PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1641886

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1641886

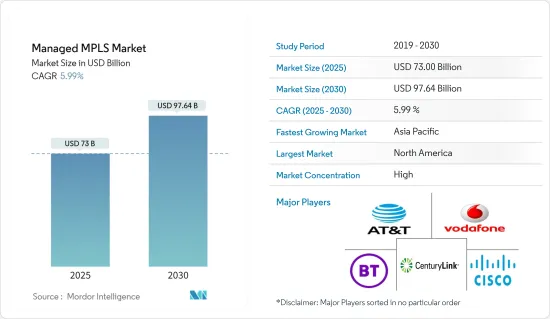

Managed MPLS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Managed MPLS Market size is estimated at USD 73.00 billion in 2025, and is expected to reach USD 97.64 billion by 2030, at a CAGR of 5.99% during the forecast period (2025-2030).

With the rapidly growing global expansion of enterprises, there is an increased demand for secure connectivity among multiple business units and effective means for data management, which is one of the significant factors boosting MPLS networks' adoption.

Key Highlights

- Several enterprises rely on virtual private cloud services on MPLS VPNs to achieve high performance and critical communication, as they provide the benefits of a private network with the economics of a public network. This is because VPC services create logical 'private' partitions within a public cloud environment, providing the benefits of a dedicated private cloud but on a more cost-effective and flexible basis.

- The emergence of SD-WAN is expected to significantly impact the networking market due to its speed and simplicity. However, SD-WAN cannot compete with security and reliability, thus pushing companies to implement a conjunction of the two. This is expected to create more significant opportunities for the managed MPLS market.

- The market studied is also expected to improve business intelligence and security surveillance applications by offering real-time video information. Additionally, the need for minimal investments to integrate analytics software with the existing surveillance infrastructure has been a significant factor that has prompted enterprises, irrespective of size, to invest in this technology and attain a significant return on investment (ROI).

- Other prominent trends projected to augment the global managed MPLS market's growth include increasing BYOD policies, growing adoption of cloud services (like computing and analytics), and rising smartphone penetration. Owing to the increased adoption of BYOD policies, Cisco Systems stated that companies favoring BYOD make an annual saving of USD 350 per year per employee.

- Due to the outbreak of COVID-19, the demand for remote work solutions has seen a surge due to organizations transitioning from their conventional workplace methods to work-from-home scenarios. These impacts must be carefully considered in the context of the organization's cybersecurity as more and more personal unsecured devices start accessing the organization's network; the risk of compromising network security increases.

- For instance, according to Centrify, over two-thirds (70%) of UK businesses are using MFA and a virtual private network (VPN) to manage the security risks posed by the increase in remote working environments due to the COVID-19 outbreak.

Managed MPLS Market Trends

BFSI Industry is Expected to Drive the Market Growth

- An increasing number of privacy breaches have alerted banks to gain control over their network and routing. For instance, according to Verizon, the number of cyber attacks in the BFSI sector worldwide increased from 721 in 2020 to 2,527 in the previous year. To address these security concerns, the IT department of these BFSI institutes has started to prefer layer 2 VPN and 3 VPN MPLS services.

- With the increasing number of multiple locations and the specific networking requirements for individual sites, the design development and implementation of unique network models have become significantly complex. Thus, BFSI institutes have opted to outsource their networking, aiding the managed MPLS market's growth.

- Further, expanding networks in the BFSI sector becomes easy with MPLS technology. The growing demand for high-quality video conferencing and VoIP service has also emerged as a critical application area for MPLS since it offers sustainable bandwidth between the user's equipment and the service provider's network, which helps to suffice VoIP's requirements.

- In addition, due to the increased digitalization of BFSI operations and growing volumes of client data, the BFSI sector has witnessed many advantages through adopting cloud services to cater to these requirements. However, this adoption has also increased the sector's vulnerability to data breaches and attacks, thus, driving institutes to opt for networks that allow the smooth functioning of cloud services while ensuring security. These factors have increased the penetration of MPLS networks in the BFSI sector.

North America is Expected to Hold Significant Market Share

- The North America region is expected to hold a significant market share. With the surge of cloud computing, there has been an increase in the demand for secure networking among enterprises, which, in turn, is expected to drive the demand for the managed MPLS market.

- In addition, the rise in cloud computing raised the requirement for secure networking among businesses, likely increasing demand for managed MPLS services. For instance, according to Cisco Systems, cloud traffic in North America last year was 19.5 ZB (1.6 ZB Per Month). This is anticipated to contribute positively to the growth of the market studied.

- Companies in the region, such as Cognizant, deliver a full range of application outsourcing, system integration services, and business process consulting. The company realized the need for transcontinental connectivity and efficient security mechanisms by increasing its global reach through business diversification.

- Moreover, according to the U.S. Census Bureau data, as of September last year, 48.3% of the workers in the District of Columbia worked from home, the highest % of home-based workers among states and state equivalents. In addition, more enterprises are shifting toward a remote working model to maintain business continuity without compromising the security of their workforce. Such factors are further expected to drive the region's demand for managed MPLS services.

Managed MPLS Industry Overview

The managed MPLS market is moderately competitive and consists of several major players. A few significant players currently dominate the market in terms of market share. The major players focus on expanding their product portfolio and customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market shares and profitability. Some of the recent developments in the market are:

- November 2022 - Equinix and VMware announced a partnership to deliver new digital infrastructure and multi-cloud services with more performant, secure, and cost-effective cloud options to satisfy business-critical performance demands at the edge while enabling them to preserve the integrity of enterprise workloads to support enterprise applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in Mobile Backhaul Networks

- 5.1.2 Increased Penetration of Cloud Services

- 5.2 Market Restraints

- 5.2.1 Higher Costs Associated With MPLS

6 MARKET SEGMENTATION

- 6.1 By Service (Qualitative Trend Analysis)

- 6.1.1 Level 2 VPN

- 6.1.2 Level 3 VPN

- 6.2 By End-user Vertical

- 6.2.1 Healthcare

- 6.2.2 BFSI

- 6.2.3 Retail

- 6.2.4 Manufacturing

- 6.2.5 Government

- 6.2.6 IT and Telecommunication

- 6.2.7 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AT&T Communications Inc.

- 7.1.2 BT Global Services Ltd

- 7.1.3 Cisco Systems Inc.

- 7.1.4 Century Link Inc.

- 7.1.5 Vodafone Group PLC

- 7.1.6 Sprint Nextel Corporation

- 7.1.7 Netmagic Solutions Pvt Ltd (NTT Communications)

- 7.1.8 Syringa Networks LLC

- 7.1.9 Orange SA

- 7.1.10 Verizon Communications Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET