PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851332

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851332

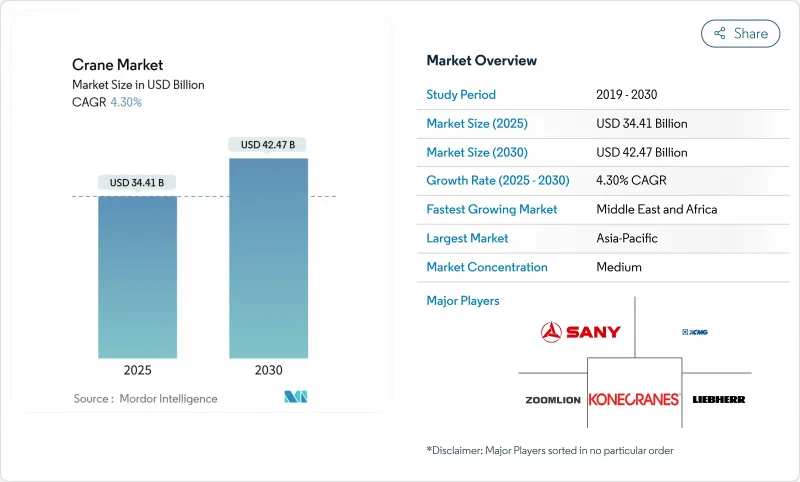

Crane - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The crane market reached USD 34.41 billion in 2025 and is projected to advance to USD 42.47 billion by 2030, translating into a 4.30% CAGR.

Stable public spending, large-scale private megaprojects, and the global shift to renewable energy form the core demand engine for the crane market. Government infrastructure programs, led by the U.S. Infrastructure Investment and Jobs Act, have created multi-year backlogs that shield contractors from short-term economic swings. Offshore wind, solar parks, and grid upgrades reinforce this positive outlook, especially for specialized heavy-lift and marine equipment. Concurrently, electrification mandates spur investment in hybrid and fully electric cranes, while telematics adoption raises fleet utilization and curbs downtime. Competition intensifies as incumbents accelerate R&D on zero-emission platforms and acquire niche innovators to broaden portfolios.

Global Crane Market Trends and Insights

Growing Infrastructure Development

Infrastructure modernization has emerged as the primary catalyst for crane demand, with the Infrastructure Investment and Jobs Act alone generating over USD 1.2 trillion in planned investments across transportation, energy, and digital infrastructure. The scale of this infrastructure push extends beyond traditional road and bridge projects to encompass data centers, semiconductor fabs, and clean energy facilities that require specialized heavy-lifting capabilities. Construction spending is projected to reach USD 2.13 trillion annually, with public infrastructure accounting for nearly 8% year-over-year growth. This infrastructure renaissance creates multi-year visibility for crane operators, extending project backlogs well into 2027. The shift toward modular construction techniques in infrastructure projects also drives demand for precision lifting equipment capable of handling prefabricated components weighing hundreds of tons. Federal infrastructure funding has enabled states to invest in workforce development programs, addressing the critical shortage of certified crane operators that could otherwise constrain market growth.

Surge in Renewable Energy Installations

The renewable energy transition fundamentally reshapes crane market dynamics, with offshore wind installations driving demand for specialized marine cranes capable of lifting turbine components exceeding 2,500 tons. Wind turbine installation vessels are being delivered with increasingly sophisticated crane systems, including Cadeler's Wind Peak vessel, capable of transporting seven complete 15 MW turbine sets per load. The scale of renewable energy deployment is unprecedented, with companies like Huisman developing specialized offshore wind installation cranes and motion-compensated platforms to handle components at heights exceeding 150 meters. Solar installations drive demand for mobile cranes, particularly in utility-scale projects where panels and mounting systems require precise positioning across vast areas. The growth of the renewable energy sector is creating new crane application categories, from floating offshore wind platforms to concentrated solar power installations requiring specialized lifting solutions. This energy transition is expected to sustain crane demand growth well beyond traditional construction cycles, as renewable energy infrastructure requires ongoing maintenance and component replacement.

High Capital and Operating Costs

The crane industry faces mounting cost pressures constraining market expansion, with new heavy-lift cranes like Manitowoc's Model 31000 commanding prices of USD 30 million while requiring substantial ongoing maintenance investments. Material cost inflation has increased construction input prices by an average of 15% across major markets, directly impacting crane manufacturing costs and rental rates. High interest rates compound these challenges, with equipment financing costs rising significantly and affecting crane purchases and rental demand. Smaller crane operators are particularly vulnerable to these cost pressures, as they lack the scale to absorb price increases and may be forced to exit the market or consolidate with larger players. The complexity of modern crane systems is also driving up maintenance costs, requiring specialized technicians and expensive replacement parts that can strain operator budgets. Training costs for certified operators are increasing, with simulation-based programs requiring substantial upfront investments despite their long-term benefits in reducing training time and improving safety outcomes.

Other drivers and restraints analyzed in the detailed report include:

- Industrial Growth Across Emerging Economies

- Accelerated Urbanization & Megaproject Pipelines

- Economic Cyclicality of Construction Spending

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mobile cranes maintain the largest market share at 45.25% in 2024, reflecting their versatility across construction, infrastructure, and industrial applications. The mobile crane segment benefits from its adaptability to diverse job sites and the ability to be rapidly deployed across multiple projects, making it the preferred choice for contractors managing varied workloads. Marine and offshore cranes are experiencing the strongest growth trajectory at 7.45% CAGR 2025-2030, driven by the unprecedented expansion of offshore wind installations and the need for specialized vessel-mounted lifting solutions.

Fixed cranes, encompassing tower cranes and overhead systems, serve critical roles in high-rise construction and industrial facilities, with the demand particularly strong in urban megaprojects across the Middle East and Asia Pacific. The marine and offshore segment's rapid growth reflects the specialized nature of offshore wind turbine installation, where cranes must operate in challenging maritime environments while handling components weighing thousands of tons. Companies like Cadeler invest heavily in wind turbine installation vessels equipped with 2,200-ton capacity cranes to serve the growing offshore wind market. The evolution toward larger offshore wind turbines drives demand for increasingly sophisticated marine crane systems capable of lifting precision in harsh weather conditions.

The 51-150 ton segment commands the largest market share at 33.90% in 2024, representing the sweet spot for general construction and industrial applications. The above 300-ton capacity segment is experiencing the fastest growth at 8.25% CAGR 2025-2030, reflecting the industry's shift toward megaprojects requiring unprecedented lifting capabilities. This mid-range capacity segment benefits from its balance of lifting capability and operational flexibility, making it suitable for various construction projects from commercial buildings to infrastructure development.

Heavy-lift applications are being driven by nuclear power plant construction, petrochemical facilities, and offshore energy projects that require cranes capable of lifting reactor components, process modules, and turbine assemblies weighing hundreds of tons. Mammoet's 6,000-ton capacity SK6000 crane development exemplifies the industry's push toward ultra-heavy lifting capabilities. The up to 50-ton segment serves smaller construction projects and maintenance applications, while the 151-300 ton range addresses mid-scale industrial and infrastructure needs. Zoomlion's 3,600-ton crawler crane, setting world records for single lifting weight, demonstrates the technological advancement in heavy-lift capabilities. Modular construction trends drive demand across all capacity ranges, as prefabricated components require precise lifting and positioning capabilities.

The Crane Market Report is Segmented by Type (Mobile Crane, Fixed Crane, and Marine and Offshore Crane), Capacity (Up To 50 T, 51 To 150 T, 151 To 300 T, and Above 300 T), Power Source (Diesel, Hybrid, and Fully Electric), Boom Type (Lattice Boom and Telescopic Boom), Application (Construction and Mining and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific accounted for 42.10% of crane market revenue in 2024 as China sustained high public works spending and India accelerated factory construction. Chinese port automation success stories, with single bridge cranes averaging 60.9 container moves an hour, illustrate regional leadership in throughput performance. India's Union Budget 2025 maintained elevated infrastructure allocations, underpinning continued demand for crawlers and tower cranes despite election-year caution. Japan and South Korea post low-single-digit growth, driven by facility maintenance and modernization.

The Middle East and Africa region is projected to post the fastest 6.65% CAGR between 2025-2030. Saudi Arabia alone intends to deploy about 20,000 tower cranes for NEOM and associated giga-projects. Local joint ventures, such as Wolffkran and Zamil Group's new factory, reduce import lead times and create a localized supply chain. High oil prices funnel revenue into downstream petrochemical complexes that rely on heavy-lift crawler cranes, broadening application diversity.

North America benefits from the USD 1.2 trillion Infrastructure Investment and Jobs Act, which funds over 60,000 projects and sustains multi-year workloads. The U.S. equipment rental sector is forecast to reach USD 77.3 billion in 2025, with cranes forming a sizable share. Europe faces mixed signals: offshore wind accelerates equipment demand, yet elevated interest rates suppress commercial real estate starts. Latin America's recovery hinges on commodity pricing, while renewed Brazilian energy auctions boost regional heavy-lift orders.

- Liebherr-International AG

- Tadano Ltd.

- Konecranes Plc

- Manitowoc Co.

- XCMG Group

- Terex Corporation

- SANY Group

- Zoomlion Heavy Industry Sci and Tech

- Kobelco Construction Machinery

- Palfinger AG

- Hitachi Sumitomo Cranes

- Favelle Favco Group

- Cargotec Oyj (Hiab)

- Sarens NV

- Mammoet

- Link-Belt Cranes

- Altec Inc.

- Effer SpA

- Bocker Maschinenwerke

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing infrastructure development

- 4.2.2 Surge in renewable-energy (wind-farm) installations

- 4.2.3 Industrial growth across emerging economies

- 4.2.4 Accelerated urbanisation and megaproject pipelines

- 4.2.5 Telematics-driven fleet optimisation (under-radar)

- 4.2.6 Adoption of hybrid/e-cranes to meet site-emission rules (under-radar)

- 4.3 Market Restraints

- 4.3.1 High capital and operating costs

- 4.3.2 Economic cyclicality of construction spending

- 4.3.3 Shortage of certified crane operators (under-radar)

- 4.3.4 Carbon-footprint scrutiny and cradle-to-grave reporting (under-radar)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts

- 5.1 By Type

- 5.1.1 Mobile Crane

- 5.1.1.1 All-terrain Crane

- 5.1.1.2 Rough-terrain Crane

- 5.1.1.3 Crawler Crane

- 5.1.1.4 Truck-mounted Crane

- 5.1.1.5 Other Mobile Cranes

- 5.1.2 Fixed Crane

- 5.1.2.1 Monorail and Under-hung

- 5.1.2.2 Overhead Track-mounted

- 5.1.2.3 Tower Crane

- 5.1.3 Marine and Offshore Crane

- 5.1.3.1 Mobile Harbor Crane

- 5.1.3.2 Fixed Harbor Crane

- 5.1.3.3 Offshore Crane

- 5.1.3.4 Ship Crane

- 5.1.1 Mobile Crane

- 5.2 By Capacity

- 5.2.1 Up to 50 T

- 5.2.2 51 to 150 T

- 5.2.3 151 to 300 T

- 5.2.4 Above 300 T

- 5.3 By Power Source

- 5.3.1 Diesel

- 5.3.2 Hybrid

- 5.3.3 Fully Electric

- 5.4 By Boom Type

- 5.4.1 Lattice Boom

- 5.4.2 Telescopic Boom

- 5.5 By Application

- 5.5.1 Construction and Mining

- 5.5.2 Energy and Utilities

- 5.5.3 Shipbuilding and Ports

- 5.5.4 Industrial Manufacturing

- 5.5.5 Logistics and Warehousing

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 South Africa

- 5.6.5.4 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Liebherr-International AG

- 6.4.2 Tadano Ltd.

- 6.4.3 Konecranes Plc

- 6.4.4 Manitowoc Co.

- 6.4.5 XCMG Group

- 6.4.6 Terex Corporation

- 6.4.7 SANY Group

- 6.4.8 Zoomlion Heavy Industry Sci and Tech

- 6.4.9 Kobelco Construction Machinery

- 6.4.10 Palfinger AG

- 6.4.11 Hitachi Sumitomo Cranes

- 6.4.12 Favelle Favco Group

- 6.4.13 Cargotec Oyj (Hiab)

- 6.4.14 Sarens NV

- 6.4.15 Mammoet

- 6.4.16 Link-Belt Cranes

- 6.4.17 Altec Inc.

- 6.4.18 Effer SpA

- 6.4.19 Bocker Maschinenwerke

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment