PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850337

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850337

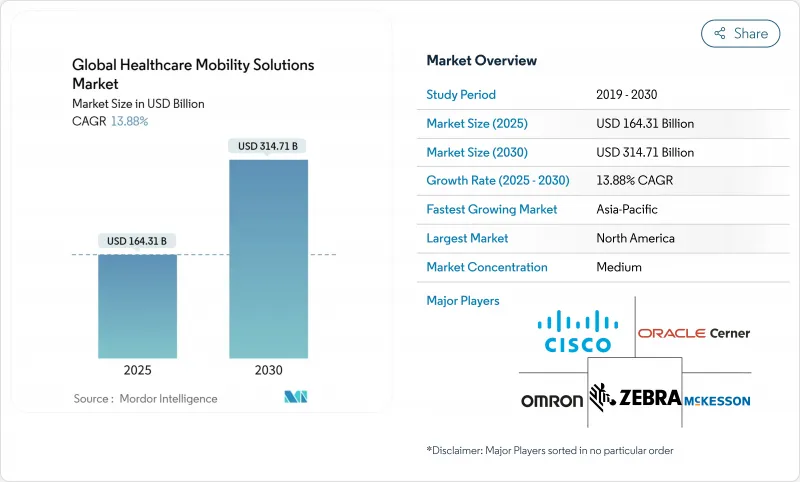

Global Healthcare Mobility Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The healthcare mobility solutions market size reaches USD 164.31 billion in 2025 and is forecast to climb to USD 314.71 billion by 2030, reflecting a 13.88% CAGR.

Across the forecast horizon, hospitals, clinics, payers, and technology firms invest in mobile platforms that improve care coordination, enable real-time monitoring, and shift services into homes and community settings. 5G private networks, edge AI, and cloud interoperability combine to support latency-sensitive applications such as remote surgery and continuous glucose monitoring, while new FDA guidance for AI-enabled devices provides a clearer commercialization pathway. Vendors that deliver secure, HIPAA-compliant architectures gain an immediate advantage as ransomware activity pushes cybersecurity to the top of procurement criteria. Clinician shortages further accelerate adoption, because mobile tools automate documentation and workforce scheduling, lowering operating costs and reducing burnout.

Global Healthcare Mobility Solutions Market Trends and Insights

Expansion of Tele-medicine & RPM Programs

US patient participation in remote patient monitoring (RPM) is projected to reach 70.6 million in 2025, up from 29 million in 2020. Mayo Clinic's Advanced Care at Home model has treated more than 2,000 patients with infection rates below inpatient norms and lower readmissions. CMS waivers now let 320-plus hospitals deliver acute care at home, moving hospital-level services into living rooms . Cleveland Clinic's AI-based virtual triage system has reached 94% diagnostic accuracy and eased emergency department congestion. Hybrid, "click-and-brick" models that blend video, messaging, and in-person follow-ups stretch fixed resources and raise patient satisfaction.

Rising Adoption of Smartphones & Wearables

More than 80% of adults in Asia-Pacific now own a smartphone, enabling hospitals to deliver coaching, medication reminders, and biometrics directly to patients. Researchers at the University of Hong Kong have demonstrated organic electrochemical transistors that turn soft microelectronics into standalone AI wearables capable of on-skin analytics. The FDA's 2025 clearance of the Stelo continuous glucose monitor for retail purchase illustrates the shift from prescription-only devices to consumer channels. As consumer devices gain clinical accuracy, data flows seamlessly into electronic records, allowing clinicians to spot trends before adverse events occur. Predictive insights generated on-device reduce emergency visits and make chronic-care economics more sustainable.

Cyber-security & HIPAA/GDPR Risks

Cybercriminals increasingly target mobile endpoints, forcing providers to harden authentication, encryption, and patch management. Many hospital networks run legacy operating systems that cannot support modern zero-trust strategies, making full compliance difficult. EU regulators have begun levying sizeable fines for GDPR violations involving unencrypted mobile data transfers. Rural facilities flagged mobile security as a prerequisite for new telehealth grants awarded in 2025. Balancing tight security with clinician usability remains a central adoption barrier during the next two years.

Other drivers and restraints analyzed in the detailed report include:

- Need to Cut Clinical Workflow Costs

- Hospital-at-home Roll-outs

- Shortage of Digital-health Talent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mobile Applications post the fastest 14.54% CAGR through 2030, even though Mobile Devices commanded 43.15% of 2024 revenue. The FDA's 2024 decision to classify digital therapeutics for ADHD as Class II devices widened reimbursement pathways, making software-only products commercially viable. Enterprise platforms from Epic and Oracle Cerner now bundle secure messaging, single-sign-on, and device tracking, simplifying rollouts. The healthcare mobility solutions market repeatedly rewards vendors that leverage existing consumer smartphones instead of specialized hardware, reducing capital expenditure for providers.

Mobile Devices stay relevant for infection-resistant casings, battery hot-swap, and barcode medication administration. Yet the declining price of rugged consumer tablets narrows the gap, slowing hardware growth. Platform vendors that combine device agnosticism with tight EHR integration gain share by limiting IT complexity. AI-infused applications extend beyond vital-sign dashboards into medication titration, opioid stewardship, and rehabilitation coaching, pushing software front and center in purchasing decisions.

Enterprise Solutions represented 62.45% of 2024 spending thanks to long-standing procurement cycles and bundled EHR contracts. Guthrie Clinic's virtual care hub saved USD 7 million in wages and cut nurse turnover by half, proving the financial upside of mobility at scale. Automated note capture, ambient dictation, and real-time analytics are now staples of enterprise roadmaps across North America and Europe.

mHealth Applications, advancing 14.65% annually, tap a younger, tech-savvy audience that tracks steps, sleep, and blood glucose daily. Direct-to-consumer channels bypass insurance codes, giving start-ups quicker feedback loops and iterative product pathways. The healthcare mobility solutions market size for mHealth is expected to widen further as employers integrate wellness apps into benefit plans and payers roll out digital-first coverage.

The Healthcare Mobility Solutions Market Report Segments the Industry Into by Products and Services (Mobile Applications (Apps), Mobile Devices, and More), by Application (Enterprise Solutions, Mhealth Applications), by End User (Payers, Providers, Patients), Care Setting (Hospitals & Clinics, Home-Care, and More), Deployment Mode (Cloud-Based and On-Premise), and Geography (North America, Europe, Asia-Pacific, and More).

Geography Analysis

North America commanded 42.53% of 2024 revenue because of mature reimbursement models, regulatory clarity, and an installed base of EHRs ready for mobile extensions. More than 320 US hospitals now hold CMS waivers for acute care at home, anchoring broad investment in logistics apps, dashboards, and 5G routers. Canadian provinces subsidize virtual consults to reach remote communities, while Mexico's private hospitals adopt mobile triage to offset clinician shortages.

Europe delivers steady adoption as cross-border standards mature. The European Health Data Space initiative promotes interoperable APIs that integrate wearables, imaging, and lab feeds. Germany funds 6G medicine research, and the UK co-authors transparency frameworks for machine-learning diagnostics with US partners. These programs help the healthcare mobility solutions market build trust in AI prognostics across the region.

Asia-Pacific records the highest 14.64% CAGR. With 1.8 billion mobile subscribers, the region trails only North America in 5G penetration. Chinese surgeons have performed remote gastrectomies over standalone 5G, creating global headlines and regulatory momentum. India's new reimbursement codes for digital-first care, plus Japan's AI diabetic retinopathy screening, add scale. In Southeast Asia, start-ups raised USD 1.5 billion for telehealth in 2024, illustrating venture confidence in the healthcare mobility solutions market.

- AirStrip Technologies Inc.

- AT&T

- Cisco Systems

- Oracle

- Mckesson

- OMRON

- Koninklijke Philips

- SAP

- Zebra Technologies

- Epic Systems Corp.

- IBM Corp.

- Apple

- Samsung Group

- GE Healthcare

- Teladoc Health

- Stryker

- Honeywell International

- Medtronic

- Microsoft Corp.

- Qualcomm

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Adoption of Smartphones & Wearables

- 4.2.2 Expansion of Tele-medicine & RPM Programs

- 4.2.3 Need to Cut Clinical Workflow Costs

- 4.2.4 Hospital-at-home Roll-outs

- 4.2.5 5G Private Networks Enable Low-latency Mobility

- 4.2.6 Spatial-computing/AR Surgical Support Apps

- 4.3 Market Restraints

- 4.3.1 Cyber-security & HIPAA/GDPR Risks

- 4.3.2 Shortage of Digital-health Talent

- 4.3.3 Legacy EMR Vendor Lock-in to Mobile APIs

- 4.3.4 Battery & Ruggedisation Costs for Medical Devices

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Products & Services

- 5.1.1 Mobile Devices

- 5.1.2 Mobile Applications

- 5.1.3 Enterprise Mobility Platforms

- 5.2 By Application

- 5.2.1 Enterprise Solutions

- 5.2.2 mHealth Applications

- 5.3 By End User

- 5.3.1 Providers

- 5.3.2 Payers

- 5.3.3 Patients

- 5.4 By Care Setting

- 5.4.1 Hospitals & Clinics

- 5.4.2 Home-Care / Hospital-at-Home

- 5.4.3 Emergency & Ambulatory Services

- 5.5 By Deployment Mode

- 5.5.1 Cloud-based

- 5.5.2 On-premise

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 AirStrip Technologies Inc.

- 6.3.2 AT&T Inc.

- 6.3.3 Cisco Systems Inc.

- 6.3.4 Oracle Cerner

- 6.3.5 McKesson Corporation

- 6.3.6 Omron Corporation

- 6.3.7 Koninklijke Philips N.V.

- 6.3.8 SAP SE

- 6.3.9 Zebra Technologies Corp.

- 6.3.10 Epic Systems Corp.

- 6.3.11 IBM Corp.

- 6.3.12 Apple Inc.

- 6.3.13 Samsung Electronics Co. Ltd.

- 6.3.14 GE Healthcare

- 6.3.15 Teladoc Health Inc.

- 6.3.16 Stryker

- 6.3.17 Honeywell International Inc.

- 6.3.18 Medtronic plc

- 6.3.19 Microsoft Corp.

- 6.3.20 Qualcomm Life

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet Need Assessment