PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852075

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852075

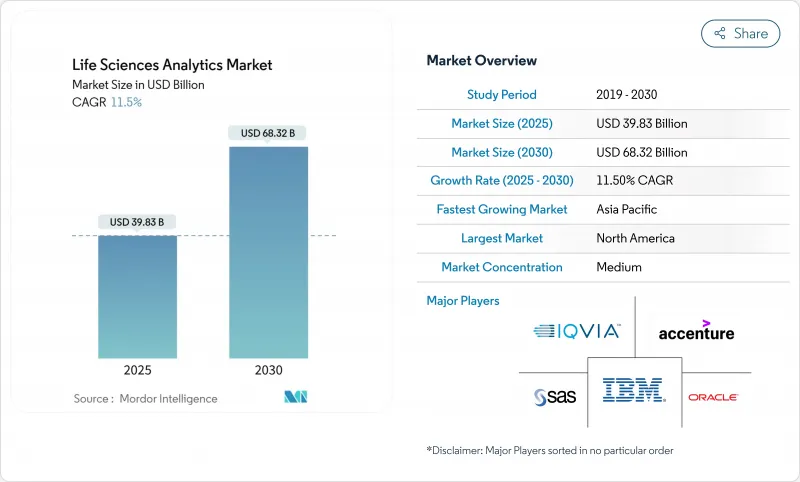

Life Sciences Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

In 2025, the life science analytics market size is valued at USD 39.83 billion and is projected to reach USD 68.32 billion by 2030, growing at an 11.5% CAGR from 2025 to 2030.

Momentum stems from the urgent need to convert growing biomedical data volumes into fast, reliable, and actionable intelligence across research, development, manufacturing, and commercialization. Accelerated adoption of cloud architectures, progress in generative AI, and regulatory emphasis on real-world evidence are combining to shorten discovery cycles and improve launch success. Vendors are expanding into multimodal analytics that unify genomic, clinical, and commercial information in a single framework, while life science companies are redesigning data governance to support collaboration at scale. Competitive intensity is rising as technology giants enter the domain and AI-native specialists target workflow gaps.

Global Life Sciences Analytics Market Trends and Insights

Escalating Volume & Complexity of Life-Science Data

Organizations now process petabytes of structured and unstructured biomedical information. A single global data aggregator already manages more than 64 petabytes, underscoring the dramatic scale shift required for contemporary analytics. The integration challenge has evolved from simple aggregation to the creation of semantic models that connect clinical, genomic, and real-world data. Teams that invest in unified data fabrics are trimming discovery cycles and boosting early-stage success probabilities. Rapid uptake of generative AI workflows is reinforcing demand for multi-modal repositories, which support iterative hypothesis testing and continuous learning. As data diversity broadens to include imaging and wearables, vendors offering automated data harmonization stand to gain share in the life science analytics market.

Regulatory Mandates: Compliance Driving Innovation

Regulatory focus on real-world evidence has turned data governance from a cost center into an innovation catalyst. Manufacturers are embedding analytics into post-market surveillance systems to detect safety signals earlier and meet regulator expectations for ongoing benefit-risk evaluation. Companies that transform compliance workflows into insight engines are reclaiming resources otherwise reserved for manual reporting. Notable results include faster signal validation, reduced inspection findings, and a larger body of evidence to support label expansions. Multinational firms that align regulatory technology stacks across regions are also accelerating product availability in growth markets, reinforcing expansion prospects for the life science analytics market.

Data Privacy Regulations: Compliance Cost Burden

Regulations such as GDPR and CCPA introduce strict consent, storage, and transfer rules that raise the compliance bar for analytics projects. Multinational sponsors must maintain duplicative data environments to satisfy territorial mandates, increasing operational overhead. Privacy-by-design architectures, tokenization, and federated learning mitigate exposure yet lengthen deployment timelines. While the rules improve public trust, the added complexity can slow experiments and limit cross-border data pooling, tempering short-to-mid-term growth of the life science analytics market.

Other drivers and restraints analyzed in the detailed report include:

- R&D Cost Pressures: Analytics-Led Productivity Revolution

- Precision Medicine Transition: Multi-Modal Analytics Requirement

- Legacy System Integration: Technical Debt Challenge

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Descriptive analytics commanded 45.0% of the life science analytics market share in 2024 as companies relied on retrospective dashboards to monitor trial milestones, manufacturing deviations, and sales patterns. The segment remains central because historical context underpins all downstream modeling. Emerging enhancements include natural language summaries that widen access to non-technical users and automated root-cause analysis that shortens review cycles.

Prescriptive analytics, however, delivers the fastest growth trajectory to 2030. Adoption accelerates as enterprises pivot from reporting to decision orchestration, embedding optimization algorithms into study design, supply chain routing, and omnichannel engagement. Early movers record reduced protocol amendments and higher response rates in targeted campaigns, reinforcing confidence in prescriptive approaches. The life science analytics market size for prescriptive solutions is projected to expand rapidly as integrated AI modules mature and cloud capacity becomes ubiquitous. Analysts expect the balance between descriptive and prescriptive spend to invert by the decade's close, positioning data-driven decisioning at the industry core.

Services captured 55.3% revenue in 2024 due to extensive implementation, customization, and training needs. Consulting teams guide data cleansing, model development, and user adoption, driving sustained service billings. Growing platform standardization and improved self-service tooling, however, are chipping away at pure service demand.

Software platforms now post the highest incremental growth. Vendors combine data lakes, feature stores, model factories, and visualization layers in unified offerings that support end-to-end workflows. Low-code interfaces enable domain experts to build predictive pipelines without programming, accelerating democratization. The life science analytics market size tied to platform subscriptions benefits from recurring revenue potential and rapid global deployment via the cloud. Industry stakeholders anticipate that software will overtake services within five years as configurability widens and packaged compliance features curb customization needs across regions.

The Life Science Analytics Market Report is Segmented by Product Type (Descriptive Analytics, and More), Component (Software Platforms, and Services), Deployment Mode (On-Premise, and More), Application (Research & Development, and More), End User (Pharmaceutical & Biotech Companies, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 41.3% of the life science analytics market in 2024, anchored by robust biopharma R&D pipelines, extensive real-world data networks, and favorable payer incentives. The United States dominates regional demand, with its AI-specific life science analytics market. Federal initiatives that promote real-world evidence collection and fast-track pathways continue to spur analytics adoption across the development lifecycle.

Asia-Pacific is the fastest-growing region, projected to record a 12.6% CAGR from 2025 to 2030. China and India lead with expanding clinical trial ecosystems, government incentives for precision medicine, and surging venture capital inflows. Cross-border licensing agreements channel global molecules into local programs, increasing reliance on analytics to coordinate distributed study operations and evaluate heterogenous patient cohorts. Nations such as Singapore and South Korea are stepping up grant funding for biomedical AI, further amplifying regional momentum.

Europe remains an influential player. Strong academic networks in Germany, the United Kingdom, and France generate novel analytical methods, while the European Medicines Agency's openness to new evidence types boosts platform demand. Strict GDPR requirements temper immediate scaling but encourage advances in privacy-preserving computation. Smaller but accelerating markets in the Middle East, Africa, and South America are also expanding their manufacturing bases and research collaborations, setting the stage for future life science analytics market growth.

- IQVIA

- SAS Institute

- Oracle

- IBM

- Accenture

- Cognizant

- Microsoft

- Veeva Systems

- Clarivate

- SAP

- MaxisIT

- Exl Service

- Wipro

- TAKE Solutions Ltd.

- Optum Life Sciences

- Dassault Systemes

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating Volume & Complexity of Life-Science Data (Omics, Imaging, RWE)

- 4.2.2 Regulatory Mandates for Data-Centric Drug Development & Post-Market Surveillance

- 4.2.3 Mounting R&D Cost Pressures Driving Analytics-Led Productivity Improvements

- 4.2.4 Transition to Precision & Personalized Medicine Requiring Multi-Modal Analytics

- 4.2.5 Enterprise-Wide Cloud & Digital Transformation Initiatives Across Biopharma

- 4.2.6 Outsourcing Surge to Specialized Analytics Vendors & AI-Enabled CROs

- 4.3 Market Restraints

- 4.3.1 Fragmented Data Landscapes & Interoperability Barriers with Legacy Systems

- 4.3.2 Stringent Global Data-Privacy Regulations & Compliance Costs

- 4.3.3 High Initial Investment & ROI Uncertainty for Advanced Analytics Platforms

- 4.3.4 Shortage of Domain-Specific Analytics Talent & Change-Management Challenges

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Descriptive Analytics

- 5.1.2 Predictive Analytics

- 5.1.3 Prescriptive Analytics

- 5.2 By Component

- 5.2.1 Software Platforms

- 5.2.2 Services

- 5.3 By Deployment Mode

- 5.3.1 On-premise

- 5.3.2 Cloud-based

- 5.4 By Application

- 5.4.1 Research & Development (Pre-clinical, Clinical Phases I-III)

- 5.4.2 Pharmacovigilance & Safety

- 5.4.3 Supply-Chain & Manufacturing QA/QC

- 5.4.4 Sales, Marketing & Market Access

- 5.4.5 Commercial Real-World Evidence / HEOR

- 5.5 By End User

- 5.5.1 Pharmaceutical & Biotechnology Companies

- 5.5.2 Medical Device Companies

- 5.5.3 Other End Users

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle-East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 IQVIA

- 6.3.2 SAS Institute Inc.

- 6.3.3 Oracle Corporation

- 6.3.4 IBM Corporation

- 6.3.5 Accenture PLC

- 6.3.6 Cognizant Technology Solutions

- 6.3.7 Microsoft Corporation

- 6.3.8 Veeva Systems Inc.

- 6.3.9 Clarivate

- 6.3.10 SAP SE

- 6.3.11 MaxisIT Inc.

- 6.3.12 ExlService Holdings, Inc.

- 6.3.13 Wipro Limited

- 6.3.14 TAKE Solutions Ltd.

- 6.3.15 Optum Life Sciences

- 6.3.16 Dassault Systmes

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment