PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852180

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852180

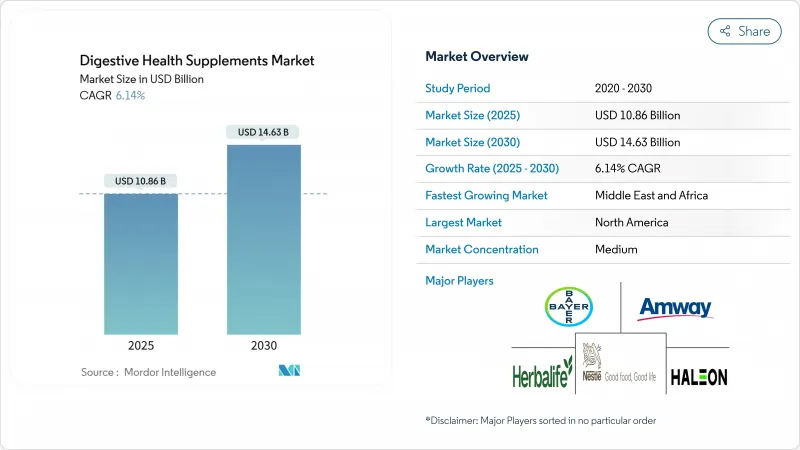

Digestive Health Supplements - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Digestive Health Supplements Market size is estimated at USD 10.86 billion in 2025, and is expected to reach USD 14.63 billion by 2030, at a CAGR of 6.14% during the forecast period (2025-2030).

Preventive health attitudes, clinical validation of microbiome interventions, and heightened global oversight are driving momentum in the market. These factors are shaping consumer preferences and pushing the industry toward higher standards. Demand is bolstered by an aging population seeking metabolic support to manage age-related health concerns, younger consumers influenced by social media, uncovering the gut-immune connection and its impact on overall well-being, and companies rolling out data-driven personalization services to cater to individual health needs. Regulatory convergence, especially with the U.S. Food and Drug Administration's surprise inspections abroad, is bridging the historical quality divide between domestic and international facilities, fostering trust in the category by ensuring consistent product standards. Concurrently, attributes like clean-label positioning and transparent sourcing have transitioned from premium perks to essential standards, compelling brands to invest in traceable supply chains and third-party verifications to meet consumer expectations and regulatory requirements.

Global Digestive Health Supplements Market Trends and Insights

Rising Incidence of Gastrointestinal Disorders Boosts Growth

As functional gastrointestinal disorders rise in prevalence, supplements are transitioning from occasional remedies to staples in long-term health regimens. The World Health Organization reports over 1.7 billion annual cases of enteric diseases, with wealthier regions seeing a marked increase in inflammatory conditions . With a growing number of individuals facing Irritable Bowel Syndrome, Gastroesophageal Reflux Disease, and lactose intolerance, the consumption of digestive supplements is on the rise. The National Institute of Diabetes and Digestive and Kidney Diseases notes that around 60 to 70 million Americans grapple with digestive diseases each year . Pharmaceutical giants, like Nestle Health Science, are lending credibility to this sector, evidenced by their recent acquisition of Vowst. This is a pivotal move, as Vowst boasts the distinction of being the first FDA-approved oral microbiota therapy for recurrent C. difficile infections. With clinical evidence backing them, certain strains are swaying consumer preferences, moving them from casual trials to targeted treatments. This evolution not only ensures a steady demand-resilient even during economic slumps-but also opens avenues for premium pricing on scientifically validated products, elevating the market's value beyond mere volume growth.

Increasing consumer awareness of the microbiome-immune axis drives demand

Research underscores the gut's crucial role in immune health, prompting consumers to gravitate towards specific probiotic strains. Studies highlight how Akkermansia muciniphila strengthens gut barriers, curbs inflammation, and boosts metabolic health, driving the surge in demand for these specialized probiotics. This growing awareness of the gut microbiome's impact on overall health has led to increased interest in targeted interventions that address specific health concerns. In a shift post-pandemic, consumers are now placing a premium on preventive health measures rather than reactive treatments, as they aim to maintain long-term wellness and resilience against potential health challenges. Digital innovations, like Dieta Health's stool-imaging app, are adeptly converting biomarker data into personalized product suggestions, empowering consumers to make informed choices. These advancements in technology are bridging the gap between scientific insights and consumer accessibility, enabling individuals to better understand their unique health needs. As a result, there's a marked tilt towards supplements targeting specific health issues, with consumers favoring tailored solutions over one-size-fits-all alternatives.

Stringent labelling and novel-food approval delays for synbiotic blends hinders growth

Europe's Novel Foods Regulation requires detailed dossiers for botanical ingredients, but interpretations vary across member states. Gaining approval for multi-strain, multi-fiber synbiotics can take over 18 months, inflating development costs and postponing product launches. The complexity of the approval process, which involves rigorous safety assessments and compliance with varying national standards, further exacerbates these delays. Smaller companies find it challenging to finance these lengthy compliance processes, giving larger firms with seasoned regulatory teams a competitive edge. National actions, like Denmark's restrictions on ashwagandha, highlight how local decisions can override EU-wide approvals, necessitating region-specific reformulations that compromise economies of scale. These reformulations often require additional investment in research and development, further straining resources for smaller players.

Other drivers and restraints analyzed in the detailed report include:

- Integration of digestive supplements into daily nutritional regimens drives growth

- Enhanced digestive health awareness through digital media platforms adds to its growth

- Adulteration and potency degradation during supply chain affecting brand trust

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, probiotics dominated the market, capturing 82.12% of the revenue. This highlights years of strain-specific research and growing consumer trust. Strong evidence supporting probiotics' efficacy has driven their widespread adoption for digestive health. Enzymes, projected to grow at a 7.45% CAGR through 2030, are gaining traction due to rising demand for solutions addressing lactose intolerance and pancreatic insufficiency. These enzymes cater to specific health needs, appealing to health-conscious consumers. The "Others" category now includes postbiotics and synbiotics, with Akkermansia muciniphila products receiving European Food Safety Authority approval in 2024. Such advancements are reshaping the digestive health supplements market, focusing on clinically validated solutions to meet emerging consumer demands.

With clinical backing, enzymes command premium prices and have established a presence in practitioner channels, where healthcare professionals recommend them. Probiotics are diversifying into age-specific and mood-enhancing formats, addressing mental well-being alongside digestive health. Manufacturers are investing in heat-stable strains, expanding their use into gummies and baked goods, thus entering the functional foods market. New entrants in the postbiotic sector emphasize shelf stability and immune benefits, reflecting the evolving competitive landscape. These innovations are expected to drive differentiation and growth as companies meet the rising demand for advanced, science-backed solutions.

The Digestive Health Supplements Market Report is Segmented by Type (Prebiotics, Probiotics, Enzymes, Botanicals, Others), Form (Capsules and Softgels, Tablets, Gummies and Chewables, Powders, Others), Distribution Channel (Supermarkets/Hypermarkets, Specialty and Health Stores, and More), and Geography (North America, Europe, Asia-Pacific, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commands a dominant 42.44% share of the global revenue, bolstered by clear FDA guidelines that empower assertive health-claim messaging. Consumers in the region increasingly view supplements as essential preventive care. According to the Council for Responsible Nutrition Survey 2023, nearly 74% of adults in the United States reported using dietary supplements, including digestive supplements . Furthermore, insurance pilots reimbursing microbiome therapeutics could solidify this trend, strengthening the digestive health supplements market in this already mature territory.

The Middle East and Africa are on a rapid ascent, boasting the fastest CAGR of 8.62% through 2030. This growth is fueled by increasing disposable incomes, the expansion of pharmacy chains, and proactive government health initiatives like Saudi Arabia's Vision 2030. With a youthful demographic and a deep-rooted cultural affinity for herbal tonics, the region is primed for the adoption of modern probiotics and enzymes. To navigate the diverse regulatory landscape and seamlessly blend Western formulations with indigenous botanicals, multinationals are forging partnerships with local distributors, setting the stage for a robust penetration of the digestive health supplements market.

Europe's regulatory environment offers both opportunities and challenges. EU-wide harmonization eases market access, but varying national interpretations create compliance hurdles. Sustainability mandates are driving a shift to organic ingredients and recyclable packaging. While consumers cautiously evaluate scientific evidence, they are willing to invest in proven products. In Asia-Pacific, traditional remedies merge with modern science, driving rapid adoption. China's regulatory framework accelerates imports via cross-border e-commerce while supporting domestic innovation. Urbanization and dietary shifts toward high-protein, low-fiber diets are boosting demand for tailored digestive solutions. Personalized nutrition services, integrating genetic and microbiome insights, further enhance the market's growth.

- Neste SA

- The Procter & Gamble Company

- Bayer AG

- Amway Corp.

- Herbalife Nutrition Ltd.

- Haleon plc

- Glanbia plc

- GNC Holdings LLC

- Abbott Laboratories Inc

- Reckitt Benckiser Group plc

- BioGaia AB's

- Renew Life Supplements

- Jarrow Formulas, Inc.

- Novozymes A/S

- Now Health Group Inc

- Zenwise Health Inc,

- Konscious LLC.(Whilesome Brands)

- Seed Health Inc.

- Otsuka Pharmaceutical Co.,Ltd(Pharamtive LLC)

- Enzyme Science(Enzymedica)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising incidence of gastrointestinal disorders boosts growth

- 4.2.2 Increasing consumer awareness of the microbiome-immune axis drives demand

- 4.2.3 Integration of digestive supplements into daily nutritional regimens drives growth

- 4.2.4 Enhanced digestive health awareness through digital media platforms adds to its growth

- 4.2.5 Increasing trend for clean-label and plant-based supplement formulations

- 4.2.6 Growing use of digestive aids among aging adults with slower metabolism

- 4.3 Market Restraints

- 4.3.1 Stringent labelling and novel-food approval delays for synbiotic blends hinders growth

- 4.3.2 Adulteration and potency degradation during supply-chain affecting brand trust

- 4.3.3 Price sensitivity limiting premium supplement uptake

- 4.3.4 Competition from alternative natural remedies affects growth

- 4.4 Supply-Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers/Consumers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Prebiotics

- 5.1.2 Probiotics

- 5.1.3 Enzymes

- 5.1.4 Botanicals

- 5.1.5 Other Types

- 5.2 By Form

- 5.2.1 Capsules and Softgels

- 5.2.2 Tablets

- 5.2.3 Gummies and Chewables

- 5.2.4 Powders

- 5.2.5 Other Forms

- 5.3 By Distribution Channel

- 5.3.1 Supermarkets/Hypermarkets

- 5.3.2 Specialty and Health Stores

- 5.3.3 Online Retailers

- 5.3.4 Other Distribution Channels

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Spain

- 5.4.2.6 Netherlands

- 5.4.2.7 Poland

- 5.4.2.8 Belgium

- 5.4.2.9 Sweden

- 5.4.2.10 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Indonesia

- 5.4.3.6 South Korea

- 5.4.3.7 Thailand

- 5.4.3.8 Singapore

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Chile

- 5.4.4.5 Peru

- 5.4.4.6 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 Morocco

- 5.4.5.7 Turkey

- 5.4.5.8 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Neste SA

- 6.4.2 The Procter & Gamble Company

- 6.4.3 Bayer AG

- 6.4.4 Amway Corp.

- 6.4.5 Herbalife Nutrition Ltd.

- 6.4.6 Haleon plc

- 6.4.7 Glanbia plc

- 6.4.8 GNC Holdings LLC

- 6.4.9 Abbott Laboratories Inc

- 6.4.10 Reckitt Benckiser Group plc

- 6.4.11 BioGaia AB's

- 6.4.12 Renew Life Supplements

- 6.4.13 Jarrow Formulas, Inc.

- 6.4.14 Novozymes A/S

- 6.4.15 Now Health Group Inc

- 6.4.16 Zenwise Health Inc,

- 6.4.17 Konscious LLC.(Whilesome Brands)

- 6.4.18 Seed Health Inc.

- 6.4.19 Otsuka Pharmaceutical Co.,Ltd(Pharamtive LLC)

- 6.4.20 Enzyme Science(Enzymedica)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK