PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850015

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850015

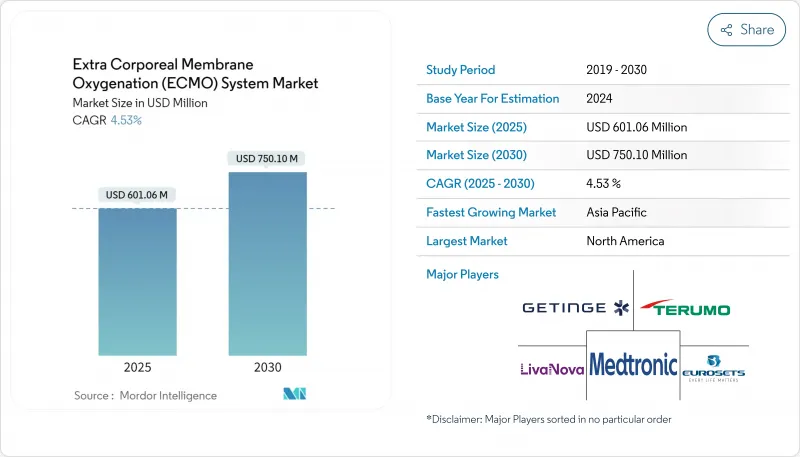

Extracorporeal Membrane Oxygenation (ECMO) System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The extracorporeal membrane oxygenation system market generated USD 601.06 million in 2025 and is forecast to reach USD 750.10 million by 2030, advancing at a 4.53% CAGR.

Demand remains resilient because ECMO fills the critical gap between conventional ventilation or cardiopulmonary bypass and definitive recovery or transplant. The recent shift from bulky consoles to lightweight, transport-ready units has widened the clinical window for support, allowing more centers to mobilize ECMO teams within emergency and perioperative settings. Rising survival evidence in adult respiratory distress syndrome, the success of extracorporeal cardiopulmonary resuscitation (ECPR), and maturing reimbursement rules in high-income countries underpin predictable revenue growth. In parallel, emerging economies are building modern ICUs at record speed, a trend that lifts procedure volumes and accelerates local manufacturing partnerships.

Global Extracorporeal Membrane Oxygenation (ECMO) System Market Trends and Insights

Escalating Global Incidence of Severe Acute Cardio-Pulmonary Failure

Aging societies, sedentary lifestyles, and higher chronic disease prevalence create a steady flow of patients who progress to refractory heart or lung failure despite optimized conventional care. COVID-19 highlighted ECMO's role when ventilatory strategies reached physiological limits, and registries continue to report sustained ARDS caseloads that require extracorporeal support. Concurrently, more centers are deploying veno-arterial circuits for cardiogenic shock following myocardial infarction, further boosting utilization in both developed and developing regions.

Continuous Technological Innovations Delivering Compact, Integrated ECMO Platforms

Modern devices integrate pumps, sensors, and touchscreen interfaces into slimline carts that fit bedside or ambulance footprints. Medtronic's VitalFlow system runs on only 40 mL priming volume yet delivers full adult flows and integrated gas exchange monitoring. Magnetically levitated pumps minimize hemolysis, while AI-based dashboards predict clot formation and neurological events with high accuracy. These advances shrink the learning curve and make inter-facility transport safer, broadening the extracorporeal membrane oxygenation system market.

Persistent Shortage of Trained Perfusion And Critical-Care Personnel

Worldwide nursing deficits reached 5.9 million positions in 2025, and the pipeline for ECMO specialists is even tighter because certification demands at least 2 years of ICU experience. Simulation-based curricula shorten upskilling, yet emerging markets still struggle to attract or retain talent. Nurse-led ECMO programs have trimmed staffing budgets by 52% in some U.S. centers but depend on robust institutional support.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Reimbursement & Funding Mechanisms Across Developed Markets

- Rapid Growth of Advanced ICU Infrastructure In High-Population Emerging Economies

- Clinical Complications And Medicolegal Risks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Veno-arterial ECMO retained 55% of the extracorporeal membrane oxygenation system market in 2024, reflecting its dual heart-lung support versatility. Procedure volumes rise steadily in shock and surgical weaning scenarios, yet the 10.9% CAGR expected for veno-venous configurations signals a pivot toward pure respiratory rescue. The extracorporeal membrane oxygenation system market size for veno-venous circuits is projected to hit USD 340 million by 2030 as evidence from COVID-19 resets ARDS treatment algorithms. Centers now employ "awake ECMO" to keep patients mobilized and extubated, reducing ventilator-associated pneumonia risk while shortening ICU stays.

Veno-arterial-venous (VAV) hybrids treat complex mixed failures but remain niche because cannulation is intricate and monitoring demands are high. Registry analyses question if additional survival gains justify the higher bleeding risks, a debate likely to temper near-term adoption. Nonetheless, innovation in dual-lumen cannulas and left-ventricular unloading may refresh VA-ECMO growth by easing hemodynamic management.

Oxygenators locked in a 30% revenue share in 2024 due to recurring replacements every 5-7 days, but consoles and centrifugal pumps are forecast to expand at 12.4% CAGR as hospitals upgrade to all-in-one workstations. Vendors now integrate gas mixers, thermal control, and hemodynamic dashboards, effectively upselling replacement cycles. The extracorporeal membrane oxygenation system market size for pumps is estimated to reach USD 260 million by 2030, with magnetically levitated impellers reducing hemolysis and maintenance downtime.

Novel dual-chamber gas exchangers that forgo wall oxygen lines could cut ICU infrastructure costs, opening low-resource settings. Biocompatible polymer coatings diminish platelet activation, extending oxygenator life and lowering consumable costs, a shift that may slightly erode aftermarket revenues but boost overall adoption.

The Extracorporeal Membrane Oxygenation (ECMO) System Market Report is Segmented by Modality (Veno-Arterial [VA], Veno-Venous [VV], and More), Component (Console / Pump, Oxygenator, and More), Application (Respiratory Failure, and More), Age Group (Neonates, Adults, and More), End User (Tertiary Care Hospitals, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 39% of the extracorporeal membrane oxygenation system market in 2024, buoyed by robust reimbursement, a mature organ-transplant ecosystem, and more than 250 ELSO-registered centers. U.S. hospitals enjoy clear Medicare billing codes, giving administrators confidence to fund additional circuits and specialized staff. Canadian provinces follow a hub-and-spoke model that dispatches mobile teams to regional ICUs, optimizing asset utilization and maintaining equitable access.

Asia-Pacific is the fastest-growing region with a projected 10.9% CAGR through 2030. China deployed thousands of units during COVID-19, sparking domestic manufacturing that now supplies peripheral markets in Southeast Asia. India's private hospital chains treat an expanding middle-class cardiac cohort, and favorable taxation on imported life-support equipment shortens replacement cycles. Japanese aging demographics and universal coverage encourage adoption, though budgets emphasize evidence-driven indications, keeping volume growth disciplined.

Europe posted steady mid-single-digit growth as national health services refine patient selection to cap costs. Germany operates 100-plus ECMO hubs, while the United Kingdom consolidated caseloads into five high-volume centers that report 55% survival in viral ARDS. Middle East adoption clusters in United Arab Emirates and Saudi Arabia, where sovereign wealth funds finance advanced cardiac institutes. Latin America shows pockets of uptake in Brazil and Argentina, although currency volatility and import tariffs temper growth. Africa's adoption remains nascent outside South Africa and Egypt, limited by capital costs and perfusionist scarcity.

- Getinge

- Medtronic

- LivaNova

- Terumo

- Fresenius Medical Care (Xenios)

- Eurosets Srl

- Abbott Laboratories

- MicroPort

- Nipro

- OriGen Biomedical

- Inspira Technologies OXY B.H.N.

- Abiomed (Johnson & Johnson MedTech)

- Hemovent GmbH

- Senko Medical Instrument

- Braile Biomedica

- Andocor NV

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating Global Incidence of Severe Acute Cardio-Pulmonary Failure

- 4.2.2 Continuous Technological Innovations Delivering Compact, Integrated ECMO Platforms

- 4.2.3 Expansion of Reimbursement & Funding Mechanisms across Developed Markets

- 4.2.4 Rapid Growth of Advanced ICU Infrastructure in High-Population Emerging Economies

- 4.2.5 Increasing Evidence Base Demonstrating Improved Survival & Cost-effectiveness

- 4.2.6 Formal Inclusion of ECMO in National and International Critical-Care Guidelines

- 4.3 Market Restraints

- 4.3.1 Persistent Shortage of Trained Perfusion and Critical-Care Personnel

- 4.3.2 Complex, Lengthy Regulatory Compliance for Class III Extracorporeal Devices

- 4.3.3 Clinical Complications and Medicolegal Risks Associated with ECMO Therapy

- 4.3.4 High Capital, Consumables and Lifecycle Costs of ECMO Therapy

- 4.4 Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porters Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Modality

- 5.1.1 Veno-Arterial (VA)

- 5.1.2 Veno-Venous (VV)

- 5.1.3 Veno-Arterial-Venous (VAV)

- 5.2 By Component

- 5.2.1 Console / Pump

- 5.2.2 Oxygenator

- 5.2.3 Heat Exchanger

- 5.2.4 Cannulae & Tubing Sets

- 5.2.5 Sensors & Controllers

- 5.3 By Application

- 5.3.1 Respiratory Failure

- 5.3.2 Cardiac Failure

- 5.3.3 Extracorporeal CPR (ECPR)

- 5.4 By Age Group

- 5.4.1 Neonates

- 5.4.2 Pediatrics

- 5.4.3 Adults

- 5.5 By End User

- 5.5.1 Tertiary Care Hospitals

- 5.5.2 Specialty & Cardio-Thoracic Clinics

- 5.5.3 Emergency Care Units

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Getinge AB

- 6.3.2 Medtronic plc

- 6.3.3 LivaNova PLC

- 6.3.4 Terumo Corporation

- 6.3.5 Fresenius Medical Care (Xenios)

- 6.3.6 Eurosets Srl

- 6.3.7 Abbott Laboratories

- 6.3.8 MicroPort Scientific

- 6.3.9 Nipro Corporation

- 6.3.10 OriGen Biomedical

- 6.3.11 Inspira Technologies OXY B.H.N.

- 6.3.12 Abiomed (Johnson & Johnson MedTech)

- 6.3.13 Hemovent GmbH

- 6.3.14 Senko Medical Instrument

- 6.3.15 Braile Biomedica

- 6.3.16 Andocor NV

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment