislation and metal price volatility keep aluminum at the core of the aerosol cans market strategy.

One-piece monobloc lines own 64.58% of 2025 unit output thanks to single-stroke impact-extrusion that minimizes weld seams and simplifies quality control. The configuration's uniform wall thickness supports a reputation for drop-test resilience and elevated internal pressures, essential for flammable propellants in hair-spray or automotive brake-cleaner SKUs.

Two-piece cans, posting a 7.05% CAGR, gain traction as servo-controlled body-maker technology enhances side-seam strength and allows hybrid metal gauges that lower material use. Brand owners appreciate the ability to produce tall, slim profiles and high-definition lithography that wraps around the cylindrical body without distortion. With demand for fast design turnarounds in seasonal product drops, manufacturers invest in modular tooling that switches between monobloc and two-piece runs, hedging against market preference shifts.

The Aerosol Cans Market Report is Segmented by Material Type (Aluminium, Steel, Tinplate, and More ), Can Type (One-Piece (Monobloc), Two-Piece, Three-Piece), Propellant Type (Compressed Gas, Bag-On-Valve, and More), Capacity (ml) (Less Than 100, 101-300, and More), End-User Industry (Personal Care and Cosmetics, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific composed 39.62% of 2025 consumption and is rising at an 7.86% CAGR, anchored by China's dual role as leading consumer and production hub. Urbanization and disposable-income growth support wider adoption of personal-care aerosols, while regional authorities impose recycling mandates that dovetail with aluminum's closed-loop advantages. Japanese brand owners advance mono-material designs, and India's accelerating beauty segment amplifies volumes for local fillers.

Europe remains a technology and regulation frontrunner. F-gas and VOC ceilings prompt swift migration to green propellants, rewarding incumbents with compliant product portfolios.Germany and the United Kingdom lead in lightweight-can R&D, while Eastern European plants extend low-cost filling capacity to pan-regional FMCG contracts. Market growth leans toward premium and sustainable offerings as volume saturation limits expansion in traditional categories.

North America demonstrates steady, innovation-driven demand. EPA reactivity rules compel formula redesigns, yet robust R&D funding helps local converters maintain portfolio agility. The United States leads in OTC healthcare and DIY paint aerosols, while Mexico strengthens as a near-shore manufacturing base. Canadian consumers show elevated interest in low-odor household sprays, bolstering adoption of water-based propellants. Together these trends sustain mid-single-digit growth across a maturing yet profitable regional landscape.

- Ball Corporation

- Crown Holdings Inc.

- Ardagh Metal Packaging SA

- Trivium Packaging

- Mauser Packaging Solutions

- Toyo Seikan Co. Ltd

- CCL Container

- Colep Packaging Portugal SA

- CPMC Holdings Limited

- Nampak Ltd

- Graham Packaging Company

- SGD Pharma

- Silgan Holdings

- DS Containers

- Montebello Packaging

- Tubex GmbH

- Grupo Zapata (Exal)

- Hindustan Tin Works

- Thai Beverage Can

- Bharat Containers

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Recyclability and circular?economy alignment

- 4.2.2 Surging demand from personal-care and cosmetics

- 4.2.3 Transition to low-VOC/green propellants

- 4.2.4 e-commerce "shelf-ready" differentiation

- 4.2.5 Regulatory push for mono-material packaging

- 4.2.6 Emergence of nutraceutical/OTC aerosol formats

- 4.3 Market Restraints

- 4.3.1 Stringent VOC and disposal regulations

- 4.3.2 Volatility in aluminium and steel prices

- 4.3.3 Rise of refillable and concentrated formats

- 4.3.4 Consumer eco-perception of aerosols

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Lifecycle and Carbon-Footprint Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Aluminium

- 5.1.2 Steel

- 5.1.3 Tinplate

- 5.1.4 Plastic

- 5.1.5 Other Material Type

- 5.2 By Can Type

- 5.2.1 One-piece (Monobloc)

- 5.2.2 Two-piece

- 5.2.3 Three-piece

- 5.3 By Propellant Type

- 5.3.1 Compressed Gas

- 5.3.2 Liquefied Gas

- 5.3.2.1 Hydrocarbon

- 5.3.2.2 DME

- 5.3.2.3 Other Liquefied Gas

- 5.3.3 Bag-on-Valve

- 5.4 By Capacity (ml)

- 5.4.1 Less than 100

- 5.4.2 101-300

- 5.4.3 301-500

- 5.4.4 More than 500

- 5.5 By End-User Industry

- 5.5.1 Personal Care and Cosmetics

- 5.5.2 Household Care

- 5.5.3 Automotive and Industrial

- 5.5.4 Healthcare and Pharmaceutical

- 5.5.5 Food and Beverage

- 5.5.6 Paints and Varnishes

- 5.5.7 Other End-User Industry

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 United Arab Emirates

- 5.6.4.1.2 Saudi Arabia

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Nigeria

- 5.6.4.2.3 Egypt

- 5.6.4.2.4 Rest of Africa

- 5.6.4.1 Middle East

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Ball Corporation

- 6.4.2 Crown Holdings Inc.

- 6.4.3 Ardagh Metal Packaging SA

- 6.4.4 Trivium Packaging

- 6.4.5 Mauser Packaging Solutions

- 6.4.6 Toyo Seikan Co. Ltd

- 6.4.7 CCL Container

- 6.4.8 Colep Packaging Portugal SA

- 6.4.9 CPMC Holdings Limited

- 6.4.10 Nampak Ltd

- 6.4.11 Graham Packaging Company

- 6.4.12 SGD Pharma

- 6.4.13 Silgan Holdings

- 6.4.14 DS Containers

- 6.4.15 Montebello Packaging

- 6.4.16 Tubex GmbH

- 6.4.17 Grupo Zapata (Exal)

- 6.4.18 Hindustan Tin Works

- 6.4.19 Thai Beverage Can

- 6.4.20 Bharat Containers

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment