PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851482

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851482

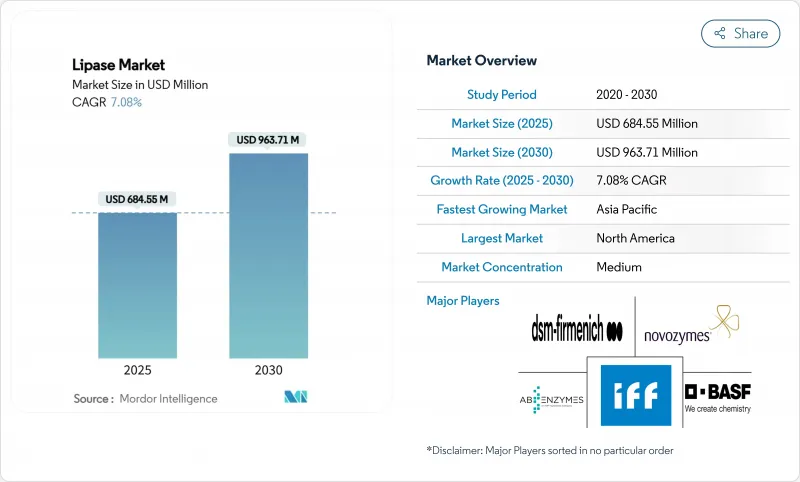

Lipase - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global lipase market size is expected to grow from USD 684.55 million in 2025 to USD 963.71 million by 2030, at a CAGR of 7.08%.

This growth is driven by the increasing adoption of precision-fermentation technologies that produce high-purity enzymes while meeting environmental and safety standards. The market expansion is supported by rising demand across food processing, personal care, and industrial biocatalysis applications, where lipases serve as alternatives to chemical additives, improve flavor profiles, and reduce energy consumption. Microbial production methods are preferred due to their scalability, faster regulatory approval processes, and compatibility with vegan, kosher, and halal certifications. While liquid formulations remain dominant in automated systems, powder formats are gaining traction in regions with warmer climates due to their enhanced stability. North America maintains market leadership due to established FDA regulatory frameworks and advanced biotechnology infrastructure, while the Asia-Pacific region demonstrates the highest growth rate as food processing industries modernize and enzyme production capacity expands.

Global Lipase Market Trends and Insights

Utilisation in Bakery Products for Dough Conditioning and Volume Enhancement

Lipase enzymes in bakery production serve multiple functions, including strengthening dough, extending shelf life, and modifying fats. The enzyme hydrolyzes triglycerides to enhance gas retention, crumb softness, and moisture distribution, reducing the need for synthetic emulsifiers. There is a growing demand for bakery products, like bread, buns, and biscuits from consumers for daily use, and the huge consumption of bakery products is creating a propelling market for food additives, like natural food preservatives which play an important role in bakery products, while improving their shelf life as well as sensory qualities. For instance, the Bureau of Labor Statistics reports that United States households spent an average of USD 574 on bakery products in 2023. The growing gluten-free segment increases lipase demand, as these enzymes help redistribute fats to compensate for the absence of gluten. This redistribution improves product texture and maintains structural integrity throughout the baking process. Industrial bakeries primarily use liquid lipase formulations for precise dosing control and consistent product quality. The industry's shift toward clean-label products has elevated lipases from auxiliary additives to essential ingredients, driven by consumer demand for natural alternatives to synthetic additives. This transition has led manufacturers to develop specialized lipase blends optimized for specific bakery applications.

Microbial Lipases Support Vegan, Kosher and Halal Food Processing

Microbial lipase production addresses religious and dietary restrictions while delivering superior performance characteristics compared to animal-derived alternatives. Plant-based food manufacturers leverage microbial lipases for fat modification in dairy alternatives, meat substitutes, and confectionery products, eliminating animal-derived ingredients without compromising functionality. Regulatory advantages favor microbial sources, as the Food and Drug Administration (FDA) Generally Recognised as Safe (GRAS) pathways streamline approval processes compared to novel animal-derived enzymes. The increasing use of microbial lipases reflects consumer demand for clean-label, ethical, and sustainable products. Food manufacturers seek enzyme solutions that meet vegan, kosher, and halal certifications to serve diverse markets without multiple product reformulations. The replacement of animal-derived lipases enables companies to expand their customer base while avoiding regulatory complexities associated with animal-based processing aids, which reduces product launch times.

Enzyme Instability Under High-Temperature

Lipase applications in food processing and industrial operations face significant limitations due to thermal stability constraints. These constraints necessitate the implementation of costly cooling systems or the development of alternative processing methods to maintain enzyme functionality. The ultra-high-temperature (UHT) and high-temperature short-time (HTST) processes, commonly used in juice and beverage production, can substantially reduce lipase activity and overall processing efficiency. Current protein engineering methods focus on enhancing thermostability through strategic approaches, including the introduction of disulfide bonds and modification of structural elements. These research efforts have produced enzyme variants demonstrating improved half-lives and enhanced specific activities under high-temperature conditions.

Other drivers and restraints analyzed in the detailed report include:

- Used in Personal Care for Gentle Degreasing and Exfoliation

- Enables Lactose-Free and Fat-Modified Dairy Diets

- Biosecurity Concerns in Fermentation Facilities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Microbial preparations dominate the lipase market with a 54.84% share in 2024. This dominance stems from their predictable yields, efficient scale-up capabilities, and simplified GRAS certification process compared to animal enzymes. The segment's growth is supported by continuous fermentation facilities that enable biomass recycling and waste reduction.

Plant-derived lipases, while representing a smaller market share, are growing at an 8.24% CAGR driven by increasing demand for vegan-certified ingredients. Research programs investigating frangipani and sea-mango latex indicate potential new botanical sources. Animal lipases continue to decline due to consumer preference for cruelty-free products and stricter allergen regulations. The consistent activity profiles achieved through precision fermentation strengthen the position of microbial sources in the lipase market.

The Global Lipase Market Report is Segmented by Source (Animal, Microbial, and Plant), Form (Powder, Liquid, and Others), Application (Food and Beverage, Animal Feed, Cosmetics and Personal Care, and Others), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America holds 38.36% market share in 2024, supported by its advanced biotechnology infrastructure and efficient regulatory frameworks for enzyme commercialization. The region's FDA GRAS approval system facilitates streamlined pathways for lipase applications in food processing, enabling quicker market entry. United States food processing companies adopt enzymatic solutions for clean-label formulations, while the personal care sector increases demand for natural ingredients. Canada's research capabilities and biotechnology clusters, combined with Mexico's growing food processing industry, further strengthen the regional market. North American companies leverage precision fermentation technology for applications in alternative proteins and sustainable manufacturing. The collaboration between Thyssenkrupp Uhde and Novonesis in enzymatic esterification technology demonstrates the region's industrial biotechnology innovation.

Asia-Pacific registers the highest growth rate at 8.22% CAGR through 2030, driven by industrialization and expanding food processing capabilities. China's enzyme manufacturing benefits from government support in biotechnology and increased demand for processed foods and personal care products. India's expanding middle class and changing dietary preferences create opportunities for lipase applications in food processing. Japan maintains consistent demand for high-quality enzymes in specialized applications, with the United States remaining the primary foreign supplier under existing trade agreements.

Europe demonstrates stable growth through environmental regulations and clean-label requirements that favor enzymatic solutions over chemical alternatives. The region's environmental compliance standards increase adoption of microbial and plant-based lipases in food processing and industrial applications. Germany and France lead enzyme consumption through their established food processing industries, while the United Kingdom's post-Brexit regulations create new market opportunities. Italy's food processing sector, particularly in dairy and confectionery, represents a key market for specialized lipase formulations.

- Novonesis (Novozymes A/S)

- DSM-Firmenich

- BASF SE

- International Flavors & Fragrances Inc.

- AB Enzymes GmbH

- Advanced Enzyme Technologies Ltd.

- Amano Enzyme Inc.

- Sacco System

- Fermenta Biotech Limited

- Renco New Zealand Ltd.

- Biocatalysts Ltd

- Creative Enzymes

- Thermo Fisher Scientific Inc.

- Kerry Group plc

- Novus Biologicals

- Sunson Industry Group Co., Ltd.

- Otto Chemie Pvt. Ltd.

- Boli Bioproducts

- Aum Enzymes

- Enzyme Development Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Utilisation in Bakery Products for Dough Conditioning and Volume Enhancement

- 4.2.2 Microbial Lipases Support Vegan, Kosher and Halal Foor Processing

- 4.2.3 Used in Personal Care for Gentle Degreasing and Exfoliation

- 4.2.4 Enables Lactose-Free and Fat-Modified Dairy Diets

- 4.2.5 Application in Alcoholic Beberage Clarification

- 4.2.6 Customized Lipase Blends for Ethnic Dairy Products

- 4.3 Market Restraints

- 4.3.1 Enzyme Instability Under High-Temperature

- 4.3.2 Allergen and Safety Concerns in Animal-Derived Lipase

- 4.3.3 Limited Compatibility with Organic Solvents

- 4.3.4 Biosecurity Concerns in Fermentation Facilities

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Source

- 5.1.1 Animal

- 5.1.2 Microbial

- 5.1.3 Plant

- 5.2 By Form

- 5.2.1 Powder

- 5.2.2 Liquid

- 5.2.3 Others

- 5.3 By Application

- 5.3.1 Food and Beverage

- 5.3.1.1 Bakery and Confectionary

- 5.3.1.2 Dairy and Dairy Products

- 5.3.1.3 Beverage

- 5.3.1.4 Others

- 5.3.2 Animal Feed

- 5.3.3 Cosmetics and Personal Care

- 5.3.4 Others

- 5.3.1 Food and Beverage

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Spain

- 5.4.2.6 Poland

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Novonesis (Novozymes A/S)

- 6.4.2 DSM-Firmenich

- 6.4.3 BASF SE

- 6.4.4 International Flavors & Fragrances Inc.

- 6.4.5 AB Enzymes GmbH

- 6.4.6 Advanced Enzyme Technologies Ltd.

- 6.4.7 Amano Enzyme Inc.

- 6.4.8 Sacco System

- 6.4.9 Fermenta Biotech Limited

- 6.4.10 Renco New Zealand Ltd.

- 6.4.11 Biocatalysts Ltd

- 6.4.12 Creative Enzymes

- 6.4.13 Thermo Fisher Scientific Inc.

- 6.4.14 Kerry Group plc

- 6.4.15 Novus Biologicals

- 6.4.16 Sunson Industry Group Co., Ltd.

- 6.4.17 Otto Chemie Pvt. Ltd.

- 6.4.18 Boli Bioproducts

- 6.4.19 Aum Enzymes

- 6.4.20 Enzyme Development Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK