PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850128

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850128

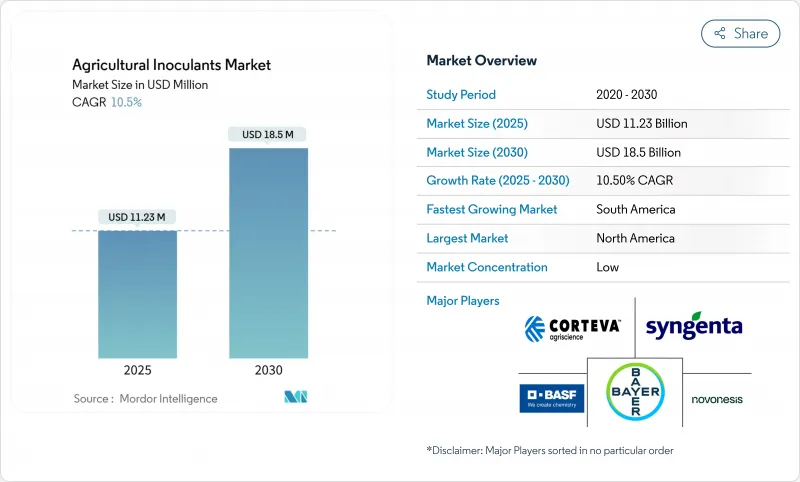

Agricultural Inoculants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The agricultural inoculants market is valued at USD 11.23 billion in 2025 and is projected to reach USD 18.50 billion by 2030, reflecting a 10.5% CAGR.

Growth now rests on these converging forces: mounting policy pressure to curb synthetic fertilizer emissions, stronger carbon-credit incentives that reward biological nitrogen fixation, and rising retail demand for residue-free food that meets tightening organic standards. The sector has moved from niche biological inputs toward mainstream crop-management tools as farmers recognize measurable yield stability and soil health gains. Suppliers capture attractive margins through premium, multi-strain formulations that align with sustainability targets while lowering nutrient costs for growers. Key capital inflows reinforce the uptrend. Venture funding in microbial encapsulation and AI-guided application systems is scaling quickly, giving start-ups the resources to commercialize differentiated technologies. At the same time, incumbents accelerate research and development in next-generation delivery methods that extend microbial viability and simplify on-farm use. This dual track of innovation and consolidation signals a market poised for continued expansion as value shifts from commodity single-strain products to integrated biological platforms that deliver verifiable agronomic outcomes.

Global Agricultural Inoculants Market Trends and Insights

Shift toward organic certification standards

Retailers and consumers now demand residue-free produce, creating a sizable market for inputs that meet strict organic standards. The European Union's Farm to Fork strategy, aiming for a 50% cut in chemical pesticide use by 2030, accelerated microbial adoption across the bloc. Updated USDA National Organic Program rules clarify acceptable microbial production practices, reducing buyer uncertainty and supporting supplier investment. Organic price premiums ranging from 20% to 40% justify higher upfront costs for biological inoculants. Nevertheless, smaller growers without specialized storage and handling infrastructure face hurdles in maintaining certification throughout the supply chain.

Shrinking arable land and food-security pressures

Global arable land per capita fell from 0.38 ha in 1970 to 0.19 ha in 2020, sharpening the focus on yield intensification rather than land expansion. In Asia-Pacific, rapid urbanization amplifies this pressure. Field studies show microbial inoculants can raise yields 4.8-6.2% in low-productivity soils by improving nutrient cycling and soil structure. For regions where land prices exceed USD 10,000 per hectare, biological inputs offer a cost-effective intensification pathway. The benefit grows as synthetic fertilizer prices remain volatile due to energy-market tightness.

Farmer awareness gaps and on-farm handling complexity

Many farmers lack training on microbial storage, viability testing, and application timing. Extension agents often focus on fertilizers and pesticides, leaving a knowledge gap for biologicals. As a result, product mishandling leads to inconsistent performance and skepticism. Brazil's "nodule crushing" technique, which lets growers propagate rhizobia from root nodules, shows that grassroots innovation can fill extension gaps and lower adoption barriers.

Other drivers and restraints analyzed in the detailed report include:

- Rapid expansion of seed-applied biological consortia

- Venture investment in encapsulation tech for microbes

- Preference for fast-response synthetic fertilizers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Crop nutrition applications captured 52% of 2024 revenue as nitrogen-fixing and phosphorus-solubilizing microbes replaced portions of synthetic fertilizers. The agricultural inoculants market size for nutrition is projected to expand steadily as rising fertilizer costs encourage biological substitution. Farmers appreciate documented savings of 15-25% on nitrogen inputs while maintaining yields, which translates into rapid payback periods.

Crop protection biologicals, while contributing a smaller base, are set for a 10.9% CAGR through 2030. Regulatory crackdowns on chemical pesticides and a surge in resistance issues among major pathogens are accelerating demand. Companies now bundle microbial protectants with nutritional strains, promising holistic soil-to-leaf coverage. This convergence pressures standalone nutrition providers to broaden portfolios or risk losing share to integrated offerings.

Bacteria held 71% of the agricultural inoculants market share in 2024, reflecting decades of rhizobia success in legumes and growing use in cereals. This leadership rests on well-documented efficacy, low cost, and familiarity among regulators.

Fungi are the fastest-growing group, projected at an 11.5% CAGR to 2030. Trichoderma and mycorrhiza strains gain traction for disease suppression and phosphorus uptake. Advances in encapsulation enhance shelf stability, while recent EPA tolerance exemptions smooth approvals. Although bacterial incumbents retain scale advantages, fungal innovators attract investment for premium stress-mitigation benefits.

The Agricultural Inoculants Market Report is Segmented by Function (Crop Nutrition and Crop Protection), Microorganism (Bacteria, Fungi, and Other Microorganisms), Mode of Application (Seed Inoculation and Soil Inoculation), Crop Type (Grains and Cereals, Pulses and Oilseeds, and More), and Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintained the largest regional share in 2024, supported by robust research and development activity and well-established ag-input distribution networks. The region's 6.9% CAGR to 2030 trails the global average because many growers remain unconvinced that biologicals can match the reliability of synthetic fertilizers. Regulatory pathways are gradually improving, and recent EPA exemptions for Bacillus and Trichoderma strains shorten the time to market for new products. Continued farmer education and carbon-credit integration could lift adoption across the Corn Belt and Prairie Provinces.

South America is the fastest-growing region with a 10.4% CAGR. Brazil's National Bio-inputs Program generated BRL 5 billion (USD 1 billion) in sales in the 2023-24 season, up 15%, underscoring strong policy support. Argentina's mature soybean inoculation infrastructure complements Brazil's aggressive new-crop initiatives, creating a continent-wide hotspot. Multinational firms are deepening local partnerships, as shown by ICL's acquisition of Nitro 1000 and FMC's pact with Ballagro, to secure regulatory footholds and production capacity.

Asia-Pacific and Africa present emerging opportunities, growing at 9.8% and 8.3% CAGRs, respectively. China's registration of over 550 microbial pesticide products shows regulatory momentum, while India's Central Insecticides Board approved 416 biologic agendas in early 2024. In Africa, smallholder-friendly approaches such as on-farm rhizobia propagation bypass cold-chain constraints, but broader market development still depends on extension support and finance access for inoculant application equipment.

- BASF SE

- Novonesis (Novozymes A/S)

- Corteva Agriscience

- Premier Tech Ltd.

- Lallemand Inc.

- Lesaffre - Agrauxine (Lesaffre Group)

- Bioceres Crop Solutions Corp.

- Verdesian Life Sciences (AEA Investors)

- Mapleton Agri Biotec

- New Edge Microbials

- T. Stanes and Company (Amalgamations Group)

- Valent BioSciences (Sumitomo Chemical)

- Bayer AG

- Syngenta AG (ChemChina)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift toward organic certification standards

- 4.2.2 Shrinking arable land and food-security pressures

- 4.2.3 Government fertilizer subsidy realignment toward bio-inputs

- 4.2.4 Rapid expansion of seed-applied biological consortia

- 4.2.5 Venture investment in encapsulation technology for microbes

- 4.2.6 Carbon-credit monetization for biological nitrogen fixation

- 4.3 Market Restraints

- 4.3.1 Farmer awareness gaps and on-farm handling complexity

- 4.3.2 Preference for fast-response synthetic fertilizers

- 4.3.3 Regulatory gray zones for stacked microbial cocktails

- 4.3.4 Biological contamination risk in extended supply chains

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts

- 5.1 By Function (Value)

- 5.1.1 Crop Nutrition

- 5.1.2 Crop Protection

- 5.2 By Microorganism (Value)

- 5.2.1 Bacteria

- 5.2.1.1 Rhizobacteria

- 5.2.1.2 Azotobacter

- 5.2.1.3 Phosphobacteria

- 5.2.1.4 Other Bacteria

- 5.2.2 Fungi

- 5.2.2.1 Trichoderma

- 5.2.2.2 Mycorrhiza

- 5.2.2.3 Other Fungi

- 5.2.3 Other Microorganisms

- 5.2.1 Bacteria

- 5.3 By Mode of Application (Value)

- 5.3.1 Seed Inoculation

- 5.3.2 Soil Inoculation

- 5.4 By Crop Type (Value)

- 5.4.1 Grains and Cereals

- 5.4.2 Pulses and Oilseeds

- 5.4.3 Commercial Crops

- 5.4.4 Fruits and Vegetables

- 5.4.5 Other Applications

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Italy

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Kenya

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)}

- 6.4.1 BASF SE

- 6.4.2 Novonesis (Novozymes A/S)

- 6.4.3 Corteva Agriscience

- 6.4.4 Premier Tech Ltd.

- 6.4.5 Lallemand Inc.

- 6.4.6 Lesaffre - Agrauxine (Lesaffre Group)

- 6.4.7 Bioceres Crop Solutions Corp.

- 6.4.8 Verdesian Life Sciences (AEA Investors)

- 6.4.9 Mapleton Agri Biotec

- 6.4.10 New Edge Microbials

- 6.4.11 T. Stanes and Company (Amalgamations Group)

- 6.4.12 Valent BioSciences (Sumitomo Chemical)

- 6.4.13 Bayer AG

- 6.4.14 Syngenta AG (ChemChina)

7 Market Opportunities and Future Outlook