PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850243

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850243

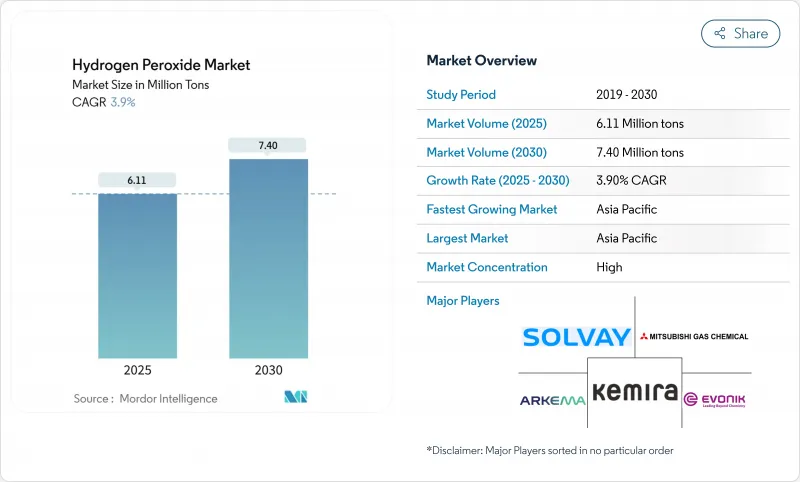

Hydrogen Peroxide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The hydrogen peroxide market stands at 6.11 million tons in 2025 and is projected to reach 7.40 million tons by 2030, registering a 3.9% CAGR.

Momentum continues to come from pulp and paper bleaching, but semiconductor fabrication, advanced wastewater treatment, and green aerospace propellants are adding new demand layers that lift average selling prices. Capacity additions in Asia-Pacific, low-carbon product launches in Europe, and stricter global hygiene protocols are reinforcing a stable growth runway even as feedstock price swings and tighter hazard classifications temper profit margins. Leading suppliers are enlarging ultra-pure production lines, investing in on-site generation technologies, and signing offtake agreements with electronics customers to secure long-term volumes in the hydrogen peroxide market.

Global Hydrogen Peroxide Market Trends and Insights

Growing Demand for High-Purity Grades in Semiconductor Wet-Process Cleaning

Ultra-high-purity hydrogen peroxide is now indispensable in sub-5 nm semiconductor production. Impurity thresholds have tightened to parts-per-trillion levels, and Solvay's INTEROX PicoPlus meets those specifications with cationic contaminants below 0.01 ppb. New fabs in Taiwan, South Korea, the United States, and Germany are signing multi-year supply agreements that lock in offtake volumes, underpinning the hydrogen peroxide market. Equipment makers are also adopting peroxide-rich advanced cleans that reduce metallic residues, further expanding per-wafer consumption. Capacity additions announced by Evonik and Fuhua Tongda in Sichuan underscore the bullish medium-term outlook.

Stricter Food-Contact Packaging Regulations Driving Food-Grade H2O2 in Europe

EU food-safety directives now require more rigorous sterilization of aseptic cartons and PET bottles. Hydrogen peroxide remains the preferred agent thanks to rapid decomposition into water and oxygen. The European Food Safety Authority reaffirmed its safety in 2024. FDA approvals for antimicrobial use in poultry processing are influencing global processors to harmonize protocols. As a result of these policies, packaging lines have begun integrating vaporized hydrogen peroxide units, driving increased demand for food-grade solutions, particularly in dairies and juice plants.The hydrogen peroxide market benefits from this regulatory tail-wind in the near term.

Health-Hazard Labelling under EU CLP and REACH Creating Compliance Costs

Peroxide producers must maintain extensive safety data sheets and invest in closed loading systems to meet Europe's harmonized hazard statements. The European Chemicals Agency lists hydrogen peroxide under several physical and health hazard categories. Compliance requires periodic toxicology updates, employee training, and upgraded packaging, adding overhead for exporters into the bloc. Smaller suppliers face disproportionate cost burdens, limiting new entrants and marginally slowing overall growth.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Chemical Pulp Capacity in APAC Integrated Mills

- Increasing On-Site H2O2 Generation for Advanced Oxidation in Industrial Wastewater

- Volatility of Feedstock Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bleaching applications accounted for 61% of the hydrogen peroxide market in 2024, anchored by pulp and paper mills that value chlorine-free brightness gains. Replacement of elemental chlorine dioxide with peroxide improves effluent profiles, sustaining baseline demand even as Western print paper declines. Demand elasticity is modest because brightness targets are codified in product specifications.

Disinfection posted the fastest 4.37% CAGR and is forecast to keep climbing as hospitals, food plants, and mass-transit hubs maintain heightened sanitation standards. TOMI Environmental Solutions reported a 42% sales jump in Q1 2025 for ionized peroxide devices. Continuous-mist delivery systems broaden use cases and lift average prices, expanding the hydrogen peroxide market beyond legacy volumes.

The industrial grade segment delivered 41% share in 2024 and remains the workhorse for textiles, mining, and basic chemicals. Cost competitiveness and supply chain density favor industrial grade in most bulk applications.

High-purity material is scaling fastest at 5.23% CAGR as chipmakers specify sub-ppb metal levels. Taiyo Nippon Sanso launched BRUTE Peroxide to serve this niche. A single 300 mm fab can offtake several kilotons annually, so each new facility adds tangible volume to the hydrogen peroxide market size for high-purity products.

The Hydrogen Peroxide Market Report Segments the Industry by Product Function (Disinfectant, Bleaching, Oxidant, and More), Grade (Standard Grade, Industrial Grade, and More), Concentration/Form (Aqueous Solution, Anhydrous, and More), End-User Industry (Pulp and Paper, Chemical Synthesis, Mining, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific controlled 53% of the hydrogen peroxide market 2024 and is rising at a 4.27% CAGR. Capacity additions in China and India feed the domestic paper and electronics sectors. Engro Polymer and Chemicals invested PKR 12 billion in a new Pakistani plant scheduled for 2026 start-up. Regional suppliers enjoy freight advantages that safeguard margins.

North America holds a significant slice of the hydrogen peroxide market. Wastewater regulations and green propulsion research spur new endpoints for concentrated (more than 90%) grades. Benchmark Space Systems demonstrated a 22 N bipropellant thruster using high-test peroxide that reached a 290-second specific impulse. These aerospace trials anchor premium demand and boost domestic consumption.

Europe exhibits mature volumes but leads sustainability innovation. Evonik's carbon-neutral peroxide, certified under the Way to GO2 program, helps customers cut Scope 3 emissions. Stricter packaging rules raise food-grade orders, while REACH compliance costs restrain smaller importers. The hydrogen peroxide market size for Europe is projected to move modestly yet steadily through 2030.

- Arkema

- BASF

- Chang Chun Group

- Dow

- EnGro Corporation Limited

- Evonik Industries AG

- FMC Corporation

- Guangdong Zhongcheng Chemicals Inc.

- Gujarat Alkalies and Chemicals Limited

- Hodogaya Chemical Co., Ltd.

- Indian Peroxide Ltd.

- Kemira Oyj

- Kingboard Holdings Limited

- Luxi Chemical Group

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- National Peroxide Limited.

- NIPPON PAPER INDUSTRIES CO., LTD.

- Nouryon

- OCI ALABAMA

- PQ Corporation

- Qingdao LaSheng Co. Ltd.

- Sichuan Hebang Biotechnology Co. Ltd.

- Solvay

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for High-Purity Grades in Semiconductor Wet-Process Cleaning

- 4.2.2 Stricter Food-Contact Packaging Regulations Driving Food-Grade H2O2 in the Europe

- 4.2.3 Expansion of Chemical Pulp Capacity in APAC Integrated Mills

- 4.2.4 Increasing On-Site H2O2 Generation for Advanced Oxidation in Industrial Wastewater

- 4.2.5 Aerospace Shift toward Green Propellants Using HTP (>90 % w/w) in North America

- 4.3 Market Restraints

- 4.3.1 Health-Hazard Labelling under EU CLP and REACH Creating Compliance Costs

- 4.3.2 Volatility of Feedstock Prices

- 4.3.3 Environmental Regulations and Disposal Challenges

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

- 4.7 Pricing Analysis

- 4.8 Trade Analysis

- 4.9 Supply Scenerio

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Function

- 5.1.1 Disinfectant

- 5.1.2 Bleaching

- 5.1.3 Oxidant

- 5.1.4 Other Product Function (Cleaning Agent, etc.)

- 5.2 By Grade

- 5.2.1 Standard Grade (less than 35 % w/w)

- 5.2.2 Industrial Grade (35-50 %)

- 5.2.3 High-Purity Grade (more than 50 %)

- 5.3 By Concentration / Form

- 5.3.1 Aqueous Solution (less than or equal to 70 %)

- 5.3.2 Anhydrous (more than 90 %)

- 5.3.3 Powder / Granular Adducts (e.g., Perborate, Percarbonate)

- 5.4 By End-user Industry

- 5.4.1 Pulp and Paper

- 5.4.2 Chemical Synthesis

- 5.4.3 Wastewater Treatment

- 5.4.4 Mining

- 5.4.5 Food and Beverage

- 5.4.6 Cosmetics and Healthcare

- 5.4.7 Textiles

- 5.4.8 Other End-user Industries (Electronics and Semiconductors, Transportation, Aseptic Packaging, Rocketry)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Malaysia

- 5.5.1.6 Thailand

- 5.5.1.7 Indonesia

- 5.5.1.8 Vietnam

- 5.5.1.9 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 South America

- 5.5.3.1 Brazil

- 5.5.3.2 Argentina

- 5.5.3.3 Colombia

- 5.5.3.4 Rest of South America

- 5.5.4 Europe

- 5.5.4.1 Germany

- 5.5.4.2 United Kingdom

- 5.5.4.3 France

- 5.5.4.4 Italy

- 5.5.4.5 Spain

- 5.5.4.6 Nordic

- 5.5.4.7 Turkey

- 5.5.4.8 Russia

- 5.5.4.9 Rest of Europe

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 Qatar

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 South Africa

- 5.5.5.5 Egypt

- 5.5.5.6 Nigeria

- 5.5.5.7 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)}

- 6.4.1 Arkema

- 6.4.2 BASF

- 6.4.3 Chang Chun Group

- 6.4.4 Dow

- 6.4.5 EnGro Corporation Limited

- 6.4.6 Evonik Industries AG

- 6.4.7 FMC Corporation

- 6.4.8 Guangdong Zhongcheng Chemicals Inc.

- 6.4.9 Gujarat Alkalies and Chemicals Limited

- 6.4.10 Hodogaya Chemical Co., Ltd.

- 6.4.11 Indian Peroxide Ltd.

- 6.4.12 Kemira Oyj

- 6.4.13 Kingboard Holdings Limited

- 6.4.14 Luxi Chemical Group

- 6.4.15 MITSUBISHI GAS CHEMICAL COMPANY, INC.

- 6.4.16 National Peroxide Limited.

- 6.4.17 NIPPON PAPER INDUSTRIES CO., LTD.

- 6.4.18 Nouryon

- 6.4.19 OCI ALABAMA

- 6.4.20 PQ Corporation

- 6.4.21 Qingdao LaSheng Co. Ltd.

- 6.4.22 Sichuan Hebang Biotechnology Co. Ltd.

- 6.4.23 Solvay

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Newer Opportunities for Hydrogen Peroxide in Wastewater Treatment