PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850180

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850180

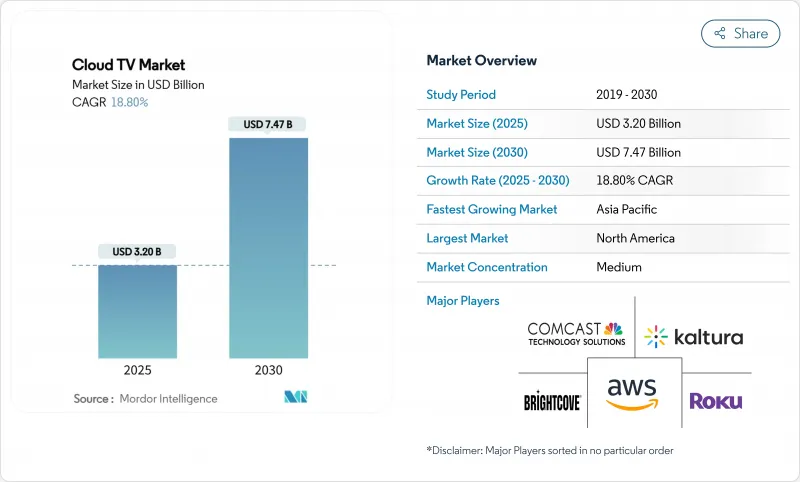

Cloud TV - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Cloud TV market size is estimated at USD 3.20 billion in 2025 and is forecast to expand to USD 7.47 billion by 2030, reflecting an 18.8% CAGR for 2025-2030.

Surging demand for scalable video workflows, rapid 5G deployment, and telco convergence strategies are propelling adoption. Public cloud deployments still dominate, but hybrid architectures are gaining favour as media companies balance elasticity with broadcast-grade performance. Regulatory fragmentation, semiconductor supply constraints, and rising iOS acquisition costs remain growth headwinds. Intensifying competition between platform operators, device OEMs, and telcos is pushing vendors to differentiate through AI-driven discovery, contextual advertising, and integrated cloud gaming services. Early movers in Asia-Pacific are capturing asymmetric advantages thanks to faster network roll-outs and mass smartphone uptake.

Global Cloud TV Market Trends and Insights

Continued Fiber-to-Home Roll-outs Enabling Stable OTT Delivery

FTTH penetration has surpassed 50% in most developed markets, creating the bandwidth reliability the Cloud TV market needs for unbuffered 4K and 8K streams. Carriers such as AT&T are allocating USD 15 billion through 2025 to extend fiber to 30 million premises, which lowers reliance on costly edge caches and fosters premium live sports streaming. Operators further monetize fiber by bundling unlimited data tiers that remove bitrate ceilings and by leveraging deterministic QoS to support interactive features.

Rapid Expansion of 5G Fixed Wireless Access in Rural North America and Europe

5G FWA provides 100-200 Mbps downlinks at sub-10 millisecond latencies, turning previously underserved rural zones into viable Cloud TV market addresses. Operators, including T-Mobile and Verizon, aim to sign 4-5 million FWA subscribers by 2025, accelerating service reach without multi-year trenching costs. Bundled broadband-plus-TV plans and portable cloud-TV use cases for RV owners further inflate rural demand.

Fragmented CDN Footprint in Emerging Africa and Caribbean Islands

Average in-country latency hits 78 milliseconds across much of Africa versus sub-45 milliseconds in North America, limiting consistent 1080p streaming. Roughly 50% of the region's internet traffic transits foreign upstream providers; outages on West African submarine cables in 2024 crippled 13 nations, highlighting fragility. Without local PoPs, Cloud TV service providers must downshift bitrates, impairing the quality of experience and ad yields.

Other drivers and restraints analyzed in the detailed report include:

- Tier-1 Pay-TV Operators' Shift to Cloud-First STB Replacement

- OEM Bundling of Cloud-TV Solutions with Connected-TV Chipsets in Asia

- Persistent Piracy and Credential-Sharing Impacting Revenue Assurance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Public cloud held 52% of revenue in 2024, yet hybrid configurations are set to grow at a 21.3% CAGR to 2030 as broadcasters pursue flexible burst capacity alongside predictable QoS. This mix lets rights-holders keep premium sports archives in private clusters while relying on hyperscalers for live-event traffic. The Cloud TV market size for hybrid deployments is projected to accelerate as content owners map workloads to cost curves and exit ageing on-prem encoders. Regulatory-sensitive verticals such as public-sector media have already moved 45% of workflows to hybrid nodes to localise user data. Across use-cases, phased migrations de-risk legacy decommissioning, supporting uninterrupted audience reach during peak seasons.

Hybrid adoption also solves cross-border rights management: operators deploy origin caches in public regions close to diaspora populations while watermarking and DRM logic run in private domains. Vendors have responded with Kubernetes-based transcoders that elastically scale across both footprints. As a result, billing shifts from capex to granular usage, letting mid-tier networks test 4K distribution without buying new ASICs. By 2030, decision frameworks for cloud TV investment will weigh energy efficiency, carbon disclosure, and sovereign-cloud mandates as heavily as bitrate economics.

Connected TVs (CTV) delivered 40% of 2024 revenue, yet smartphones are the fastest-growing end-point with a 23.5% CAGR forecast. Open-RAN 5G plus cheaper OLED panels have blurred the experiential gap so that 4K HDR on a 6.7-inch screen rivals lounge-room sets. Short-form series cut for vertical orientation dominate Gen-Z watchlists, forcing publishers to storyboard concurrently for tall and wide frames. The Cloud TV market share of mobile usage is expected to overtake CTVs in several Southeast Asian countries by 2027, powered by lower data tariffs and instalment-plan handset upgrades.

Multi-device sync is now table-stakes: advertisers use household graph technology to sequence a 15-second teaser on mobile, a 30-second deep-dive on CTV, and a shoppable overlay on tablet within the same evening. Cloud encoder vendors embed SSAI markers that cue dynamic QR codes aligned with active screen size. Such convergence recasts the notion of a primary screen; the winning proposition will offer frictionless hand-off rather than device-specific UX.

Cloud TV Market Report is Segment by Deployment (Public Cloud, Private Cloud, Hybrid Cloud), Device Type (STB, Mobile Phones, Connected TV), Applications (Telecom, Entertainment and Media, and More), Organization Size (Small and Medium Enterprises, Large Enterprises), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 43% of 2024 revenue owing to mature broadband penetration, high SVOD stacking, and early adoption of contextual ad tech. Regional CDN nodes deliver sub-second start-up times, reinforcing willingness to pay for 4K and Dolby Vision tiers. Yet elevated iOS CPI threatens smaller studios' profitability, nudging spend toward Android and web channels. The emergence of retail media networks, exemplified by Walmart's integration of VIZIO's SmartCast OS, demonstrates how data-rich retailers can bypass traditional broadcasters and sell incremental connected-TV inventory directly to brands .

Asia-Pacific is the fastest-growing region at a 21% CAGR, propelled by mass 5G roll-out, affordable Android TVs, and regional language curation. India's Cloud TV 3.0 initiative adds voice assistants in 10 dialects, unlocking audiences previously tied to cable. Chinese OEMs preload proprietary TV operating systems that double as commerce gateways, giving device brands a bigger revenue share from advertising. South Korea piloted 8K livestreams of the 2024 Asian Games over 5G SA, setting a benchmark for immersive broadcasting. Collectively, these factors speed viewer migration from terrestrial TV to IP-delivered services.

Europe presents a patchwork of opportunities and constraints. High disposable income supports premium bundle uptake, as seen in Scandinavian markets where fibre households average two paid TV apps plus one cloud gaming pass. Network-slicing pilots in Germany prove that dedicated bandwidth can guarantee 20 ms round-trip for AAA cloud titles, yet country-specific loot-box rules complicate pan-EU launches. At the same time, cross-border M&A such as Swisscom's acquisition of Vodafone Italia signals a drive to consolidate spectrum, fibre backbones, and streaming rights under fewer umbrellas, promising broader footprint synergies swisscom.com. Europe's net-zero commitments are prompting broadcasters to move playout into greener data centres, potentially accelerating hybrid-cloud migrations.

- Brightcove Inc.

- Kaltura Inc.

- Ooyala Inc.

- Amino Technologies PLC

- DaCast LLC

- MatrixStream Technologies Inc.

- PCCW Ltd.

- Liberty Global PLC

- Charter Communications (Spectrum)

- Roku Inc.

- Comcast Technology Solutions

- Amazon Web Services

- Google (YouTube TV)

- Apple Inc. (tvOS Services)

- Netflix Inc.

- MUVI LLC

- UpLynk LLC

- Minoto Video Inc.

- Monetize Media Inc.

- Fordela Corp.

- Wowza Media Systems

- Edgecast (Edgio)

- Tencent Cloud

- Huawei Cloud

- Akamai Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Continued Fiber-to-Home Roll-outs Enabling Stable OTT Delivery

- 4.2.2 Rapid Expansion of 5G Fixed Wireless Access in Rural North America and Europe

- 4.2.3 Tier-1 Pay-TV Operators' Shift to "Cloud-first" STB Replacement

- 4.2.4 OEM Bundling of Cloud-TV Solutions with Connected-TV Chipsets in Asia

- 4.2.5 FAST Channel Monetisation Models Accelerating Publisher Adoption in Europe

- 4.2.6 Multi-tenant SaaS Platforms Reducing TCO for Mid-tier Operators

- 4.3 Market Restraints

- 4.3.1 Fragmented CDN Footprint in Emerging Africa and Caribbean Islands

- 4.3.2 Persistent Piracy and Credential-Sharing Impacting Revenue Assurance

- 4.3.3 High Initial Encoding/Transcoding Costs for UHD/HDR Content

- 4.3.4 Legacy CAS/DRM Interoperability Gaps Slowing Migration for Small MSOs

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porters Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Intensity of Competitive Rivalry

- 4.6.5 Threat of Substitute Products

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 Public Cloud

- 5.1.2 Private Cloud

- 5.1.3 Hybrid Cloud

- 5.2 By Device Type

- 5.2.1 Connected TV

- 5.2.2 Mobile Phones

- 5.2.3 Set-Top Box (STB)

- 5.3 By Application

- 5.3.1 Entertainment and Media

- 5.3.2 Telecom

- 5.3.3 Information Technology

- 5.3.4 Consumer Television

- 5.3.5 Other Applications

- 5.4 By Organisation Size

- 5.4.1 Large Enterprise

- 5.4.2 Small and Medium Enterprise

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Mexico

- 5.5.2.4 Rest of Latin America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 New Zealand

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)

- 6.3.1 Brightcove Inc.

- 6.3.2 Kaltura Inc.

- 6.3.3 Ooyala Inc.

- 6.3.4 Amino Technologies PLC

- 6.3.5 DaCast LLC

- 6.3.6 MatrixStream Technologies Inc.

- 6.3.7 PCCW Ltd.

- 6.3.8 Liberty Global PLC

- 6.3.9 Charter Communications (Spectrum)

- 6.3.10 Roku Inc.

- 6.3.11 Comcast Technology Solutions

- 6.3.12 Amazon Web Services

- 6.3.13 Google (YouTube TV)

- 6.3.14 Apple Inc. (tvOS Services)

- 6.3.15 Netflix Inc.

- 6.3.16 MUVI LLC

- 6.3.17 UpLynk LLC

- 6.3.18 Minoto Video Inc.

- 6.3.19 Monetize Media Inc.

- 6.3.20 Fordela Corp.

- 6.3.21 Wowza Media Systems

- 6.3.22 Edgecast (Edgio)

- 6.3.23 Tencent Cloud

- 6.3.24 Huawei Cloud

- 6.3.25 Akamai Technologies

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment