PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640409

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640409

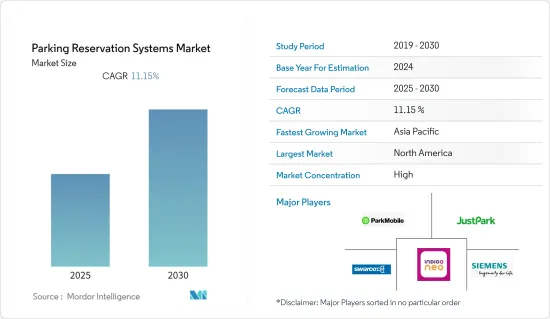

Parking Reservation Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Parking Reservation Systems Market is expected to register a CAGR of 11.15% during the forecast period.

The growing demand for real-time car parking data, new smart city projects, and the rising number of cars are a few factors contributing to the market's growth.

Key Highlights

- The market for parking reservation systems is being driven by the advancement of AI solutions in the automotive sector, such as linked automobiles and the migration to electric vehicles. To keep EV fleet drivers charged, JustPark and FleetCharge developed an innovative initiative to offer incentives for installing EV charging stations in homes in October 2022. JustPark will set up an EV charging station, provide a guaranteed monthly payment, and pay for any electricity costs.

- The market for parking reservation systems will benefit from the growing popularity of smartphones. Due to rising disposable incomes, people are using the newest technology for comfort and hassle-free living. Examples include selecting connected cars and high-end smartphones with cutting-edge capabilities. So, consumers are willing to pay more to park these luxury vehicles easily. These mobile-based parking reservation solutions are more effective at locating and offering parking reservation options and retrieving current parking availability and associated packages.

- The COVID-19 pandemic squeezed the world economy by affecting the manufacturing industry, production, disruption, and financial systems. Post-epidemic, the industries returned to regular operations, and travel and tourism-most adversely affected-got an excellent opportunity to expand. People used their vehicles to commute to preserve social distancing, which required advanced and managed Parking Reservation Systems.

- Cost can be the biggest challenge because more money would be needed to maintain the system when it is run using software-based technologies. Customers will have to cover peak access fees and software maintenance costs. The cost of parking will increase due to the deployment of reporting and ticketing technology.

Parking Reservation Market Trends

Mobile-based Solutions to Witness Significant Growth

- In most cities, there is a significant parking system issue due to the rapid urban population growth. The mobile-based parking reservation solutions have greater efficiency in identifying and providing parking reservation solutions in terms of retrieving real-time parking availability and related packages.

- Smartphones are being utilized for more than just making calls; they are a central hub for many different functions. They are packed with features like GPS and e-wallets that can be used to find specific locations, such as electric charging stations or parking lots. The smartphone's e-wallet will be used to conveniently pay for everything, including the parking fee.

- The Government is aware of the issues caused by a lack of parking and is acting to address them. The integrated transportation system is supported by an efficient parking management structure, promoting sustainable transportation. For drivers and owners of parking spaces in Qatar, the Smart Parking service was introduced.

- In January 2023, Apple and the digital parking reservation service SpotHero partnered to provide consumers with access to parking information for over 8,000 locations across the United States and Canada. It will inform users of the parking options and availability close to a particular location.

North America Occupies the Largest Market Share

- The next phase of the automobile industry is that of connected automobiles, and automakers are making significant investments in these new economic ecosystems, business models, and revenue streams. The majority of the world's top automakers, including General Motors, Ford, and Chevrolet, constantly creating ground-breaking AI technologies for their vehicles, have their origins in North America.

- North American cities were designed with the idea that cars would be the primary source of transportation. In the United States, there are eight parking spaces for every car, which take up more than 5% of the total urban land area. These parking places must be mechanized as AI technology advances in the nation.

- In October 2022, SpotHero, the digital parking leader in North America, celebrated the sale of USD 1 billion in parking reservations sold since it entered the business in 2011. The most dynamic pricing solution in the parking sector, SpotHero IQ, enables operators to run their companies more successfully and better manage their parking inventory, which boosts revenues.

- In January 2022, Waterloo, Ontario-based company simplified parking in crowded cities with smart parking technology using the eXactpark app.

Parking Reservation Industry Overview

The parking reservation systems market is highly competitive due to the abundance of options offered by firms competing in domestic and global markets. The key firms use tactics like product innovation and mergers and acquisitions, which suggests that the market is relatively concentrated. Some of the major players in the market are Conduent Incorporated, Siemens AG, ParkMe Inc, and JustPark Parking Ltd, among others.

In January 2022, to digitize the parking environment in India using the vehicle's FASTag, Airtel Payments Bank partnered with Park+.Park+ access control systems are used in over 1,500 societies,30 malls, and 150 corporate parks nationwide. With the help of this partnership, significant commercial and residential buildings around the country will have access to smart parking options based on FASTag.

In February 2022, Vauxhall established a new collaboration with parking service JustPark to allow exclusive access to off-street charging stations. Also, this agreement will enable more individuals to switch to electric vehicles because they can locate convenient charging stations close to their residences.

In June 2022, in collaboration with ComfortDelGro and Alipay+, Touch 'n Go eWallet increased the reach of its cross-border payment capabilities to Singapore. ComfortDelGro runs over 9,000 taxis across Singapore. This international partnership enables its customers to travel with the eWallet and take advantage of a simple and convenient payment experience outside of their native country.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Increasing Number of Vehicles

- 4.3.2 Increasing Smart City Projects Across the World

- 4.4 Market Challenges

- 4.4.1 Slow Adoption Rate

5 MARKET SEGMENTATION

- 5.1 By Parking Site

- 5.1.1 On-street Parking

- 5.1.2 Off-street Parking

- 5.2 By Solutions

- 5.2.1 Web-based

- 5.2.2 Mobile-based

- 5.2.3 Voice Call-based

- 5.3 By End-user Vertical

- 5.3.1 Government

- 5.3.2 Retail

- 5.3.3 Hospitality

- 5.3.4 Entertainment/Recreation

- 5.3.5 Transportation

- 5.3.6 Other End-user Verticals

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Rest of Asia Pacific

- 5.4.4 Rest of the World

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Conduent Incorporated

- 6.1.2 Siemens AG

- 6.1.3 ParkMe Inc.

- 6.1.4 JustPark Parking Ltd

- 6.1.5 The Kapsch Group

- 6.1.6 Standard Parking Corporation

- 6.1.7 APCOA Parking AG

- 6.1.8 Streetline Inc.

- 6.1.9 Amano Corporation

- 6.1.10 Swarco Corporation

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS