PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640560

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640560

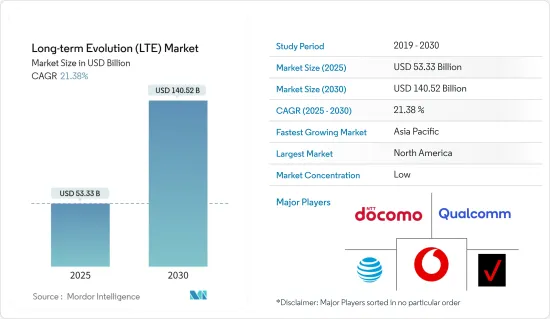

Long-term Evolution (LTE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Long-term Evolution Market size is estimated at USD 53.33 billion in 2025, and is expected to reach USD 140.52 billion by 2030, at a CAGR of 21.38% during the forecast period (2025-2030).

The continuous proliferation of smartphones across the globe has increased the average data consumption by an average man, which has increased the need for LTE services, driving the market.

Key Highlights

- Many businesses across the globe have been growing, and so require data, owing to the digitization of every aspect of the business. Telecommunication companies are making enormous investments in new and advanced wireless technologies and looking for better applications to provide payoffs.

- LTE networks need to provide higher data rates and spectral efficiency to meet this growing demand for mobile data services. Higher data rates enable users to download and upload data more quickly, while greater spectral efficiency enables operators to use their existing spectrum more efficiently, allowing them to provide more data services to more users.

- The increased adoption of Public Safety LTE (PS-LTE) is one of the key drivers of growth in the Long-Term Evolution (LTE) market. PS-LTE is a standard for mobile communications that are designed specifically for use by public safety agencies such as police, fire, and emergency medical services. It provides dedicated wireless broadband connectivity for public safety personnel, enabling them to access critical data and communication services in real time.

- Compatibility issues can restrain LTE's growth, as they can create barriers to adoption and limit the ability of users to utilize the technology entirely. Compatibility issues can pose significant challenges to the growth and adoption of LTE technology.

- The COVID-19 pandemic had a mixed impact on the LTE industry, with both positive and negative effects. However, the increased demand for mobile data and the expansion of telemedicine and e-commerce services highlighted the importance of LTE technology in enabling remote work and other online activities.

Long-term Evolution (LTE) Market Trends

VoLTE Application Segment is Expected to Hold Significant Market Share

- Voice over Long-Term Evolution (VoLTE) is a technology that allows voice calls to be made over LTE networks rather than using traditional circuit-switched networks. This technology has been gaining popularity in the LTE market, offering better voice quality and faster call setup times than conventional networks.

- The LTE market has grown rapidly in recent years due to the increasing demand for high-speed data services. VoLTE is an important application in the LTE market as it allows operators to use their LTE networks to provide voice services rather than relying on legacy circuit-switched networks. This allows operators to free up spectrum and network resources previously used for voice services, which can be used to provide better data services.

- VoLTE also provides a better user experience by offering features such as high-definition (HD) voice, which provides better call quality, and video calling, which allows users to make video calls over LTE networks. VoLTE supports rich communication services (RCS), allowing users to share multimedia content such as photos and videos during calls.

- Many recent technological advancements have contributed to popularizing and adopting such services in developing countries, such as India. The Telecom Regulatory Authority of India (TRAI) has recommended that the government auction spectrum for 5G services in the 3.3-3.6 GHz frequency band. The government has also allowed telecom operators to conduct trials of 5G technology in India.

- With the increasing 5G coverage, the market is expected to witness further growth across major regions of the globe. According to Cisco Annual Internet Report, China (20.7%), Japan (20.6%), and the United Kingdom (19.5%) will likely be the top three 5G countries in terms of device and connection share by 2023.

Asia-Pacific is Expected to Hold Significant Market Share

- Long-Term Evolution (LTE) technology has seen significant growth and adoption in Asian countries recently. The main driving factors behind this growth are the increasing demand for high-speed data services and the growing number of mobile subscribers in these countries.

- Moreover, smartphone penetration in growing economies in this region has grown exponentially in recent years. It is expected to grow in the coming years, which drives the market in this region.

- China is the largest LTE market in Asia, with more than 1.2 billion mobile subscribers. The country has invested heavily in 4G and 5G infrastructure, and by 2023, the country will have the largest global 5G network with over 20.7% of devices and connections. South Korea is also a significant LTE market in Asia, with one of the highest 5G penetration rates globally.

- Furthermore, shifting consumer preferences and increased demand for high-speed mobile broadband in the Asia-Pacific region have created enormous opportunities in the APAC industry. In addition, telecom carriers in this area have more LTE deployments planned in these emerging nations.

- Rapid urbanization, fast industrial growth, and advancement in communication technology are important factors leading the way for advanced wireless networks and solutions in this region.

Long-term Evolution (LTE) Industry Overview

The Long-term Evolution (LTE) Market is highly fragmented, with major players like AT&T Inc., Verizon Communication Inc, Vodafone Inc, NTT DoCoMo Inc., and Qualcomm Inc. The players in the market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In January 2023, Vodafone successfully performed an internet call using its new network to enable connected devices, opening the path for crucial applications such as emergency monitoring and responsive healthcare in distant locations. The Voice over Long-Term Evolution (VoLTE) call, often known as 4G calling, was made in Italy over Vodafone's commercial Category M (CAT-M) network. The network is perfect for serving many Internet of Things (IoT) devices across a single mobile phone site without reducing service to smartphone users. This is Europe's first VoLTE call on active commercial CAT-M network infrastructure.

In July 2022, Nokia and AT&T Mexico established a partnership to deliver the benefits of 5G to the country. Nokia was also chosen as a strategic partner for AT&T Mexico's 5G Innovation Lab to investigate the creation of 5G use cases specific to Mexico and the local 5G ecosystem.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Need For Higher Data Rates and Greater Spectral Efficiency Driven By Increased Data Usage

- 5.1.2 Increased Adoption of Public Safety LTE

- 5.2 Market Restraints

- 5.2.1 Availability of Limited Spectrum

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 LTE-TDD

- 6.1.2 LTE Advanced

- 6.1.3 LTT-FDD

- 6.2 By Application

- 6.2.1 Video on Demand

- 6.2.2 VoLTE

- 6.2.3 High Speed Data Services

- 6.2.4 Defense and Security

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AT&T Inc.

- 7.1.2 Verizon Communication Inc

- 7.1.3 Vodafone Inc

- 7.1.4 NTT DoCoMo Inc.

- 7.1.5 Qualcomm Inc.

- 7.1.6 Apple Inc.

- 7.1.7 Samsung Electronics Co. Ltd.

- 7.1.8 Ericsson Inc.

- 7.1.9 Broadcom Corporation

- 7.1.10 Microsoft Corporation

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS