PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444908

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444908

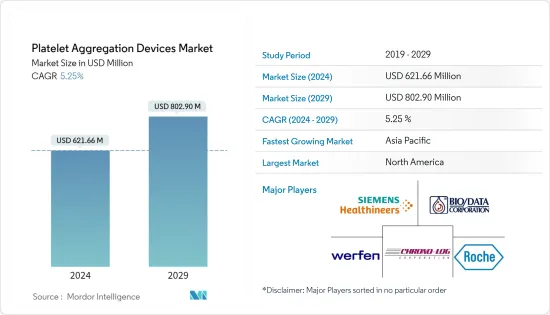

Platelet Aggregation Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Platelet Aggregation Devices Market size is estimated at USD 621.66 million in 2024, and is expected to reach USD 802.90 million by 2029, growing at a CAGR of 5.25% during the forecast period (2024-2029).

The outbreak of COVID-19 worldwide had a significant impact on the market, and there was substantial evidence that SARS-CoV-2 infection is associated with atherothrombotic phenomena. An NCBI article published in July 2021 mentioned that the incidence of thrombocytopenia is a critical occurrence in SARS-CoV-2 infection, which not only may exacerbate the respiratory symptoms but also increase the risk of mortality and it is a prognostic factor associated with platelets in COVID-19. The increasing research related to the platelet aggregation process on human platelet cells involved in COVID-19 had a notable impact on the market's growth over the pandemic period. Also, the demand for platelet aggregation devices is expected to remain intact during the post-pandemic period, thereby fueling market growth over the pandemic period.

The major factors attributing to the growth of the platelet aggregation devices market are the rising burden of chronic diseases, the increasing geriatric population, and technological advancements in platelet aggregometer.

For instance, the British Heart Foundation (BHF) data published in January 2022 reported that the most common heart conditions affected globally were coronary (ischemic) heart disease (global prevalence estimated at 200 million), peripheral arterial (vascular) disease (110 million), stroke (100 million) and atrial fibrillation (60 million) in 2022. The report also mentioned that the prevalence of heart and circulatory diseases in North America was 46 million, in Europe 99 million, in Africa 58 million, in South America 32 million, and in Asia and Australia 310 million in 2022. Thus, the high incidence of cardiovascular diseases among the global population is expected to contribute to the market's growth. Thus, the significant increase in the number of people suffering from cardiovascular diseases ultimately increases the use of platelet aggregation devices to study platelet aggregation among the affected patients and may drive market growth over the forecast period.

Moreover, the increasing launches of various advanced platelet aggregation devices by key market players are also expected to drive the market's growth over the forecast period. For instance, in July 2021, Sysmex Corporation launched two new automated blood coagulation analyzers, CN-3500 and CN-6500, in specific countries in the EMEA region. These new blood coagulation analyzers allow for flexible measurements in response to a broad range of test orders in the fields of thrombosis and hemostasis, in addition to the blood coagulation and platelet aggregation parameters, which can also be measured by the CN-6000/CN-3000.

However, owing to the dearth of skilled professionals to handle new technologies or devices, the market is expected to witness hindrances in terms of growth over the forecast period.

Platelet Aggregation Devices Market Trends

The Systems Segment is Expected to Witness Notable Growth in the Market Over the Forecast Period

The platelet aggregation system or aggregometer determines how well the platelets stick together. Such systems measure platelet aggregation using a platelet antagonist, such as ADP, thrombin, and ristocetin. Aggregation systems are likely to grow over the forecast period due to factors such as continuous technological advances in the field of platelet aggregation devices, the escalation of trends in platelet aggregation testing methods, growing adoption, and market preference for automated systems among diagnostic laboratories, and growing advantages offered by point-of-care testing analyzers, as compared to conventional instruments.

The growing burden of bleeding disorders and cardiovascular disorders is expected to increase the demand for platelet aggregation systems, which are used to diagnose bleeding disorders. As per the data provided by Genetic Home Reference updates in July 2022, the incidence of immune thrombocytopenia was estimated at 4 per 100,000 in children and 3 per 100,000 in adults worldwide annually. Such incidence of bleeding disorders is expected to drive the demand for platelet aggregation systems to screen anti-thrombotic factors, thereby contributing to the growth of the studied segment.

Furthermore, the rising market player's strategies, such as collaborations, acquisitions, and mergers, are also expected to drive the growth of the studied segment. For instance, in July 2021, Baxter International, Inc. reported its Baxter Healthcare Corporation subsidiary had completed the acquisition of assets related to the PerClot Polysaccharide Hemostatic System from CryoLife, Inc. The PerClot Polysaccharide Hemostatic System is used as an adjunctive hemostatic device to control bleeding during multiple open and laparoscopic surgical procedures, including gynecologic, general, cardiovascular, and urology.

Hence, owing to the above-mentioned factors, such as the rising incidence of bleeding disorders and market players' strategies, the market in this segment is expected to grow over the forecast period.

North America is Expected to Hold the Largest Share in the Market Over the Forecast Period

The North American region holds the largest market share due to the strong presence of device manufacturers, due to the increasing number of target disorders, the increasing geriatric population, technological advancements in platelet aggregometer, and rising awareness among healthcare professionals regarding the benefits offered by platelet aggregation testing in disease diagnosis.

As per a report by the United States Centers for Disease Control (CDC) statistics updated in 2021, every 40 seconds, an American may have a heart attack. Also, according to the World Federation of Hemophilia 2021 report, there were about 14,816 patients with hemophilia (including Hemophilia A -11,790 and Hemophilia B-3,026) in the United States and people diagnosed with hemophilia in the United States and 3,924 patients with hemophilia in Canada (including Hemophilia A -3,223 and Hemophilia B-701) in 2021. Therefore, the high incidence of various chronic and blood disorders in this region is expected to drive the demand for platelet aggregation devices owing to the effective disease diagnosis.

Additionally, the increasing product approvals by the regulatory authorities are also expected to contribute to the growth of the market in this region. For instance, in November 2022, Cerus Corporation received approval from Health Canada to extend the storage of platelets treated with the INTERCEPT blood system from five days to seven days from the time of collection, joining other territories where intercept platelets are approved for seven-day storage.

Thus, owing to the abovementioned factors, such as the increasing incidence of chronic and blood disorders and rising product developments, the North American region is expected to show lucrative growth over the forecast period.

Platelet Aggregation Devices Industry Overview

The Platelet Aggregation Devices Market studied is moderately competitive, and several companies are operating in this market. The novel launches and recent developments are the key strategies the key players adopt to develop their positions in the platelet aggregation devices market. The global players in the market are Aggredyne Inc., Bio/Data Corporation, Chrono-Log Corporation, F. Hoffmann-La Roche Ltd, Haemonetics Corporation, Siemens Healthcare GmbH, and Werfen, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidence of Chronic Diseases

- 4.2.2 Increasing Geriatric Population

- 4.2.3 Technological Advancements in Platelet Aggregometers

- 4.3 Market Restraints

- 4.3.1 High Cost of Devices and Shortage of Skilled Personnel

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product

- 5.1.1 Systems

- 5.1.2 Reagents

- 5.1.3 Consumables and Accessories

- 5.2 By Application

- 5.2.1 Clinical Applications

- 5.2.2 Research Applications

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Diagnostic Laboratories

- 5.3.3 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle-East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 AggreDyne, Inc.

- 6.1.2 Bio/Data Corporation

- 6.1.3 Chrono-Log Corporation

- 6.1.4 F. Hoffmann-La Roche Ltd

- 6.1.5 Haemonetics Corporation

- 6.1.6 Siemens Healthcare GmbH

- 6.1.7 Werfen

- 6.1.8 Sysmex Corporation

- 6.1.9 Sienco, Inc.

- 6.1.10 Drucker Diagnostics

- 6.1.11 Heamochrom Diagnostica GmbH

- 6.1.12 Grifols, S.A.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS