PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687338

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687338

Transparent Display - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

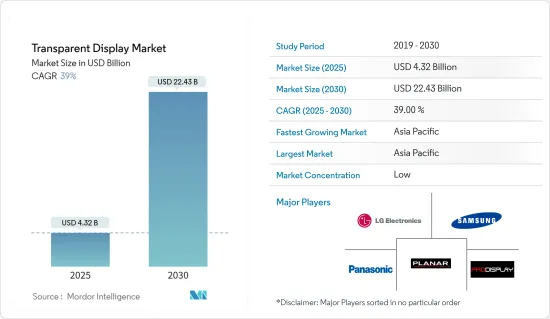

The Transparent Display Market size is estimated at USD 4.32 billion in 2025, and is expected to reach USD 22.43 billion by 2030, at a CAGR of 39% during the forecast period (2025-2030).

Key Highlights

- A transparent display or a see-through display is an electronic display that authorizes the user to see what is shown on the screen while still being able to see through it. The main applications of this type of display are head-up displays, augmented reality systems, digital signage, and general large-scale spatial light modulation.

- These transparent display screens communicate dynamic or interactive content via a transparent surface, authorizing viewers to see what is shown on the screen while still being competent to see through the display. These are widely used in digital signage products for various verticals, such as retail, hospitality, smart appliances, and automotive.

- Transparent displays are being used to provide ADAS (advanced driver assistance) features, including collision avoidance alerts and lane departure warnings. The automotive industry is going through a digital transformation, continuously focusing on adopting new technologies such as autonomous driving, automotive touchscreen displays, and electric powertrains, which will drive the market in the near future.

- Augmented and virtual reality are developing as next-generation display platforms for better human digital interactions. AR/VR headsets are emerging as interactive displays with the feature to provide vivid 3D visual experiences, used across various applications such as education, engineering, healthcare, and gaming. The demand for lightweight and compact glass-like form factors in AR and VR devices drives the demand for advanced display technology.

- Moreover, transparent display panel manufacturers make most of their money from the average selling price and the number of display panels they ship, and changes in these prices and numbers impact how much money they make. The price and number of shipments of display panels rely on many things, such as the cost of raw materials, the rate of yield, competition, supply and demand, pricing strategy, and shipping costs. In the display industry, both the average selling price (ASP) of raw materials and the average selling price of display panels change a lot, which may further challenge the market growth.

Transparent Display Market Trends

Retail Sector to Hold a Significant Market Share

- Transparent displays are significantly used in the retail sector, as they are gaining popularity for their ability to create immersive and interactive experiences. They allow retailers to showcase products visually appealingly while providing information. The development can be attributed to advancements in display technology, reduced costs, and the desire to captivate customers with innovative presentations. These displays are being utilized for advertising, product demonstrations, and even as interactive information panels, enhancing the overall shopping experience.

- The transparent displays allow products to be showcased with accompanying digital content, providing a unique and engaging way for customers to view and interact with merchandise. Also, retailers can create interactive and immersive experiences by integrating touch or gesture controls with transparent displays, enabling customers to learn more about products or access additional information.

- Transparent displays can seamlessly integrate with other technologies, such as augmented reality (AR) or virtual reality (VR), providing customers with more engaging and personalized experiences. As technology advances, transparent displays are likely to play an increasingly crucial role in shaping the future of retail by combining the physical and digital aspects of shopping.

- The rise in the number of retail outlets and an upsurge in the use of transparent displays for head-up display products are some factors responsible for driving the growth of the retail evident display demand. During fiscal year 2023, Reliance Retail had over 18 thousand retail stores across India. Aggressive store expansion and spurt in same-store sales were the primary drivers behind Reliance Retail's revenue growth for the same year. Reliance Retail is one of the country's highly profitable subsidiaries of Reliance Industries Limited.

- Further, since transparent displays can be integrated into store windows or other strategic locations without obstructing the view, retailers optimize limited space for promotional and functional purposes. Such benefits in the retail sector may further create demand for the transparent display.

Asia-Pacific is Expected to Witness Rapid Growth

- The growing demand for transparent displays across the region's various industries like automotive, retail, consumer, and others is expected to drive the market.

- The region's automotive industry is expected to be one of the significant industries contributing to the market's growth. ITA reports that China remains the global leader in annual vehicle sales and manufacturing output, projecting a production of 35 million vehicles by 2025. The Chinese automobile industry has played a significant role in driving the country's economic growth, as stated by CAAM. Despite a slowdown in development, the industry is expected to continue contributing to the economy. In 2022, China witnessed the sale of approximately 23.56 million passenger cars and 3.3 million commercial vehicles. CAAM anticipates that China's auto production and sales volumes will maintain steady growth, with an estimated increase of over 3% by 2024.

- The growth in various end-user industries in Japan is expected to fuel market demand, attracting more companies to invest in advanced technologies. For instance, in June 2023, Japan Display Inc. (JDI) unveiled a groundbreaking innovation - the world's inaugural transparent liquid crystal meta-surface reflector. This cutting-edge technology enables the manipulation of mmWave reflection in any desired direction. The transparent liquid crystal meta-surface reflector can seamlessly integrate into window glass, advertising media, or any other setting where transparency is advantageous. This remarkable development significantly enhances the versatility and adaptability of installations.

- The Indian Retail industry is expected to be one of the significant industries contributing to the market's growth. According to Invest India, by 2032, it is projected that the Indian retail market will achieve a value of USD 2 Trillion. This growth can be attributed to various socio-demographic and economic factors, including urbanization, income growth, and increased nuclear families.

- Furthermore, India is anticipated to become the third-largest online retail market by 2030 and will have approximately 6 million MSME merchants by 2027. As technology progresses and consumer expectations change, transparent glass screens offer a thrilling prospect for retailers to differentiate themselves from competitors and engage the interest of contemporary shoppers.

- Similarly, India's electronics market is renowned for its immense consumption, making it one of the largest in the world. As per ICEA, India boasts one of the most substantial electronic markets globally in terms of consumption, which is expected to soar to USD 109 billion by 2026. The high demand for various consumer electronics such as mobile devices, PCs, and similar products primarily fuels the market's remarkable potential.

Transparent Display Market Overview

The transparent display market is fragmented and competitive owing to the presence of limited players, most of whom operate globally and have a strong market presence. To gain a competitive advantage, the vendors are increasingly focusing on developing innovative solutions and establishing a robust supply chain. Some of the major players in the transparent display market are Planar Systems Inc. (Leyard Optoelectronic Co.), Samsung Electronics Co. Ltd, LG Electronics Co. Ltd, Panasonic Corporation, and Pro Display.

In January 2024, Samsung launched its first transparent version of Micro-LED display technology, which it claims is better than other transparent screens. At CES, Samsung introduced new non-transparent 76-inch and non-transparent 114-inch Micro LED models. Samsung's 110-inch micro LED 4K TV is priced at around USD150,000.

In January 2024, LG Electronics unveiled the world's first wireless transparent OLED TV at CES 2024. The LG SIGNATURE OLED T combines a transparent 4K OLED screen and LG's wireless video and audio transmission technology to transform the screen experience in ways that have never been possible before. The OLED T unlocks a world of near-limitless potential, giving users the unprecedented freedom to meticulously curate their living spaces.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Advanced Displays in the Automotive Market

- 5.1.2 Growth of Augmented and Virtual Reality

- 5.2 Market Restraints

- 5.2.1 Complex Manufacturing Process and Expensive to Deploy in Consumer Products

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 LCD

- 6.1.2 OLED

- 6.1.3 Other Technologies

- 6.2 By End-user Industry

- 6.2.1 Retail

- 6.2.2 Consumer Electronics

- 6.2.3 Automotive

- 6.2.4 Aerospace and Defense

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.3.5 Australia and New Zealand

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Planar Systems Inc. (Leyard Optoelectronic Co.)

- 7.1.2 Samsung Electronics Co. Ltd

- 7.1.3 LG Electronics Co. Ltd

- 7.1.4 Panasonic Corporation

- 7.1.5 Pro Display

- 7.1.6 Crystal Display Systems Ltd

- 7.1.7 Hangzhou Hikvision Digital Technology Co. Ltd

- 7.1.8 Nexnovo Technology Co. Ltd

- 7.1.9 2Point0 Concepts

- 7.1.10 Shenzhen AuroLED Technology Co. Ltd

- 7.1.11 BOE Technology Group

8 INVESTMENT ANALYSIS

9 FUTURE TRENDS