Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687206

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687206

North America Commercial Aircraft Cabin Interior - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 176 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

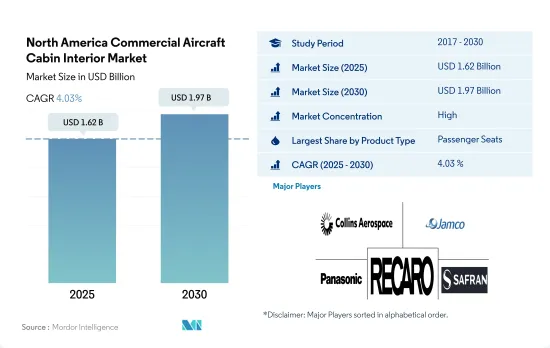

The North America Commercial Aircraft Cabin Interior Market size is estimated at 1.62 billion USD in 2025, and is expected to reach 1.97 billion USD by 2030, growing at a CAGR of 4.03% during the forecast period (2025-2030).

North American airlines are adopting advanced cabin features to enhance passenger experience, which may drive the demand for cabin interior products

- The airline companies in the region are focusing on increasing the utility of the products and improving the overall passenger comfort and experience. An enhanced seating structure with more developed space than economy-class seats is becoming highly essential due to rising preferences from business-class travelers. North American airline operators and OEMs are increasing their efforts to reduce weight and develop a sustainable way to manage the airline industry, which is in line with the Zero-Emission 2050 goal.

- North American airline companies are focusing on modernized cabins with advanced interior lighting to improve the passenger experience. The widespread adoption of LED ambient lighting technology on next-generation aircraft has enabled cabin modernization activities to maintain a consistent service quality on board. In the United States, United Airlines, American Airlines, Southwest Airlines, and Delta Airlines have in-flight entertainment (IFE) screens in their active fleets of commercial aircraft. Similarly, Air Canada, WestJet, and Air Transat in Canada also have IFE screens in their active fleet of commercial aircraft.

- North America's commercial aircraft accounted for around 30% of the total commercial aircraft worldwide during 2017-2022. The presence of a large number of passenger aircraft, along with fleet replacement of aging fleets, is expected to boost the demand for commercial aircraft cabin interior products in the North American passenger aviation sector by 1.41% during the forecast period.

Airlines modernizing their fleet to enhance passengers' overall travel experiences is driving the demand for aircraft cabin interiors in North America

- The commercial aircraft segment is expected to experience significant growth during the forecast period, primarily driven by the demand for narrowbody aircraft due to the growing number of domestic passengers in North America. Fleet development of the aircraft, increased demand for fuel-efficient aircraft, growth in the number of airline passengers, and the airline industry's consideration of the zero-emission 2050 goal are the factors fueling the demand for commercial aircraft. As of August 2023, the region had a backlog of 1,474 Boeing and 986 Airbus aircraft. Of these total aircraft, the United States alone had 2,405 aircraft in backlog. Hence, the country is expected to witness more significant growth.

- Passengers drive the demand for aircraft cabin interiors segment as they seek personalized travel experiences. Hence, airlines are responding by investing in customizable seating, lighting, and IFE options that cater to various passenger preferences. For instance, airlines in the region are investing in customizable seating options that cater to various passenger preferences, such as extra legroom and lie-flat beds. Additionally, it was observed that in the United States, airlines such as Alaska Airlines, Frontier Airlines, Southwest Airlines, and Spirit Airlines do not provide any IFE system because these airlines have opted for the option of streaming entertainment on the passenger's own device with some additional cost to use their in-flight Wi-Fi.

- North American airlines are opting for LED ambient lighting technology on next-generation aircraft, enabling cabin modernization activities to maintain a consistent service quality on board. With such developments, the market is expected to grow by 1.27% during 2023-2030.

North America Commercial Aircraft Cabin Interior Market Trends

Rising economy, increase in tourism industry and ease of restrictions are the driving factors for a consistent air passenger traffic growth in North America

- North America's vast landmass and diverse destinations make it a popular choice for millions of passengers who choose to fly both domestically and internationally. Factors such as a growing economy, increased affordability of air travel, and a rising middle class have contributed to a significant uptick in air passenger traffic. Air passenger traffic in the United States reached 1.04 billion in 2022, up by 7% compared to 2021 and 12% compared to 2019. In 2022, from January through December, US airlines carried 853 million passengers, up from 658 million in 2021 and 388 million in 2020. The total number of passengers carried by airlines in Canada reached 107 million in 2022, surpassing the levels in 2021 by 6%. In 2022, Mexico had 100 million air passenger traffic, representing a 7% growth compared to its 2021 traffic levels. North America has benefitted from fewer and shorter-lasting travel restrictions than many other countries and regions. This has boosted domestic travel in the large home market, as well as international travel. Net profits in the region are expected to rise from USD 9.9 billion in 2022 to USD 11.4 billion in 2023.

- To cater to the demand driven by air passenger traffic, various airlines in the region are planning to procure new aircraft. For instance, around one-third of global aircraft deliveries in 2023 were anticipated to be received by various carriers in North America. Although the region's aircraft deliveries were already above 2019 levels in 2022, they were expected to grow by an additional 72 units in 2023. Overall, with consistent air travel, the region's air passenger traffic is expected to increase by 1.7 billion in 2030 compared to 1.2 billion recorded in 2022.

Rising economic stability, particularly in the United States, is expected to support North America's GDP per capita growth

- The United States is a developed country and has the world's largest nominal GDP and net wealth. Real GDP increased by 2.1% in 2022, compared to 5.9% in 2021. The increase in real GDP in 2022 primarily reflected increases in consumer spending, exports, private inventory investment, and non-residential fixed investment that were partly offset by decreases in residential fixed investment and federal government spending. The rise in most sectors is expected to eventually boost the region's GDP per capita and, hence, support the air transport industry. North America has the highest continental GDP per capita by both GDP Nominal and PPP in the world. In 2022, the United States had the highest GDP per capita in the region at USD 76,350.

- In 2022, Canada's real gross domestic product (GDP) grew by 3.8%. Oil and gas extraction (except oil sands) decreased by 1.6% in December, primarily due to lower-than-seasonal growth in oil extraction in the month after strong offshore production. Winter storms had a significant impact on air and railway transportation in December. The month saw a 2.3% decrease in air transportation, the first such decrease since January 2022.

- Mexico has solid macroeconomic institutions, is open to trade, and has a diversified manufacturing base connected to global value chains. The Mexican economy grew by 3.1% in 2022, after a bounce-back of 4.7% in 2021 and an 8.0% fall in 2020 due to the COVID-19 pandemic. The economy has recovered its employment and Gross Domestic Product (GDP) pre-pandemic levels. Mexico's stable macroeconomic framework, the US dynamism, and solid manufacturing base will support economic growth.

North America Commercial Aircraft Cabin Interior Industry Overview

The North America Commercial Aircraft Cabin Interior Market is fairly consolidated, with the top five companies occupying 70.57%. The major players in this market are Collins Aerospace, Jamco Corporation, Panasonic Avionics Corporation, Recaro Group and Safran (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 56545

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Air Passenger Traffic

- 4.2 New Aircraft Deliveries

- 4.3 GDP Per Capita (current Price)

- 4.4 Revenue Of Aircraft Manufacturers

- 4.5 Aircraft Backlog

- 4.6 Gross Orders

- 4.7 Expenditure On Airport Construction Projects (ongoing)

- 4.8 Expenditure Of Airlines On Fuel

- 4.9 Regulatory Framework

- 4.10 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Product Type

- 5.1.1 Cabin Lights

- 5.1.2 Cabin Windows

- 5.1.3 In-Flight Entertainment System

- 5.1.4 Passenger Seats

- 5.1.5 Other Product Types

- 5.2 Aircraft Type

- 5.2.1 Narrowbody

- 5.2.2 Widebody

- 5.3 Cabin Class

- 5.3.1 Business and First Class

- 5.3.2 Economy and Premium Economy Class

- 5.4 Country

- 5.4.1 Canada

- 5.4.2 United States

- 5.4.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Adient Aerospace

- 6.4.2 Astronics Corporation

- 6.4.3 Collins Aerospace

- 6.4.4 Diehl Aerospace GmbH

- 6.4.5 Expliseat

- 6.4.6 FACC AG

- 6.4.7 GKN Aerospace Service Limited

- 6.4.8 Jamco Corporation

- 6.4.9 Luminator Technology Group

- 6.4.10 Panasonic Avionics Corporation

- 6.4.11 Recaro Group

- 6.4.12 Safran

- 6.4.13 SCHOTT Technical Glass Solutions GmbH

- 6.4.14 STG Aerospace

- 6.4.15 Thales Group

- 6.4.16 Thompson Aero Seating

7 KEY STRATEGIC QUESTIONS FOR COMMERCIAL AIRCRAFT CABIN INTERIOR CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.