PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444930

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444930

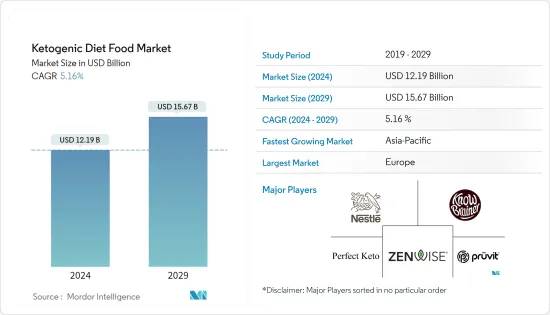

Ketogenic Diet Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Ketogenic Diet Food Market size is estimated at USD 12.19 billion in 2024, and is expected to reach USD 15.67 billion by 2029, growing at a CAGR of 5.16% during the forecast period (2024-2029).

Because of the COVID-19 pandemic, people's working styles changed. Many countries developed work-from-home cultures.Because of this, the prevalence of obesity, cardiovascular diseases, high blood pressure, and many more chronic diseases started to rise among people. The ketogenic food market is going to grow over the long term owing to increased awareness among people about their health and fitness. Following the keto diet can have plenty of benefits, like helping with weight loss, reducing migraines, improving heart health, reducing cholesterol, and many more. Due to all these benefits known to consumers, the market is expected to grow over the long term.

Furthermore, online food delivery services and e-commerce websites are growing all over the world owing to their convenience. As a result, consumers have more food options and selections. Especially among millennials, keto diets are very popular as they give more energy with less calorie intake, which eventually helps with weight management. Athletes and sports enthusiasts are also shifting to a ketogenic diet in order to stay fit and active for a longer period of time. Therefore, the increasing need for the keto diet among consumers is paving the way for manufacturers to introduce keto products, particularly supplements and snacks that deliver on the high-fat, low-carb formula, especially with added nutrients and vitamins, which are often lacking in a keto diet. Several market players are launching products and ingredients to support the keto food market. For instance, in June 2022, King Arthur Baking Co. launched a new collection of keto-friendly baking mixes. The keto mixes, which are made using non-GMO certified ingredients, are available in a yellow cake mix, a chocolate cake mix, an all-purpose muffin mix, and a pizza crust mix. Each mix has 2 grams or less of net carbs per serving and no added sugar.

Ketogenic Diet Food Market Trends

Increasing Obesity is Driving the Market Growth

Obesity is one of the major health problems in the world today. According to the Trust for America's Health report from September 2022, 4 in 10 American adults have obesity. Because of this, consumers are shifting towards healthy food habits and incorporating keto-friendly foods into their diet regimen. They are also going to fitness centers and gyms to stay fit. The gym trainers and doctors recommend the ketogenic diet instead of intermittent fasting. The high-fat and low-carb beverages are designed to provide sustained energy and help accelerate the metabolic state of ketosis, which makes the body more efficient when burning fat for energy. Considering children's obesity in many regions, the market players are innovating products like cakes, chocolates, protein bars, and many more that are keto-friendly. For instance, in April 2022, Jimmy's Healthy Foods Inc. launched Keto-Friendly Chocolate Fudge Pudding. Additionally, the availability of different keto-friendly products on online shopping apps like Amazon, Walmart, and many more is also driving the market.

Asia-Pacific is Emerging as the Fastest-growing Market

In China, ketogenic diet food is widely available in the form of tablets, pills, snacks, powder, or liquid. Also, keto certifications are emerging, including Certified Ketogenic and Paleo Foundation Certified Keto. These certifications are expected to appeal to lifestyle users who see keto as an extension of the Paleo diet or a clean-label diet. China has a large young population, which contributes to the consumption of ketogenic foods. Ketogenic beverages, like alcoholic and non-alcoholic beverages, are quite famous in the region. Because of changes in environment, lifestyle, and urbanization, consumers need their food to be healthy, easy to carry, and nutrient-rich. Australian consumers are also very conscious of their health, and the market players there have been launching snacks and snack bars that are keto-friendly. For instance, in March 2021, an Australian food company, My Muscle Chef, launched new healthy keto bars that are made from plant-based ingredients.

Ketogenic Diet Food Industry Overview

The global ketogenic diet food market is highly competitive and comprises regional and international competitors. The market is dominated by players like Perfect Keto, LLC, Glanbia PLC, Nestle, and Pruvit Ventures Inc. These players focus on leveraging the opportunities posed by emerging markets to expand their product portfolios to cater to the requirements of various product segments, especially supplements and beverages. Also, companies have turned to strategic partnerships as their main way to expand their customer base and geographic reach.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Supplements

- 5.1.2 Beverages

- 5.1.3 Snacks

- 5.1.4 Other Product Types

- 5.2 By Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Pharmacy/Drug Stores

- 5.2.3 Specialty Stores

- 5.2.4 Online Retail Stores

- 5.2.5 Other Distribution Channels

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 Spain

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Position Analysis

- 6.3 Company Profiles

- 6.3.1 Nestle S.A.

- 6.3.2 Zenwise Health

- 6.3.3 Know Brainer Foods LLC

- 6.3.4 Pruvit Ventures Inc.

- 6.3.5 Perfect Keto LLC

- 6.3.6 TDN Nutrition

- 6.3.7 NOW Foods

- 6.3.8 Glanbia PLC

- 6.3.9 Atrium Innovations Inc. (Garden Of Life)

- 6.3.10 Keto and Co.

- 6.3.11 Keto Krisp

- 6.3.12 American Licorice LLC (Zing Bars)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS