PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687955

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687955

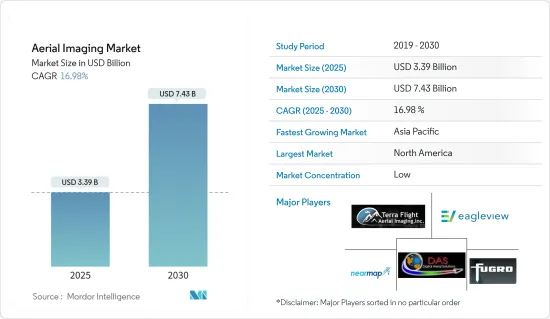

Aerial Imaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Aerial Imaging Market size is estimated at USD 3.39 billion in 2025, and is expected to reach USD 7.43 billion by 2030, at a CAGR of 16.98% during the forecast period (2025-2030).

Aerial imaging and its evolution into video imagery have been captured using various small aerial platforms for over three decades. Small-scale platforms such as radio-controlled model aircraft, helicopters that use small 35 mm SLR, and light-weighted video cameras have been used to acquire color, panchromatic, color infrared (CIR), and multispectral aerial photography for a wide range of applications.

The market has been augmented by the technology development of ready-to-fly (RTF) devices, soft-copy photogrammetry software, low-cost digital cameras, image processing, GPS, thermal, multispectral, hyperspectral, and LiDAR sensors. UAVs have become a sophisticated means of acquiring high-resolution photographic and 4K video datasets for small-area coverage studies.

Aerial imaging uses GPS, which aids in precise location. For instance, farmers use GPS targeting to monitor the health of the crops, identify problem areas, and spray fertilizer. Energy and power site management benefits from the precision of aerial imaging, as it can be repaired from weather damages and targeted more accurately.

Police departments also use maps that are being created using aerial imagery. The department uses it for the movement of essential items, placing physical distancing markers, workforce allocation, deciding where to set up isolation centers, marking nearby hospitals and police stations from hotspots, and the shortest routes for easy movement in an emergency.

The COVID-19 pandemic has led to increased demand for aerial imagery. This imagery is used to study the virus's economic impact and remotely monitor infrastructure and facilities. The demand increased from various industries, including government, energy, power, oil, and gas. Also, the imagery monitored supply chain situations during the pandemic's peak.

Although the trend of drone surveying is already becoming mainstream, the pandemic tipped the scale in its favor substantially. UAVs have become a go-to technology during the COVID-19 pandemic because they can accomplish tasks without contact. They have played a crucial role in surveying and mapping areas where hospitals and COVID-19 test centers can be built and monitoring such sites.

Aerial Imaging Market Trends

The Government is Expected to be the Largest End User of Aerial Imaging

Aerial imaging has become vital for various municipal, state, and federal government planning applications. It has also become an integral aspect of the mapmaking process. Aerial images reflect a location's physical and cultural environment at a particular moment.

When properly understood, these aerial photographs give geographers, historians, ecologists, geologists, urban planners, archaeologists, and other experts a graphical foundation that is frequently important to their research. Lawyers increasingly use aerial photography to decide matters involving property disputes, riparian rights, and transportation rights-of-way. Recently, genealogists have employed aerial photography to discover and find ancestral locations.

Government drone use is quickly rising due to the number of departments with drone projects and applications. Ambitious government organizations and departments are experimenting with new job areas, from transportation and public works to planning and environmental services.

The US government has experimented with new weaponry that may be deployed on the battlefield. Gaining an edge on the battlefield is crucial to a war's survival and success. Uncrewed aerial vehicles (UAVs) have been the most significant invention in military conflict in recent decades, if not the preceding century.

For example, the United States Geological Survey's Upper Midwest Environmental Sciences Center has recently partnered with the Bureau of Ocean Energy Management and the US Fish and Wildlife Service. The Vision Group at the International Computer Science Institute at the University of California, Berkeley, will create deep learning algorithms and tools for the automatic identification, enumeration, categorization, and annotation of sea ducks and other marine creatures from digital aerial imagery.

Most individuals utilize aerial images, whether they realize it or not. Aerial imagery may help individuals and organizations of all sizes and sectors save time and money, from basic applications like Google Images or Google Earth to complicated applications like police agencies using it to reduce crime.

Airborne waterfowl population surveys can influence harvest and other regulatory decisions, environmental evaluations, and impact estimates of prospective wildlife exposure to offshore energy development projects in the United States. High-resolution digital images collected during aircraft surveys of the Atlantic Outer Continental Shelf and the Great Lakes will provide data for algorithm development and baseline information on animal distributions and abundance.

Aerial pictures can help governments, professional response and recovery organizations, communities, and people anticipate, respond to, and recover from the consequences of expected imminent or actual hazard occurrences or circumstances. The increasing aerial photography usage in many government sectors has increased the demand for aerial pictures worldwide.

North America to Hold a Significant Market Share

North America is one of the major investors and adopters of the studied market due to the high level of research done by the regional companies and the increasing adoption of the technologies among the regional end-user industries.

Aerial imaging extracts information on land cover, vegetation, soil, and geology maps using spatial data captured from orthographic images. It is also used in government-based applications such as inland and property information, archaeology, environment studies, and disaster and emergency response management. Aerial imaging is then used to develop plans, maps, and forecasts crucial for accurately presenting the Earth's surface. Also, aerial imaging is gaining prominence among engineers, planners, and developers in land mapping and development.

Market expansion is the primary factor driving the increased adoption of aerial imaging platforms in disaster management, military, forestry, and urban planning applications. The use of aerial imaging and mapping platforms is growing among urban planners in road planning and real estate management, and they are used in land use calculations. The region exhibits a strong uptake of aerial imaging platforms due to major aerial imaging solution providers focusing on new product developments powered by AI and machine learning technologies.

In addition, agriculture in North America has become chiefly industrialized and reliant on an integrated system of supporting agribusinesses; however, original traditions are still practiced in Mexico. Most farmers in the United States and Canada rely primarily on technology. Technology companies have been working to provide insights to farmers through multiple data sources, including sensors, in-field cameras, aerial imagery gathered by drones and airplanes, and satellite imagery data. These imagery data sources require powerful computing resources, massive data storage capabilities, and time to generate insights.

Moreover, the demand for aerial imaging in the region's construction activity is increasing continuously. For instance, with drone technology, field engineers can track job progress and monitor these inconsistencies more efficiently.

Additionally, with the US government's historic infrastructure bill, the construction industry braced for a substantial boost in investment by increasing government spending on the construction industry. Contractors and surveyors are expected to be in great demand to oversee various civil construction projects around the country, with USD 110 billion set aside for roads, bridges, and other significant infrastructure projects.

Factors such as the growing use of technologies and the number of government construction projects that have boosted the demand for the benefits of technologies for the inspection, monitoring, and surveillance of the site area are critical reasons for the market's growth.

Aerial Imaging Industry Overview

The aerial imaging market is fragmented, with many industry players exploring the market potential. This industry's marketing and advertising level is also growing, while the firm concentration ratio is moderate and growing. Some of the major players in the market are Terra Flight Aerial Imaging Inc., Fugro Ltd, Nearmap Ltd, Eagle View Technologies Inc., and Digital Aerial Solutions LLC.

February 2023 - Ondas announced the creation of Ondas Autonomous Systems to oversee the integrated drone operations of wholly owned subsidiaries American Robotics and Airobotics. In the rail, energy, mining, agricultural, public safety, critical infrastructure, and government markets, Ondas Networks and Ondas Autonomous Systems provide users with increased connection, data gathering capabilities, and data collection and information processing capabilities.

April 2024 - Bowman Consulting Group Ltd, a national engineering services firm specializing in infrastructure solutions, finalized an agreement to acquire Surdex Corporation, known for its geospatial and engineering services, offering a range of digital ortho imagery at various altitudes, LiDAR technology, digital mapping, hydrography, and disaster mapping. Originally an aerial photography company, Surdex has evolved into digital imagery and mapping. The company boasts a fleet of ten aircraft, including single- and twin-engine models and unmanned aerial vehicles (UAVs), enabling them to cater to the geospatial needs of public and private sector clients.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise of Location-based Services

- 5.1.2 Increasing Demand from Diversified Applications

- 5.2 Market Restraints

- 5.2.1 Security and Privacy Issues

- 5.2.2 Stringent Government Regulations

6 MARKET SEGMENTATION

- 6.1 By Platform Type

- 6.1.1 Fixed-wing Aircraft

- 6.1.2 Helicopters

- 6.1.3 UAVs/Drones

- 6.1.4 Other Platform Types

- 6.2 By Application

- 6.2.1 Geospatial Mapping

- 6.2.2 Infrastructure Planning

- 6.2.3 Asset Inventory Management

- 6.2.4 Environmental Monitoring

- 6.2.5 National and Urban Mapping

- 6.2.6 Surveillance and Monitoring

- 6.2.7 Disaster Management

- 6.2.8 Other Applications

- 6.3 By End-user Industry

- 6.3.1 Construction

- 6.3.2 Aerospace and Defense

- 6.3.3 Government

- 6.3.4 Oil and Gas

- 6.3.5 Energy and Power

- 6.3.6 Agriculture

- 6.3.7 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Terra Flight Aerial Imaging Inc.

- 7.1.2 Fugro Ltd

- 7.1.3 Nearmap Ltd

- 7.1.4 Eagle View Technologies Inc.

- 7.1.5 Digital Aerial Solutions LLC

- 7.1.6 Dronegenuity

- 7.1.7 Cooper Aerial Surveys Co.

- 7.1.8 Landiscor Real Estate Mapping

- 7.1.9 Kucera International Inc.

- 7.1.10 GeoVantage Inc. (Aeroptic LLC)

- 7.1.11 Global UAV Technologies Ltd (High Eye Aerial Imaging Inc.)

- 7.1.12 Eagle Aerial Solutions

- 7.1.13 Aerobotics, (Pty) Ltd

- 7.1.14 Airobotics GmbH (ONDAS Holdings)

- 7.1.15 SkyIMD Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET