PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687331

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687331

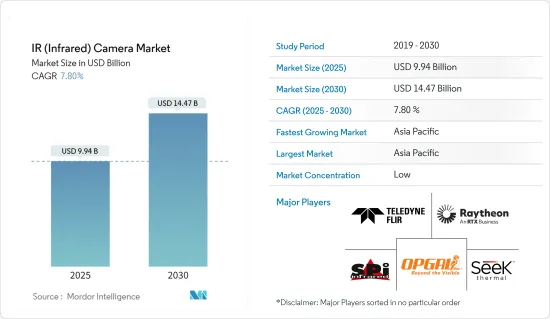

IR (Infrared) Camera - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The IR Camera Market size is estimated at USD 9.94 billion in 2025, and is expected to reach USD 14.47 billion by 2030, at a CAGR of 7.8% during the forecast period (2025-2030).

Infrared cameras are widely used for security and surveillance purposes. They can detect movement and capture thermal images even in complete darkness. This makes them suitable for monitoring large areas, identifying intruders, and preventing theft or vandalism.

Key Highlights

- In addition, these cameras can be integrated with advanced video analytics to enhance threat detection and improve overall security measures. Some security cameras are equipped with smart IR technology. This technology modifies the brightness of the camera's infrared LEDs according to how far away an object is, avoiding the problem of the object being overly bright. It addresses the issue of images being washed out by infrared LEDs when objects are near the camera.

- Infrared cameras play a crucial role in energy audits and efficiency assessments. They allow users to identify areas of heat loss, insulation gaps, and building air leakage. By pinpointing these energy inefficiencies, infrared cameras enable users to make targeted improvements, reducing energy consumption and lowering utility bills. Moreover, these cameras aid in detecting faulty or inefficient equipment early, helping businesses optimize their energy usage.

- Infrared cameras are invaluable tools for preventive maintenance programs. By identifying abnormal heat patterns in electrical systems, mechanical equipment, and rotating machinery, these cameras can help detect potential failures before they occur. This proactive approach allows for timely repairs or replacements, minimizing downtime and preventing costly breakdowns. As a result, businesses can save money and improve overall operational efficiency. Infrared cameras are also extensively used for electrical inspections, as they can quickly identify overheating components and potential fire hazards.

- Infrared cameras have become essential tools for firefighters and rescue teams. These cameras can penetrate smoke and darkness to locate hotspots and identify potential victims during firefighting and search-and-rescue operations. Infrared cameras enhance situational awareness by providing real-time thermal imaging, enabling quicker and more effective response times.

- Infrared cameras have become increasingly popular in various industries due to their ability to capture thermal radiation. These cameras have found applications in fields such as security, building inspections, and even medical diagnostics. However, there are concerns regarding the accuracy of their functionality and the stringent import/export regulations governing their distribution.

IR (Infrared) Camera Market Trends

Automotive Industry to be the Fastest Growing End User

- The automotive industry's demand for infrared cameras is rising, driven by the growing adoption of advanced driver-assistant systems (ADAS). Governments worldwide are also promoting ADAS deployment.

- For example, the Federal Automated Vehicles Policy, issued by the National Highway Traffic Safety Administration (NHTSA) of the US Department of Transportation, encompasses a spectrum of vehicles, from those equipped with advanced driver-assistance systems to entirely autonomous vehicles.

- In the automotive sector, IR cameras can detect heat signatures, enhancing vision in low-light conditions and adverse weather. IR cameras are also utilized for night vision systems and driver monitoring systems. They also play a crucial role in advanced driver assistance systems (ADAS), providing accurate distance and object detection and enabling features like adaptive cruise control and automatic emergency braking.

- The growing popularity of autonomous or self-driving vehicles also contributes to the market's growth. For instance, Intel predicts that global car sales will hit 101.4 million units by 2030, and autonomous vehicles are projected to represent approximately 12% of all car registrations that year.

- The market for dashboards and parking cameras is also experiencing a recent surge in demand. The automotive industry's adoption of infrared cameras has been driven by the increasing use of dashboard cameras, particularly in high-end and luxury vehicles, for security purposes.

Asia Pacific Expected to Register Major Growth

- The Asia-Pacific region is witnessing a surge in investments in automation and Industry 4.0 technologies. The demand for robust inspection and observation systems, coupled with a high pace of product innovation, is propelling the growth of IR camera systems. Industries such as manufacturing, oil and gas, and utilities extensively utilize infrared cameras for non-contact temperature measurement, condition monitoring, and predictive maintenance. These cameras enable early detection of equipment failures, hotspot identification, and energy efficiency assessments.

- China has witnessed a surge in demand for IR cameras, particularly for observation tasks like investigation, remote surveillance, border control, and safeguarding critical infrastructure. The need for powerful infrared and thermal zoom cameras is on the rise. China's application of infrared cameras is expanding beyond security. They are increasingly being deployed for water pollution control, ecological monitoring, and mineral resource surveys.

- According to the National Crime Records Bureau, crime rates in India have been on the rise. This has prompted security agencies nationwide to advocate for the installation of imaging cameras, including infrared (IR) cameras, to enhance household safety.

- Furthermore, the Indian automotive sector, as per the India Brand Equity Foundation (IBEF), has been witnessing a steady annual growth rate of 9.5%. With the increasing recognition of IR camera technology in automobiles, the market for these cameras in India is poised for further expansion.

- Japan's rising demand for IR cameras is driven by advancements in defense, military, surveillance, and healthcare applications. Notably, Japan's defense budget for fiscal year 2024 is estimated at JPY 7.95 trillion (USD 0.052 trillion), a significant increase from previous years, reflecting the government's focus on bolstering national defense.

IR (Infrared) Camera Market Overview

The IR camera market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Teledyne FLIR LLC (Teledyne Technologies), SPI Corp., OPGAL Optronic Industries Ltd (Elbit Systems), Raytheon Company, and Seek Thermal Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- January 2024 - Valeo and Teledyne FLIR, a subsidiary of Teledyne Technologies Incorporated, have joined forces in a strategic collaboration. They aim to introduce thermal imaging technology to the automotive sector to bolster road safety. The collaboration has already yielded a major contract with a prominent global automotive OEM in late 2023. Under this contract, the companies will provide cutting-edge thermal imaging cameras as a key component of an advanced driver-assist system (ADAS). This technology promises to be a game-changer for vehicle and road safety.

- January 2024 - Raytheon has recently disclosed that they have been awarded a contract worth USD 154 million to supply the US Army with Commander's Independent Viewer (CIV) systems. These systems will be used to enhance the capabilities of the Army's Bradley Fighting Vehicles. The CIV system incorporates advanced electro-optical/infrared sight technology, including second-generation forward-looking infrared (FLIR) cameras and sensors. With these cutting-edge features, the Bradley Fighting Vehicle will gain a comprehensive 360-degree view of the battlefield and improved targeting capabilities. It is worth noting that military forces have successfully utilized Raytheon's FLIR technology for over fifty years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Surveillance Across Various Verticals

- 5.1.2 Gradually Decreasing Costs of Thermal Cameras

- 5.2 Market Challenges

- 5.2.1 Lack of Accuracy in Camera Functionality and Stringent Import/Export Regulations

6 MARKET SEGMENTATION

- 6.1 By Detector

- 6.1.1 Cooled

- 6.1.2 Uncooled

- 6.2 By Material

- 6.2.1 Germanium

- 6.2.2 Silicon

- 6.2.3 Sapphire

- 6.2.4 Other Materials

- 6.3 By Type

- 6.3.1 Near and Short-wavelength IR

- 6.3.2 Medium-wavelength IR

- 6.3.3 Long-wavelength IR

- 6.4 By End-user Vertical

- 6.4.1 Military and Defense

- 6.4.2 Automotive

- 6.4.3 Industrial

- 6.4.4 Commercial and Public

- 6.4.5 Residential

- 6.4.6 Other End-user Vertical

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 France

- 6.5.3 Asia

- 6.5.3.1 China

- 6.5.3.2 India

- 6.5.3.3 Japan

- 6.5.3.4 Australia and New Zealand

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Positioning Analysis

- 7.2 Company Profiles

- 7.2.1 Teledyne FLIR LLC (Teledyne Technologies)

- 7.2.2 SPI Corp.

- 7.2.3 OPGAL Optronic Industries Ltd (Elbit Systems)

- 7.2.4 Raytheon Company

- 7.2.5 Seek Thermal, Inc.

- 7.2.6 Fluke Corporation

- 7.2.7 Testo SE & Co. Kgaa

- 7.2.8 Guide Sensmart Tech Co. Ltd (Guide Infrared)

- 7.2.9 Hangzhou Hikvision Digital Technology Co., Ltd

- 7.2.10 Leonardo DRS, Inc.

- 7.2.11 InfraTec GmbH

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET