PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444193

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444193

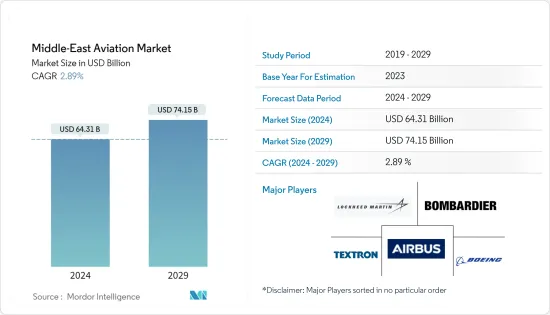

Middle-East Aviation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Middle-East Aviation Market size is estimated at USD 64.31 billion in 2024, and is expected to reach USD 74.15 billion by 2029, growing at a CAGR of 2.89% during the forecast period (2024-2029).

Aviation passenger traffic in the Middle East increased every year over the past decade until 2019. However, the passenger traffic growth decreased in 2019 compared to 2018, and the advent of the COVID-19 pandemic further slashed passenger traffic in 2020 and 2021. According to IATA, for 2021, annual passenger volumes of Middle Eastern airlines were 71.6% below 2019. The region is home to some prominent full-service carriers operating long-haul routes, like Emirates, Etihad, and Qatar Airways, which witnessed huge losses due to the closure of international borders.

Additionally, with the international passenger traffic projected to recover slower than domestic travel, several full-service carriers in the region have canceled or deferred their aircraft orders. Nevertheless, the advent of new budget carriers, like Air Arabia Abu Dhabi and Wizz Air Abu Dhabi, is expected to propel the demand for new narrow-body aircraft in the future.

On the other hand, the general aviation sector is recovering quickly due to the high demand for private travel in the region. A large number of high-net-worth individuals in the region have resulted in a higher preference for business jet and helicopter travel during the pandemic.

Military aviation has not witnessed any major disruption in demand in the region, as countries are proceeding with their procurement plans without delays in delivery timelines. Military aviation in the Middle East is expected to witness impressive growth in the coming years, owing to various combat aircraft procurement plans by countries like Turkey, Kuwait, Qatar, and Bahrain.

Middle East Aviation Market Trends

Growing Demand for Business Jets will Drive the General Aviation Segment During the Forecast Period

The Middle East has been a lucrative market for both the business and private aviation verticals due to the presence of a large high net worth and ultra-high net worth individual (HNWI/UHNWI) population in the region. There is a high demand for large-cabin and long-range business jets in the Middle East due to their high luxury and comfort. In 2021, 14 business jets were delivered to the customers in the Middle East, and the business jet demand is expected to grow in the coming years in the region after a downfall of several years. Due to the growing concerns regarding the spread of the COVID-19, first-class and corporate travelers are expected to prefer general aviation options for safer and quicker transport, which is expected to drive the segment in the future. Business jet manufacturers have also shifted their focus onto the region. They consider the Middle East a high potential region for future business jet sales, as several companies in the United States and Europe are cutting back on frills like the corporate plane charter to save money and appease investors. Additionally, the growth in demand for charter operations is driving the segment, as several charter companies are expanding their fleets with the addition of new business jets. For instance, in December 2021, Qatar Executive announced that it had taken delivery of three Gulfstream G650ER aircraft, taking the total G650 aircraft in its fleet to 11. Such developments are expected to drive the growth of the segment during the forecast period.

Saudi Arabia is Expected to Dominate the Market During the Forecast Period

In the Middle Eastern aviation market, Saudi Arabia currently accounts for a major market share. The country is undergoing a progressive change to become a key aviation-related industry in the region and is witnessing an increase in the number of developments related to the market. Saudi Arabia has long recognized the aviation sector as a means to drive economic growth. The privatization of airports has played a major role in increasing the growth of the aviation industry in Saudi Arabia. Moreover, in the last two decades, the aviation market in Saudi Arabia witnessed significant growth in terms of airport infrastructure. With the air passenger traffic showing signs of recovery and the government offering financial aid, airlines in the country are now focusing on fleet expansion. As of November 2021, Saudi Arabian Airlines is considering a massive aircraft order of more than 100 aircraft from either Airbus or Boeing. The airline is targeting a fleet of 250 aircraft by 2030. On the other hand, military aviation in Saudi Arabia is witnessing significant growth and changes. Saudi Arabia is expanding its military aviation fleet, for which they have already placed orders for several military aircraft. The ongoing rivalry between Saudi Arabia and Iran may be the main driver, which is likely to lead to a growth in terms of military aircraft acquisitions in Saudi Arabia. In March 2021, Lockheed Martin subsidiary, Sikorsky, announced that it had obtained a USD 53.87 million contract modification to produce four UH-60M Black Hawk helicopters for Saudi Arabia. The deliveries are expected to be completed by June 2022. Saudi Arabia is also a lucrative market for general aviation in the Middle Eastern region. The high wealth in the country and the focus of the government to transform the country into a major tourist hub as part of the Vision 2030 are projected to drive the market for general aviation during the forecast period.

Middle East Aviation Industry Overview

Lockheed Martin Corporation, Bombardier Inc., The Boeing Company, Airbus SE, and Textron Inc. are some of the prominent players in the Middle Eastern aviation market. Various initiatives and product innovations have led the companies to strengthen their presence in the market. For Airbus and Boeing, the Middle East has been a major demand-generating region for wide-body aircraft over the years. However, this is expected to change due to the emergence of new LCCs and the slump in demand for long-haul flights. In the military sector, players from Turkey are expected to increase their market share during the forecast period, as the country has been focusing on developing its domestic aircraft development and manufacturing capabilities. On the other hand, as the Middle East becomes a lucrative market for business jets, several business jet orders are expected from this region over the next decade. This is expected to further intensify the rivalry among the players in the market in the coming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

- 3.1 Market Size and Forecast, 2018 - 2027

- 3.2 Market Share by Application, 2021

- 3.3 Market Share by Geography, 2021

- 3.4 Structure of the Market and Key Participants

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD billion)

- 5.1 By Application

- 5.1.1 Commercial Aircraft

- 5.1.1.1 Passenger Aircraft

- 5.1.1.2 Freighter

- 5.1.2 Military Aircraft

- 5.1.2.1 Combat Aircraft

- 5.1.2.2 Non-combat Aircraft

- 5.1.3 General Aviation

- 5.1.3.1 Helicopter

- 5.1.3.2 Piston Fixed-wing Aircraft

- 5.1.3.3 Turboprop Aircraft

- 5.1.3.4 Business Jet

- 5.1.1 Commercial Aircraft

- 5.2 By Geography

- 5.2.1 Saudi Arabia

- 5.2.2 United Arab Emirates

- 5.2.3 Qatar

- 5.2.4 Israel

- 5.2.5 Turkey

- 5.2.6 Rest of the Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ATR Aircraft

- 6.1.2 Bombardier Inc.

- 6.1.3 Embraer SA

- 6.1.4 The Boeing Company

- 6.1.5 Airbus SE

- 6.1.6 Leonardo SpA

- 6.1.7 Textron Inc.

- 6.1.8 Dassault Aviation SA

- 6.1.9 General Dynamics Corporation

- 6.1.10 Cirrus Aircraft Corp.

- 6.1.11 Honda Aircraft Company

- 6.1.12 Lockheed Martin Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS