PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1639406

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1639406

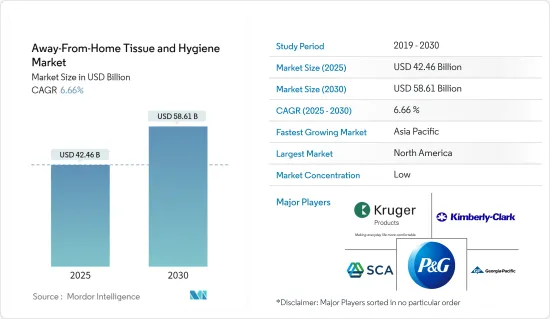

Away-From-Home Tissue and Hygiene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Away-From-Home Tissue and Hygiene Market size is estimated at USD 42.46 billion in 2025, and is expected to reach USD 58.61 billion by 2030, at a CAGR of 6.66% during the forecast period (2025-2030).

It is estimated that more than 9% of the paper products processed worldwide end up as tissue products, accounting for at least 21 million tons of tissue paper annually. In recent years, away-from-home products are estimated to be accountable for more than one-third of global tissue consumption, and these products are increasing at a moderate pace every year. Furthermore, the Russia-Ukraine war has an impact on the overall ecosystem of the market.

Key Highlights

- Most away-from-home tissue products are bought by building owners, institutions, and janitorial services directly from distributors. The products are usually bought in bulk and are often installed in dispensers used in their establishments to maintain customers' loyalty toward that brand. The primary ground of competition usually revolves around the product's price, compatibility with dispensers, and ease of replenishment.

- These products have become one of the most widely used commodities in the world. The increasing demand from urban regions for away-from-home tissue products is mainly driving the hygiene market. Many end users, from restaurants and food trucks to commercial users, have a constant demand for these products in urban markets compared to rural establishments that rely on retail variants.

- The high raw material price is a significant factor that is limiting the growth of the market for tissue all over the world. Moreover, new innovative products, such as electronic dryers, are impacting the development of the market.

Away From Home Tissue Market Trends

Toilet Paper to Occupy the Maximum Market Demand

- Paper and cloth towels in the market are proven to have the highest drying capacity compared to other alternatives, like electronic dryers. According to a study conducted by Mayo Clinic Proceedings, a prominent medical journal, on the drying efficiency of several hand drying methods, the results indicated that residual water was more efficiently removed from the hands by paper towels compared to jet and hot air dryers.

- Recent studies claim that 3 in 10 shoppers are considered heavy users of bathroom tissues and shop for about 13 rolls every month. Toilet papers are seeing the advantage of the support of effective category segmentation and added value innovations. Prime innovations, like dermatologically tested, flushable, and double-layered toilet papers, distinguish general toilet papers from premium ones.

- In some countries, the market's value growth is entirely driven by the introduction of premium and super-premium toilet paper. The differentiation of these premium and super-premium away-from-home tissue and hygiene products are already seen on supermarket shelves in the form of premium packaging, as the biggest sub-sector of away-from-home market bathroom tissues are already enjoying household penetration rates close to 100%.

Asia-Pacific to be the Fastest Growing Market

- In Asia- Pacific, countries like China, Australia, Singapore, and India stood as the key source of demand for these products. The high demand from the market channels, such as hospitals and healthcare units, hospitality units, food businesses, and other businesses, is driving the demand for away-from-home tissue and hygiene products in the region. The highest demand was recorded in restaurants, stores, public toilets, etc., for environmental sanitation needs, where hygiene products are provided widely for customers.

- The rapidly growing middle-class population in many Asia-Pacific countries and the increasing disposable incomes of the population significantly increased domestic travel, which drives the demand for away-from-home tissue and hygiene products.

- The region is also becoming one of the most famous medical tourism hubs. There are more than 0.3 million births and 0.1 million deaths every day in the region, which leads to increased consumption of away-from-home tissue and hygiene products, such as wipes, paper towels, and napkins, in both domestic users and commercial users, like hospitals and the healthcare industry.

Away From Home Tissue Industry Overview

The away-from-home tissue and hygiene market is highly fragmented. Due to high demand, many players are entering the market to have a stronghold in it by developing high-quality products for various end-user applications. Some key players include Kimberly-Clark Corporation, Georgia Pacific LLC (Koch industries), SCA (Svenska Cellulosa Aktiebolaget), Procter & Gamble, Clearwater Paper Corporation, Wausau Paper Corp., and Kruger Products, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Recycled Products

- 4.2.2 Increased Spending on Hygiene

- 4.3 Market Restraints

- 4.3.1 Growing Trend of Electronic Dryers

- 4.3.2 Slow Growth In the Market

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Paper Napkins

- 5.1.2 Paper Towels

- 5.1.3 Wipes

- 5.1.4 Toilet Papers

- 5.1.5 Incontinence Products

- 5.1.6 Other Product Types

- 5.2 By End User

- 5.2.1 Commercial

- 5.2.2 Food and Beverages Industry

- 5.2.3 Hospitals and Healthcare

- 5.2.4 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Kimberly-Clark Corporation

- 6.1.2 Georgia Pacific LLC

- 6.1.3 SCA (Svenska Cellulosa Aktiebolaget)

- 6.1.4 Procter & Gamble

- 6.1.5 Cascades Tissue Group Inc.

- 6.1.6 Wausau Paper Corp.

- 6.1.7 Sofidel Group

- 6.1.8 Clearwater Paper Corporation

- 6.1.9 Kruger Products

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS