PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1433492

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1433492

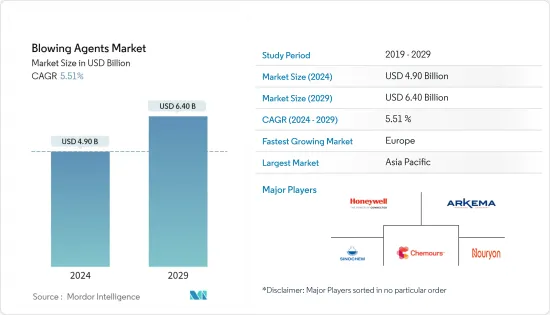

Blowing Agents - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Blowing Agents Market size is estimated at USD 4.90 billion in 2024, and is expected to reach USD 6.40 billion by 2029, growing at a CAGR of 5.51% during the forecast period (2024-2029).

Major factors driving the market studied is rise in demand for polymeric insulation foams for buildings, automotive, and appliances. stringent environmental regulations regarding blowing agents is expected to hinder the growth of the market studied.

Key Highlights

- High Demand for Zero Ozone Depletion Potential (ODP) and Low Global Warming Potential (GWP) Blowing Agents is likely to act as an opportunity in the future.

- In terms of revenue, North America dominated the market studied during the forecast period. In terms of volume, Asia-Pacific dominated the global market.

Blowing Agents Market Trends

Increasing Demand from the Building and Construction Industry

- Owing to their non-VOC, non-ozone depleting, low global warming potential, and reduced energy consumption, blowing agents are environmentally acceptable, and are thus, used in building and construction. They help to create better uniform components, resulting in better, tighter insulation, higher energy efficiency, and limited energy consumption.

- Blowing agents are used as a component in building insulation, such as block pipe and roof insulation, doors, sheathing, and in structures that require foundation. They are also used as sealants for windows and doors.

- They are majorly used in polyurethane foams that have high utilization in pipes to prevent loss of heat and to maintain temperatures even during cold climates, to avoid freezing or cracking for long-distance heating.

- They are also used in phenolic foams, but with limited usage. Phenolic foams are majorly used in panels to act as insulating barriers in roofing, wall cavities, and floor insulation. The increasing construction activities worldwide is expected to significantly boost the blowing agents market.

- The Asia-Pacific region dominates the building and construction sector, with India, China, and various other South East Asian countries driving the market growth significantly.

- The positive factors like the aforementioned ones are expected to drive the market growth through the forecast period.

China to Dominate the Asia-Pacific Market

- As a Group I member, China is expected to freeze HFC production and use at agreed baseline levels, by or before 2024, and is expected to phase down the production and use, beginning with a 10% phasedown below freeze levels, by 2029.

- Though the usage of CFC-11 was banned internationally in 2010, owing to the ozone depletion effects of the substance, evidence has been found proving the illegal production and usage of CFC-11 as a blowing agent in the rigid polyurethane foam insulation sector. According to a field study carried out by the Environmental Investigative Agency, a UK-based NGO, the atmospheric levels of CFC-11 in China are significantly greater than expected, proving the harmful nature of CFC-11.

- Apart from the banned CFCs and HCFCs (whose usage is regulated and is expected to phase out by 2040), China has been using alternative blowing agents, like preblended CP (cyclopentane), HFO blends, and water.

- China has the world's largest construction industry. However, the growth rate of the industry has become increasingly modest, as the Chinese government is looking to shift toward a services-led economy.

- China has the second-largest packaging industry in the world and is expected to witness a consistent growth during the forecast period, owing to the rise of customized packaging, increased demand for microwave food, snack foods, and frozen foods, among others.

- China has the world's largest textile and apparel industry, which is also a key player for the country's economy. However, there has been a drop in the market share occupied by the country in the global apparel export market, owing to the trade war with the United States and maturation of the market.

- Hence, the aforementioned factors are likely to affect the demand for blowing agents in China during the forecast period.

Blowing Agents Industry Overview

The global market for blowing agents is fragmented. There are many local players in the market along with international players. The major companies include Honeywell International Inc., The Chemours Company, Arkema, Sinochem Group Co. Ltd, and Nouryon, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rise in Demand for Polymeric Insulation Foams for Buildings, Automotive, and Appliances

- 4.1.2 Increasing Demand for Foam Blowing Agents in the Manufacturing of Polyurethane Foams

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations Regarding Blowing Agents

- 4.2.2 Impact of COVID-19

- 4.2.3 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Policies and Regulations

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Hydrochlorofluorocarbons (HCFCs)

- 5.1.2 Hydrofluorocarbons (HFCs)

- 5.1.3 Hydrocarbons (HCs)

- 5.1.4 Hydrofluoroolefin (HFO)

- 5.1.5 Other Product Types

- 5.2 Foam Type

- 5.2.1 Polyurethane Foam

- 5.2.2 Polystyrene Foam

- 5.2.3 Phenolic Foam

- 5.2.4 Polypropylene Foam

- 5.2.5 Polyethylene Foam

- 5.2.6 Other Foam Types

- 5.3 Application

- 5.3.1 Building and Construction

- 5.3.2 Automotive

- 5.3.3 Bedding and Furniture

- 5.3.4 Appliances

- 5.3.5 Packaging

- 5.3.6 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Rest of North America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 A-Gas

- 6.4.2 Americhem

- 6.4.3 Arkema

- 6.4.4 Form Supplies Inc. (FSI)

- 6.4.5 Harp International Ltd

- 6.4.6 HCS Group GmbH

- 6.4.7 Honeywell International Inc.

- 6.4.8 Huntsman International LLC

- 6.4.9 Lanxess

- 6.4.10 Nouryon

- 6.4.11 Sinochem Group Co. Ltd

- 6.4.12 Solvay

- 6.4.13 The Chemours Company

- 6.4.14 The Linde Group

- 6.4.15 Zeon Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 High Demand for Zero Ozone Depletion Potential (ODP) and Low Global Warming Potential (GWP) Blowing Agents

- 7.2 High Consumption of Extruded Sheets of Polystyrene for Packaging Foam