PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687230

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687230

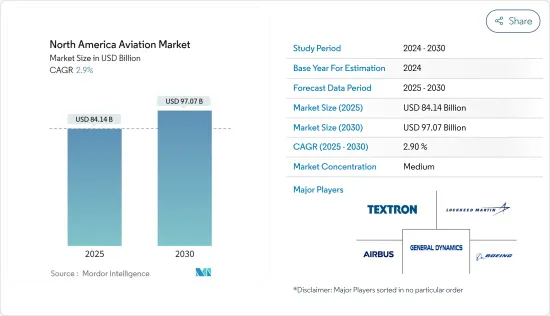

North America Aviation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America Aviation Market size is estimated at USD 84.14 billion in 2025, and is expected to reach USD 97.07 billion by 2030, at a CAGR of 2.9% during the forecast period (2025-2030).

An increase in low-cost carriers (LCCs) and ultra-low-cost carriers (ULCCs) has disrupted the traditional airline business model. These carriers offer competitive fares, enticing a larger customer base and expanding air travel accessibility to more people.

The presence of various aircraft manufacturers has led to the maturation of the aviation industry across North America. The defense industry has also benefited from government investments in introducing advanced defense solutions and research and development capabilities for helicopters and fighter jets. Procuring advanced fighter jets, transport and trainer aircraft, and helicopters from regional players has also contributed significantly to market growth. With fuel prices increasing, companies are expected to experience increased operating costs. Fuel surcharges add USD 600 to over USD 1,000 per hour, depending on aircraft types and fuel price changes. Due to this, companies have to transfer the costs to the consumers, which increases trip costs or cuts their profit margin. Such factors hamper the market's growth.

Moreover, the growth of the general aviation market in the region is anticipated to be supported by the growing focus on improving private airport infrastructure and favorable regulatory changes during the forecast period.

North American Aviation Market Trends

The Commercial Aircraft Segment is Expected to Witness Significant Growth During the Forecast Period

The commercial aircraft segment is expected to witness significant growth in the North American aviation market during the forecast period. The need for passenger planes mainly fuels this increase as domestic trips continue to rise.

Expansion of airline fleets, rising desire for fuel-efficient planes, growth in air travel, and the industry's shift toward the zero-emission 2050 target are driving the demand for commercial aircraft. By August 2023, 1,474 Boeing and 986 Airbus aircraft were expected to be delivered in the region. The United States is the sole owner of 2,405 aircraft awaiting delivery. Therefore, the country is anticipated to experience significant growth over the forecast period.

Leading airlines like American Airlines, Delta Air Lines, and United Airlines have significant aircraft deliveries scheduled for 2024, and cargo companies like Air Canada are rapidly growing and updating their fleets. In January 2024, Delta Air Lines selected Airbus to fulfill its requirements for new, fuel-efficient widebody aircraft by ordering 20 A350-1000 planes. Delta Air Lines has over 450 Airbus aircraft in operation and more than 200 on order. These advancements are projected to fuel expansion in the commercial aircraft industry over the forecast period.

The United States is Expected to Witness Significant Growth During the Forecast Period

The United States is anticipated to experience notable expansion in the coming years, as it ranks among the biggest aviation markets globally. In response to the growing need for air travel, multiple US airlines are enhancing their fleets and acquiring technologically advanced aircraft. In June 2023, United Parcel Service announced its intention to increase its fleet by incorporating 55 aircraft within the next two years. Most of these will be small feeder planes operated by contractors, and the company also aims to introduce an additional eight B777F aircraft between 2023 and 2025.

In addition to civil aviation, the United States allocates most of its funds to its military. As per the SIPRI, the US military spending rose by around 2.3% in 2023, totaling USD 916 billion, solidifying its position as the top defense spender globally, accounting for 37% of worldwide expenditure. The United States is projected to experience consistent growth in the defense industry in the next ten years, as it intends to upgrade its outdated fighter jets with more advanced versions. The US Marine Corps plans to acquire approximately 340 F-35B and 80 F-35C models to replace the AV-8B Harrier II and old F/A-18 Hornet jets.

In April 2024, the United States bought 81 Soviet-era fighter and bomber planes from Kazakhstan, which sold 117 military aircraft in an auction, including MiG-31 interceptors, MiG-27 fighter bombers, MiG-29 fighters, and Su-24 bombers. In conclusion, these developments are expected to expand the market throughout the forecast period.

North American Aviation Industry Overview

The aviation market in North America includes major companies like The Boeing Company, Airbus SE, Lockheed Martin Corporation, Textron Inc., and General Dynamics Corporation. Due to the existence of these large aircraft manufacturers, the market has become very competitive. Moreover, this area is a focal point for international aerospace suppliers because most of the aircraft production across the world is located here, where they have manufacturing, sales, and support establishments.

To control the aviation market in the region, the companies use various growth tactics, including implementing new approaches, expanding offerings, improving workforce efficiency, acquiring supply chain partners, merging with other companies, entering new markets, and offering competitive prices. Cooperation and alliances are crucial growth tactics that aerospace manufacturers in North America embrace. Many of them work with international companies to exchange knowledge and skills to create new technologies and products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 Market Segmentation

- 5.1 Type

- 5.1.1 Commercial Aircraft

- 5.1.1.1 Passenger Aircraft

- 5.1.1.2 Freighter Aircraft

- 5.1.2 Military Aircraft

- 5.1.2.1 Combat Aircraft

- 5.1.2.2 Non-combat Aircraft

- 5.1.3 General Aviation

- 5.1.3.1 Helicopter

- 5.1.3.2 Piston Fixed-wing Aircraft

- 5.1.3.3 Turboprop Aircraft

- 5.1.3.4 Business Jet

- 5.1.1 Commercial Aircraft

- 5.2 Geography

- 5.2.1 United States

- 5.2.2 Canada

6 Competitive Landscape

- 6.1 Vendor Market Share

- 6.2 Company Profile

- 6.2.1 Airbus SE

- 6.2.2 Lockheed Martin Corporation

- 6.2.3 The Boeing Company

- 6.2.4 General Dynamics Corporation

- 6.2.5 Textron Inc.

- 6.2.6 Embraer SA

- 6.2.7 Bombardier Inc.

- 6.2.8 Pilatus Aircraft Ltd

- 6.2.9 Leonardo SpA

- 6.2.10 Dassault Aviation SA

- 6.2.11 Piper Aircraft Inc.

- 6.2.12 Honda Aircraft Company

7 Market Opportunities and Future Trends