PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640702

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640702

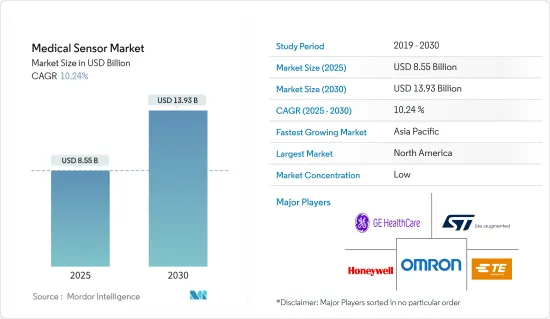

Medical Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Medical Sensor Market size is estimated at USD 8.55 billion in 2025, and is expected to reach USD 13.93 billion by 2030, at a CAGR of 10.24% during the forecast period (2025-2030).

The development of new devices that provide faster analysis, lower costs, and are user-friendly contributes to the growth of the medical sensor market.

Key Highlights

- Medical sensors are devices that respond to various physical stimuli, such as sound, pressure, heat, light, and any particular motion, and communicate the resulting impulse for examination at the point of care. These devices convert physical stimuli into electrical impulses. Medical sensors offer significant benefits in disease diagnosis, treatment, and management.

- Advances in low-power electronics, MEMS technology, power harvesting, and smart materials have increased the applications of these technologies in the medical and healthcare industries. From simple medical devices to intelligent distributed healthcare systems, accurate detection, and early warning of patients' healthcare conditions, sensors have played a major role in this industry. Furthermore, the development of unobtrusive sensing solutions has paved the path for enhanced patient health.

- This market is driven by increasing government initiatives for mHealth products, increasing adoption of smartphones and other electronic devices equipped with sensor technology, increasing public and private investments in sensor deployment in mHealth, and increasing adoption of IoT and advanced technologies.

- Miniaturization of sensors leading to ease in integration acts as a driver to the medical sensor market. This can help in diagnosing diseases that require very detailed sensing techniques.

- Manufacturers of medical devices are putting a lot of effort into developing portable devices with sensors. Due to their rising usage in these devices, the demand for low-cost advanced sensors with a tiny form factor, better functionality, low power consumption, and high reliability is increasing.

- Moreover, the rising medical infrastructure developments with increased medical facilities are expected to propel the demand for medical devices or equipment, further driving market growth.

- In many underdeveloped and developing countries, the health status is still poor. This problem causes the people of these countries not to have proper access to optimal health services. Most healthcare systems, whether private or public, or government, are clustered in urban areas, and there is a scarcity of health services in rural belts.

Medical Sensors Market Trends

Pressure Sensors are Expected to Witness Significant Growth

- Pressure sensors are crucial components for medical devices to sustain and enhance the quality of a more effective and safe operation. Furthermore, they are the reason there has been a notable increase in portable healthcare monitoring products since they became an integral part of designing medical applications.

- Pressure sensors can monitor a patient's condition by providing definite and reliable diagnostics for various conditions. This can include monitoring oxygen therapy effectiveness in oxygen concentrators, automating drug infusion by administering the correct volume and rate of fluid in infusion pumps, or even measuring blood pressure.

- Moreover, many people suffer from asthma attacks and use inhalers as a solution. Poor inhaler techniques prevent patients from receiving their full therapeutic benefits. In order to counter this situation, leading medical equipment manufacturers are employing pressure sensors in inhalers, and individuals are starting to receive proper asthma care measures.

- The increasing cases of respiratory diseases such as chronic obstructive pulmonary disorder (COPD) and asthma are creating a high demand for pressure sensors, further supporting market growth. Wearable pressure sensors are widely used in medicine to track important signs and in robotics to help mechanical fingers manipulate delicate objects. However, traditional soft capacitive pressure sensors only work at pressures below 3 kPa, so even simple clothing, such as close-fitting clothing, can affect performance.

- The increasing prevalence of diabetes drives the demand for pressure sensors in various medical devices and systems used for diabetes management, monitoring, and treatment. Pressure sensors play a vital role in ensuring these devices' accuracy, reliability, and effectiveness, contributing to improved outcomes and quality of life for individuals with diabetes.

- According to the International Diabetes Federation, around 10.5% of the global adult population suffered from diabetes in 2021; by the year 2045, this is expected to rise to over 12%. Diabetes, or diabetes mellitus, is a group of metabolic disorders resulting in chronic high blood sugar levels.

- Additionally, home medical wearables, fitness trackers, and health monitors have significantly increased the demand for pressure sensors. This is due to the increasing focus on data-centric systems. These systems require increased functionality and reduced power consumption. This trend is driven by the development of intelligent systems that closely monitor people and the environment and proactively provide warnings, actions, or suggestions for action.

North America Holds the Largest Market Share

- The medical device market in North America is one of the largest among all the regions and is expected to grow considerably during the forecast period. Factors such as a well-developed healthcare infrastructure, the presence of adequate and favorable reimbursement policies, rapid adoption of advanced medical technologies, and major players within the region are responsible for market growth.

- The growing number of patients undergoing diagnosis and treatment in the regions due to a rising incidence and prevalence of chronic conditions has promoted the acceptance of advanced medical devices and associated sensors in the past few years.

- As of January 2022, there were around 18.1 million cancer survivors in the United States, according to the National Cancer Institute. This represented about 5.4% of the population. The number of cancer survivors is estimated to increase by 24.4% to 22.5 million by 2032. Cancer is the second leading cause of death in the United States, followed by heart disease. The rising number of cancer patients increases the demand for medical imaging devices, thus driving market growth.

- Furthermore, the growing demand for home healthcare devices and increased investments in medical device research and development will support market growth as sensors are integral parts of medical devices.

- Medical devices rely on several industries in which the United States has competitive advantages, including instrumentation, telecommunications, biotechnology, microelectronics, and software development. Collaborations have led to recent advances in neurostimulators, stent technology, biomarkers, robotic assistance, and implantable electronics.

- Many federal policies, programs, and actions have been initiated by governments in the region to achieve progress in health services. For example, within the United States, the federal government has been encouraging the use of healthcare data through various policies and initiatives. Affordable Care Act (ACA), the most important healthcare legislation in the United States, authorized the Department of Health and Human Services to release data that promotes transparency in healthcare and medical insurance markets.

- In October 2023, Mindray announced new integrations as part of a collaboration agreement with Edwards Lifesciences, a provider of medical innovations for critical care monitoring and structural heart disease. The new solution integrates Mindray's BeneVision N-series patient monitoring system and Edwards' FloTrac sensor to enable hemodynamic monitoring.

Medical Sensors Industry Overview

The medical sensor market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are GE Healthcare Inc., STMicroelectronics NV, Honeywell International Inc., TE Connectivity Ltd (First Sensors AG), and Omron Corporation. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- February 2024: GE HealthCare and Biofourmis announced a strategic collaboration to enhance continuity of care by enabling safe, effective, and accessible care in the home to support the patient's journey beyond the hospital setting. The partnership leverages the combined expertise of two market leaders to scale and deliver innovative care-at-home solutions.

- February 2024: STMicroelectronics, one of the global semiconductor leaders serving customers across the spectrum of electronics applications, and Mobile Physics, a software development start-up specializing in environmental physics, revealed a partnership that enables smartphones and other devices to measure household and ambient air quality with a built-in optical sensor.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Miniaturization of Sensors Leading to Ease in Integration

- 5.1.2 Increasing Advancement in Medical Devices and Accessories

- 5.2 Market Challenges

- 5.2.1 Slower Rate of Penetration of Advanced Medical Systems in Developing Regions

- 5.2.2 Stringent Regulatory Environment for Product Approvals

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Flow Sensor

- 6.1.2 Biosensor

- 6.1.3 Temperature Sensor

- 6.1.4 Pressure Sensor

- 6.1.5 Other Types

- 6.2 By Application

- 6.2.1 Clinical Applications

- 6.2.2 Consumer Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 GE Healthcare Inc

- 7.1.2 STMicroelectronics NV

- 7.1.3 Honeywell International Inc.

- 7.1.4 TE Connectivity Ltd (First Sensors AG)

- 7.1.5 Omron Corporation

- 7.1.6 Servoflo Corporation

- 7.1.7 Sensirion Holding AG

- 7.1.8 Siemens AG

- 7.1.9 NXP Semiconductors (Freescale Semiconductor)

- 7.1.10 Amphenol Advanced Sensors (Amphenol Corporation)

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET