PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850256

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850256

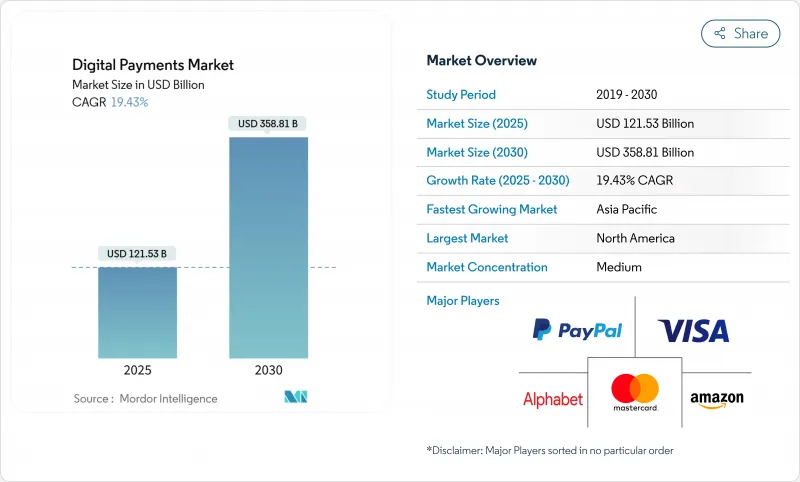

Digital Payments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The digital payments market size is estimated at USD 121.53 billion in 2025 and is on course to reach USD 358.81 billion by 2030, reflecting a 19.43% CAGR for the 2025-2030 period.

This strong outlook is shaped by synchronized regulation across major economies, the spread of interoperable payment rails, and rising demand for seamless cross-border commerce. Interactions between large card networks and alternative payment methods are redefining competitive boundaries, while artificial intelligence raises the bar for fraud prevention and real-time decisioning. Strategic opportunities arise where mature markets provide volume stability and emerging regions deliver rapid expansion, encouraging processors to balance investments in efficiency with moves into high-growth corridors. Regulatory clarity around tokenization and instant payments compresses fragmentation costs, rewarding early movers that align product roadmaps with new compliance templates.

Global Digital Payments Market Trends and Insights

QR-Code Payment Standardization Drives Southeast Asian Integration

Standardized QR infrastructure is scaling rapidly, as Indonesia's QRIS processed 779 million transactions worth IDR 82 trillion (USD 5.4 billion) in Q4 2024, connecting 55 million users and 36 million merchants. Cross-border linkage with Thailand sets a template that could trim remittance costs by up to 50%, positioning ASEAN for integrated payment corridors. Government leadership lets micro-enterprises accept digital payments without credit histories, accelerating financial inclusion.

EU Tokenization Mandates Establish Global Security Standards

The Markets in Crypto-Assets regulation took effect in December 2024 and obliges tokenization for digital assets, influencing processors beyond Europe. Visa's issuance of 1 billion tokens across Asia-Pacific shows how compliance builds scalable security layers that improve user experience. Reserve-backed token rules shape global stablecoin design, while European Central Bank guidance on a digital euro adds interoperability checkpoints.

Fragmented Caribbean KYC Rules Create Friction

Divergent anti-money-laundering standards across Caribbean nations compel processors to run multiple compliance programs, raising cost-to-serve and slowing regional integration.

Other drivers and restraints analyzed in the detailed report include:

- Cross-Border E-Commerce Fuels Alternative Payment Method Adoption

- Gen-Z BNPL Adoption Reshapes North American Credit Markets

- Rural Africa Cash Preference Limits Digital Penetration

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Point-of-sale channels accounted for 57.2% of the digital payments market size in 2024, but online and remote options are compounding at an 18.6% CAGR through 2030. This trajectory reflects European mobile payment value climbing from EUR 4 billion (USD 4.4 billion) in 2017 to EUR 195 billion (USD 212.6 billion) in 2024, validating policy-led adoption. Contactless preferences, cited by 49.1% of travelers wanting permanent mobile payments, keep pushing merchants to upgrade acceptance infrastructure. The spread of instant payment rails blurs channel lines, so providers integrate unified orchestration that covers in-store, web, and in-app flows. Real-time authorization with AI-driven risk engines gives POS vendors a differentiator as remote volume migrates to wallets and pay-by-bank.

Solutions commanded 63.4% revenue in 2024, whereas services are advancing at a 20.4% CAGR, showing that implementation expertise now drives wallet share. Fiserv repositioned its Clover stack from hardware to commerce enablement, delivering double-digit top-line expansion and proof that services deepen engagement. Stripe processed USD 1.4 trillion in 2024, with developer-centric onboarding underscoring how orchestration services capture switching merchants. Advisory and compliance services are in demand as MiCA, instant payment mandates, and ISO 20022 migration raise complexity. Significant cross-border opportunity exists for firms that bundle settlement, FX, and tax reporting in white-label APIs.

Digital Payments Market is Segmented by Mode of Payment (Point of Sale (POS), Online / Remote Payment), Component (Solutions, Services), Enterprise Size (Large Enterprises, Smes), End-User Industry (Retail and E-Commerce, Healthcare, and More), by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 38.3% revenue in 2024, underpinned by card network dominance and the rollout of FedNow, yet competitive pressure escalates as Asia-Pacific posts a 17.3% CAGR through 2030. The emergence of stablecoin initiatives backed by major U.S. banks signals that digital currency rails may cut settlement friction across the Canada-United States-Mexico corridor, fostering new service models.

Asia-Pacific is the primary growth engine, powered by China's digital yuan pilots, India's UPI expansion, and the regional impact of QRIS integration. Indonesia alone processed USD 5.4 billion in QR payments in Q4 2024, confirming the network effect of standardized codes. Local processors form alliances with global gateways to bridge compliance gaps, while Japan's direct acquiring reforms encourage foreign PSP entry.

Europe leverages regulatory leadership. MiCA removes fragmentation, and the instant payments regulation effective January 2025 forces banks to offer round-the-clock euro transfers, shaping processor investment priorities. Harmonized token standards encourage cross-border service design, while niche markets in the Nordics and Baltics continue to pilot open-banking-based pay-by-account checkouts.

South America, the Middle East, and Africa present diverse adoption curves. Brazil's PIX, Mexico's CoDi, and GCC instant payroll schemes each demonstrate how state-backed rails shorten settlement cycles and lower merchant costs. Mobile money agents across Africa handled USD 1.68 trillion in 2024, yet rural gaps remain due to cash bias and network reliability challenges.

- PayPal Holdings Inc.

- Visa Inc.

- Mastercard Inc.

- Amazon.com Inc. (Amazon Pay)

- Alphabet Inc. (Google Pay)

- Apple Inc. (Apple Pay)

- Stripe Inc.

- Adyen N.V.

- Fiserv Inc.

- Fidelity National Information Services Inc. (Worldpay)

- Block Inc. (Square and Cash App)

- ACI Worldwide Inc.

- Ant Group Co. Ltd. (Alipay)

- Tencent Holdings Ltd. (WeChat Pay)

- Paytm (One97 Communications Ltd.)

- Rapyd Financial Networks Ltd.

- Nets Group (Nexi)

- Mollie B.V.

- Verifone Inc.

- Lightspeed Commerce Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Surge in QR-code payments across Southeast Asia

- 4.2.2 EU tokenisation mandates boosting the online security

- 4.2.3 Cross-border e-commerce demand for APMs in South America

- 4.2.4 Increase in Gen-Z BNPL uptake adoption in North America

- 4.2.5 Instant payroll disbursement schemes in GCC

- 4.3 Market Restraints

- 4.3.1 Fragmented KYC rules in the Caribbeans challenges the market

- 4.3.2 Increase adoption of Cash preference in rural Africa

- 4.3.3 Rising CNP fraud costs for mid-tier merchants

- 4.4 Value Chain Analysis

- 4.5 Industry Stakeholder Analysis

- 4.6 Payments Infrastructure and Evolution of Payment Landscape

- 4.7 Digital Payment Infrastructure Analysis

- 4.8 Regulatory Sandbox

- 4.8.1 Regulatory Landscape Across the World

- 4.8.2 Business Models with Regulatory Roadblocks

- 4.8.3 Scope for Development vs. Evolving Landscape

- 4.9 Porter's Five Forces

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes

- 4.9.5 Intensity of Competitive Rivalry

- 4.10 Assessment of Macro Economic Trends on the Market

5 MARKET SIZE and GROWTH FORECASTS (VALUE)

- 5.1 By Mode of Payment

- 5.1.1 Point of Sale (POS)

- 5.1.2 Online / Remote Payment

- 5.2 By Component

- 5.2.1 Solutions (Gateway, Processing, Wallet, Fraud, Other)

- 5.2.2 Services (Consulting, Integration, Support)

- 5.3 By Enterprise Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By End-user Industry

- 5.4.1 Retail and E-commerce

- 5.4.2 Media and Entertainment

- 5.4.3 Healthcare

- 5.4.4 Hospitality and Travel

- 5.4.5 Other Industries (Education, Utilities, Govt.)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Nordics

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 GCC

- 5.5.5.2 Turkey

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 PayPal Holdings Inc.

- 6.4.2 Visa Inc.

- 6.4.3 Mastercard Inc.

- 6.4.4 Amazon.com Inc. (Amazon Pay)

- 6.4.5 Alphabet Inc. (Google Pay)

- 6.4.6 Apple Inc. (Apple Pay)

- 6.4.7 Stripe Inc.

- 6.4.8 Adyen N.V.

- 6.4.9 Fiserv Inc.

- 6.4.10 Fidelity National Information Services Inc. (Worldpay)

- 6.4.11 Block Inc. (Square and Cash App)

- 6.4.12 ACI Worldwide Inc.

- 6.4.13 Ant Group Co. Ltd. (Alipay)

- 6.4.14 Tencent Holdings Ltd. (WeChat Pay)

- 6.4.15 Paytm (One97 Communications Ltd.)

- 6.4.16 Rapyd Financial Networks Ltd.

- 6.4.17 Nets Group (Nexi)

- 6.4.18 Mollie B.V.

- 6.4.19 Verifone Inc.

- 6.4.20 Lightspeed Commerce Inc.

7 MARKET OPPORTUNITIES and FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment