PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687438

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687438

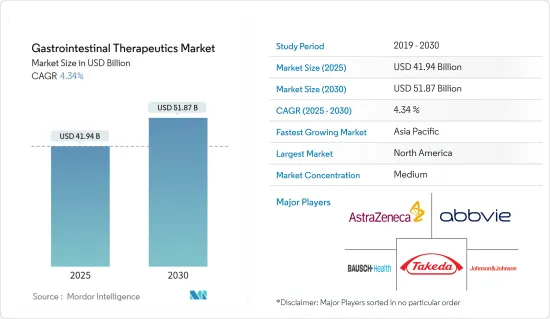

Gastrointestinal Therapeutics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Gastrointestinal Therapeutics Market size is estimated at USD 41.94 billion in 2025, and is expected to reach USD 51.87 billion by 2030, at a CAGR of 4.34% during the forecast period (2025-2030).

Factors such as the increasing prevalence of gastrointestinal diseases and the rising investments in research and development by pharmaceutical companies are expected to boost the market growth.

The increasing burden of gastrointestinal diseases such as ulcerative colitis, irritable bowel syndrome, Crohn's disease, celiac disease, gastroenteritis, and others among the population is the key factor driving the market growth. For instance, according to a report published by the International Journal of Colorectal Disease in May 2023, in Japan, patients diagnosed with ulcerative colitis (UC) tended to be younger and exhibited a higher prevalence among men compared to women, while the opposite trend was observed in the United States.

Additionally, as per an article published in NLM in July 2022, it was observed that GERD, the most prevalent gastrointestinal condition, affects 20% of individuals in Western culture. As per the same source, an estimated prevalence of GERD in the United States ranges between 18.1% and 27.8%, and the prevalence of GERD is higher among men than women. Thus, the high burden of GI tract diseases such as cancer and GERD is expected to increase demand for effective therapeutics approaches, thereby boosting the market growth.

Furthermore, the rising company's investment in research and development of gastro-related drugs and rising drug launches that increase the availability of the drugs in the market are also expected to fuel the market growth. For instance, in September 2023, gastrointestinal health company Vivante Health received USD 31 million in its Series B funding round led by new investor Mercato Partners, bringing its total raise to USD 47 million. Vivante provides personalized care plans to track their symptoms and connect patients with a coordinated care team, including dietitians, internists, and gastroenterologists. Similarly, in June 2023, the American Gastroenterological Association invested in Oshi Health. Oshi Health provides diagnosis and integrated care for digestive conditions.

Therefore, owing to the factors above, such as the rising prevalence of GI disorders and the increasing R&D activities for the development of gastrointestinal disease treatment, it is likely to boost the growth of the gastrointestinal therapeutics market over the forecast period. However, stringent regulatory norms regarding drug approvals and an increasing number of patent expiries are expected to impede the market growth over the forecast period.

Gastrointestinal Therapeutics Market Trends

Crohn's Disease Segment is Expected to Witness Significant Growth Over the Forecast Period

Crohn's disease, a chronic immune-mediated disorder, remains a significant challenge for both patients and healthcare providers, with its hallmark inflammation primarily affecting the digestive tract. In the medical management of Crohn's disease, various drugs are used to induce and maintain remission. For instance, infliximab and adalimumab are used to target proteins to decrease inflammation in the intestines.

The growing burden of Crohn's disease across the world is expected to create the demand for effective treatment, thereby boosting the segment growth. For instance, according to an article published in MedLine.Gov in January 2023, Crohn's disease is most common in Western Europe and North America, where it has a prevalence of 100 to 300 per 100,000 people. More than half a million Americans are currently affected by this disorder. Crohn's disease occurs more often in people of northern European ancestry and those of eastern and central European (Ashkenazi) Jewish descent than among people of other ethnic backgrounds. For reasons that are not clear, the prevalence of Crohn's disease has been increasing in the United States and some other parts of the world. Thus, the rising new and emerging treatments are expected to increase the availability of effective and safe drugs in the market, boosting segment growth.

Furthermore, the increasing drug approval by regulatory bodies is expected to increase the availability of novel therapeutics for treating Crohn's disease patients. It is anticipated to fuel the market growth over the forecast period. For instance, in October 2023, Eli Lilly and Company revealed positive results from its Phase 3 study evaluating minkizumab, an investigational interleukin-23p19 antagonist, for treating adults with moderately to severely active Crohn's disease. The study, known as VIVID-1, demonstrated that minkizumab met both co-primary and major secondary endpoints compared to placebo, underscoring its potential as a promising therapeutic agent for this patient population. Crohn's disease, characterized by symptoms such as abdominal pain, diarrhea, and weight loss, can lead to serious complications, highlighting the urgent need for effective treatments like minkizumab.

Therefore, owing to the factors above, such as the growing burden of Crohn's Disease and product approvals, the studied segment is expected to grow over the forecast period.

North America is Expected to Hold a Significant Market Share Over the Forecast Period

North America is expected to hold a significant market share over the forecast period owing to factors such as the increasing burden of gastrointestinal diseases, rising product launches, and growing company initiatives.

The increasing burden of gastrointestinal diseases such as ulcerative colitis and others among the population is the key factor driving the market growth. For instance, in December 2023, an article from US Pharm highlighted that approximately 1.6 million individuals in the United States are afflicted with inflammatory bowel disease (IBD), encompassing Crohn's disease and ulcerative colitis. These conditions are characterized by gastrointestinal tract inflammation and may manifest symptoms, including persistent diarrhea, abdominal discomfort, and hematochezia.

Additionally, an article released by NBC Universal in February 2023 underscored the prevalence of Norovirus, also known as Norovirus or stomach flu, which accounted for 19 to 21 million incidents of vomiting and diarrhea in the United States during the year 2023. This resulted in 465,000 emergency room admissions and 109,000 hospitalizations. Notably, during the winter season in 2023, there was a notable increase in cases and outbreaks, peaking in March 2023, with elevated norovirus activity persisting well into late spring.

Furthermore, the rising government funding for gastrointestinal diseases research and development is expected to increase the company's focus on developing novel treatment drugs, propelling market growth. For instance, according to the data published by NIH, in May 2022, the government-funded an estimated USD 352 million for the research and development of colorectal cancer disease in the United States in 2022, compared to USD 335 million in 2021. In addition, as per the same source, an estimated USD 92 million was funded by the government for research and development of Crohn's disease in 2022, compared to USD 88 million in 2021.

Moreover, the rising drug launches and approvals in the region and an increasing company focus on adopting key strategies such as collaboration, partnerships, and others are also contributing to the market growth. For instance, in October 2023, the US Food and Drug Administration (FDA) approved mirikizumab, a novel and highly efficacious therapy, for the treatment of ulcerative colitis (UC), presenting a promising therapeutic avenue for individuals grappling with this chronic and incapacitating inflammatory bowel ailment. Similarly, in August 2023, an international phase 3 clinical trial conducted in collaboration with Weill Cornell Medicine and NewYork-Presbyterian revealed that zolbetuximab, a newly developed targeted intervention, when administered alongside conventional chemotherapy, prolonged survival rates among patients afflicted with advanced gastric or gastroesophageal junction cancer, demonstrating overexpression of a specific biomarker.

Therefore, owing to factors such as an increase in GI drug launches, high prevalence of GI diseases, rise in funding, and other strategic activities by the key players, the studied segment is expected to grow over the forecast period.

Gastrointestinal Therapeutics Industry Overview

The gastrointestinal therapeutics market is moderately competitive, with the presence of many market players. The companies are adopting key strategies such as new product development, collaborations, partnerships, and others to retain their market position. Some market players include Abbvie Inc., AstraZeneca, Johnson & Johnson (Janssen Global Services LLC), Takeda Pharmaceutical Company Limited, and Bausch Health Companies Inc. (Salix Pharmaceuticals Inc.).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Gastrointestinal Diseases

- 4.2.2 Rising Investments in Research and Development by Pharmaceutical Companies

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory Norms Regarding Drug Approvals

- 4.3.2 Increasing Number of Patent Expiries

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Drug Type

- 5.1.1 Biologics/ Biosimilars

- 5.1.2 Antacids

- 5.1.3 Laxatives

- 5.1.4 Antidiarrheal agents

- 5.1.5 Antiemetics

- 5.1.6 Antiulcer agents

- 5.1.7 Other Drug Types

- 5.2 By Dosage Form

- 5.2.1 Oral

- 5.2.2 Parenteral

- 5.2.3 Other Dosage Forms

- 5.3 By Application

- 5.3.1 Ulcerative Colitis

- 5.3.2 Irritable Bowel Syndrome

- 5.3.3 Crohn's Disease

- 5.3.4 Celiac Disease

- 5.3.5 Gastroenteritis

- 5.3.6 Other Applications

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPANY PROFILES AND COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Abbott

- 6.1.2 Abbvie Inc.

- 6.1.3 AstraZeneca

- 6.1.4 Bayer AG

- 6.1.5 GSK plc

- 6.1.6 Johnson & Johnson(Janssen Global Services LLC)

- 6.1.7 Pfizer Inc.

- 6.1.8 Takeda Pharmaceutical Company Limited

- 6.1.9 Bausch Health Companies Inc. (Salix Pharmaceuticals Inc.)

- 6.1.10 Boehringer Ingelheim International GmbH

- 6.1.11 Cipla Inc.

- 6.1.12 Sebela Pharmaceuticals

7 MARKET OPPORTUNITIES AND FUTURE TRENDS