PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1331345

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1331345

Global Medical Electrodes Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028)

The Medical Electrodes Market size is expected to grow from USD 0.94 billion in 2023 to USD 1.14 billion by 2028, at a CAGR of 4.10% during the forecast period (2023-2028).

Key Highlights

- The COVID-19 pandemic significantly impacted the medical electrodes market. A study published in the Journal of Neurosurgical Anesthesiology in March 2022 showed that SARS-CoV-2 had a detrimental impact on the central nervous system, with investigations using a full montage of electroencephalogram (EEG) electrodes revealing nonspecific EEG abnormalities associated with COVID-19 infection.

- Furthermore, most COVID-19 patients showed symptoms of EEG discontinuity during monitoring using a shortened electrode montage, resulting in increased use of medical electrodes for COVID-19 patients. However, the demand for non-emergency diagnosis and treatment procedures decreased during the pandemic. Nevertheless, the market is growing at a stable pace due to the resumption of hospital services, diagnosis procedures, and product availability. It is expected to continue this trend in the coming years.

- The growth of the medical electrodes market can mainly be attributed to the increasing prevalence of cardiovascular and neurological diseases, technological advancements, and a rising focus on minimally invasive surgeries. The rise in neurological conditions, including cerebrovascular disease, Alzheimer's, dementia, migraine, epilepsy, tetanus, meningitis, Parkinson's disease, multiple sclerosis, and poliomyelitis, is expected to lead to increased research on neurophysiological pathways, resulting in higher adoption of medical electrodes and boosting market growth. According to a report published by the Alzheimer's Association in March 2022, Alzheimer's dementia is expected to affect an estimated 6.7 million Americans aged 65 and above in 2023, and this figure may rise to 13.8 million by 2060 unless medical breakthroughs are developed to prevent, delay, or cure the disease.

- In addition, companies are making rigorous investments toward the development of efficient diagnostic and therapeutic platforms, indicating promising growth prospects for the medical electrode market. These companies are focusing on growth strategies such as new product launches, mergers and acquisitions, and portfolio expansion. For example, in September 2021, NeuroOne Medical Technologies Corporation received Food and Drug Administration (FDA) clearance to market its Evo sEEG Electrode technology. Promising outcomes and increasing competition among leading medical device companies to approve and commercialize products in different areas of unmet medical needs are expected to boost the medical electrodes market.

- However, the biocompatibility of medical electrodes and the stringent regulatory guidelines, coverage, and different approval processes in various countries are significant barriers to the medical electrode market's growth. Despite these challenges, the growing burden of neurological diseases and product launches are expected to propel the market's growth over the forecast period.

Medical Electrodes Market Trends

Cardiology Segment Expected to Witness Significant Growth Rate Over the Forecast Period

- Electrodes are strategically placed on the chest, arms, and legs, and the lead wires connect them to ECG equipment. The electrical activity of the heart is measured, interpreted, and printed to detect cardiovascular events such as heart attacks, heart failure, endocarditis, irregular heartbeats, and others. During each cardiac cycle, the electrodes detect the small electrical changes caused by heart muscle depolarization and repolarization.

- The standard 12-lead electrocardiogram (ECG) is widely used in assessing cardiovascular diseases and is considered one of the most important tests for interpreting cardiac rhythm, detecting myocardial ischemia and infarction, conduction system abnormalities, preexcitation, long QT syndromes, atrial abnormalities, ventricular hypertrophy, pericarditis, and other conditions.

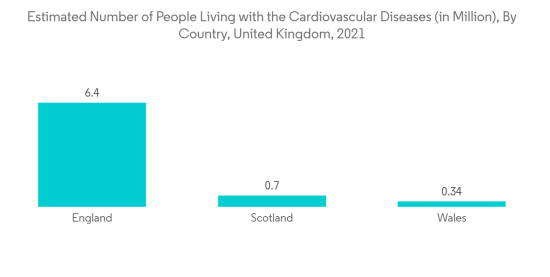

- Moreover, the prevalence of heart diseases is growing, which is expected to fuel the market's growth. According to a February 2023 report by the British Heart Foundation, there were 7.6 million people with heart and circulation illnesses in the UK by 2021. The electrodes record, analyze and print the heart's electrical activity. Therefore, the high burden of cardiac illnesses is anticipated to drive segment expansion over the forecast period.

- Furthermore, increasing demand for cardiology electrodes, intensified R&D efforts, improvements in cardiology electrode technology, and expanding awareness about the benefits of using cardiology electrodes are significant factors predicted to drive the cardiology electrodes segment. For example, in September 2021, Bittium introduced a new generation of electrodes, including the Bittium OmegaSnap patch electrodes, designed with user comfort in mind to provide a patient-friendly solution for continuous ECG measurements for up to 7 days without needing to replace the electrode.

- In conclusion, the growing prevalence of cardiac diseases and the introduction of new products by market players are expected to drive the growth of the cardiology electrodes segment over the forecast period.

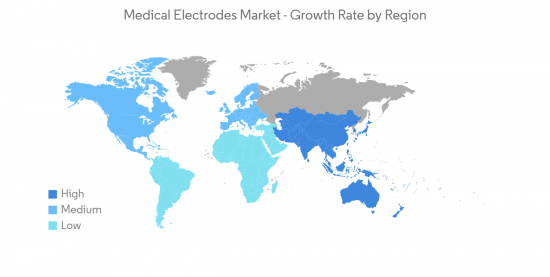

North America Expected to Hold a Significant Share in the Market Over the Forecast Period

- The North American region commands a significant share of the market studied, primarily due to its superior healthcare infrastructure, effective government policies, vast multinational company base, and a high level of awareness about testing and testing devices in healthcare. This region also witnesses a high prevalence of chronic inflammatory disorders, such as cardiovascular diseases, diabetes, inflammatory bowel disease (IBD), and cancer, compared to other chronic indications.

- According to the Government of Canada's statistics published in November 2021, approximately 229,200 Canadians were diagnosed with cancer in 2021, with prostate cancer expected to remain the most diagnosed cancer, accounting for 46% of all cancer diagnoses. Furthermore, a 2022 article published by the Centers for Disease Control and Prevention (CDC) reveals that about 20.1 million adults aged 20 years and older had coronary artery disease in the United States in 2020, and each year, around 805,000 people in the United States have a heart attack. As a result, the high burden of cardiovascular diseases is anticipated to drive the demand for effective diagnosis and fuel market growth in this country over the forecast period.

- In addition, several market players are implementing various strategic initiatives, including product launches. For example, in February 2021, Stratus Medical was granted a third US patent related to its Nimbus RF Multitined Expandable Electrode. US Patent No. 10,925,664, titled "Methods For Radio Frequency Neurotomy," was issued on February 23, 2021, by the United States Patent and Trademark Office.

- Furthermore, in May 2021, a DC-based startup, iCE Neuro Systems, received approval from the United States Food and Drug Administration (USFDA) for a subcutaneous electrode called iCE-SG, designed to monitor the brain's electrical activity from beneath the skin of the scalp.

- Therefore, considering these factors, such as rising chronic disease incidence and product launches, the market studied is expected to experience growth over the forecast period.

Medical Electrodes Industry Overview

The medical electrodes market is moderately competitive and consists of global and local players. Some prominent players are vigorously making acquisitions and joint ventures with other companies to consolidate their market positions across the world. Due to the increase in cardiovascular and neurological diseases across the world, companies are coming up with novel products to cater to consumers across different geographies. 3M, CONMED Corporation, Koninklijke Philips NV, Medtronic PLC, Natus Medical Incorporated, and Nihon Kohden Corporation are some of the major players in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Cardiovascular and Neurological Diseases

- 4.2.2 Increasing Technological Advancements

- 4.2.3 Rising Focus toward Minimally Invasive Surgeries

- 4.3 Market Restraints

- 4.3.1 Biocompatibility Issues with Medical Electrodes

- 4.3.2 Stringent Regulatory Guidelines Associated with Medical Electrodes

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product Type

- 5.1.1 Surface Electrodes

- 5.1.2 Needle Electrodes

- 5.2 By Usability

- 5.2.1 Disposable Medical Electrodes

- 5.2.2 Reusable Medical Electrodes

- 5.3 By Modality Type

- 5.3.1 Electrocardiography (ECG)

- 5.3.2 Electroencephalography (EEG)

- 5.3.3 Electromyography (EMG)

- 5.3.4 Brainstem Auditory Evoked Potentials (BAEPS)

- 5.3.5 Other Modality Types

- 5.4 By Application

- 5.4.1 Cardiology

- 5.4.2 Neurophysiology

- 5.4.3 Sleep Disorders

- 5.4.4 Intraoperative Monitoring

- 5.4.5 Other Applications

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 3M

- 6.1.2 Ad-Tech Medical Instrument Corporation

- 6.1.3 Ambu AS

- 6.1.4 Cognionics Inc.

- 6.1.5 Cardinal Health

- 6.1.6 CONMED Corporation

- 6.1.7 Cooper Surgical Inc.

- 6.1.8 Dymedix

- 6.1.9 Koninklijke Philips NV

- 6.1.10 DCC Healthcare (Leonhard Lang GmbH)

- 6.1.11 Medtronic PLC

- 6.1.12 Natus Medical Incorporated

- 6.1.13 Nihon Kohden Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS