PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906886

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906886

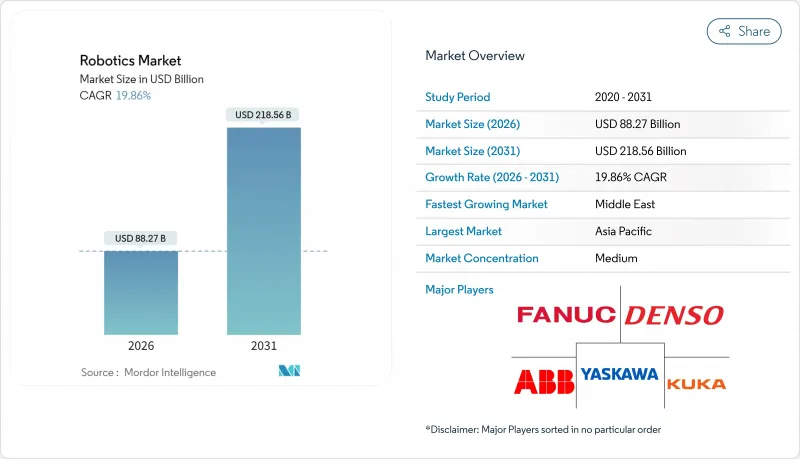

Robotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Robotics market size in 2026 is estimated at USD 88.27 billion, growing from 2025 value of USD 73.64 billion with 2031 projections showing USD 218.56 billion, growing at 19.86% CAGR over 2026-2031.

This growth trajectory reflects structural labor shortages in advanced economies, systematic cost deflation in automation hardware, and government-backed reshoring programs that treat robots as strategic infrastructure rather than optional capital goods. Large enterprises accelerate adoption to stabilise production amid wage pressure, while small and medium firms now gain access through collaborative systems and Robot-as-a-Service contracts. Regional momentum is shifting: Asia-Pacific retains volume leadership, but the Middle East shows the quickest pace as sovereign funds pursue technology-driven diversification. On the supply side, declining component costs and low-code programming platforms reshape the value chain toward software intelligence, setting up recurring revenue streams for vendors that master artificial-intelligence-based control. Cyber-security weaknesses, export-control friction, and skill gaps among smaller users remain braking forces, yet they also open specialist service niches, especially around secure deployment and lifecycle support.

Global Robotics Market Trends and Insights

Rising Labour-Shortage Led Automation Demand

Demographic headwinds in Japan, the United States, and much of Western Europe have shifted automation from cost-saving to capacity-assurance mode. Unfilled factory vacancies topped 2 million roles across G-7 manufacturing in 2024, while Japan's robot density reached 399 units per 10,000 employees, the highest on record. Automakers such as Stellantis adopted human-centric robotic cells that trim repetitive strain injuries yet safeguard headcount, signalling a nuanced push toward collaborative deployment. The global robotics market benefits because these structural gaps persist through economic cycles, giving vendors a predictable demand base that decouples from GDP volatility.

Declining Average Robot Price Per Functional Hour

Component commoditisation and scale production cut collaborative robot prices by roughly 15% a year post-2024, while software upgrades doubled performance relative to price. Chinese suppliers even marketed entry-level humanoids at CNY 199,000 (USD 27,512), placing robots within small-factory capital budgets. As hardware costs slide, adoption curves steepen among small and emerging-market manufacturers, thereby widening the addressable pool for the global robotics market.

Persistent SME Integration Skill-Gap

Sixty-eight percent of SMEs still lack engineering talent for robotics deployment, prolonging payback periods and dampening utilisation rates. Integrators cluster in urban hubs, leaving regional firms underserved. Without accelerated skills development or turnkey service models, the global robotics market leaves considerable latent demand untapped.

Other drivers and restraints analyzed in the detailed report include:

- Proliferation of Low-Code Robot-Programming Platforms

- Fiscal Incentives for Reshoring Manufacturing in G-7

- Geopolitical Export-Control on Advanced Servos

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Industrial robots accounted for 71.04% of the global robotics market in 2025, riding sustained demand from high-throughput automotive and electronics assembly lines. Yet collaborative robots expand at a 25.64% CAGR to 2031, underpinned by safety-certified force-sensing and sub-USD 30,000 price tags that place them within SME budgets. This pivot signals that flexible, human-supervised cells, rather than fenced-off lines, will drive the next deployment wave of the global robotics market.

A surge in Chinese cobot makers lifted their domestic share from 35% to 73% between 2017 and 2024, heightening price competition and accelerating worldwide unit growth. Service-robot niches also flourish: surgical systems surpassed USD 4.18 billion in 2025, reaffirming healthcare as the fastest-rising end-use. This diversification reduces cyclicality for the global robotics market and cushions hardware vendors against single-sector downturns.

Hardware still represented 63.12% of 2025 spending, but software revenue is set to grow 22.91% annually as artificial intelligence becomes the primary value driver. Higher-level control stacks now incorporate cloud analytics and reinforcement learning that deliver 25% faster cycle times with 20% lower electricity use on ABB's OmniCore platform. The global robotics market size for subscription-based Robot-as-a-Service is projected to treble by 2031 as customers migrate from capital expenditure toward operating expenditure models.

Service revenues, covering integration, remote monitoring, and predictive maintenance, further solidify vendor lock-in. As a result, software and services blur, embedding update rights and cyber-security patches into multi-year contracts. This trend rewires profit pools and raises entry barriers for purely hardware-centric challengers within the global robotics market.

The Robotics Market Report is Segmented by Robot Type (Industrial Robots, Service Robots, and More), Component (Hardware, Software, and Services), Application (Manufacturing and Assembly, Logistics and Warehousing, Medical and Surgical, and More), End-User Industry (Automotive, Electronics and Semiconductor, Food and Beverage, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific secured 37.72% of global robotics market share in 2025, anchored by China's 430,000 annual industrial-robot installations and two-thirds of worldwide robotics patent grants. Chinese factories integrate robots into lithium-ion battery and consumer-electronics lines, while domestic brands escalate exports, embedding regional cost competitiveness into the global robotics market. Japan posted JPY 180.2 billion (USD 1.64 billion) profit at Fanuc in 2024 on revived Chinese demand and domestic demographic pressure. South Korea's USD 2.6 billion public-private programme channels humanoid expertise toward battery-plant automation, underscoring strategic prioritisation.

The Middle East registers the highest 21.31% CAGR to 2031 as sovereign wealth vehicles divert hydrocarbons surplus into industrial digitalisation, logistics, and healthcare robotics. Free-trade zones in the United Arab Emirates trial warehouse AMRs to service regional e-commerce flows, reducing over-reliance on seasonal migrant labour. National programmes additionally fund advanced manufacturing hubs that attract global integrators, amplifying the addressable base for the global robotics market.

North American demand remains resilient, propelled by CHIPS-Act-backed fabs and defence contracts such as the USD 642.2 million Navy counter-drone award to Anduril. Europe focuses on safe human-robot collaboration standards and sustainability targets, helped by EUR 69 million (USD 75 million) in annual German funding for artificial-intelligence integration. Both regions increasingly outsource commodity sub-assemblies to Asia while investing in high-value software and integration, reflecting a barbell strategy within the global robotics market.

- ABB Ltd.

- Fanuc Corporation

- Yaskawa Electric Corporation

- KUKA AG

- Kawasaki Heavy Industries Ltd

- Universal Robots A/S (Teradyne)

- Denso Corporation

- Mitsubishi Electric Corporation

- Omron Corporation

- Staubli International AG

- Epson Robots (Seiko Epson)

- Comau SpA

- Nachi-Fujikoshi Corp.

- Toshiba Corporation

- Intuitive Surgical Inc.

- Stryker Corporation

- iRobot Corporation

- Boston Dynamics Inc.

- Locus Robotics Corp.

- DJI Technology Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising labour-shortage led automation demand

- 4.2.2 Declining average robot price per functional hour

- 4.2.3 Proliferation of low-code robot-programming platforms

- 4.2.4 Fiscal incentives for reshoring manufacturing in G-7

- 4.2.5 Warehouse AMR roll-outs by e-commerce 3PLs

- 4.2.6 Nation-level humanoid RandD missions (e.g., China 2025)

- 4.3 Market Restraints

- 4.3.1 Persistent SME integration skill-gap

- 4.3.2 Geopolitical export-control on advanced servos

- 4.3.3 Rare-earth magnet price volatility

- 4.3.4 Cyber-security vulnerabilities in ROS deployments

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Robot Type

- 5.1.1 Industrial Robots

- 5.1.2 Service Robots

- 5.1.3 Collaborative (Cobots)

- 5.1.4 Mobile/AMR

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services (Integration, RaaS)

- 5.3 By Application

- 5.3.1 Manufacturing and Assembly

- 5.3.2 Logistics and Warehousing

- 5.3.3 Medical and Surgical

- 5.3.4 Defense and Security

- 5.3.5 Inspection and Maintenance

- 5.3.6 Cleaning and Sanitation

- 5.4 By End-User Industry

- 5.4.1 Automotive

- 5.4.2 Electronics and Semiconductor

- 5.4.3 Food and Beverage

- 5.4.4 Healthcare Providers

- 5.4.5 Military and Defense

- 5.4.6 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 Fanuc Corporation

- 6.4.3 Yaskawa Electric Corporation

- 6.4.4 KUKA AG

- 6.4.5 Kawasaki Heavy Industries Ltd

- 6.4.6 Universal Robots A/S (Teradyne)

- 6.4.7 Denso Corporation

- 6.4.8 Mitsubishi Electric Corporation

- 6.4.9 Omron Corporation

- 6.4.10 Staubli International AG

- 6.4.11 Epson Robots (Seiko Epson)

- 6.4.12 Comau SpA

- 6.4.13 Nachi-Fujikoshi Corp.

- 6.4.14 Toshiba Corporation

- 6.4.15 Intuitive Surgical Inc.

- 6.4.16 Stryker Corporation

- 6.4.17 iRobot Corporation

- 6.4.18 Boston Dynamics Inc.

- 6.4.19 Locus Robotics Corp.

- 6.4.20 DJI Technology Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment