Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687313

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687313

UK Snack Bar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 157 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

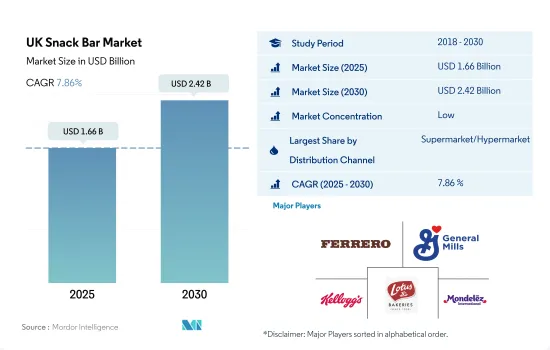

The UK Snack Bar Market size is estimated at 1.66 billion USD in 2025, and is expected to reach 2.42 billion USD by 2030, growing at a CAGR of 7.86% during the forecast period (2025-2030).

Supermarket/hypermarket accounted for a major share due to strong penetration across the country coupled with discounts offered on the snack bars

- Supermarkets/hypermarkets are the largest channels in the UK snack bar market. The channel held the major share of 53% by value in the overall distribution channels segment. These channels provide a super-sized shopping experience with suitable displays and assortments of indulgent snacking products. The proximity factor of these channels, especially in bigger cities and metropolitan areas, gives them an added advantage of influencing the snacking habits of consumers. Some of the popular stores operating across the country are Tesco PLC, J Sainsbury PLC, Asda Stores Ltd, Wm Morrison Supermarkets PLC, Lidl, and Aldi. In 2022, Tesco and Asda had 3,456 stores and 497 Morrisons stores in the United Kingdom.

- Convenience stores are the second most widely preferred distribution channels after supermarkets and hypermarkets for the purchase of snack bars. The volume sales of snack bars through convenience stores is estimated to register a 35.56% volume share in 2024. Consumer preference toward convenience stores is due to ease of access and being open for longer hours compared to traditional stores. In 2022, there were 48,590 convenience stores located across the United Kingdom.

- The online retail channel is considered the fastest-growing segment across the country. Snack bar sales are anticipated to grow through these channels at a rate of 6.58% from 2023 to 2024 in value terms due to consumers' preference for buying on the internet, especially the goods they are familiar with, such as confectionaries, in terms of the manufacturer's name, brand positioning, image, and packaging design.

UK Snack Bar Market Trends

The introduction of healthy variants like clean label, natural, and organic snack bar products across the country resulted in higher sales

- Adults' average mealtimes are getting shorter, especially among consumers in the working class, and there is an increasing desire for alternatives for portion control. Snack bars have grown in popularity as acceptable alternatives to breakfast foods.

- The demand for fair trade snack bars and other clean labeling is expected to be the key trends that influence the consumer's purchase and continue to influence the market forward over the years. In 2023, 77% of people in the UK will choose Fairtrade products, including snack bars, demonstrating continued consumer commitment to products that are ethically and sustainably produced.

- Price is a significant factor in consumer buying behavior for snack bars in the United Kingdom. The trend of premium snack bars is expected to drive market growth and consumer recognition in this country.

- Consumers in the United Kingdom consume many kinds of snack bars with different health benefits. For instance, bars that are high in protein (20 grams or more) are aimed to be eaten after intense exercise, so they are perfect for active types.

UK Snack Bar Industry Overview

The UK Snack Bar Market is fragmented, with the top five companies occupying 28.55%. The major players in this market are Ferrero International SA, General Mills Inc., Kellogg Company, Lotus Bakeries and Mondelez International Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 61163

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Regulatory Framework

- 4.2 Consumer Buying Behavior

- 4.3 Ingredient Analysis

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Confectionery Variant

- 5.1.1 Cereal Bar

- 5.1.2 Fruit & Nut Bar

- 5.1.3 Protein Bar

- 5.2 Distribution Channel

- 5.2.1 Convenience Store

- 5.2.2 Online Retail Store

- 5.2.3 Supermarket/Hypermarket

- 5.2.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Abbott Laboratories

- 6.4.2 Associated British Foods plc

- 6.4.3 August Storck KG

- 6.4.4 Ferrero International SA

- 6.4.5 General Mills Inc.

- 6.4.6 Kellogg Company

- 6.4.7 Lotus Bakeries

- 6.4.8 Mars Incorporated

- 6.4.9 Mondelez International Inc.

- 6.4.10 PepsiCo Inc.

- 6.4.11 Post Holdings Inc.

- 6.4.12 Simply Good Foods Co.

- 6.4.13 The Hershey Company

- 6.4.14 Wholebake Limited

- 6.4.15 YIldIz Holding AS

7 KEY STRATEGIC QUESTIONS FOR CONFECTIONERY CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.