PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850348

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850348

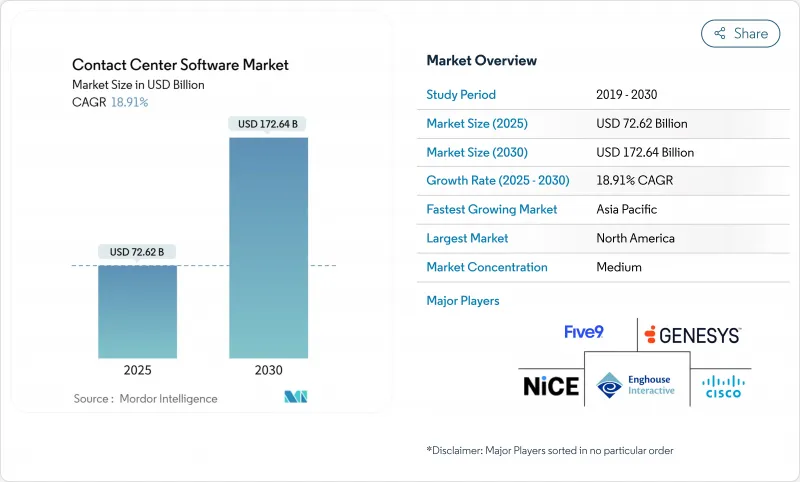

Contact Center Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Contact Center Software Market size is estimated at USD 72.62 billion in 2025, and is expected to reach USD 172.64 billion by 2030, at a CAGR of 18.91% during the forecast period (2025-2030).

Elevated demand for omnichannel customer experiences, rapid cloud migration, and breakthroughs in generative AI are the core growth catalysts. Vendors are embedding autonomous agent technology that automates more than 90% of routine interactions, cutting operating costs and boosting customer satisfaction. Cloud-first infrastructure adoption remains pivotal because AI workloads need elastic computing power. Regulations that encourage innovation, especially in North America, and a wave of strategic acquisitions are accelerating platform consolidation. The competitive focus has shifted toward vertically trained AI models, industry-specific compliance features, and ease of integration with existing enterprise systems, all of which are steering sizeable enterprise budgets toward advanced solutions in the contact center software market.

Global Contact Center Software Market Trends and Insights

Surge in Omnichannel CX Demand

Unified platforms that keep context across voice, chat, email, and social channels are replacing siloed systems. Retailers have proven the economic value, lowering average handling time by 12-15% and cutting cost to serve by 20% after adopting smart agent assist technology. Heavily regulated sectors such as healthcare require auditable interaction trails across every channel, heightening adoption urgency. Vendors now bundle channel orchestration, interaction analytics, and workflow automation in a single license, accelerating revenue per customer. This driver outpaces voice-only upgrades, cementing the omnichannel paradigm inside the contact center software market.

Rapid Cloud-First CCaaS Adoption

Enterprises are prioritizing CCaaS to secure elastic compute for real-time AI and to eliminate costly hardware refresh cycles. The California DMV's move to a cloud contact center raised customer satisfaction and lowered operational expenditure. API-ready clouds also integrate seamlessly with CRM and ERP, enabling unified customer data. Migration complexity persists; fewer than 40% of businesses have completed full UCaaS transitions due to dual-system management challenges, yet the economic and agility benefits keep cloud in the leadership position within the contact center software market.

Legacy Integration Complexity

Large enterprises house decades-old CRM and ERP systems. Those platforms lack modern APIs, forcing custom middleware builds that double project timelines and raise costs. Contact centers must stay live during migration, so parallel run modes inflate overhead. Governance teams add further scrutiny, elongating decision cycles and tempering near-term growth in the contact center software market.

Other drivers and restraints analyzed in the detailed report include:

- AI-Driven Workforce Optimization

- GenAI Autonomous-Agent Breakthroughs

- Data-Privacy & Security Regulation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Omnichannel routing captured 28.4% of the contact center software market share in 2024, underscoring the industry shift toward unified experiences. Real-time reporting & analytics accelerate at a 21.6% CAGR as organizations demand predictive insights that shape proactive service strategies. Vendors such as NICE process more than 100 million interactions every month through Enlighten Copilot, evidencing customer appetite for actionable analytics. Outbound and inbound capabilities are converging around AI-driven sentiment detection and contextual scripting. Workforce optimization adds layered value by pairing routing intelligence with predictive scheduling. Integration solutions, though essential, are gradually simplified as cloud-native API ecosystems mature, reducing total cost of ownership and elevating platform stickiness across the contact center software market.

Adoption patterns show that enterprises increasingly purchase bundled suites combining routing, analytics, and workforce optimization to avoid vendor sprawl. Advanced packages introduce real-time transcription and next-best-action guidance, shortening agent onboarding periods. Predictive dialing revives outbound campaigns by applying compliance filters and dynamic pacing, which lowers regulatory fines and raises conversion rates. Collectively, these trends sustain double-digit growth while encouraging vendors to extend intellectual property through microservice architectures and industry-specific AI models, reinforcing competitive moats within the contact center software market.

Cloud platforms held 71% of the contact center software market size in 2024, expanding at an 18.98% CAGR. Enterprises cite elastic compute, rapid feature deployment, and embedded AI toolkits as top motivators for migration. The U.S. Postal Service's shift to a cloud-based platform enables real-time package tracking and proactive notifications. Hybrid approaches persist among financial institutions and public-sector agencies that must meet strict data-sovereignty rules.

On-premises systems are largely relegated to maintenance mode, though vendors still provide security patches. The complexity of cut-over projects means many multinationals operate hybrid contact-center estates for several quarters, balancing risk while employees acclimate to new workflows. Cost savings from retiring legacy PBX hardware, coupled with subscription pricing, reinforce the cloud's economic proposition. As public-cloud AI accelerators become cheaper and more abundant, the performance gap between cloud and premises widens, anchoring future investment decisions in favour of cloud within the contact center software market.

The Contact Center Software Market Report is Segmented by Solution Type (Outbound, Inbound, Omni-Channel Routing, Workforce Optimisation, Reporting and Analytics, and More), Deployment Model (Cloud and On-Premise), Service (Professional and Managed), End-User Industry (IT and Telecommunication, BFSI, Healthcare, Retail and Consumer Goods, Government and Public Sector, Media and Entertainment, and More ), and Geography.

Geography Analysis

North America accounted for 38.5% of global revenue in 2024, supported by early cloud uptake, robust venture funding, and favorable policy that encourages AI innovation. Federal and state agencies are modernizing citizen services using AI-enhanced call centers, as illustrated by Minnesota's driver and vehicle services upgrade. The mature ecosystem drives sophisticated deployments that integrate real-time analytics and autonomous agents. AI accelerator supply constraints and chip shortages represent the main execution risk, potentially pushing project costs higher and elongating timelines.

Asia Pacific is the fastest-growing region at 22.4% CAGR. India's conversational AI market is expected to exceed USD 1 billion by 2029, reflecting high customer retention risk linked to slow service delivery. China's cloud communication sector surpassed USD 6.8 billion in 2024, propelled by internet giants deploying integrated cloud platforms, while Southeast Asia draws record data-center investment aimed at supporting 25% annual capacity growth. Rapid smartphone penetration, a young digitally savvy workforce, and pro-technology government programs create prime conditions for cloud CCaaS adoption, cementing future momentum in the contact center software market.

Europe registers steady growth underpinned by strict privacy regulations that encourage advanced compliance tooling. Latin America and the Middle East & Africa remain nascent but show rising demand as telecom infrastructure improves. Government-sponsored digital-first initiatives, coupled with multinational expansion into these regions, stimulate enduring interest. Varied economic maturity means vendors position modular offerings that scale with local needs, ensuring the contact center software market can capture incremental revenue across diverse regulatory environments.

- Genesys Telecommunications Laboratories Inc.

- NICE Ltd

- Five9 Inc.

- Cisco Systems Inc.

- Amazon Web Services Inc. (Amazon Connect)

- Avaya Inc.

- Talkdesk Inc.

- RingCentral Inc.

- Zoom Video Communications Inc. (Webex CC)

- 8x8 Inc.

- Dialpad Inc.

- Twilio Inc. (Twilio Flex)

- Vonage Holdings Corp.

- Oracle Corporation

- SAP SE

- Mitel Networks Corp.

- Enghouse Interactive Inc.

- NEC Enterprise Solutions

- Content Guru Ltd

- Verint Systems Inc.

- Alvaria Inc.

- Calabrio Inc.

- Vocalcom SA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in omnichannel CX demand

- 4.2.2 Rapid cloud-first CCaaS adoption

- 4.2.3 AI-driven workforce optimisation

- 4.2.4 GenAI autonomous-agent breakthroughs

- 4.2.5 Real-time sentiment analytics compliance

- 4.2.6 Telco-network API embedded CC functions

- 4.3 Market Restraints

- 4.3.1 Legacy integration complexity

- 4.3.2 Data-privacy and security regulation

- 4.3.3 Cloud-vendor egress-fee lock-in

- 4.3.4 Bias and audit risk in GenAI models

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Solution Type

- 5.1.1 Outbound

- 5.1.2 Inbound

- 5.1.3 Omnichannel Routing

- 5.1.4 Workforce Optimisation

- 5.1.5 Reporting and Analytics

- 5.1.6 Integration

- 5.1.7 Other Solutions

- 5.2 By Deployment Model

- 5.2.1 Cloud

- 5.2.2 On-premise

- 5.3 By Service

- 5.3.1 Professional

- 5.3.2 Managed

- 5.4 By End-user Industry

- 5.4.1 IT and Telecommunication

- 5.4.2 BFSI

- 5.4.3 Healthcare

- 5.4.4 Retail and Consumer Goods

- 5.4.5 Government and Public Sector

- 5.4.6 Media and Entertainment

- 5.4.7 Education

- 5.4.8 Other Industries

- 5.5 By Organisation Size

- 5.5.1 Large Enterprises

- 5.5.2 Small and Mid-sized Enterprises

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Russia

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 Australia

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Genesys Telecommunications Laboratories Inc.

- 6.4.2 NICE Ltd

- 6.4.3 Five9 Inc.

- 6.4.4 Cisco Systems Inc.

- 6.4.5 Amazon Web Services Inc. (Amazon Connect)

- 6.4.6 Avaya Inc.

- 6.4.7 Talkdesk Inc.

- 6.4.8 RingCentral Inc.

- 6.4.9 Zoom Video Communications Inc. (Webex CC)

- 6.4.10 8x8 Inc.

- 6.4.11 Dialpad Inc.

- 6.4.12 Twilio Inc. (Twilio Flex)

- 6.4.13 Vonage Holdings Corp.

- 6.4.14 Oracle Corporation

- 6.4.15 SAP SE

- 6.4.16 Mitel Networks Corp.

- 6.4.17 Enghouse Interactive Inc.

- 6.4.18 NEC Enterprise Solutions

- 6.4.19 Content Guru Ltd

- 6.4.20 Verint Systems Inc.

- 6.4.21 Alvaria Inc.

- 6.4.22 Calabrio Inc.

- 6.4.23 Vocalcom SA

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment