PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686590

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686590

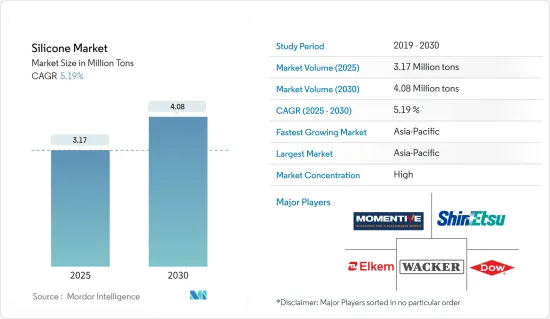

Silicone - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Silicone Market size is estimated at 3.17 million tons in 2025, and is expected to reach 4.08 million tons by 2030, at a CAGR of 5.19% during the forecast period (2025-2030).

COVID-19 hampered the silicone market. During the early stages of the pandemic, lockdowns and restrictions on movement disrupted global supply chains, leading to delays in raw material procurement and production shutdowns. This resulted in temporary shortages of silicone products and impacted manufacturing operations. However, as lockdown measures eased and economic activities resumed, enormous demand for silicone was released across various industries such as automotive, construction, electronics, and healthcare.

The major factors driving the silicone market are the increased usage of silicone in the healthcare industry, the growing demand from the power transmission and distribution segment, and rising applications of silicone in the automotive industry.

On the flip side, government regulations and competition from substitutes are expected to hinder the growth of the market.

Rising potential demand for electroactive polymers (EAP) from various end users and increasing contribution of silicone-based materials to energy efficiency and sustainability in construction are likely to act as an opportunity in the silicone market during the forecast period.

Asia-Pacific is expected to dominate the silicone market among other regions, with China and India leading the region's growth.

Silicone Market Trends

The Industrial Processes Segment to Dominate the Market

- The main applications of silicones in the field of manufacturing processes include antifoaming agents, industry coatings, fluids and oils, room-temperature vulcanizing sealants, moldings, and additives for polymers.

- Silicones are widely used in offshore drilling because of space and weight limitations, where the management of foam and waste is essential. Silicones allow the gas trapped in the drilling mud to be released. Due to the presence of foam, which hinders the process and requires time for maintenance work, antifoaming agents reduce energy consumption and chemical use while boosting production.

- Thus, expanding the global oil and gas industry is anticipated to benefit from the demand for silicone. Various expansion projects underway are expected to drive the growth. India is a significant economy in Asia-Pacific in the oil and gas segment. According to the report released by the India Brand Equity Foundation (IBEF), the oil demand in India is projected to reach 11 million barrels by 2045. In addition, India's natural gas consumption is expected to increase by 25 billion cubic meters by the end of 2024.

- Moreover, according to the data published by the Energy Institute, global oil production reached 4,407.2 million metric tons in 2022.

- Also, according to the report released by the Organization of the Petroleum Exporting Countries (OPEC), there is a rise in demand for crude oil, which increased to 101.89 million barrels per day in 2023. This leads to increased demand for silicone from the oil and gas industries.

- In 2023, China, the globe's top importer of crude oil, brought in 11.3 million barrels of crude oil daily, marking a 10% rise from the previous year, as per data from China's customs. Refineries in China saw their highest crude oil imports in 2023 to meet the nation's rising demand for refining, aiming to meet transportation fuel needs and generate raw materials for its expanding petrochemical.

- Due to all the above factors, the market is expected to witness post-recovery solid growth during the forecast period.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is the largest consumer of silicone, with the Chinese, Indian, and Japanese markets driving growth in the region over the years.

- Semiconductors are one of the significant parts of the electronics segment, which involves the usage of silicones as silicone encapsulates, coats, and adheres to the protection of semiconductors, PCBs, and ECUs. According to the Semiconductor Industry Association and the World Semiconductor Trade Statistics (WSTS), the semiconductor sales value in China stood at USD 11.66 billion in January 2023.

- Moreover, China has several large shipbuilding conglomerates, including China Shipbuilding Industry Corporation (CSIC), China State Shipbuilding Corporation (CSSC), COSCO shipping, CMHI, and Sinotrans. China's shipyards build a wide variety of ships, including freighters, containerships, oil tankers, naval vessels, passenger craft, luxury carriers, and so on, which leads to the demand for silicone.

- Also, according to the India Brand Equity Foundation (IBEF), the demand for semiconductor goods in India is expected to be USD 400 billion by FY 2025. The Government of Uttar Pradesh also aims to become a semiconductor hub in the country, given that India is estimated to benefit from INR 76,000 crore (USD 9,093.66 million) as an investment into the chip industry under the Production Linked Incentive scheme.

- China's consumer electronics market is set to bounce back with positive growth in 2024, driven by growing market demand and innovation while increasing retail spending. China's total retail sales of consumer electronics are expected to reach CNY 2.2 trillion (USD 305 billion), and the growth rate is expected to increase further to 5% in 2024.

- Thus, the above-mentioned factors are expected to contribute to the increasing demand for silicone in Asia-Pacific during the forecast period.

Silicone Industry Overview

The silicone market is consolidated. The major players (not in any particular order) include Wacker Chemie AG, Dow, Shin-Etsu Chemical Co. Ltd, Momentive, and Elkem ASA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Application in Automotive Industry

- 4.1.2 Increasing Usage in Healthcare Industry

- 4.1.3 Growing Demand from Power Transmission and Distribution

- 4.2 Restraints

- 4.2.1 Government Regulation

- 4.2.2 Competition from Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Form

- 5.1.1 Elastomers

- 5.1.2 Fluids

- 5.1.3 Resins

- 5.1.4 Other Forms

- 5.2 End User

- 5.2.1 Transportation

- 5.2.2 Construction Materials

- 5.2.3 Electronics

- 5.2.4 Healthcare

- 5.2.5 Industrial Processes

- 5.2.6 Personal Care and Consumer Products

- 5.2.7 Other End Users (Textiles and Coatings)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Thailand

- 5.3.1.6 Malaysia

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 ASEAN Countries

- 5.3.1.10 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Turkey

- 5.3.3.7 Russia

- 5.3.3.8 NORDIC

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BRB International (PETRONAS Chemicals Group Berhad)

- 6.4.2 CHT Germany GmbH

- 6.4.3 Dow

- 6.4.4 DyStar Singapore Pte Ltd

- 6.4.5 Elkem ASA

- 6.4.6 Evonik Industries AG

- 6.4.7 Hoshine Silicon Industry Co. Ltd

- 6.4.8 Jiangsu Mingzhu Silicone Rubber Material Co. Ltd

- 6.4.9 KANEKA CORPORATION

- 6.4.10 Mitsubishi Chemical Corporation

- 6.4.11 Momentive

- 6.4.12 Shin-Etsu Chemical Co. Ltd

- 6.4.13 Wacker Chemie AG

- 6.4.14 Wynca Tinyo Silicone Co. Ltd

- 6.4.15 Zhejiang Sucon Silicone Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Potential Demand For Electro Active Polymers (EAP)

- 7.2 Increasing Contribution of Silicone-based Materials to Energy-efficiency and Sustainability in Construction