PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687266

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687266

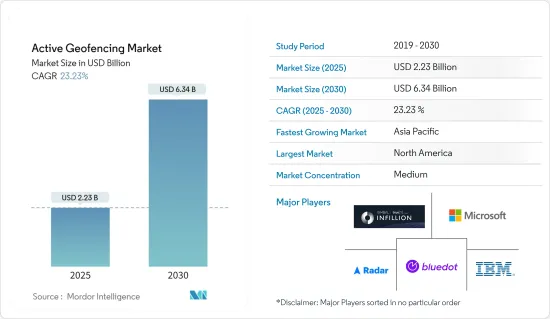

Active Geofencing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Active Geofencing Market size is estimated at USD 2.23 billion in 2025, and is expected to reach USD 6.34 billion by 2030, at a CAGR of 23.23% during the forecast period (2025-2030).

Active geofencing is growing due to more effective use of Spatial Data, improving Real Time Location Technologies, and increased adoption worldwide for location-bassed applications by consumers.

Key Highlights

- Geofencing is a location-based service used by each end user, for which an application or software uses technologies such as GPS, PFID, WiFI, and mobile data to enable them to trigger preprogrammed actions when the device leaves virtual boundaries of geographical zones known as geofences.

- How people and businesses interact with the world and make huge savings has changed due to the increased use of spatial data and real-time location technologies. All kinds of devices and systems are connected to the Internet, such as phones, Smart buildings, car navigation systems, industries, or fleets of autonomous vehicles. Technology that provides real-time location data is required to maintain the system's proper functioning on a daily basis.

- With technological flexibility and capabilities, advancement in Active Geofencing is increasing. The market's growth is driven by trends such as digital marketing and clustering, autonomous cars, increased adoption of Bring Your Own Device, etc. The market studied, therefore, is expected to remain robust and will have a significant growth contribution from players in the market.

- Increasing concerns and regulations regarding location tracking can threaten active geofencing technologies. Moreover, active geofencing solutions are being held back due to the lack of regulatory bodies dealing with privacy and data collection in various regions.

- The COVID-19 virus increased the use of Active Geofences in several sectors, such as healthcare, industry, and many others. For example, an application had to be submitted by individual companies to identify staff at their premises and communicate with them directly and immediately. Active geofencing has facilitated secure, timely communication during an emergency.

Active Geofencing Market Trends

Retail Segment to Witness Significant Growth

- An active geofence enables retailers to determine potential customers within a defined radius of any point of sale, sending them personalised notifications and specific offers that they can use in order to make their purchases. In addition, as digitisation continues to spread across all retail sectors, demand for effective geofencing is growing rapidly in the retail sector.

- In view of the fact that retailers can target consumers who are most likely to take part in their services or products, advertising campaigns using geofenced data tend to deliver higher return on investment. This leads to higher profits for retail organisations.

- Moreover, In the future, active geofencing will be combined with augmented reality (AR), customers and advanced technologies andexpect a more digital-first, personalized shopping experience. As more mobile devices become wearables, customers are expected to experience a more digital first and personalised shopping experience. In the coming forecast period, this will lead to a higher uptake of active geofencing in retail.

- Recent research on trends which are shaping the future of shopping, predicts that by 2025, about one third of consumers in the United States will be using AR technologies when purchasing products online. AR technologies enable virtual product viewing when shopping online. The study showed that while in countries like Saudi Arabia and United Arab Emirates, the expected use of AR was as high as 45 percent, in Europe, this share was much lower.

North America is Expected to Hold the Major Share of the Market

- In North America, active geofencing investments and innovation have been made at various endpoints, such as healthcare, transport, logistics, financial services sector, security, and many others. Market forces push for integrating spatial information and real-time location technologies in this region.

- Further, this region is dominated by companies in the BFSI sector, retail and transport, and logistics sectors capable of using active geofencing. In addition, North America has one of the most developed economies in the world in the form of the United States and Canada. As a result of the strong communication and Internet infrastructure in the region, it is also leading the market.

- In addition, the adoption of automated tools that take different geofence solutions has increased due to the wide deployment of digital technologies and the growing demand for business intelligence tools in all kinds of enterprises.

- However, many regional retailers are increasingly applying active geofencing through digital offers and promotions to strengthen customer loyalty. Retailers can also better understand where their customers are coming from before and after they visit one particular shop.

Active Geofencing Industry Overview

The active geofencing market is semi-consolidated due to prominent vendors like Bluedot Innovation Pty Ltd, Infillion Inc. (GIMBLE), IBM Corporation, Microsoft Corporation, Radar Labs Inc., etc. The key players are involved in various strategies, such as acquisitions and partnerships, to improve their market share and enhance their profitability in the market studied.

- In July 2023, Radar announced our partnership with Cordial, Increasing engagement and revenue through location-based experiences like on-premise app modes, store maps and locators, and address autocomplete. In real time, brands such as JOANN deliver highly personalised, contextually relevant experiences to their customers through the combination of Radar's industry location infrastructure with Cordial's marketing and data platform.

- In June 2023, Autodesk has announced the strategic partnership with Esri, one of the global industry leader in Geographic Information System (GIS) software, Where the Autodesk BIM Collaborate Pro and Esri's ArcGIS Online integrate through ArcGIS GeoBIM for a holistic view of design models and location intelligence to reduce risk, provide better project collaboration, and improve communication with stakeholders.

- In September 2022, M3 announced significant advancements to its proprietary Labour Management software, M3 labor, consisting of geofencing and beacon technologies. With this new functionality, users of the M3 Labour service can create an area radius where staff can punch in and out at work. These new features are intended to ensure that hotel staff clock in and out when and where they should while preventing them from doing so elsewhere, thereby avoiding the possibility of false and erroneous punching.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Use of Spatial Data and Improved Real-time Location Technology

- 5.1.2 Higher Adoption of Location-based Application among Consumers

- 5.2 Market Restraints

- 5.2.1 Rising Awareness Regarding Safety and Security among Consumers of Location Tracking

6 MARKET SEGMENTATION

- 6.1 By Organization Size

- 6.1.1 Small-Scale and Medium-Scale Businesses

- 6.1.2 Large-Scale Businesses

- 6.2 By End-user Industry

- 6.2.1 Banking, Financial Services, and Insurance

- 6.2.2 Retail

- 6.2.3 Defense, Government, and Military

- 6.2.4 Healthcare

- 6.2.5 Industrial Manufacturing

- 6.2.6 Transportation and Logistics

- 6.2.7 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Bluedot Innovation Pty Ltd

- 7.1.2 Infillion Inc. (GIMBLE)

- 7.1.3 IBM Corporation

- 7.1.4 Microsoft Corporation

- 7.1.5 Radar Labs Inc.

- 7.1.6 Google LLC

- 7.1.7 Samsung Electronics Co.

- 7.1.8 Verve Inc.

- 7.1.9 Apple Inc.

- 7.1.10 LocationSmart

- 7.1.11 SZ DJI Technology Co.

- 7.1.12 ESRI

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET