PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687195

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687195

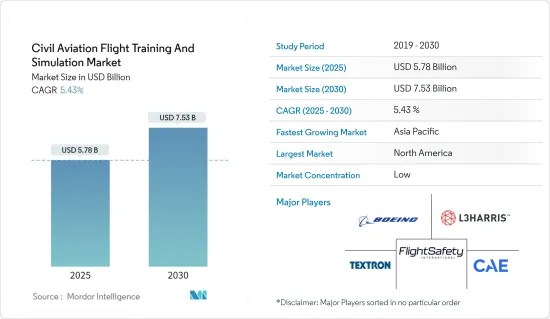

Civil Aviation Flight Training And Simulation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Civil Aviation Flight Training And Simulation Market size is estimated at USD 5.78 billion in 2025, and is expected to reach USD 7.53 billion by 2030, at a CAGR of 5.43% during the forecast period (2025-2030).

Flight simulators are crucial for training pilots, providing a realistic environment to develop and maintain flying skills. These simulators accurately replicate the experience of flying an actual aircraft, covering various scenarios, weather conditions, and emergencies. The need for aviation simulators is rising with the increasing global air traffic and the demand for skilled pilots. Airlines and flight training academies heavily rely on simulators for efficient, cost-effective, and safe pilot training.

Additionally, the rapid growth in global passenger traffic has led to a surge in next-generation aircraft procurement, as evidenced by the substantial order books of major commercial aircraft manufacturers like Boeing and Airbus. This expansion of airline fleets has driven the demand for trained pilots with commercial pilot certification, further fueling the need for flight simulators.

Despite the advancements in simulation-based training, there are limitations to learning with simulators, necessitating the integration of hands-on training in flight school curriculums. Flight schools require improved and diverse training aircraft but face challenges due to high initial and maintenance costs. Consequently, there is a demand for new, cost-effective training aircraft that can be quickly introduced to equip flight schools with better training equipment. Such developments are expected to drive the market positively during the forecast period.

Civil Aviation Flight Training And Simulation Market Trends

The Full Flight Simulator (FFS) Segment is Projected to Occupy the Largest Market During the Forecast Period

A full-flight simulator can replicate the flight parameters of the respective aircraft type designed for. The simulator is mounted on a platform to replicate an accurate flight's movement and acoustics by simulating the acceleration and G-forces acting on the aircraft. Comparatively, an FFS is more technologically advanced than its FTD counterpart and uses advanced motion, visuals, communication, and air traffic technology. For instance, an FFS can simulate the friction of the air along the fuselage and expose pilots to spatial orientation exercises to provide more than a 180-degree view of satellite quality of all-important objects at an airport and enable the pilot to precisely plan their approach procedures for the airport in the simulator. Previously, FFS was graded A through D, with D being the highest standard. These levels have been changed to seven international levels in recent years, and Level D is now Type 7. The Level D/Type 7 standard is used for initial and recurrent commercial pilot training for commercial air transport.

While the shortage of pilots has fostered the demand for FFS simulators by the aviation training institutes in the region, the launch of new commercial aircraft families has encouraged FFS OEMs to release new variants of their simulator offerings that integrate sophisticated features such as virtual reality (VR). In line with this, in February 2024, Embraer and CAE officially inaugurated Singapore's first-ever E-Jets E2 full flight simulator (FFS). This is a significant achievement for the expanded Embraer CAE Training Services (ECTS) joint venture, as it introduces the cutting-edge E2 training program. The program incorporates CAE's competency-based training assessment (CBTA) courseware, interactive classroom instruction utilizing the CAE Simfinity virtual simulator (VSIM), and immersive practical training facilitated by the state-of-the-art CAE 7000XR Series FFS. Such developments are envisioned to bolster the growth prospects of the fixed-wing aircraft segment of the market in focus during the forecast period.

North America to Occupy the Largest Market Share During the Forecast Period

North America holds the largest market share, mainly due to the large aviation market in the US. Air passenger traffic in the country increased rapidly in the past decade. For instance, in 2023, air passenger traffic in the US accounted for 1.05 billion, a rise of 12% compared to 2022, which recorded 937 million. This rise in air passenger traffic has also generated the need for airlines to hire new pilots and expand fleet size and routes, driving the demand for the flight simulator market.

American Airlines, Delta Airlines, and United Airlines are the three largest domestic airlines in the US. As of February 2024, American Airlines operated the largest commercial fleet in the world, with approximately 1,539 aircraft from Airbus and Boeing. In March 2024, the airline awarded Boeing a contract to deliver 85 737-10s and 85 A321neos. According to the Bureau of Labor Statistics, 105,500 commercial airline pilots were in the US in 2023.

Though the pandemic has resulted in the furloughing of pilots in the region in the last two years, a great demand for pilots in the region is anticipated in the latter half of the forecast period. Voluntary departures, fleet modifications, and the rapid rise in domestic travel demand created a significant demand for pilot training in the coming years.

Hence, several airlines have taken measures to increase their pilot training capabilities. Airlines like American Airlines, United Airlines, and Delta Air Lines have reported that they have ramped up pilot training to help pilots return to service as quickly as possible. For instance, in February 2024, United Airlines announced the opening of a new 150,000-square-foot building at its Flight Training Center in Denver. To enhance their training capabilities, the airline has incorporated 12 cutting-edge full-motion flight simulators into the facility, with six already in place. Such developments are anticipated to drive the growth of the civil aviation flight training and simulation market.

Civil Aviation Flight Training And Simulation Industry Overview

The flight simulator market is fragmented, with several players occupying the market. CAE Inc. is the market leader mainly due to its vast geographical presence and brand image. L3Harris Technologies Inc., TRU Simulation + Training Inc., FlightSafety International Inc., and The Boeing Company are other prominent players in the market.

Simulation and training providers and equipment manufacturers constantly strive to build brand reputation and reach out to geographic extremes to attract more customers. Flight schools are looking for long-term collaborations with airlines and aircraft operators for pilot training programs, which may help them make sustainable revenues for longer durations. There is a growing demand for simulators that can be re-configured or possibly upgraded to support newer aircraft models, and the focus on manufacturing such simulators will drive the growth of the players during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Simulator Type

- 5.1.1 Full Flight Simulator (FFS)

- 5.1.2 Flight Training Devices (FDS)

- 5.1.3 Other Training Types

- 5.2 By Aircraft Type

- 5.2.1 Fixed-wing

- 5.2.2 Rotary-wing

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 CAE Inc.

- 6.2.2 FlightSafety International Inc.

- 6.2.3 L3 Harris Technologies Inc.

- 6.2.4 TRU Simulation + Training Inc. (Textron Inc.)

- 6.2.5 The Boeing Company

- 6.2.6 Frasca International Inc.

- 6.2.7 ALSIM EMEA

- 6.2.8 RTX Corporation

- 6.2.9 Airbus SE

- 6.2.10 Simcom Aviation Training

- 6.2.11 Pureflight Aviation Training

- 6.2.12 FAAC Inc.

- 6.2.13 Avion Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS