Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687231

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687231

Surfactants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

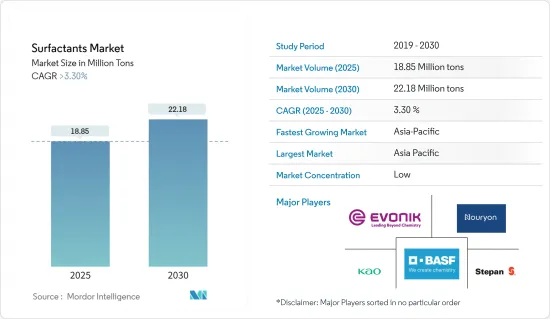

The Surfactants Market size is estimated at 18.85 million tons in 2025, and is expected to reach 22.18 million tons by 2030, at a CAGR of greater than 3.3% during the forecast period (2025-2030).

Key Highlights

- Over the short term, the rising personal care and cosmetic industry and the growing usage in the manufacturing of detergents and cleaners are expected to drive the growth of the surfactant market.

- However, the increasing environmental awareness against the use of surfactants is expected to hinder the growth of the market.

- New inventions in the field of surfactants and the introduction of bio-based surfactants are likely to create more opportunities.

- Asia-Pacific is expected to dominate the market, and it is likely to witness the highest CAGR during the forecast period.

Surfactants Market Trends

Anionic Surfactants are Expected to Dominate the Market

- Anionic surfactants belong to the class of surface-active reagents, in which the head of the surfactant macromolecule remains negatively charged. This allows it to bind to impurities and particles suspended in the liquid.

- Anionic surfactants account for approximately half of the total share of the surfactants market. A growing focus on environmental regulations is expected to increase the demand for anionic surfactants.

- Anionic surfactants are widely used for industrial and household cleaning and for pesticide formulations. Of the anionic surfactants, biodegradable linear alkylbenzene sulfonates (LAS) are the most common and can be found in wastewater systems and river water.

- Anionic surfactants work best to remove dirt, clay, and some oily stains. They work through ionization. When added to water, the anionic surfactants ionize and take a negative charge. The negatively charged surfactants bind to positively charged particles like clay. Anionic surfactants are effective in removing particulate soils.

- Some of the most used anionic surfactants are sulfonic acid salts, alcohol sulfates, phosphoric acid esters, alkylbenzene sulfonates, and carboxylic acid salts.

- The increasing demand for anionic surfactants in cosmetic products, such as skincare and hair care products in personal care applications, owing to their superior characteristics, such as foaming, cleansing, thickening, solubilizing, emulsifying, antimicrobial effects, penetration enhancement, and other special effects, is expected to boost the demand.

- The current market demand for environment-friendly alternatives has led to a boost in demand for bio-based anionic surfactants.

Asia-Pacific is Expected to Dominate the Market

- In Asia-Pacific, China is likely to dominate the market studied. In China, cosmetics and personal care are among the fastest-growing sectors. Continuous growth in population is another factor fuelling the demand for personal care, soaps, and detergents in the country, which augments the surfactants market.

- The output from the Chinese chemical industry is essential in various products, including soaps, detergents, cosmetics, etc. There are more than 60 manufacturers of washing, care, and cleaning agents in the country. However, the market studied is dominated by global players like BASF SE and Evonik Industries AG. China is also one of the largest exporters of soaps and detergent products.

- Moreover, India is one of the largest producers of soaps in the world. The per capita consumption of toilet/bathing soaps in the country is around 800 grams. Around 65% of the Indian population resides in rural areas, and the increasing disposable incomes and growth in rural markets make consumers shift to premium products. This shift is expected to drive the Indian surfactants market.

- According to the India Brand Equity Foundation, the beauty, cosmetic, and grooming market is expected to reach USD 20 billion by 2025.

- According to the Ministry of Economy, Trade and Industry (METI), Japan, in 2022, the total production of cationic surfactants in the country stood at 46.09 thousand metric tons, registering an increase of more than 3% compared to the previous year.

- The South Korean paint and coating market is the fourth-largest Asia-Pacific region. KCC, Samhwa Paints, Kangnam Jevisco (formerly Kunsul Chemical Industrial Company, popularly called KCI), Noroo Paints, and Chokwang Paints are the major paint and coating producers. They dominate the South Korean paint and coating market.

- Overall, the market for surfactants in the region is expected to witness steady growth during the forecast period.

Surfactants Industry Overview

The surfactants market is highly fragmented, with the top five companies accounting for a minimal share of the market. Some major players in the market (in no particular order) include Nouryon, Evonik Industries AG, Kao Corporation, BASF SE, and Stepan Company, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 56859

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Demand from the Personal Care and Cosmetics Industry Globally

- 4.1.2 Increasing Usage in Manufacturing of Detergents and cleaners

- 4.2 Market Restraints

- 4.2.1 Environmental Concerns and Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Type

- 5.1.1 Anionic Surfactants

- 5.1.1.1 Linear Alkylbenzene Sulfonate (LAS or LABS)

- 5.1.1.2 Alcohol Ethoxy Sulfates (AES)

- 5.1.1.3 Alpha Olefin Sulfonates (AOS)

- 5.1.1.4 Secondary Alkane Sulfonate (SAS)

- 5.1.1.5 Methyl Ester Sulfonates (MES)

- 5.1.1.6 Sulfosuccinates

- 5.1.1.7 Other Types of Anionic Surfactants

- 5.1.2 Cationic Surfactants

- 5.1.2.1 Quaternary Ammonium Compounds

- 5.1.2.2 Other Types of Cationic Surfactants

- 5.1.3 Non-ionic Surfactants

- 5.1.3.1 Alcohol Ethoxylates

- 5.1.3.2 Ethoxylated Alkyl-phenols

- 5.1.3.3 Fatty Acid Esters

- 5.1.3.4 Other Non-ionic Surfactants

- 5.1.4 Amphoteric Surfactants

- 5.1.5 Silicone Surfactants

- 5.1.1 Anionic Surfactants

- 5.2 By Application

- 5.2.1 Household Soaps and Detergents

- 5.2.2 Personal Care

- 5.2.3 Lubricants and Fuel Additives

- 5.2.4 Industry and Institutional Cleaning

- 5.2.5 Food Processing

- 5.2.6 Oilfield Chemicals

- 5.2.7 Agricultural Chemicals

- 5.2.8 Textile Processing

- 5.2.9 Emulsion Polymerization

- 5.2.10 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Arkema

- 6.4.3 Ashland

- 6.4.4 BASF SE

- 6.4.5 Bayer AG

- 6.4.6 Cepsa

- 6.4.7 Clariant

- 6.4.8 Croda International PLC

- 6.4.9 Dow Inc.

- 6.4.10 Emery Oleochemicals

- 6.4.11 Evonik Industries AG

- 6.4.12 Galaxy Surfactants

- 6.4.13 Geo Speciality Chemicals

- 6.4.14 Godrej Industries Limited

- 6.4.15 Huntsman International LLC

- 6.4.16 Innospec

- 6.4.17 Kao Corporation

- 6.4.18 KLK Oleo

- 6.4.19 Lankem

- 6.4.20 Lonza

- 6.4.21 Nouryon

- 6.4.22 Oxiteno

- 6.4.23 P&G Chemicals

- 6.4.24 Reliance Industries Ltd

- 6.4.25 Sanyo Chemical Industries Ltd

- 6.4.26 Sasol

- 6.4.27 Sinopec (China Petrochemical Corporation)

- 6.4.28 Solvay

- 6.4.29 Stepan Company

- 6.4.30 Sulfatrade SA

- 6.4.31 Sumitomo Chemical Co. Ltd

- 6.4.32 Taiwan NJC Corporation Ltd

- 6.4.33 TENSAC

- 6.4.34 YPF SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Expansion of Application Base For Bio-based Surfactants

- 7.2 Possible Innovations in the Application of Specialty Surfactants

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.