PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640598

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640598

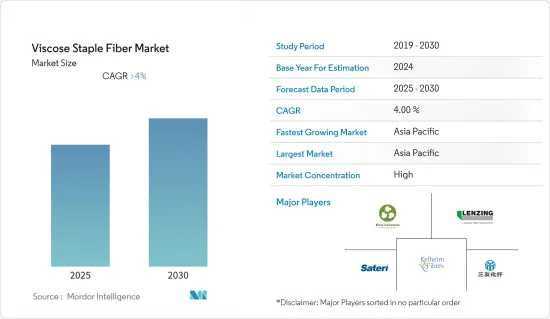

Viscose Staple Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Viscose Staple Fiber Market is expected to register a CAGR of greater than 4% during the forecast period.

The COVID-19 pandemic has significantly impacted the value chain in every aspect. Because of the government's limitations, the supply of raw materials came to a standstill. As a result of the lockdowns in several countries, viscose fiber prices have dropped, forcing many companies, such as Lenzing AG, to start making safety masks at their factories, as non-woven fibers are needed for mask manufacturing. The pandemic had a detrimental influence on the market, particularly in automobile and garment applications. However, the industry saw marginal growth in 2021, as several firms have begun to produce woven textiles in their facilities. In the scheduled time, the market is expected to grow positively.

Key Highlights

- In the short term, the market will be driven by the demand for viscose fiber from the fashion apparel sector.

- Synthetic fibers may hamper the market expansion of viscose fibers.

- Future market opportunities will arise from the growing usage of dense fibers in the medical sector.

- The Asia-Pacific region dominated the market and is also estimated to record the fastest CAGR during the forecast period.

Viscose Staple Fibre Market Trends

Increasing Demand for Woven Fibers

- Natural and biodegradable viscose staple fibers (VSF) or artificial cotton fibers are made from wood pulp and cotton pulp, both of which have properties similar to cotton fibers. These fibers are adaptable and pliable and may be used in various applications, including garments, home textiles, home furnishings, dress materials, and woven and knitted.

- Increasing demand for textiles and apparel is expected to drive the demand for VSF in these applications. Asia-Pacific, the largest market for woven fabrics, is witnessing healthy growth due to the increasing demand in countries like India, China, etc.

- In India, the demand for apparel has increased with growing consumer preference in response to growing foreign textile brands. The demand has been augmented by digitalization and social networking sites and apps, which help increase garments sales. Indian apparel exports to the United States climbed by 38.5% in 2021 to a total of USD 209.63 million, according to The International Trade Administration of the U.S. Department of Commerce.

- Viscose is the most critical artificial cellulose fiber, with a market share of around 79% of all man-made cellulose fibers.

- Small regions, such as Bangladesh, have witnessed an increase in population and living standards, driving the demand for knitted fabrics.

- All the factors above are expected to increase the demand for viscose staple fiber during the forecast period.

The Asia-Pacific Region is Expected to Dominate the Market

- Asia-Pacific is expected to dominate the VSF market during the forecast period owing to the rapidly increasing yarn production.. China is the largest producer and consumer of viscose staple fiber globally.

- China is the largest clothing producer in the world and has the largest production capacity for textile products consisting of cotton, man-made fibers, and silk. The major problem faced by the Chinese viscose staple fiber industry is the presence of surplus production capacities.

- Lenzing and Birla are some of the major global manufacturers with their production facilities in China.

- According to Invest India, in 2021, India's domestic clothing and textile sector provides 5% of the GDP, 7% of industrial production in value terms, and 12% of export revenues. India is the world's sixth-largest exporter of textiles and clothing.

- With the removal of Anti Dumping Duty on viscose fiber in India, the industry is set to see a growth surge in the coming years.

- There has been an increase in wages in the country due to which the textile production is expected to shift to low-wage ASEAN countries, ultimately affecting the sales of viscose staple fiber in China.

- Additionally, supportive government regulations, such as the Amended Technological Upgradation Fund Scheme (ATUFS) and the Scheme for Integrated Textile Parks (SITP), and capital and freight subsidy on textiles by the states of Maharashtra and Haryana have provided a boost to the industry. This, in turn, has significantly driven the market for viscose staple fiber in India.

- Due to all these factors, the market for viscose staple fiber is expected to grow in the region during the forecast period.

Viscose Staple Fibre Industry Overview

The viscose staple fiber market is consolidated, and the top five manufacturers occupy around 60% of the market. The major players in the market include Lenzing AG, Birla Cellulose, SATERI, Xinjiang Zhongtai Chemical Co. Ltd, and Tangshan Sanyou Group Xingda Chemical Fibre Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Apparels and Clothing

- 4.1.2 Increased Adoption of Viscose Fabrics, due to Ambiguity in Cotton Prices

- 4.2 Restraints

- 4.2.1 Competition from Synthetic Fibers

- 4.2.2 Unfavorable Conditions Arising due to the Impact of COVID-19, Especially in End-user Industries like Automotive and Others

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Production Process

- 4.6 Technological Product Advancement

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Woven (Textile and Apparel)

- 5.1.2 Non-woven and Specialty

- 5.1.2.1 Healthcare

- 5.1.2.2 Automotive

- 5.1.2.3 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 Rest of the World

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Other Rest of the World

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share(%)**/Ranking Analysis

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Asia Pacific Rayon Limited

- 6.3.2 Birla Cellulose

- 6.3.3 Glanzstoff

- 6.3.4 Jilin Chemical Fiber Group Co. Ltd

- 6.3.5 Kelheim Fibres GmbH

- 6.3.6 LENZING AG

- 6.3.7 Nanjing Chemical Fibre Co. Ltd

- 6.3.8 Sateri

- 6.3.9 SNIACE Group

- 6.3.10 Tangshan Sanyou Group Xingda Chemical Fibre Co. Ltd

- 6.3.11 Yibin Hiest Fibre Limited Corporation (Milan)

- 6.3.12 Xinjiang Zhongtoi Chemical Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Use of Cellulose Fibers in Healthcare Applications