PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851967

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851967

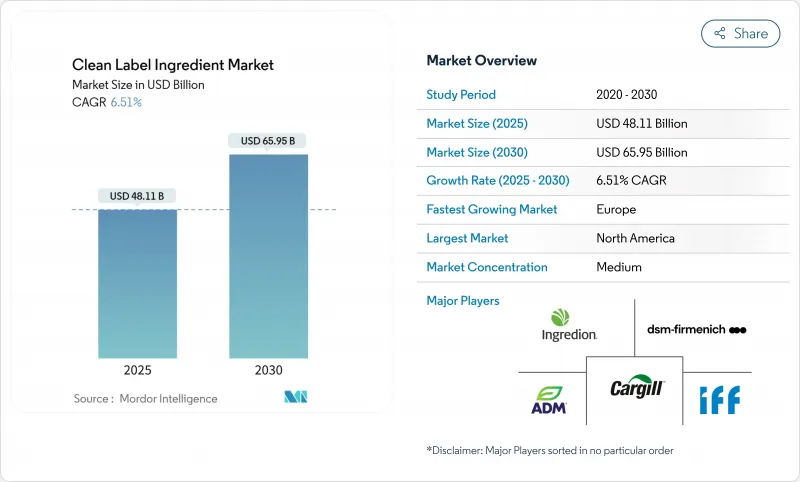

Clean Label Ingredient - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The clean label ingredients market size is estimated to be worth USD 48.11 billion in 2025 and is expected to grow to USD 65.95 billion by 2030, registering a CAGR of 6.51% during the forecast period.

This growth is driven by increasing consumer demand for simple and recognizable ingredients, heightened health awareness following the pandemic, and retailers' efforts to simplify ingredient lists. Regulatory initiatives, such as the U.S. Food and Drug Administration (FDA) phasing out petroleum-based dyes, are further encouraging the adoption of natural colors, flavors, and preservatives. In response, manufacturers are investing in research and development focused on botanical extraction, fermentation processes, and traceability technologies to ensure transparency and validate clean label claims. Although natural ingredients currently cost more-natural colorants are priced 25-35% higher than synthetic alternatives-the price gap is narrowing as production scales up and supply agreements strengthen. Additionally, the expansion of retail private-label programs and e-commerce platforms is driving greater adoption, signaling the shift of clean label ingredients from a niche market to a mainstream trend across various regions.

Global Clean Label Ingredient Market Trends and Insights

Health Issues Related with Artificial Food Additives

Scientific evidence increasingly links artificial food additives to adverse health outcomes, prompting consumers to demand cleaner-label alternatives. A pivotal 2024 study from the National Library of Medicine found strong ties between synthetic food colorants and respiratory issues, notably impaired lung function in children. With a growing awareness of the diet-health connection, consumers are actively steering clear of artificial additives and preservatives commonly found in processed foods. This shift in consumer sentiment is echoed in the International Food Information Council's 2024 survey. Here, 26% of U.S. respondents deemed "Natural" as the top indicator of healthy food, while 16% prioritized "Non-GMO" claims. Such sentiments highlight a pronounced alignment with clean label principles, emphasizing natural and minimally processed ingredients. Responding to this consumer shift and the mounting scientific backing, regulatory bodies are stepping up. In April 2025, the U.S. Food and Drug Administration (FDA) rolled out a major initiative to phase out petroleum-based synthetic dyes from the food supply, marking a pivotal regulatory shift and underscoring the government's commitment to public health. Collectively, these regulatory, scientific, and consumer-driven dynamics are reshaping food safety standards, enhancing industry transparency, and cementing the clean label movement's prominence in contemporary food production.

Shift Towards Plant-Based and Organic Ingredients

The clean label movement is gaining momentum and converging with the plant-based revolution, reshaping global food industry innovation strategies. This alignment is driven by heightened awareness of diet-health links, environmental concerns, and a shift toward ethical consumption. Consumers now demand transparency in ingredient sourcing and favor natural, minimally processed, plant-derived alternatives over synthetic additives. This trend is especially pronounced in the flavors and enhancers segment. Manufacturers are swiftly moving from artificial compounds to naturally sourced ingredients. Companies are pouring investments into cutting-edge technologies like precision fermentation, enzymatic extraction, and solvent-free processing. These advancements aim to create natural flavor modulators that boast enhanced functionality, stability, and shelf life. For instance, in March 2024, BASF Aroma Ingredients bolstered its Isobionics portfolio with the launch of Isobionics Natural beta-Caryophyllene 80. With a purity level of 80%, this ingredient caters to diverse applications in beverages, food, and fragrances, highlighting the industry's dedication to clean-label and plant-based innovation. Such strides emphasize the deepening bond between these movements and their shared influence on future product development.

Higher Cost of Clean Label Ingredients

Manufacturers face challenges with the premium pricing of clean-label ingredients, working to align with consumer expectations while ensuring economic feasibility. Consider natural colorants: they command a price that's 25-35% above their synthetic counterparts, squeezing margins throughout the value chain. Several factors contribute to this price differential: complex sourcing networks, lower yields from natural extraction, and stricter quality control for natural ingredients. For instance, sourcing natural colorants like beetroot or turmeric involves navigating seasonal harvests and ensuring non-contamination during processing, which increases costs. Moreover, the production of natural ingredients has limited scalability, and raw materials are often seasonally available, amplifying the cost gap. For example, the production of carmine, a natural red colorant derived from cochineal insects, is labor-intensive and subject to fluctuations in insect availability. This disparity highlights the need for strategic pricing and consumer education to rationalize the premium on clean-label products.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand for Allergen-Free and Gluten-Free Products

- Expansion of Vegan and Vegetarian Product Lines

- Limited Awareness in the Emerging Economies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, food flavors and enhancers dominate the clean label ingredients market with a commanding 33.38% share. This underscores their pivotal role in ensuring product palatability and securing consumer acceptance. The prominence of this segment highlights manufacturers' strategic focus on maintaining sensory appeal while transitioning to cleaner formulations. Companies such as Givaudan, Sensient Technologies, and Symrise are making significant investments in natural flavor solutions, responding to the surging demand for clean-label products. For instance, in March 2024, Sensient Flavors and Extracts unveiled SmokeLess Smoke, a new range of natural, clean-label flavors, capturing the full spectrum of popular smoky notes sought after in gourmet culinary products.

Conversely, food colorants are rapidly ascending, earning the distinction of the fastest-growing segment, with a projected CAGR of 7.98% from 2025 to 2030. This growth spurt is primarily due to the FDA's recent approval of three natural color additives: Galdieria extract blue, butterfly pea flower extract, and calcium phosphate. Furthermore, the rising adoption of natural colorants in beverages, confectionery, and dairy products propels this segment's expansion. Simultaneously, food preservatives are experiencing a renaissance, with a pronounced shift towards innovative, plant-sourced antimicrobial solutions. For instance, rosemary extract and citrus-derived compounds are emerging as effective natural preservatives. This transition offers manufacturers alternatives to synthetic preservatives, all while ensuring uncompromised shelf stability.

The Global Clean-Label Ingredients Market Report Segments the Industry by Ingredient Type (Food Preservatives, Food Sweeteners, Food Colorants, Food Hydrocolloids, and More); by Form (Dry and Liquid); by Application (Bakery and Confectionery, Dairy and Frozen Desserts, and More ); and by Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, North America commands a 35.43% share of the clean label ingredients market, bolstered by heightened consumer awareness and a stringent regulatory landscape. The FDA's recent moves to eliminate petroleum-based synthetic dyes and boost food labeling transparency further cement the region's dominance. While Canada sees growth driven by health-conscious consumers, Mexico's expansion is spurred by a burgeoning middle class and heightened health awareness.

Europe, with a projected CAGR of 6.64% from 2025-2030, is set to be the fastest-growing region, thanks to strict regulatory standards and a strong consumer tilt towards natural products. The European Commission's Clean Industrial Deal is bolstering the competitiveness of clean label manufacturers by advocating sustainable production and lightening administrative loads. The UK and Germany spearhead the European market, with the UK navigating post-Brexit regulations to uphold high food ingredient standards. Meanwhile, France, Spain, and Italy, with their culinary traditions emphasizing quality, are witnessing robust growth. Russia and other European nations are slowly carving out their market shares as consumer awareness rises.

Despite hurdles in consumer awareness and regulatory clarity, the Asia-Pacific region is carving out a notable space in the clean label ingredients market. China and India, with their vast middle-class populations, are primed for growth, driven by escalating concerns over food safety and quality. Japan, with its refined food culture, and Australia, backed by stringent regulations and health-focused consumers, are leading the charge. Adoption rates vary across the region, with developed economies at the forefront. Urbanization, rising disposable incomes, and a health-conscious younger demographic fuel the region's growth.

- Cargill Incorporated

- Archer Daniels Midland Company

- Ingredion Incorporated

- Tate and Lyle PLC

- Kerry Group PLC

- DSM-Firmenich

- International Flavors & Fragrances Inc. (IFF)

- Sensient Technologies Corporation

- Ajinomoto Co. Inc.

- Corbion N.V.

- Givaudan S.A.

- Roquette Freres S.A.

- Dohler GmbH

- Kalsec Inc.

- CP Kelco (J.M. Huber Corp.)

- Puratos Group

- Sudzucker AG

- Nexira SAS

- Limagrain Ingredients

- Camlin Fine Sciences Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Health issue related with artificial food additives

- 4.2.2 Shift towards plant-based and organic ingredients

- 4.2.3 Rising demand for allergen-free and gluten-free products

- 4.2.4 Expansion of vegan and vegetarian product lines

- 4.2.5 Global health crises emphasizing the need for healthier food choices

- 4.2.6 Increased research and development investments by companies in clean label formulations

- 4.3 Market Restraints

- 4.3.1 Higher cost of ingredients

- 4.3.2 Limited awarness in the emerging economies

- 4.3.3 Complex regulatory requirements hinder market entry

- 4.3.4 Competition from cheaper, traditional ingredients

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Ingredient Type

- 5.1.1 Food Preservatives

- 5.1.2 Food Sweeteners

- 5.1.3 Food Colorants

- 5.1.4 Food Hydrocolloids

- 5.1.5 Food Flavors and Enhancers

- 5.1.6 Other Ingredients Types

- 5.2 By Form

- 5.2.1 Dry

- 5.2.2 Liquid

- 5.3 By Application

- 5.3.1 Bakery and Confectionery

- 5.3.2 Dairy and Frozen Desserts

- 5.3.3 Beverages

- 5.3.4 Meat and Meat Products

- 5.3.5 Sauces, and Condiments

- 5.3.6 Other Applications

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Colombia

- 5.4.2.4 Chile

- 5.4.2.5 Peru

- 5.4.2.6 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Netherlands

- 5.4.3.6 Poland

- 5.4.3.7 Belgium

- 5.4.3.8 Sweden

- 5.4.3.9 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 Australia

- 5.4.4.5 Indonesia

- 5.4.4.6 South Korea

- 5.4.4.7 Thailand

- 5.4.4.8 Singapore

- 5.4.4.9 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 Morocco

- 5.4.5.7 Turkey

- 5.4.5.8 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Cargill Incorporated

- 6.4.2 Archer Daniels Midland Company

- 6.4.3 Ingredion Incorporated

- 6.4.4 Tate and Lyle PLC

- 6.4.5 Kerry Group PLC

- 6.4.6 DSM-Firmenich

- 6.4.7 International Flavors & Fragrances Inc. (IFF)

- 6.4.8 Sensient Technologies Corporation

- 6.4.9 Ajinomoto Co. Inc.

- 6.4.10 Corbion N.V.

- 6.4.11 Givaudan S.A.

- 6.4.12 Roquette Freres S.A.

- 6.4.13 Dohler GmbH

- 6.4.14 Kalsec Inc.

- 6.4.15 CP Kelco (J.M. Huber Corp.)

- 6.4.16 Puratos Group

- 6.4.17 Sudzucker AG

- 6.4.18 Nexira SAS

- 6.4.19 Limagrain Ingredients

- 6.4.20 Camlin Fine Sciences Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK