PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850170

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850170

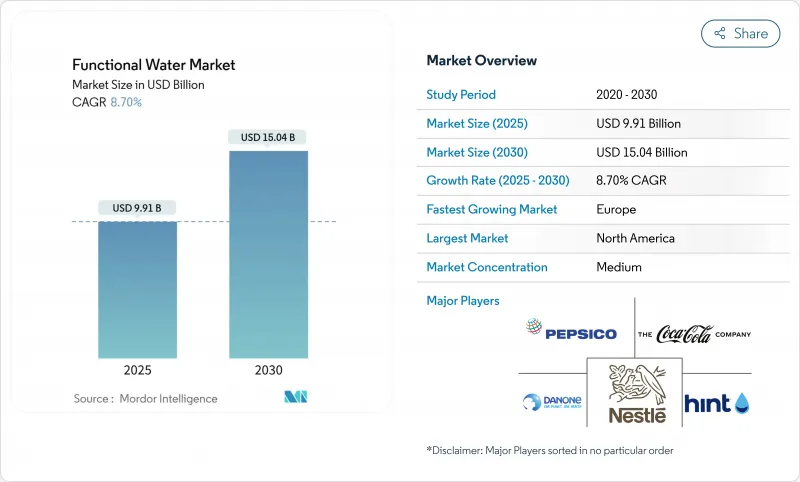

Functional Water - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The functional water market was valued at USD 9.91 billion in 2025 and is expected to reach USD 15.04 billion by 2030, growing at a CAGR of 8.70%.

The market has shifted from a niche segment to a mainstream category, driven by consumer demand for drinks offering health benefits beyond hydration. Initially focused on basic vitamin and mineral enhancements, the market now includes advanced formulations targeting immunity, energy, digestion, cognition, and skin health. Companies are innovating with functional ingredients like electrolytes, botanicals, antioxidants, proteins, and probiotics. Competition has intensified as established players leverage distribution networks and brand strength, while new entrants focus on clean-label and natural products. Rising health awareness, preventive healthcare trends, and demand for convenient, ready-to-drink options fuel growth. While supermarkets and hypermarkets dominate, online retail and specialty health stores are gaining traction due to changing shopping habits and direct-to-consumer sales.

Global Functional Water Market Trends and Insights

Rising Health Awareness Fuels Demand for Beverages with Added Vitamins, Minerals, And Electrolytes

Health awareness is driving demand for beverages containing vitamins, minerals, and electrolytes, which has moved functional water into the mainstream market. Consumers increasingly understand the connection between hydration, nutrition, and health, leading them to seek alternatives to sugary and carbonated drinks. They prefer options offering health benefits beyond basic hydration. Functional water, enhanced with nutrients like vitamins, minerals, and electrolytes, serves as a practical solution for supporting immunity, energy, athletic recovery, and general health. This trend is significant among millennials, fitness enthusiasts, and urban consumers who maintain busy lifestyles and face higher risks of lifestyle diseases such as obesity, diabetes, and metabolic disorders. Consumer preference for low-calorie, sugar-free beverages and wellness routines has strengthened this market shift. For instance, in November 2024, Applied Nutrition launched Sparkling Protein Water, containing 10g of protein, zero sugar, electrolyte-rich coconut water powder, and vitamin C, with 44 calories per can.

Increasing Preference for Low-Calorie Alternatives Boosts Functional Water Consumption

The functional water category is experiencing substantial growth driven by the beverage industry's strategic shift toward sugar reduction initiatives, establishing itself as a viable alternative that delivers both functional benefits and flavor profiles without caloric content. This market expansion is particularly evident in regions with elevated diabetes and obesity prevalence, where functional waters serve as an essential transition option for consumers seeking reduced sugar consumption while maintaining beverage diversity. Product development initiatives have concentrated on implementing natural sweetening systems and advanced flavor technologies that deliver optimal taste profiles with zero or minimal caloric impact. Major beverage corporations are leveraging this category as a primary growth driver beyond their conventional sugar-based portfolios, exemplified by PepsiCo's strategic acquisitions of Soulboost and Lifewtr to capture the health-conscious consumer segment while maintaining their core soda business operations.

High Product Prices Limit Accessibility in Price-Sensitive Markets

The elevated price points of functional waters relative to conventional bottled water constitute a significant impediment to market expansion in price-sensitive regions. The premium positioning, while beneficial for brand margins, substantially restricts market accessibility to high-income consumer segments, particularly in emerging economies where purchasing decisions are predominantly driven by affordability rather than functional attributes. Market vulnerability becomes pronounced during economic downturns, as evidenced by consumption patterns observed in recent inflationary periods. Manufacturers capable of implementing stratified pricing strategies while maintaining product efficacy stand to penetrate broader market segments, specifically in emerging markets where price considerations remain the fundamental obstacle to market growth.

Other drivers and restraints analyzed in the detailed report include:

- Busy Lifestyles Increase Demand for Convenient and Portable Health Beverages

- Strategic Endorsements and Marketing by Celebrities and Athletes Enhance Brand Appeal

- Brand Differentiation in a Crowded Functional Beverage Market Hinders Growth

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The vitamin segment holds a 15.65% market share in 2024 and is expected to maintain its leadership position with a CAGR of 10.65% from 2025-2030, surpassing other functional water categories. This segment's strong performance is attributed to its accessible wellness positioning and ability to incorporate multiple vitamin combinations that target various health benefits. The protein segment, though smaller, is experiencing growth among fitness enthusiasts and health-conscious consumers who prefer it as an alternative to traditional protein shakes.

Electrolyte/mineral waters maintain their market position through established associations with sports recovery and hydration benefits, with manufacturers highlighting mineral content as a key differentiator. The "Others" segment, which includes CBD, probiotics, and collagen, represents an emerging area of product innovation. The development of functional fruit-based recovery beverages demonstrates the ability to combine multiple ingredients electrolytes, peptides, carbohydrates, and prebiotic fiber while maintaining product stability and taste quality. In July 2024, Suja Juice Co. introduced a new enhanced water line containing organic fruits, vegetables, and vegan probiotics, offering 2 billion colony-forming units (CFUs) of vegan probiotics for immune and digestive health benefits.

The functional water market demonstrates distinct segmentation in packaging formats, with PET bottles maintaining a dominant market position at 85.12% share in 2024, despite increasing sustainability concerns. The aluminum can segment exhibits significant market momentum with a projected CAGR of 13.43% during 2025-2030, attributed to its enhanced recyclability metrics and premium market positioning. According to the International Aluminium Institute, aluminum's 76% global recycling rate substantially exceeds PET's recycling performance, presenting both environmental advantages and strategic marketing opportunities for brands prioritizing sustainability initiatives .

In response to sustainability requirements, plastic bottle manufacturers are implementing production efficiency measures and incorporating post-consumer-recyclate (PCR) materials, though supply chain constraints and economic factors present ongoing challenges. The alternative packaging segment, encompassing paperboard cartons and flexible pouches, represents a specialized market segment gaining traction in specific distribution channels, particularly in multi-serve formats and e-commerce logistics optimization.

The Functional Water Market Report is Segmented by Product Type (Vitamin, Protein, Electrolyte/Mineral, and Others), Packaging (PET Bottle, Can, and Others), Flavor (Flavored, and Non-Flavored), Distribution Channel (Supermarkets/Hypermarkets, Convenience/Grocery Stores, and More); and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintains market leadership in the functional water segment, commanding a 51.22% market share in 2024. This dominance stems from multiple structural advantages: advanced consumer health literacy, well-developed retail distribution networks, and a pervasive fitness-oriented consumer culture that prioritizes functional beverage benefits. The region's strategic importance is further evidenced by its position as a primary innovation center, where multinational beverage corporations, including PepsiCo and Coca-Cola, systematically introduce and validate new functional water products before implementing international expansion strategies.

Europe represents the fastest-growing regional market with a projected CAGR of 7.67% from 2025-2030. The region benefits from established regulatory frameworks for health claims and increasing consumer understanding of functional ingredients. European consumers demonstrate heightened scrutiny of health claims, leading to an emphasis on scientific substantiation and clean-label formulations. The EU's Nutrition and Health Claims Regulation influences the market by requiring scientific validation of functional claims, creating opportunities for brands meeting these standards . The Asia-Pacific region shows significant long-term growth potential, with urbanization, rising disposable incomes, and increasing health awareness driving adoption, particularly in Japan, South Korea, and Australia.

South America and the Middle East and Africa regions show emerging opportunities with varying development patterns. Urban centers demonstrate accelerated adoption while rural areas remain untapped due to distribution challenges and price sensitivity. In the Middle East, water scarcity concerns create opportunities for functional water brands that align with water conservation while offering premium hydration. The global functional water market expansion focuses on localized formulation strategies addressing regional taste preferences and functional priorities, moving away from standardized global products toward market-specific offerings.

- The Coca-Cola Company

- PepsiCo, Inc.

- Danone S.A.

- Nestle S.A.

- Hint Inc.

- Dr Pepper Snapple Group

- Flow Beverage Corp.

- Centr Brands Corp.

- Disruptive Beverages Inc.

- The Vita Coco Company

- Balance Water Company LLC

- Perfect Hydration

- Nirvana Water Sciences Corp.

- Nooma Inc.

- Vitamin Well

- The Wonderful Company LLC

- CENTR Brands Corp.

- Function Drinks

- Voss Water

- Good Idea Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Health Awareness Fuels Demand for Beverages with Added Vitamins, Minerals, And Electrolytes

- 4.2.2 Increasing Preference for Low-Calorie Alternatives Boosts Functional Water Consumption

- 4.2.3 Busy Lifestyles Increase Demand for Convenient and Portable Health Beverages.

- 4.2.4 Strategic Endorsements and Marketing by Celebrities and Athletes Enhance Brand Appeal

- 4.2.5 Product Innovations with Botanical Extracts and Nootropics Attract Wellness-Oriented Consumers

- 4.2.6 Expansion of Modern Retail and Online Channels Improves Product Accessibility Globally

- 4.3 Market Restraints

- 4.3.1 High Product Prices Limit Accessibility in Price-Sensitive Markets

- 4.3.2 Brand Differentiation in a Crowded Functional Beverage Market Hinders Growth

- 4.3.3 Intense Competition from Flavored Water, Sports Drinks, And Energy Beverages

- 4.3.4 Lack of Consumer Awareness in Rural and Underdeveloped Regions Hampers Market Growth

- 4.4 Regulatory Outlook

- 4.5 Technology Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Vitamin

- 5.1.2 Protein

- 5.1.3 Electrolyte/Mineral

- 5.1.4 Others

- 5.2 By Packaging

- 5.2.1 PET Bottle

- 5.2.2 Can

- 5.2.3 Others

- 5.3 By Flavor

- 5.3.1 Flavored

- 5.3.2 Non-Flavored

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Convenience/Grocery Stores

- 5.4.3 Online Retail Stores

- 5.4.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 The Coca-Cola Company

- 6.4.2 PepsiCo, Inc.

- 6.4.3 Danone S.A.

- 6.4.4 Nestle S.A.

- 6.4.5 Hint Inc.

- 6.4.6 Dr Pepper Snapple Group

- 6.4.7 Flow Beverage Corp.

- 6.4.8 Centr Brands Corp.

- 6.4.9 Disruptive Beverages Inc.

- 6.4.10 The Vita Coco Company

- 6.4.11 Balance Water Company LLC

- 6.4.12 Perfect Hydration

- 6.4.13 Nirvana Water Sciences Corp.

- 6.4.14 Nooma Inc.

- 6.4.15 Vitamin Well

- 6.4.16 The Wonderful Company LLC

- 6.4.17 CENTR Brands Corp.

- 6.4.18 Function Drinks

- 6.4.19 Voss Water

- 6.4.20 Good Idea Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK