PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687454

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687454

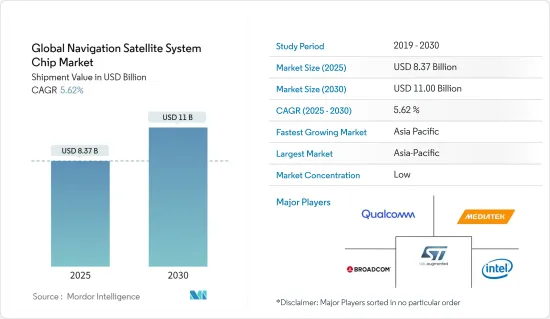

Global Navigation Satellite System Chip - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Global Navigation Satellite System Chip Market size in terms of shipment value is expected to grow from USD 8.37 billion in 2025 to USD 11.00 billion by 2030, at a CAGR of 5.62% during the forecast period (2025-2030).

The outbreak of the COVID-19 pandemic significantly disrupted the supply chain and production of semiconductors in the initial phase of 2020. For multiple chipmakers, the impact was more severe. Due to labor shortages, many packages and testing plants in the Asia-Pacific region reduced or even suspended operations. This also created a bottleneck for end-product companies that depend on semiconductors.

Global navigation satellite system (GNSS) essentially refers to the constellation of satellites that provide signals from space, transmit positioning, and data timing to the GNSS receivers. The receivers then use such data to determine various factors, such as location, speed, and altitude, combined with several sensors.

The precision and accuracy of such chips are primarily dependent on the satellites in the visibility range. As a result, multiple countries are eagerly trying to deploy regional constellations for better navigation and mapping. However, in the market, only five countries (China, Russia, the United States, India, and Japan) and the European Union have their GNSS systems.

GNSS users expect near-instantaneous position sharing speeds. This is often impossible with standard positioning as at least four satellites must be identified, and their complete data should be received. In adverse signal conditions or harsh environments, transmitting and receiving data can take minutes, hours, or even fail. However, the performance can be improved by integrating the GNSS receiver data with information from mobile network cells to benefit numerous applications in the IoT industry.

In January 2021, U-Blox announced its ALEX - R5 module, which integrates low-power wide-area (LPWA) cellular communication and GNSS technology into the system-in-package. The two key elements are the company's UBX - R5 LTE - M/NB-IoT chipset with a secure cloud functionality and the U-Blox M8 GNSS chip for adequate location accuracy for healthcare applications.

The increasing volume of consumer electronics equipped with navigation and positioning features is expected to create a considerable demand for low-power GNSS chips. Technologically advanced wearable devices are in the demand trend currently. At present, almost 50% of the global population has been using tech-advanced wearable devices, such as fitness bands and smartwatches. GNSS chips are majorly being integrated into these devices to give precise locations to the user even while running, walking, or driving, allowing them to stay connected with their close ones.

In August 2020, Sony Corporation announced the release of high-precision GNSS receiver LSIs for IoT and wearable devices. The new LSIs support the conventional L1 band reception and L5 band reception, which are currently being expanded across GNSS constellations, making them suitable for dual-band positioning.

Global Navigation Satellite System (GNSS) Chip Market Trends

The Smartphones Segment is Expected to Hold a Significant Market Share

Despite considerable saturation of mature markets, such as EU28, North America, and China, the shipments of smartphones still outnumber devices using GNSS chips. Smartphones have been using GNSS chips for a considerable time. In most cases, these chips support all publicly available satellite networks, such as GPS, GLONASS, Galileo, etc. However, compared to dedicated navigation devices, these solutions were less accurate.

Additionally, a degree of monopoly in the smartphone hardware market limited the scope for GNSS chip installations. Most of the time, Qualcomm hardware does not include Broadcom GNNS chips and vice versa, as they are prime competitors. However, in recent years, this scenario has been changing.

The European Commission has approved a regulation mandating that new smartphones launched in the market will have to include satellite and Wi-Fi location services. According to the regulation, chipsets enabled with the global navigation satellite system (GNSS) capabilities are likely to have access to the EU's satellite system Galileo, which provides accurate positioning and timing information. Eight EU countries have been following this regulation and are using Galileo-compatible chipsets.

According to the European GNSS Agency, over 95% of the satellite navigation chipset supply market supports Galileo in new products, including various manufacturers of smartphone chipsets like Broadcom, Qualcomm, and Mediatek. With leading GNSS chipset providers producing Galileo-ready chipsets and global smartphone brands already integrating these chipsets in their latest smartphone models, the market is expected to have further growth opportunities during the forecast period.

Further, the new generation of Android smartphones is equipped with high-performance global navigation satellite system (GNSS) chips capable of tracking dual-frequency multi-constellation data. Starting from Android version 9, users can disable the duty cycle power-saving option; thus, better quality pseudo-range and carrier phase raw data are available. Also, the application of the Precise Point Positioning (PPP) algorithm has become more enjoyable. This work aims to assess the PPP performance of the first dual-frequency GNSS smartphone produced by Xiaomi equipped with a Broadcom BCM47755. The advantage of acquiring dual-frequency data is highlighted by comparing the performance obtained by Xiaomi with that of a single-frequency smartphone, the Samsung S8. The vertical and horizontal accuracy achieved by Xiaomi is 0.51 m and 6 m, respectively, while those achieved by Samsung is 5.64 m for 15 m for horizontal and vertical.

Asia-Pacific is Expected to Account for a Significant Market Share

BeiDou, first launched in 2000 and operated by the China National Space Administration, is based in China (CNSA). BeiDou has 48 satellites in orbit after 20 years. B1I (1561.098 MHz), B1C (1575.42 MHz), B2a (1175.42 MHz), B2I and B2b (1207.14 MHz), and B3I are among the signals being transmitted by BeiDou satellites (1268.52 MHz).

China's attitude to GNSS differs from that of Europe. While there are 11 widely acknowledged GNSS-enabled technical groupings in Europe, ranging from consumer products to vital infrastructure, the situation in China is far more complicated. There were three broad sectors - industrial market, mass consumer market, and specific market.

On March 11, 2021, China rolled out its 14th five-year plan. It is a plan that touches on all aspects of development over the next five years and presents China's 2035 vision. The 14th Five-Year Plan's persistent emphasis on R&D and innovation substantially impacts China's GNSS industry. "Deepen the promotion and use of BeiDou systems; Promote the industry's high-quality growth" is advocated as a policy guideline in the plan as an important national strategic project. The strategy is expected to signify a boost in the GNSS industry's research and development, promote BeiDou's industrial application and accelerate significant core technology advancements.

Further, the Korean Committee of Space Technology hopes to build a ground test by 2021, fundamental satellite navigation technology by 2022, and actual satellite manufacturing by 2024, according to the Korean Committee of Space Technology. Three satellites will be put in the geostationary orbit above the Korean Peninsula, making the KPS a seven-satellite constellation.

In February 2021, the Ministry of Science and ICT announced a budget of KRW 615 billion (USD 553.1 million) for space activities to increase the country's capacity to create satellites, rockets, and other critical equipment.

Global Navigation Satellite System (GNSS) Chip Industry Overview

The GNSS chip market consists of several players. In terms of market share, none of the players dominate the market. Significant players include Qualcomm Technologies Inc., Mediatek Inc., and STMicroelectronics NV, among others. The market players are considering strategic partnerships and collaborations to expand their market shares. Some of the recent developments in the market are:

- December 2021 - MediaTek announced device maker acceptance and endorsements from some smartphone brands, including OPPO, Vivo, Xiaomi, and Honor, for its Dimensity 9000 5G smartphone chip for next-generation flagship smartphones. The first flagship smartphones powered by the Dimensity 9000 will hit the market in the first quarter of 2022. Since the processor supports the newest Wi-Fi, Bluetooth, and GNSS standards, smartphone users can experience seamless communication.

- January 2021 - Qualcomm Technologies Inc. and Alps Alpine Co. Ltd announced a camera-based sensing and positioning device called ViewPose to support absolute lane-level vehicle positioning. Alps Alpine is leveraging multiple solutions from Qualcomm Technologies like the Qualcomm Snapdragon Automotive 5G platform, which supports Multi-Frequency GNSS and a Snapdragon Automotive Cockpit Platform for processing multiple camera images and Vision Enhanced Precise Positioning (VEPP) software. This provides a cost-effective solution to lane-level accuracy for the electric front, rear- and side-view mirrors, high-definition map crowdsourcing, lane-level navigation for cellular vehicle-to-everything (C-V2X), and advanced driving assistance systems (ADAS) and autonomous driving applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of the COVID-19 Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Adoption of Environment-friendly Transport Solutions, Sustainable Agriculture, and Meteorological Monitoring

- 5.1.2 Increasing Demand for Accurate Real-time Data

- 5.1.3 Evolution of GNSS Infrastructure, such as the Appearance of New Signals and Frequencies

- 5.2 Market Challenges

- 5.2.1 Inability of GNSS to Offer Accurate Underground, Underwater, and Indoor Navigation

- 5.2.2 Complexity Regarding High Power Consumption

6 KEY GNSS STATISTICS

- 6.1 GNSS Receiver Shipments (in billion units), by Price Categories

- 6.2 High-end Receiver Shipments (in million units), by Price Categories

- 6.3 Shipment of GNSS Devices (in thousand units), by Orbital Sub-segment

- 6.4 Installed Base of GNSS Devices (in billion Units) by End User

7 MARKET SEGMENTATION

- 7.1 Device Type

- 7.1.1 Smartphones

- 7.1.2 Tablets and Wearables

- 7.1.3 Personal Tracking Devices

- 7.1.4 Low-power Asset Trackers

- 7.1.5 In-vehicle Systems

- 7.1.6 Drones

- 7.1.7 Other Device Types

- 7.2 End-user Industry

- 7.2.1 Automotive

- 7.2.2 Consumer Electronics

- 7.2.3 Aviation

- 7.2.4 Other End-user Industries

- 7.3 Geography

- 7.3.1 North America

- 7.3.1.1 United States

- 7.3.2 Europe

- 7.3.2.1 Russia

- 7.3.3 Asia-Pacific

- 7.3.3.1 China

- 7.3.3.2 Japan

- 7.3.3.3 South Korea

- 7.3.4 Latin America

- 7.3.5 Middle-East and Africa

- 7.3.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Qualcomm Technologies Inc.

- 8.1.2 Mediatek Inc.

- 8.1.3 STMicroelectronics NV

- 8.1.4 Broadcom Inc.

- 8.1.5 Intel Corporation

- 8.1.6 U-blox Holdings AG

- 8.1.7 Thales Group

- 8.1.8 Quectel Wireless Solutions Co. Ltd

- 8.1.9 Skyworks Solutions Inc.

- 8.1.10 Furuno Electric Co. Ltd

- 8.1.11 Hemisphere GNSS

- 8.1.12 Trimble Inc.

- 8.1.13 Sony Group Corporation

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET